Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants, and Others), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), By Form (Dry and Liquid), and By Region – Global Opportunities & Forecast, 2022-2029

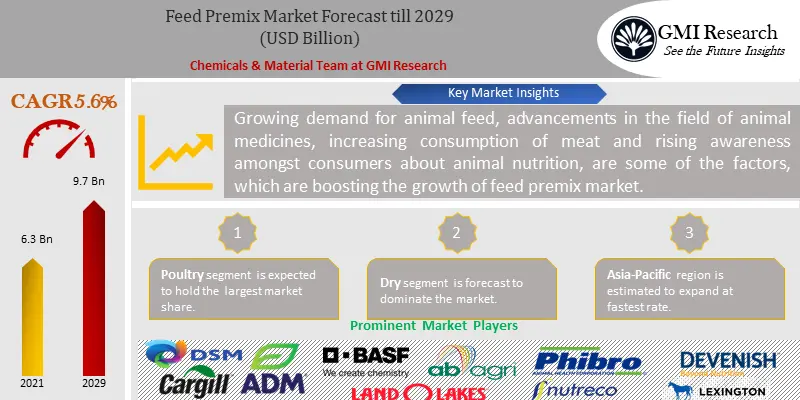

GMI Research analysis indicates that the Feed Premix Market size was estimated at USD 6.3 billion in 2021 and is slated to register a single digit CAGR of 5.6% over the forecast period and is projected to reach USD 9.7 billion in 2029 attributed to growing adoption of feed premixes to improve animal health and productivity.

Introduction

Feed premix is a mixture of vitamins, medicaments, trace minerals, amino acids, diluents, and other supplements. A feed premix is added to livestock diets in order to achieve a sufficient level of vitamins and minerals and give them proper nourishment. Micronutrients, including vitamins, minerals, and amino acids, are mostly not found in animal feed. Hence, consumers add feed premix to animal feed, which helps them in getting a wholesome nutritional diet. Premixes are essential for optimizing growth, zootechnical performance, and reproduction in livestock.

To have an edge over the competition by knowing the market dynamics and current trends of “Feed Premix Market,” request for Sample Report here

Major Feed Premix Market Drivers

Feed premix market is primarily driven by surge in the demand for animal protein, advancements in animal medicines, technological innovations and increasing adoption of intensive livestock farming practices around the world. Moreover, increasing awareness about providing adequate nutrition levels in animal feed for enhancing the health and productivity of livestock is another prominent factor driving the growth of the feed premix market. Consumption of meat is increasing rapidly in developing countries like Brazil, China and Indonesia, which is pushing the demand for high-quality feed concentrates in these regions. Brazil has one of the largest cattle populations globally, as per United States Department of Agriculture’s (USDA) report, cattle inventory in Brazil was estimated to be 193.8 million head in 2022 and this figure is likely to increase in coming years. As the consumption of meat increases in these countries demand for feed premix will increase to increase production of livestock.

Feed premixes offer nutritional supplements that help in achieving high-quality products, including meat, eggs, milk, fur, leather, and wool by the cattle. Additionally, they also help to improve livestock health and control diseases. With continuous advancements in technology and awareness among farmers, implementation of innovative animal husbandry practices including vaccine technology, genetic engineering, dust filtering technology, biometric sensors, and use of artificial intelligence for monitoring the farm animals are steering the growth of the animal husbandry industry, thereby boosting the growth of the feed premix market. Growing awareness among health-conscious consumers regarding the importance of high-quality standards in foods, including meat and other animal protein products, is further driving the adoption of feed premix among the livestock farmers. However, strict regulations imposed by governments related to the ban of antibiotics in various countries coupled with high cost of feed premix ingredients are some of the factors restricting the growth of feed premixes market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Ingredients Type, Amino Acids is estimated to hold the largest market share.

Amino acid is widely used as a feed premix for in animals like cows, sheep, pigs, hens, and other cattle. Amino acid contains proteins and polypeptides which supports animals’ growth, helps in increasing production, and reduces risks of diseases in animals, thereby contributing significantly to the profitability of a farm.

Based on Livestock, Poultry segment is forecast to lead the market attributed to growing demand for poultry meat.

Feed premix is gaining traction in poultry farming owing to its low production cost, consistent quality and increased efficiency. Globally, the consumption of poultry meat has increased significantly in last decade. In India, the poultry meat consumption was estimated to be more than 4 million metric tons in 2022, which indicates an increase of over 13% as compared to 2019. As per OECD-FAO Agricultural Outlook 2021-2030, poultry meat is projected to represent 41% of all protein, which comes from meat sources by 2030. Such trends are expected to positive impact on global poultry feed premix market in future. In addition, pet segment is driven by increasing adoption of pets and growing awareness amongst consumers about animal nutrition.

Based on Form, Dry segment is expected to capture the largest market share.

Dry feed premixes are becoming more popular in the feed premix market due to its longer-shelf life and easy to use features. Furthermore, liquid feed premix offers Increased accuracy, appropriate feeding scales, and reduces dust during handling and feeding which are propelling its demand in the feed premix market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Based on Region, Asia-Pacific region is projected to expand at fastest rate.

Asia-Pacific feed premix market is propelled by increasing consumption of meat, growing population growth rates and rise in the number of feed mills and feed production. In addition, rising number of aquatic and poultry animal farms in India and China, increasing demand for amino acids and presence of massive livestock population, are some of the factors accelerating the demand for feed premix in the Asia-Pacific region.

Top Market Players

Various notable players operating in the feed premix market are Koninklijke DSM N.V., Cargill, Incorporated, Archer-Daniels-Midland Company, BASF SE, AB Agri Ltd., Land O’Lakes, Inc., Phibro Animal Health Corporation, Devenish Nutrition, LLC., Lexington Enterprises Pte. Ltd., and Nutreco N.V., among others.

Key Developments:

-

- In January 2020, Layn Corp., a major manufacturer of natural animal nutrition ingredients based out of China introduced TruGro MAX, which is a natural animal feed additive designed to improve oxidative status of animals.

- In March 2019, BASF SE, a chemicals company based in Germany introduced phytase Natuphos E for the Japanese feed industry. Natuphos E will help companies to make livestock feed environment friendly and more affordable in Japan. This product is manfacturerd in Germany will be help in reducing phosphorus emissions from livestock and has 18-month shelf-life stability.

- In June 2019, Land O’ Lakes, Inc., entered into partnership with Royal Agrifirm Group to establish dairy animal feed joint venture Agrilakes in China. With this joint venture, both the companies will leverage each other’s knowledge, research capabilities and insights to deliver high quality feed solutions to customers in China.

Segments Covered in the Report

Global feed premix market has been segmented on the basis of ingredient type, livestock, form, and regions. Based on ingredient type, the market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, and others. Based on livestock, the market is segmented into poultry, ruminants, swine, aquatic animals, equine, and pets. Based on the form, the market is segmented into dry and liquid.

For detailed scope of the “Feed Premix Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 6.3 billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Ingredient Type, By Livestock, By Form and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Koninklijke DSM N.V., Cargill, Incorporated, Archer-Daniels-Midland Company, BASF SE, AB Agri Ltd., Land O’Lakes, Inc., Phibro Animal Health Corporation, Devenish Nutrition, LLC. , Lexington Enterprises Pte. Ltd., and Nutreco N.V. among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Feed Premix Market by Ingredients Type

-

- Vitamins

- Minerals

- Amino Acids

- Antibiotics

- Antioxidants

- Others

Global Feed Premix Market by Livestock

-

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Equine

- Pets

Global Feed Premix Market by Form

-

- Dry

- Liquid

Global Feed Premix Market by Region

-

- North America Feed Premix Market (Option 1: As a part of the free 25% customization)

- By Ingredients Type

- By Livestock

- By Form

- US Market All-Up

- Canada Market All-Up

- Europe Feed Premix Market (Option 2: As a part of the free 25% customization)

- By Ingredients Type

- By Livestock

- By Form

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Feed Premix Market (Option 3: As a part of the free 25% customization)

- By Ingredients Type

- By Livestock

- By Form

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Feed Premix Market (Option 4: As a part of the free 25% customization)

- By Ingredients Type

- By Livestock

- By Form

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Feed Premix Market (Option 1: As a part of the free 25% customization)

Global Feed Premix Market Players (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Koninklijke DSM N.V.

- Cargill, Incorporated

- Archer-Daniels-Midland Company

- BASF SE

- AB Agri Ltd.

- Land O’Lakes, Inc.

- Phibro Animal Health Corporation

- Devenish Nutrition, LLC.

- Lexington Enterprises Pte. Ltd.

- Nutreco N.V.

Frequently Asked Question About This Report

Feed Premix Market [UP884A-00-0620]

Feed premix market size was valued at USD 6.3 billion in 2021.

Feed premix market is estimated to expand at a CAGR of 5.6% over the period 2022-2029.

Feed Premix market is forecast to touch USD 9.7 billion in 2029.

Asia-Pacific region is expected to grow at fastest rate.

- Published Date: Oct-2021

- Report Format: Excel/PPT

- Report Code: UP884A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants, and Others), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), By Form (Dry and Liquid), and By Region – Global Opportunities & Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research