High Performance Computing (HPC) Market Size, Growth, and Trend Analysis by Component, By Deployment, By End-Use and By Region – Global Opportunities & Forecast, 2020-2027

High Performance Computing (HPC) Market Size, Growth, and Trend Analysis by Component (Servers, Storage, Networking Devices, Software, Services, and Others), By Deployment (On-Premises and Cloud), By End-Use (BFSI, Media & Entertainment, Retail, Transportation, Government & Defense, Education & Research, Manufacturing, Healthcare & Bioscience, and Others) and By Region – Global Opportunities & Forecast, 2020-2027

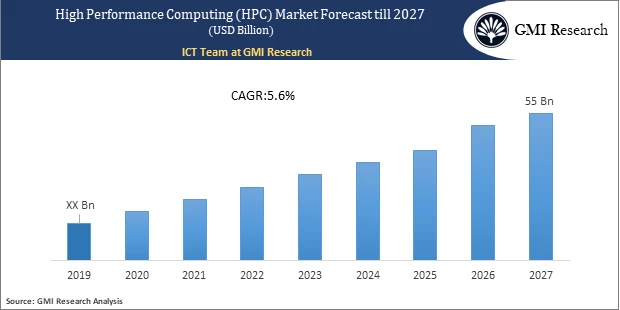

High Performance Computing (HPC) Market is expected to grow at a CAGR of 5.6% from 2019 to exceed 55 billion by 2027.

Introduction of the High Performance Computing (HPC) Market Report

High-performance computing refers to the process of aggregating computing power in a way that delivers much superior performance than one could get out of a traditional desktop, computer, or workstation to solve large problems in engineering, business, or science. The data around industries is growing up, which requires high number of mathematical calculations and computational capabilities to resolve business issues, thus increasing the need for HPCs.

To have an edge over the competition by knowing the market dynamics and current trends of “High Performance Computing (HPC) Market,” request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The major factors propelling the growth of the high performance computing (HPC) market size are the increasing need for high-efficiency computing and constant diversification across industries, expansion of the IT industry, developments in virtualization, and growing preference for hybrid high-performance computing (HPC) solutions. Moreover, HPC systems have the ability to process large volumes of data, which is encouraging defense agencies, government agencies, energy companies, utilities, and academic institutions to install high-performance computing systems. HPC systems feature various benefits, which includes ability to calculate complex algorithms and increased computational power. These factors play a crucial role in augmenting the growth of the global high-performance computing (HPC) industry.

Impact of COVID-19 on the High Performance Computing (HPC) Market

In the current pandemic situation, the sudden shutdown of schools, colleges, offices, and physical retail stores has extensively disrupted operations, which has increased the demand for digital workplace services and tools. During this scenario, most of the people prefer working from home instead of working in offices. These factors have significantly surged the growth of the HPC market size.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Component – Segment Analysis

Based on the component, the servers segment is projected to grow at a higher CAGR during the forecast period. This is mainly due to the increase in the number of data centers as several mid-size enterprises are in the process of investing heavily on on-premises and colocation infrastructure to support the rising demand for public cloud services. Moreover, the presence of major HPC servers manufacturing companies, which includes IBM Corporation, Fujitsu Limited, Lenovo, and Dell, Inc., is another factor surging the growth of the servers segment, thus driving the HPC market growth.

End-Use – Segment Analysis

On the basis of the end-use, the government & defense segment is anticipated to grow at a faster CAGR over the forecast period. Government & defense agencies are significantly adopting cutting-edge IT solutions to improve the computing efficiency. In addition, high-performance computing systems also support digitalization initiatives and contributing to economic development. Furthermore, governments of various nations are inclining towards using HPC as a response to the COVID-19 pandemic. For instance, HP Development Company, L.P. is engaged in providing high-performance computing and AI solutions to fight against the pandemic. These factors are substantially contributing to the growth of the government & defense segment in the global high performance computing (HPC) market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

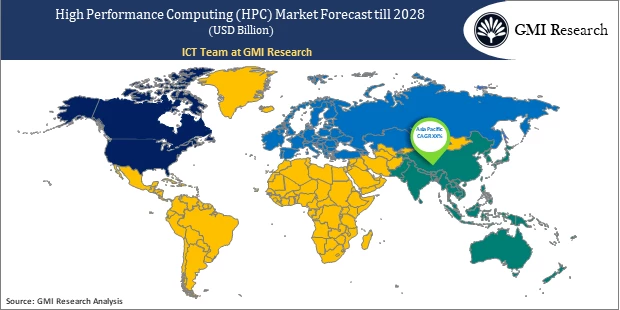

Region – Segment Analysis

Based on the region, the Asia-Pacific region is expected to grow at a higher CAGR over the forecast period. This is majorly attributed to the increasing adoption of HPC systems by government & defense and manufacturing industries. Moreover, it is being widely adopted for weather forecasting and scientific research. In addition, China is among the top 10 countries that is increasing the demand of the high-performance computing market. Moreover, China is home to supercomputers, which includes Sunway TaihuLight and Tianhe-2 (Milkyway-2). Tianhe-2 (Milkyway-2) was created by the National University of Defense Technology of China and supported by the government of Guangzhou city and the government of Guangdong province. These factors are bolstering the growth of the high performance computing (HPC) market in Asia-Pacific.

Top Market Players

Various notable players operating in the market include Atos SE, Advanced Micro Devices, Inc, Dell Inc., Cisco, HP Development Company, L.P., FUJITSU, IBM, Intel Corporation, Microsoft, and Oracle, among others.

Key Developments:

-

- In 2020, Atos SE announced its latest scalable, robust, open, and secure HPC Software Suites to allow users to manage their supercomputing environments effectively, reduce energy consumption, and optimize performance.

- In 2020, Advanced Micro Devices, Inc announced the launch of world’s fastest HPC GPU, named AMD Instinct MI100 accelerator. It is the first x86 server GPU to beat the 10 teraflops (FP64) performance barrier.

- In 2020, Intel Corporation introduced the upcoming 3rd Gen Intel Xeon Scalable processors, that are also known as “Ice Lake”. It provides enhanced performance for high performance computing (HPC) workloads by higher memory bandwidth.

Segments covered in the Report:

The global high performance computing (HPC) market has been segmented on the basis of component, deployment, end-use, and regions. Based on component, the market is segmented into servers, storage, networking devices, software, services, and others. Based on deployment, the market is segmented into on-premises and cloud. Based on end-use, the market is segmented into BFSI, media & entertainment, retail, transportation, government & defense, education & research, manufacturing, healthcare & bioscience, and others.

For detailed scope of the “High Performance Computing (HPC) Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global high performance computing (HPC) market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in high performance computing (HPC) market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global high performance computing (HPC) market?

- Which component generated maximum revenues in 2019 and identify the most promising component during the forecast period?

- What are the various deployment areas of global high performance computing (HPC) market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2019 |

| Market Forecast Period |

2020-2027 |

| Market Revenues (2027) |

USD 55 billion |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Component, By Deployment, By End-Use, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Atos SE, Advanced Micro Devices, Inc, Dell Inc., Cisco, HP Development Company, L.P., FUJITSU, IBM, Intel Corporation, Microsoft, Oracle, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global High Performance Computing (HPC) Market by Component

-

- Servers

- Storage

- Networking Devices

- Software

- Services

- Others

Global High Performance Computing (HPC) Market by Deployment

-

- On-Premises

- Cloud

Global High Performance Computing (HPC) Market by End-Use

-

- BFSI

- Media & Entertainment

- Retail

- Transportation

- Government & Defense

- Education & Research

- Manufacturing

- Healthcare & Bioscience

- Others

Global High Performance Computing (HPC) Market by Region

-

- North America High Performance Computing (HPC) Market (Option 1: As a part of the free 25% customization)

- By Component

- By Deployment

- By End-Use

- US Market All-Up

- Canada Market All-Up

- Europe High Performance Computing (HPC) Market (Option 2: As a part of the free 25% customization)

- By Component

- By Deployment

- By End-Use

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific High Performance Computing (HPC) Market (Option 3: As a part of the free 25% customization)

- By Component

- By Deployment

- By End-Use

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW High Performance Computing (HPC) Market (Option 4: As a part of the free 25% customization)

- By Component

- By Deployment

- By End-Use

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) High Performance Computing (HPC) Market All-Up

- North America High Performance Computing (HPC) Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the High Performance Computing (HPC) Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Atos SE

- Advanced Micro Devices, Inc

- Dell Inc.

- Cisco

- HP Development Company, L.P.

- FUJITSU

- IBM

- Intel Corporation

- Microsoft

- Oracle

Frequently Asked Question About This Report

High Performance Computing (HPC) Market [UP1727-001001]

The growth rate of High Performance Computing Market during 2020-2027 is 5.6%.

The major factors propelling the growth of the high performance computing (HPC) market size are the increasing need for high-efficiency computing and constant diversification across industries, expansion of the IT industry, developments in virtualization, and growing preference for hybrid high-performance computing (HPC) solutions

The Asia-Pacific region is expected to grow at a higher CAGR over the forecast period. This is majorly attributed to the increasing adoption of HPC systems by government & defense and manufacturing industries.

The top key players of High Performance Computing Market are Atos SE, Advanced Micro Devices, Inc, Dell Inc., Cisco, HP Development Company, L.P., FUJITSU, IBM, Intel Corporation, Microsoft, and Oracle, among others.

- Published Date: Mar - 2020

- Report Format: Excel/PPT

- Report Code: UP1727-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

High Performance Computing (HPC) Market Size, Growth, and Trend Analysis by Component, By Deployment, By End-Use and By Region – Global Opportunities & Forecast, 2020-2027

$ 4,499.00 – $ 6,649.00

Why GMI Research