Health Insurance Market Share, Size, and Trend Analysis Report by Providers, By Insurance Type, By Coverage Type, By Demographics and By Region – Global Opportunities & Forecast, 2020-2027

Health Insurance Market Share, Size, and Trend Analysis Report by Providers (Private Providers and Public Providers), By Insurance Type (Disease Insurance, Medical Insurance, and Income Protection Insurance), By Coverage Type (Lifetime Coverage and Term Coverage), By Demographics (Minors, Adults, and Senior Citizens) and By Region – Global Opportunities & Forecast, 2020-2027.

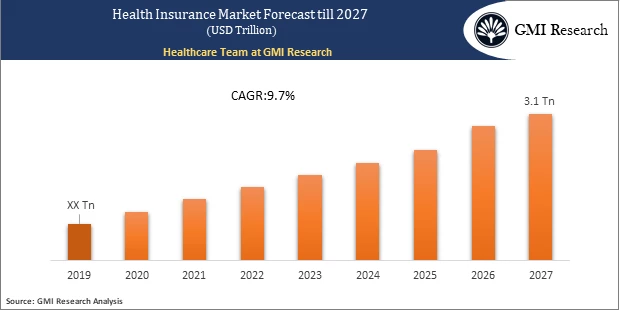

Health Insurance Market size is forecast to reach USD 3.1 Trillion by 2027, estimated to grow at a CAGR of 9.7% during 2020-2027.

Introduction of the Health Insurance Market Report

Health insurance is a kind of insurance, which covers medical expenses that arise due to an illness. These expenses could be related to the cost of medicines, doctor consultation fees, and hospitalization costs. Health insurance offers fast reimbursement for people suffering from diseases with the minimum premium amount. It is often included in the employer’s benefit packages as a means of attracting quality employees, with premiums partially covered by the employer or could be deducted from employee paycheques.

To have an edge over the competition by knowing the market dynamics and current trends of “Health Insurance Market,” request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The major factor surging the growth of the global health insurance market size include the rise in the healthcare expenditure which is allowing people to spend adequately on their healthcare expenses owing to increasing health concerns. Health insurance provides the policyholders with financial coverage for their medical expenses when they are hospitalized. There are various kinds of medical expenses, such as physician consultation charges, treatment done for any disease, injury, and other physical or mental impairment. Moreover, coverage for all treatment, which includes large & small surgeries and critical illness with low premium amount, is another factor propelling the growth of the global health insurance market. In addition, there is a mandatory provision of health insurance for public and private sector employees, which is surging the growth of the market. The majority of the geriatric population is prone to chronic conditions and senior citizens suffering from diseases might require constant critical monitoring and surgical procedures. Furthermore, the geriatric population comes under the unproductive portion of population and cannot afford expensive surgical procedures and long hospital stays, which is encouraging them to opt for health insurance with different cost-effective policies. These factors are contributing to the growth of the global health insurance market share in terms of revenue.

Impact of COVID-19 on the Health Insurance Market

The health insurance market is positively impacted by the widespread COVID-19 pandemic. There has been a drastic rise in medical expenses, which has impacted the market’s demand. This has paved the way for insurance companies to come up with COVID-19 specific policies to meet the requirements. The pandemic has supplemented the growth of the market with the introduction of digital health products, thus, top health insurance companies are inclining towards seamless app/web-based processes.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Providers – Segment Analysis

Based on the providers, the private providers segment is anticipated to grow at a faster CAGR over the forecast period. This is mainly attributed to private insurance providers who are offering advanced treatment options, referral to a consultant, and flexible & quick treatment time in private hospitals to subscribers at a certain amount. Furthermore, these companies also give control over the choice of healthcare services. People who opt for health insurance from private providers get the authority to choose their doctors and services. These factors play a crucial role in augmenting the growth of the private providers segment in the global health insurance market.

Insurance Type – Segment Analysis

On the basis of the insurance type, the medical insurance segment is expected to grow at a higher CAGR over the forecast period. This is majorly due to the rise in the number of road accidents that incur huge expenses for costly surgeries. In addition, medical insurance covers the cost of medical admission, hospital accommodation, diagnostic tests, which includes CT & MRI scans, nursing care, and the cost of seeing consultants. Moreover, governments of developing countries, such as India, China, among others, have implemented several initiatives regarding women’s health. For instance, specific policies for women cover reimbursement for various life-threatening diseases, such as cervical cancer. These factors are likely to boost the growth of the medical insurance segment in the global health insurance market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

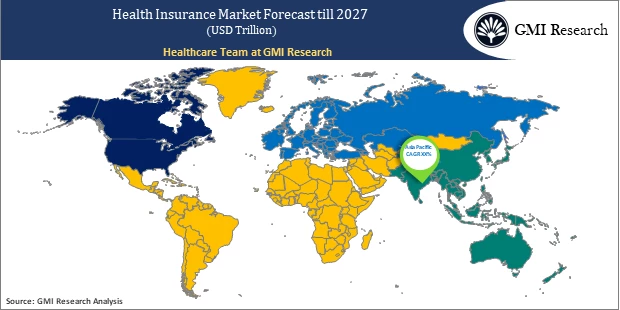

Region – Segment Analysis

Based on the region, the Asia-Pacific region is projected to grow at a higher CAGR during the forecast period owing to the increasing prevalence of chronic diseases, availability of expensive health facilities, and rise in demand for health insurance policies in high populous countries, such as China and India. These countries contain a large number of low and middle-class economy groups that are currently not insured. Furthermore, a huge availability of low premium term insurance plans provided by national policy providers is majorly preferred in developing countries, which is further driving the growth of the health insurance market in Asia-Pacific.

Top Market Players

Various notable players operating in the market include ASSICURAZIONI GENERALI S.P.A, Allianz, Anthem, Inc., AIA Group Limited, China Life Insurance (Overseas) Company Limited, Cigna, Health Care Service Corporation, Highmark Inc., United HealthCare Services, Inc., and WellCare Health Plans, Inc., among others.

Key Developments:

-

- In 2020, Highmark Inc. and HealthNow New York Inc. announced an agreement to affiliate and marked a key milestone in plans to bring together the two not-for-profit Blue Cross Blue Shield health insurance plans to serve the communities of North-eastern and Western New York and Highmark’s Pennsylvania, Delaware, and West Virginia regions.

Segments covered in the Report:

The global health insurance market has been segmented on the basis of providers, insurance type, coverage type, demographics, and regions. Based on providers, the market is segmented into private providers and public providers. Based on insurance type, the market is segmented into disease insurance, medical insurance, and income protection insurance. Based on Coverage Type, the market is segmented into lifetime coverage and term coverage. Based on Demographics the market is segmented into minors, adults, and senior citizens.

For detailed scope of the “Health Insurance Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global health insurance market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in health insurance market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global health insurance market?

- Which providers generated maximum revenues in 2019 and identify the most promising providers during the forecast period?

- What are the various insurance type areas of global health insurance market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2019 |

| Market Forecast Period |

2020-2027 |

| Market Revenues (2027) |

USD 3.1 Trillion |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Providers, By Insurance Type, By Coverage Type, By Demographics, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | ASSICURAZIONI GENERALI S.P.A, Allianz, Anthem, Inc., AIA Group Limited, China Life Insurance (Overseas) Company Limited, Cigna, Health Care Service Corporation, Highmark Inc., United HealthCare Services, Inc., WellCare Health Plans, Inc., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Health Insurance Market by Providers

-

- Private Providers

- Public Providers

Global Health Insurance Market by Insurance Type

-

- Disease Insurance

- Medical Insurance

- Income Protection Insurance

Global Health Insurance Market by Coverage Type

-

- Lifetime Coverage

- Term Coverage

Global Health Insurance Market by Demographics

-

- Minors

- Adults

- Senior Citizens

Global Health Insurance Market by Region

-

- North America Health Insurance Market (Option 1: As a part of the free 25% customization)

- North America Health Insurance Market by Providers

- North America Health Insurance Market by Insurance Type

- North America Health Insurance Market by Coverage Type

- North America Health Insurance Market by Demographics

- US Health Insurance Market All-Up

- Canada Health Insurance Market All-Up

- Europe Health Insurance Market (Option 2: As a part of the free 25% customization)

- Europe Health Insurance Market by Providers

- Europe Health Insurance Market by Insurance Type

- Europe Health Insurance Market by Coverage Type

- Europe Health Insurance Market by Demographics

- UK Health Insurance Market All-Up

- Germany Health Insurance Market All-Up

- France Health Insurance Market All-Up

- Spain Health Insurance Market All-Up

- Rest of Europe Health Insurance Market All-Up

- Asia-Pacific Health Insurance Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Health Insurance Market by Providers

- Asia-Pacific Health Insurance Market by Insurance Type

- Asia-Pacific Health Insurance Market by Coverage Type

- Asia-Pacific Health Insurance Market by Demographics

- China Health Insurance Market All-Up

- India Health Insurance Market All-Up

- Japan Health Insurance Market All-Up

- Rest of APAC Health Insurance Market All-Up

- RoW Health Insurance Market (Option 4: As a part of the free 25% customization)

- RoW Health Insurance Market by Providers

- RoW Health Insurance Market by Insurance Type

- RoW Health Insurance Market by Coverage Type

- RoW Health Insurance Market by Demographics

- Brazil Health Insurance Market All-Up

- South Africa Health Insurance Market All-Up

- Saudi Arabia Health Insurance Market All-Up

- UAE Health Insurance Market All-Up

- Rest of world (remaining countries of the LAMEA region) Health Insurance Market All-Up

- North America Health Insurance Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Health Insurance (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- ASSICURAZIONI GENERALI S.P.A

- Allianz

- Anthem, Inc.

- AIA Group Limited

- China Life Insurance (Overseas) Company Limited

- Cigna

- Health Care Service Corporation

- Highmark Inc.

- United HealthCare Services, Inc.

- WellCare Health Plans, Inc.

Frequently Asked Question About This Report

Health Insurance Market [UP1844-001001]

The top players in this Health Insurance Market are ASSICURAZIONI GENERALI S.P.A, Allianz, Anthem, Inc., AIA Group Limited, China Life Insurance (Overseas) Company Limited, Cigna, Health Care Service Corporation, Highmark Inc., United HealthCare Services, Inc., and WellCare Health Plans, Inc., among others.

The private providers segment is anticipated to grow at a faster CAGR over the forecast period. This is mainly attributed to private insurance providers who are offering advanced treatment options, referral to a consultant, and flexible & quick treatment time in private hospitals to subscribers at a certain amount.

Which region projected to grow at higher CAGR during the forecast period in Health Insurance Market?

The growth rate of Health Insurance Market during 2020-2027 is 9.7%.

- Published Date: Mar - 2021

- Report Format: Excel/PPT

- Report Code: UP1844-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Health Insurance Market Share, Size, and Trend Analysis Report by Providers, By Insurance Type, By Coverage Type, By Demographics and By Region – Global Opportunities & Forecast, 2020-2027

$ 4,499.00 – $ 6,649.00

Why GMI Research