Digital Therapeutics Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

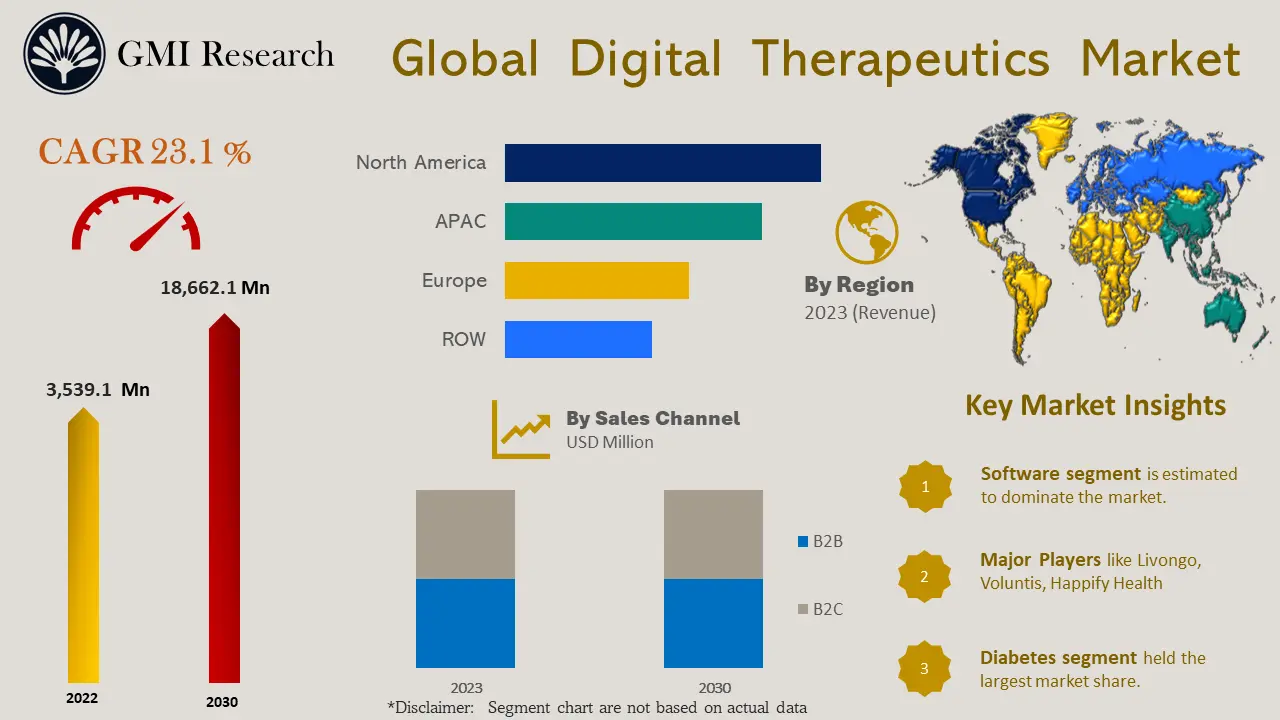

GMI Research analysis indicates that the Digital Therapeutics Market size was estimated at USD 3,539 million in 2022 and is forecast to touch USD 18,662 million in 2030, and the market is expected to grow at a CAGR of 23.1% from 2023-2030.

Major Digital Therapeutics Market Drivers

Major Digital Therapeutics Market Drivers

The digital therapeutics market is predicted to be propelled by the significant rise in the usage of smart and connected devices in emerging and developed nations, a rise in united health systems, competitive prices of digital health technologies, high-performance benefits of digital therapeutics, and the rise in the occurrence of preventable chronic illnesses. For instance, during 2022, Kepios stated that with 5 billion internet users globally, constituting 63% of the global population, there is a growing awareness of smart health tracking. The rising number of internet users is estimated to contribute to the enhanced adoption and awareness of these technologies. Moreover, the developing demand for patient-centric care and incorporated healthcare solutions and systems is estimated to be a driving factor in the global digital therapeutics market growth.

A deduction in fertility rates is a significant factor that presents a boost to the geriatric population. In 2019, the World Bank Group stated that 16.25% of the total population around the US and 19.51% in the United Kingdom were 65 years old or older. The aging population, with a higher vulnerability to different diseases, necessitates continuous monitoring. The combination of smartphone applications, innovations in medical technology, and government initiatives has collectively contributed to addressing the growing prevalence of chronic diseases in different countries. These factors boost the digital therapeutics market in the forecast period.

Sample Request

To have an edge over the competition by knowing the market dynamics and current trends of “Digital Therapeutics Market” request for Sample Report here

The significant rise in the incidence of chronic ailments including diabetes, cardiac conditions, and obesity, which results in durable hospitalization, a higher disease weight, and developed mortality rates, is projected to attributing the growth of the digital therapeutic market. The substantial rise in diabetes incidence among elderly inhabitants aged 65 years or more coupled with managing chronic diseases such as diabetes often involves multidimensional techniques including the usage of digital therapeutic software and devices fosters demand. Digital therapeutic solutions play an important role in chronic disease management, serving as an important factor in treatment. These solutions are becoming increasingly integral in the overall approach to managing chronic conditions effectively. The increasing incidence of non-communication diseases and the associated mortality present a positive impact on digital therapeutics market growth. This also offers an opportunity for players to establish and access untapped markets.

The digital therapeutics market represents an evolving segment of software and device-driven products designed to prevent, treat, and manage medical conditions. However, the growing concerns connected to cybersecurity predicted to significant challenge, restricting the adoption of therapeutics in this space. Patient concerns about the threats and vulnerabilities in preventing their medical data contribute to the limited adoption of digital therapeutics. The existence of certain cyberattacks and risks acts as a deterrent, impacting the widespread acceptance of these products in the forecast period. For instance, in 2022, Appdome Inc. stated that there has been an increased threat of cyberattacks on digital therapeutics appplications compared to previous years. This heightened risk is attributed to the increased accessibility of more users and a rise in patient health information. These elevated risks of cybersecurity breaches, specifically concerning patients’ personal health information, have been a contrasting factor in the global acceptance of digital therapeutics products among the patient population. Limitations linked with digital therapeutic products such as the introduction of over-predictive and false results and potential mismanagement of a patient’s health, are predicted to pose limitations on the market development in the forecast period.

Request Research Methodology

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

The digital therapeutics market is driven by different factors, including the growing prevalence of preventable chronic diseases, rising need for safe and accessible alternatives for treating chronic and mental health situations, increasing emphasis on participatory, preventive, and personalized healthcare, and the imperative to regulate healthcare costs coupled with increased investments in digital therapeutics. These factors collectively contribute to the development and expansion of the digital therapeutics industry.

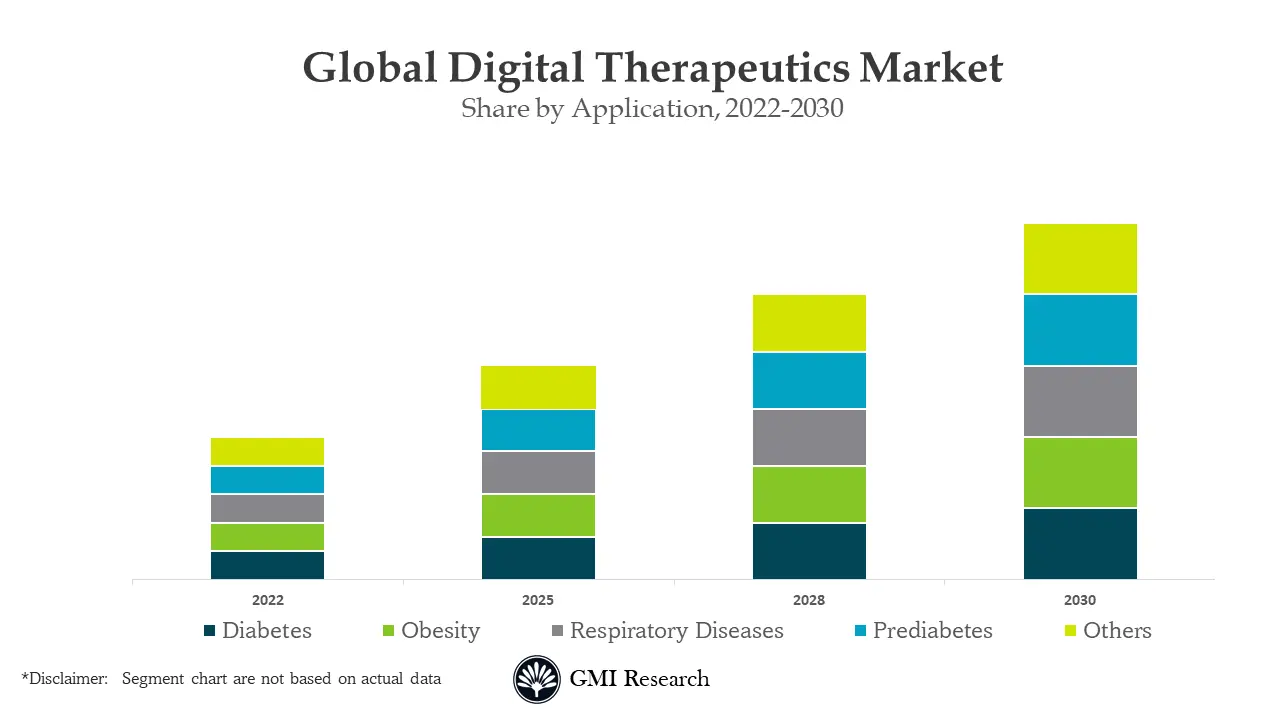

By Application, Treatment/Care segment presents the highest CAGR in the global digital therapeutics market

The treatment and care segment is predicted to dominate the market, propelled by the increasing economic burden of treating different conditions. Investments in digital therapeutics focus on improving cost-effective and scalable treatment platforms, specifically for conditions that impose a significant economic burden. The growth of the treatment and care application segment in the digital therapeutics market is propelled by factors, including strategic partnerships by market players. For instance, in 2021 strategic partnership between Hydrus 7 Lab and Emillo, a European Digital Health company. This collaborative initiative is predicted to further foster the market in the coming period.

By Product Type, Software and Services is the largest product type segment of the digital therapeutics market

The software and services held the highest revenue share in the digital therapeutics market, primarily attributed to the increased acceptance of software. Software solutions deliver patients with convenient usability, personalized meditation, and easy access, contributing to their widespread adoption and dominance in the market. The growing aim of players to develop software personalized for patients with chronic conditions, including cardiovascular diseases, mental health issues, and diabetes, is a significant factor contributing to growth of the software and services segment in the global digital therapeutics market. For instance, in 2022, Pfizer Inc. and Sidekick Health joined hands to launch a new solution concerning digital therapeutics to manage treatment amongst patients who are suffering from atopic dermatitis.

Request for Customization

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

By Sales, B2B segment is the largest sales segment of the global digital therapeutics market

B2B segment holds the largest revenue share segment because it comprises several entities such as employers, payers, pharmaceutical companies, and providers. The revenue share is registered by foremost market players and pharmaceutical firms due to the growing number of strategic partnerships, mergers and acquisitions, collaborations, expansions, and many others amongst them for new product developments and launches. Additionally, the significant increase in the aim of companies in delivering the product of their personnel is enhancing, and prolonging the client base, thereby driving this segment.

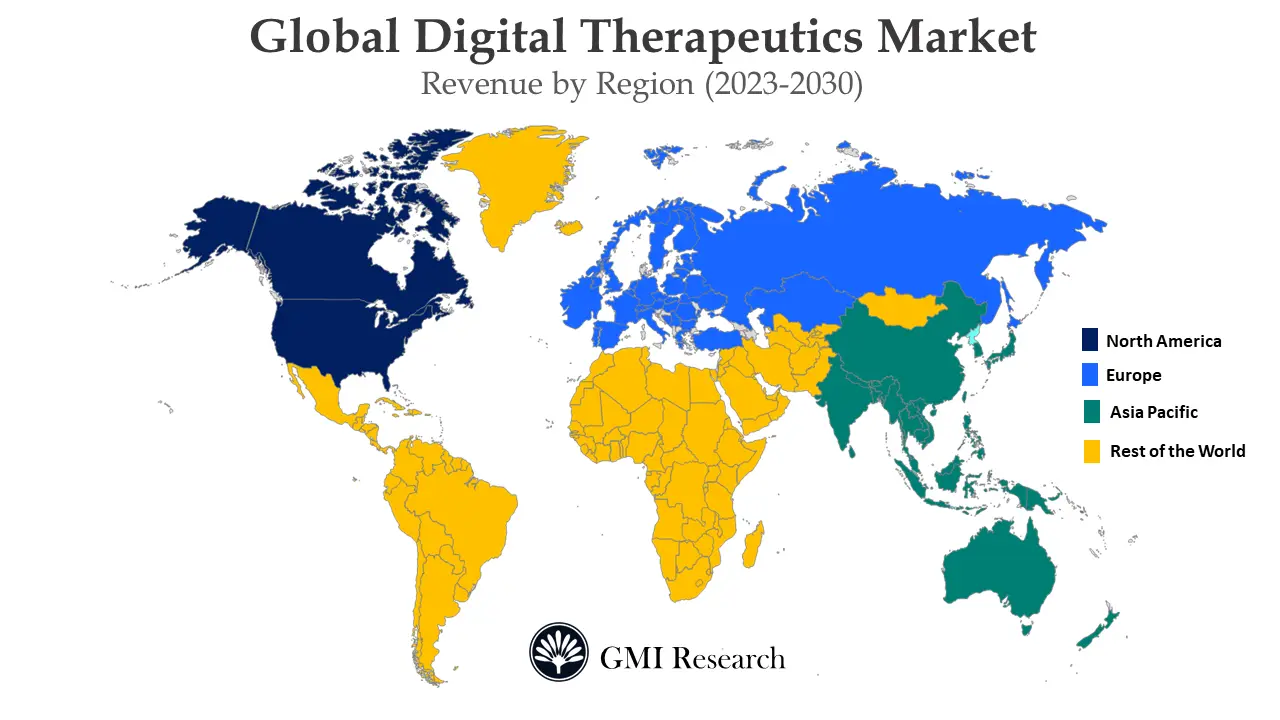

By Region, North America is anticipated to register the digital therapeutics market

The regional market is predicted to rise due to a considerable rise in several cases of chronic diseases and mental health conditions. Additionally, a growing number of agreements and strategic partnerships among the foremost players to aim at different research and development activities of these products is predicted to increase the production of these devices internationally. Also, favorable government rules that focus on developed customized care connected to chronic health conditions foster North America digital health therapeutics market size.

The surge in investment in digital therapeutics is an influencing factor behind the market statistics in North America. Government programs, venture capital firms, and private equity funds are actively contributing to the development and regionalization of digital therapeutics solutions in the region. This financial assistance plays an important role in influencing innovation within the digital therapeutics market in North America.

Top Market Players

Top Market Players

Various notable players operating in the Digital Therapeutics market include Omada Health, Inc., DarioHealth Corp., Livongo, Welldoc’s BlueStar, Voluntis, Happify Health, Propeller Health, Kaia Health Software Inc., Pear Therapeutics, Inc., Akili Interactive Labs, Inc among others.

Sample Request

For detailed scope of the “Digital Therapeutics Market” report request a Sample Copy of the report

Key Developments:

-

- In 2023, Mahana Therapeutics signed an agreement with the Consumer Health Division of Bayer to significantly commercialize and promote digital therapeutics.

- In 2023, Big Health acquired Limbix to expand its product portfolio and help several individuals get good mental health back.

- In 2023, Kaia Health successfully launched Angela, an AI-driven voice-based assistant for digital care, a guide, or a companion to provide customized assistance to its customers.

- In 2023, Jolly Good Inc. signed an agreement with Teijin Pharma Ltd., to encourage the advancement of VR digital therapeutics mainly for depression.

- In 2023, Lupin Digital Health launched LYFE, an effective digital therapeutics solution to decrease the threat of heart attack and develop the quality of life.

- In 2022, Biofourmis announced an expansion into virtual specialty care by launching Biofourmis care to develop healthy results and decrease the total cost of personal care among intricate chronic disease patients by recognizing patterns of medical worsening.

- In 2021, DarioHealth Corp. launched Dario Move, a new digital physical therapy solution to manage common musculoskeletal (MSK) conditions that drive significant costs for employers and health plans.

- In 2021, Welldoc’s and Dexcom expanded strategic partnership for a new integrated platform offering to improve health of people with Type 2 diabetes. The Dexcom G6 system measures glucose level beneath the surface of skin, and BlueStar guides individual through complicated journey of living with diabetes.

- In 2021, Voluntis announced the issuance of a new patent by the European Patent Office(EPO) for intelligent patient support in drug dosing applied in the field of diabetes for insulin titration with Its Theraxium digital therapeutic platform.

Segments covered in the Report:

The Global Digital Therapeutics Market has been segmented on the basis of Product, Sales and Application. Based on the Product, the market is segmented into Software and Services, Devices. Based on the Application, the market is segmented into Preventive and Treatment/Care. The Preventive segment is further segmented into Pre-diabetes, Obesity, Smoking Cessation, Others. The Treatment/Care segment is further segmented into Cardiovascular Diseases, Diabetes, Neurological Disorders, Respiratory Diseases, Others. Based on the Sales, the market is segmented into B2B and B2C.

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 3,539 Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Product Type, By Application, By Sales and Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Omada Health, Inc., DarioHealth Corp., Livongo, Welldoc’s BlueStar, Voluntis, Happify Health, Propeller Health, Kaia Health Software Inc., Pear Therapeutics, Inc., Akili Interactive Labs, Inc among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Digital Therapeutics Market by Product Type

-

- Software and Services

- Devices

Global Digital Therapeutics Market by Application

-

- Preventive

- Pre-diabetes

- Obesity

- Smoking Cessation

- Others

- Treatment/Care:

- Cardiovascular Diseases

- Diabetes

- Neurological Disorders

- Respiratory Diseases

- Others

- Preventive

Global Digital Therapeutics Market by Sales

-

- B2B

- B2C

Global Digital Therapeutics Market by Region

-

-

North America Digital Therapeutics Market (Option 1: As a part of the free 25% customization)

- By Product Type

- By Application

- By Sales

- US Market All-Up

- Canada Market All-Up

-

Europe Digital Therapeutics Market (Option 2: As a part of the free 25% customization)

- By Product Type

- By Application

- By Sales

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Digital Therapeutics Market (Option 3: As a part of the free 25% customization)

- By Product Type

- By Application

- By Sales

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Digital Therapeutics Market (Option 4: As a part of the free 25% customization)

- By Product Type

- By Application

- By Sales

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Digital Therapeutics (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Omada Health, Inc.

- DarioHealth Corp.

- Livongo

- Welldoc’s BlueStar

- Voluntis

- Happify Health

- Propeller Health

- Kaia Health Software Inc.

- Pear Therapeutics, Inc.

- Akili Interactive Labs, Inc

Frequently Asked Question About This Report

Digital Therapeutics Market [HM46A-00-0719]

Increasing prevalence of chronic disease stands to be one of the key market drivers of the digital therapeutics market. Caring for individuals who suffer from chronic health condition, such as diabetes, high blood pressure, congestive heart failure and chronic obstructive pulmonary disease, costs the US healthcare system billions of dollars annually.

Diabetes segment accounted for the largest share in the digital therapeutics market owing to the increasing number of cases and prevalence of diabetes globally, thereby positively contributing to the growth of this segment in the digital therapeutics market

Digital therapeutics market is predicted to grow at 23.1% CAGR during the forecast period.

Various notable players operating in the Digital Therapeutics market include Omada Health, Inc., DarioHealth Corp., Livongo, Welldoc’s BlueStar, Voluntis, Happify Health, Propeller Health, Kaia Health Software Inc., Pear Therapeutics, Inc., Akili Interactive Labs, Inc among others.

Related Reports

- Published Date: Nov-2023

- Report Format: Excel/PPT

- Report Code: HM46A-00-0719

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Digital Therapeutics Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research