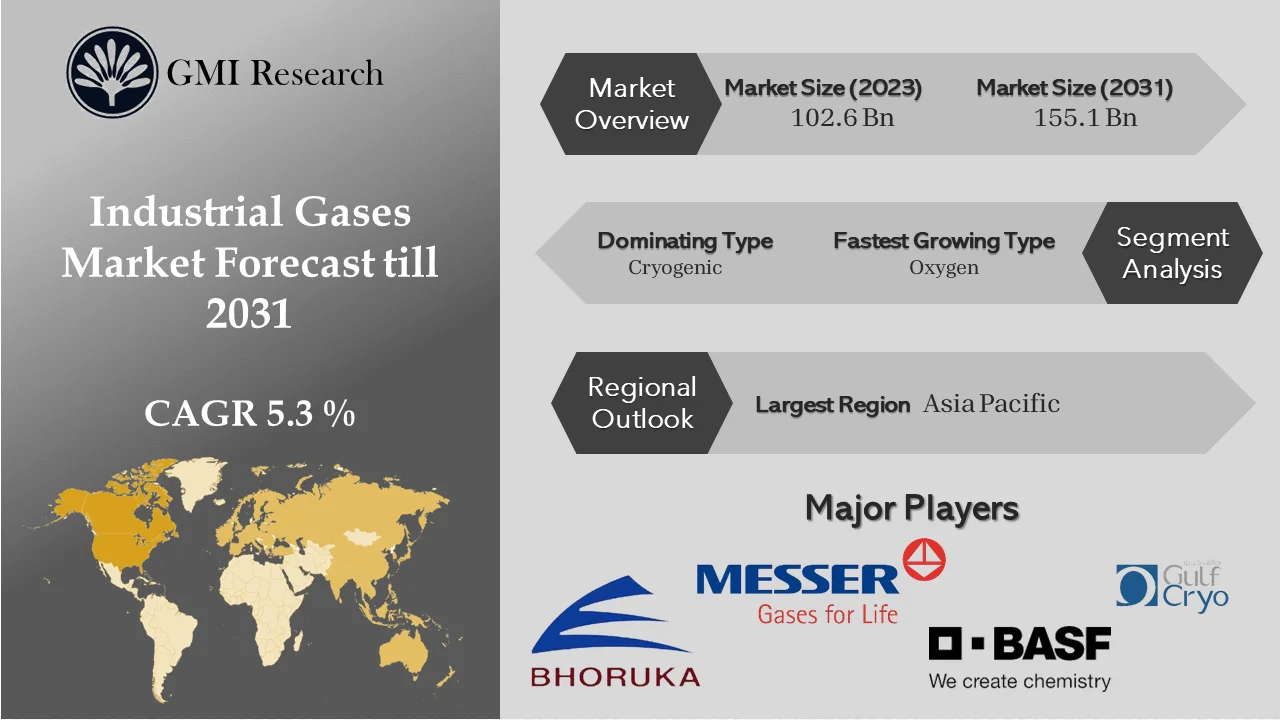

Industrial Gases Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

Industrial Gases Market size reached USD 102.6 billion in 2023 and is estimated to reach USD 155.1 billion in 2031 and the market is estimated to grow at a CAGR of 5.3% from 2024-2031.

To have an edge over the competition by knowing the market dynamics and current trends of “Industrial Gases Market”, request for Sample Report here

Industrial Gases Market Key Drivers and Emerging Trends

The global industrial gases market growth and size have risen due to the development of the manufacturing industry in emerging economies, the increase in demand from the healthcare industry, and growing environmental concerns. The growth of the manufacturing sector in developing countries of Asia Pacific primarily drives the market growth. In addition, the rise in urbanization and industrialization, along with the growing usage of industrial gases in sectors such as metal, mining, food and beverages, and healthcare manufacturing, are estimated to contribute to market expansion in the coming period.

The growth of global market is driven by the usage of industrial gas in the electronics (PV) industry for manufacturing solar components, polysilicon, wafers, screens, LED solid-state lighting, semiconductors, and LED solid-state lighting. Particularly, solar PV energy is emerging as a popular source of sustainable energy generation, increasing investments across the globe. The reduction in production costs associated with these gases is projected to propel their increased usage in the forecast period. Global industrial production is increasing and is estimated to continue, leading to a rising need for industrial gases in sectors such as metals, aerospace, and mining due to their extensive usage.

Market players in the global industrial gas market have untapped opportunities, propelled by the growing industrial gas demand in crisis medical situations. In addition, the global expansion of processing and manufacturing industries is projected to present growth opportunities for rising industrial gas companies market share in the forecast period. The glass, fiber optics, oil, and gas market demand extensive utilization of industrial gases. The growth in these industries, particularly in emerging countries, is propelling the swift expansion of the industrial gas market share. Furthermore, the rising awareness of environmental prevention against degradation and the demand for clean energy has led to an increase in the usage of industrial gases in different countries.

The growing global demand for crude oil and the increasing need for refining have propelled the demand in the market for industrial gases. These gases are increasingly implemented in the oil & gas industry for both downstream and upstream applications. Different major applications including well lifting, inspection & maintenance, gas analysis, compositional analysis, shipbuilding, leak testing, coiled tubing, drilling, firefighting, and others lead the demand for industrial gases. The growth and expansion of the oil & gas industry, demanding gases such as carbon dioxide, nitrogen, hydrogen, oxygen, and others are foremost factors fostering the global industrial gases market.

The anticipated rise in government and private investments, especially in emerging countries, to discover new possibilities in different industrial segments such as food and beverage, metallurgy, mining, and many more is predicted to contribute to the global industrial gases market size. For instance, the World Investment Report 2020 from the United Nations Conference on Trade and Development reported that the Asia Pacific region received over USD 474 billion in foreign direct investment in 2019, constituting more than 30% of the global FDI movement. The group further noted that Southeast Asian nations, including Singapore and Malaysia, are predicted to emerge as some of the region’s robust economies, presenting growth opportunities for industrial gases industry development.

Meanwhile, the market growth is projected to face challenges due to stringent laws and regulations concerning the manufacturing, transportation, and storage of gases. For instance, the EU Regulations 231/2012 outlines precise hydrocarbon composition demands for the storage and distribution of industrial gases, while the European Agreement on the Carriage of Dangerous Goods by Road, ADR 13 regulation, mandates safety measures for the transportation of these gases.

Whereas, the rising spending in the food and beverages as well as the healthcare industry is estimated to propel the gas demand in the forecast period. As per the Germany Trade & Invest report, Europe, followed by Germany is the 4th largest food and beverages industry around the globe and is the largest food producer. In addition, Germany being the 3rd largest exporter of food and beverages, experienced sales of USD 84.31 billion from trades of processed foods and agricultural products in 2018. This trend is projected to continue in the forecast period, increasing in demand for numerous gases in the food and beverages industry.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

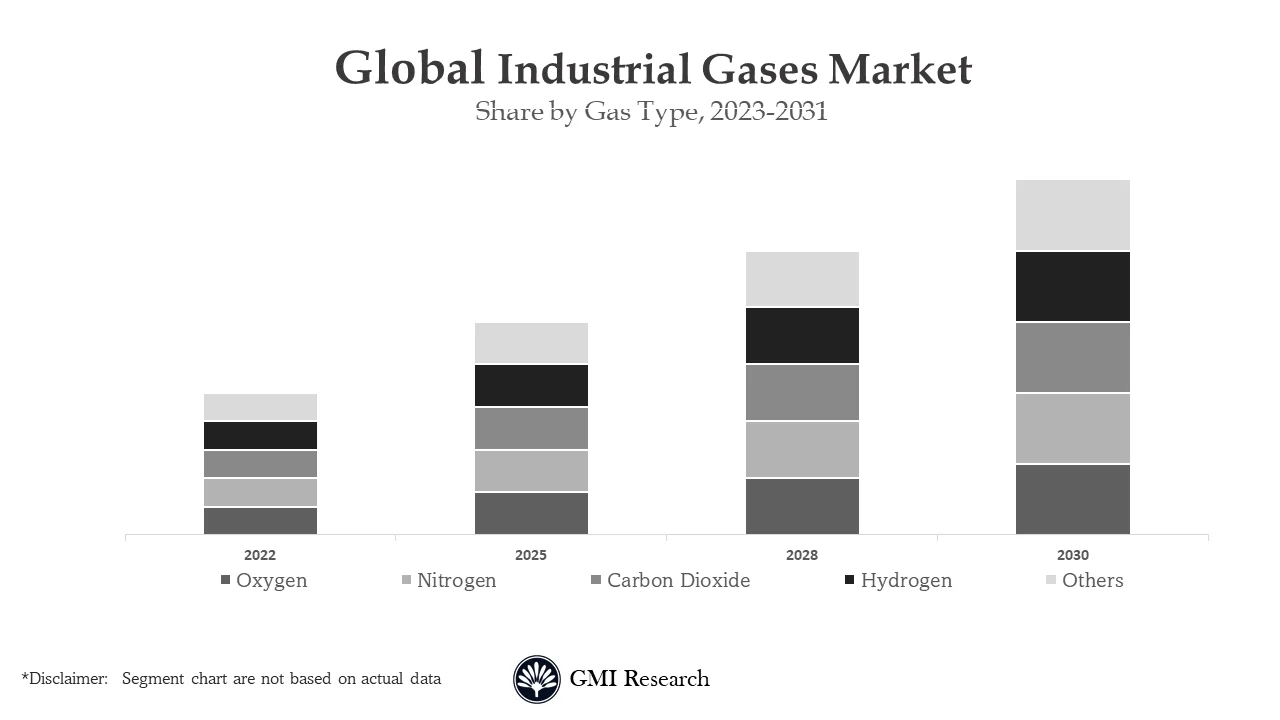

Oxygen segment accounted for the largest market share by product in the global industrial gases market

Oxygen is classified as a reactive oxidizing agent and a nonmetal, promptly forming oxides with different compounds and elements. It makes up 21% of Earth’s atmosphere. The prevalent commercial methods for producing approximately 99% pure oxygen include air separation through vacuum swing adsorption or cryogenic distillation procedures, where oxygen is separated from the atmosphere. Oxygen is supplied in spray cans, gas cylinders, and different containers. The expanding industries including automobiles, chemicals, medicine, agriculture, construction equipment, glass, space exploration, steel manufacture, beverages, food, and many more rely on a consistent supply of oxygen for their procedures. This rise in industrial activities is leading to an increase in oxygen production demand. Additionally, the different applications of oxygen across the chemical industry, serving as an oxidizing agent and compound, are influencing the growth of the oxygen segment. The presence of these factors is predicted to offer considerable opportunities for market expansion.

Cylinder segment by distribution dominated the largest market size in the global industrial gases market

The cylinder segment accounted largest share because this segment presents the delivery of gases through packed cylinders, catering primarily to clients with a measured need for industrial gases. Gases including helium, hydrogen, oxygen, argon, and nitrogen can be easily squeezed into cylinders and allotted at pressures of up to 300 bar using this method.

By application, manufacturing industry segment accounted largest share of the global industrial gases market

The manufacturing industry segment dominated the global market because industrial gases demand including carbon dioxide, nitrogen, hydrogen, and oxygen is estimated to grow in emerging nations due to innovations and developments in the manufacturing industry. In the rubber industry, carbon dioxide is commonly employed in the form of dry ice for the gentle and non-abrasive maintenance of rubber molds. Producers of molded rubber products commonly use carbon dioxide to minimize production downtime and cut down on maintenance and labor costs. Employing carbon dioxide for the cleaning of important tools and molds across the rubber industry provided different benefits compared to traditional cleaning methods.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

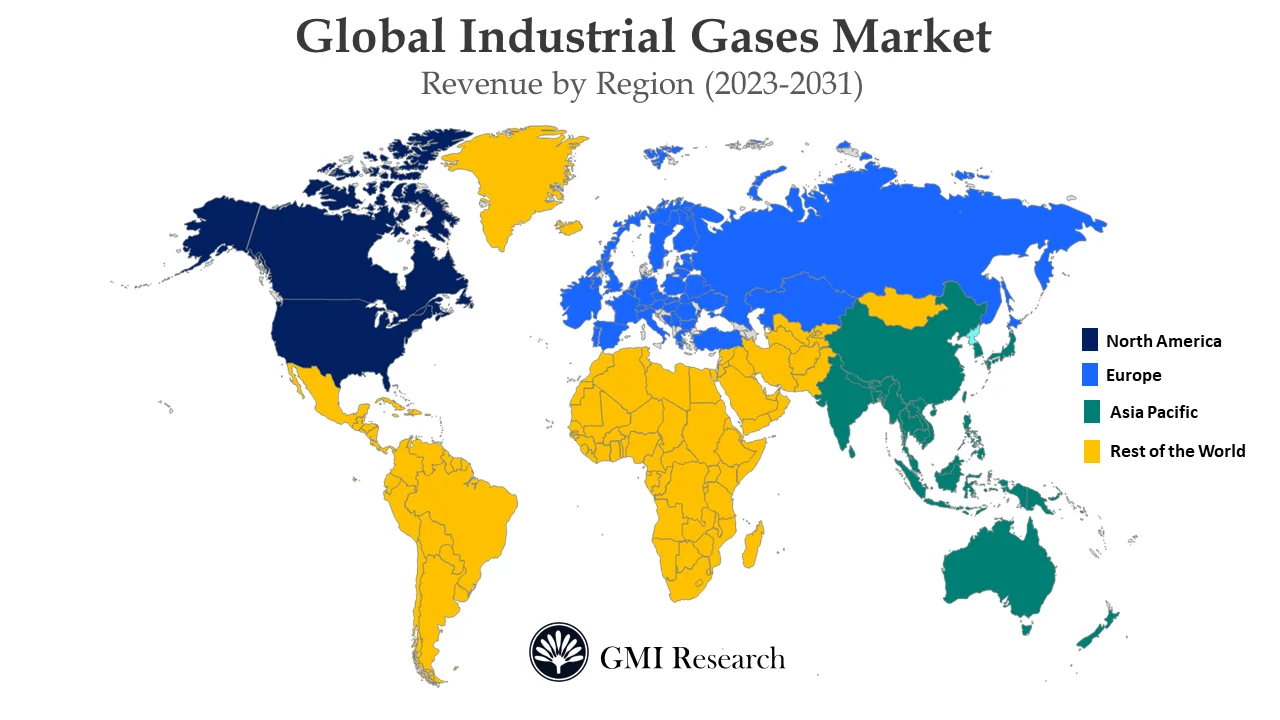

By region, Asia Pacific registered the largest revenue share in the global industrial gases market

The Asia Pacific region holds the largest market share for industrial gases, with China being a significant customer in this area. However, India is estimated to witness the fastest growth around the region. China aerospace market is estimated to regain profitability during 2022, rebounding from a decline in preceding years. As per the Civil Aviation Administration of China, the aviation sector to retrieve domestic traffic to close 85% of pre-pandemic levels. Additionally, industrial gases are important in transportation, being used in different applications such as tire manufacturing with compressed nitrogen, utilizing high-pressure argon for airbags, and employing nitrogen and carbon dioxide for secure and precise welding. As per the International Air Transport Association, India is projected to emerge as the 3rd largest aviation market by 2030 globally.

Top Market Players

Various notable players operating in the market include Air Liquide, Air Products Inc., Linde plc, Matheson Tri-Gas, Messer Group, Gulf Cryo, BASF SE, Southern Company, Universal Industrial Gases, Inc., and Bhuruka Gases Limited, among others.

Key Developments:

-

- In 2022, Linde joined hands with BASF to distribute steam and hydrogen to address the growing need for the global industrial gases market.

- In 2022, Air Liquide announced an investment in an innovative Air Separation Unit conferred to the Industrial Merchant activities. This unit is projected to launch up to 350 tons of oxygen per day, with an utmost volume of 300 tons. Air Liquide India is responsible for the ownership, construction, and function of this ASU, planned to start functions by 2023.

- In 2021, Air Products Canada Ltd., the Province of Alberta, and the Government of Canada announced a project of multi-billion dollar to construct a net-zero hydrogen energy complex. This initiative outlines Air Products’ commitment to function Canada’s green hydrogen network.

- In 2021, Air Liquide acquired a stake of 40% in the Frech company H2V Normandy to construct a large-scale complex of electrolyzers to introduce green hydrogen across France.

- In 2019, Air Products entered into a contract of USD 168 million from NASA with an aim to supply helium for its space projects. The assigned project is for two years.

- In 2019, Linde and ExxonMobil Asia Pacific Pvt. Ltd., entered into a multi-billion agreement for the expansion of the organization’s integrated manufacturing complex in Singapore. The project includes building and operation of additional gasifiers, a 1,200 metric ton per day air separation plant and Linde’s proprietary downstream gas processing units.

Segments Covered in the Report:

The Global Industrial Gases Market has been segmented on the basis of Product, Application and Distribution. Based on the Product, the market is segmented into Nitrogen, Oxygen, Carbon dioxide, Hydrogen, Acetylene, Argon. Based on the Application, the market is segmented into Healthcare, Manufacturing, Metallurgy & Glass, Food & Beverages, Retail, Chemicals & Energy, Others. Based on the Distribution, the market is segmented into On-site, Bulk (Liquid Gas Transport), Cylinder (Merchant)

For detailed scope of the “Industrial Gases Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 102.6 Billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Application, By Distribution , By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Air Liquide, Air Products Inc., Linde plc, Matheson Tri-Gas, Messer Group, Gulf Cryo, BASF SE, Southern Company, Universal Industrial Gases, Inc., and Bhuruka Gases Limited, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Industrial Gases Market by Product

-

- Oxygen

- Nitrogen

- Hydrogen

- Carbon dioxide

- Acetylene

- Argon

Global Industrial Gases Market by Application

-

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

Global Industrial Gases Market by Distribution

-

- On-site

- Bulk (Liquid Gas Transport)

- Cylinder (Merchant)

Global Industrial Gases Market by Region

-

-

North America Industrial Gases Market (Option 1: As a part of the free 25% customization)

- By Product

- By Application

- By Distribution

- US Market All-Up

- Canada Market All-Up

-

Europe Industrial Gases Market (Option 2: As a part of the free 25% customization)

- By Product

- By Application

- By Distribution

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Industrial Gases Market (Option 3: As a part of the free 25% customization)

- By Product

- By Application

- By Distribution

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Industrial Gases Market (Option 4: As a part of the free 25% customization)

- By Product

- By Application

- By Distribution

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Industrial Gases (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Air Liquide

- Air Products Inc.

- Linde plc

- Matheson Tri-Gas

- Messer Group

- Gulf Cryo

- BASF SE

- Southern Company

- Universal Industrial Gases, Inc.,

- Bhuruka Gases Limited

Frequently Asked Question About This Report

Industrial Gases Market [UP1863-001001]

The cryogenic segment is projected to dominate the market during the forecast period. The growing usage of industrial gases for the production of cryogenic fuels such as liquid hydrogen and liquid oxygen for rockets and spacecraft is surging the segment growth.

The various top players in the market include Air Liquide, Air Products Inc., Linde plc, Matheson Tri-Gas, Messer Group, Gulf Cryo, BASF SE, Southern Company, Universal Industrial Gases, Inc., and Bhuruka Gases Limited, among others.

The various end-user include metallurgy, healthcare, chemical, food & beverage, oil and gas, power, pulp, and paper, electronics, water treatment, mining and others.

The market size of Industrial Gases Market in 2023 was 102.6 Billion.

Related Reports

- Published Date: Jan- 2023

- Report Format: Excel/PPT

- Report Code: UP1863-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Industrial Gases Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research