Drone Services Market Size, Share, Growth Opportunities, Trends Analysis & Industry Forecast Report, 2023-2030

Analysts at GMI Research estimates that the Drone Services Market size was worth USD 14.7 billion in 2022, and forecast to touch USD 65.8 billion in 2030, growing at a significant higher CAGR of 21.1% from 2023-2030 attributed to growing demand for drone monitoring and inspection services in wind farms and power lines.

Drone Services Market Overview

In the recent times, drones have become more popular as it can easily capture data from difficult-to-reach areas and its capability to work remotely. Some of the commercial drone applications includes aerial photography and videography, delivery services and infrastructure inspection.

To have an edge over the competition by knowing the market dynamics and current trends of “Drone Service Market”, request for Sample Report here

Major Drone Services Market Drivers

Primary factors driving drone services market are growing demand for high-quality data, decline in the prices of manufacturing drones, and integration of advanced technologies like Artificial Intelligence (AI) and Internet of Things (IoT) in drone services. Companies operating in different industry verticals like agriculture and construction are preferring to use drone services for gathering information related to hydrography, soil type and land development of a particular area due to its cost-effective features. Traditional procedures involve the usage of satellites and helicopters for collecting photogrammetric and geospatial data. However, using satellites and helicopters is costly, and they might not be able to provide accurate or detailed information. Thus, adoption of drones is expected to increase in the future as these aircrafts are equipped with high mega pixel cameras and advanced image processing software which helps in gathering detailed information in low-heights and high-quality images at comparatively less price than helicopters and satellites.

Global urban population is expanding rapidly. As per United Nation’s estimates, around 68% of the world’s population will be living in urban areas. But growing urbanization creates challenges related to traffic congestion as the mobilization of people in cities increases, which leads to congestion and longer commute time. Thus, many cities worldwide are looking for alternative transportation services like autonomous drones and urban air mobility solutions. Concept of air taxi is gaining popularity as potential solution to reduce traffic congestion in urban areas. Major companies in United States are planning to launch their air taxi services in the country. For instance, Joby Aviation, developer of electric vertical takeoff and landing aircraft based in United States partnered with Uber to connect its ariel taxi with ground ride hailing. In May 2022, Job Aviation secured certificate to commence its commercial air taxi. Currently, the company along with its partners are planning to launch aerial taxi services by 2024 in the country. Government in United Arab Emirates (UAE) approved the design of designs of flying taxi stations in Dubai and air taxi services in city is set to be operational by 2026. Such initiatives are expected to create lucrative growth opportunities for commercial drones market in the coming years. However, drone service providers are facing challenges for manufacturing drones, due to lack of insurance coverage for ariel delivery drones, which is restricting the overall drone industry growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

As per drone market forecast, Platform Service segment is projected to grow at the fastest rate.

Platform is sub-segmented into flights piloting & operation, data analysis and data processing. Cost of manufacturing drones is going down due to technological advancements coupled with higher efficiency of drone services platforms in collecting data, are some of the factors propelling the segment’s growth.

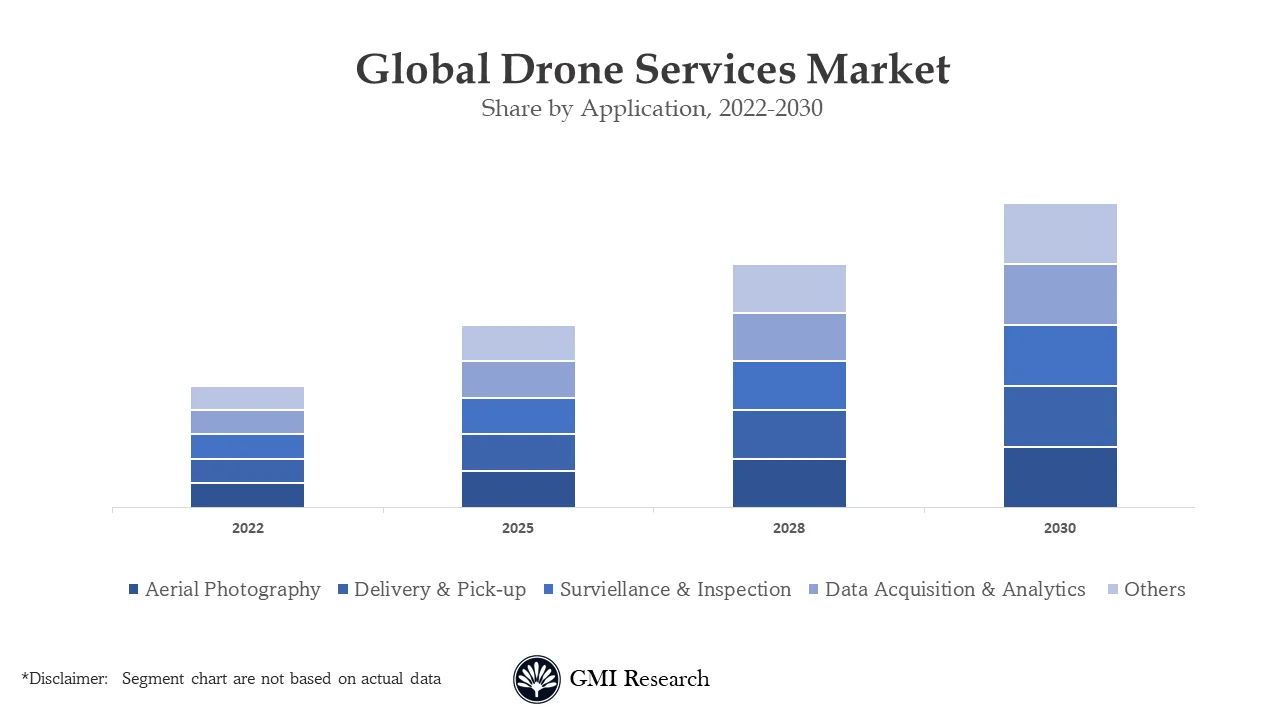

Based on Application, Delivery & Pick-Up segment is estimated to hold the largest drone services market share.

Increasing demand for packaged delivery services in e-commerce industry due to growing acceptance amongst consumers towards online shopping and growing adoption of smartphone devices. China is one of the largest e-commerce markets worldwide, the retail e-commerce sales in the country exceeded USD 2.6 trillion in 2021, and this figure is expected to double in coming 5-6 years. Demand for e-commerce deliveries will rise in future globally, as the usage of smartphone is increasing, which will create new opportunities for the drone industry.

According to drone market analysis, End-to-End segment is forecast to expand at the highest CAGR.

Surge in the demand for package solutions like piloting and operations and data analysis for processing data, is accelerating the segment’s growth.

Industry: Segment Analysis

Growing adoption of ariel data collection tools in the agriculture industry, lack of skilled workforce and availability and rise in venture funding for the development of agriculture drones is driving the Agricultural drones market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

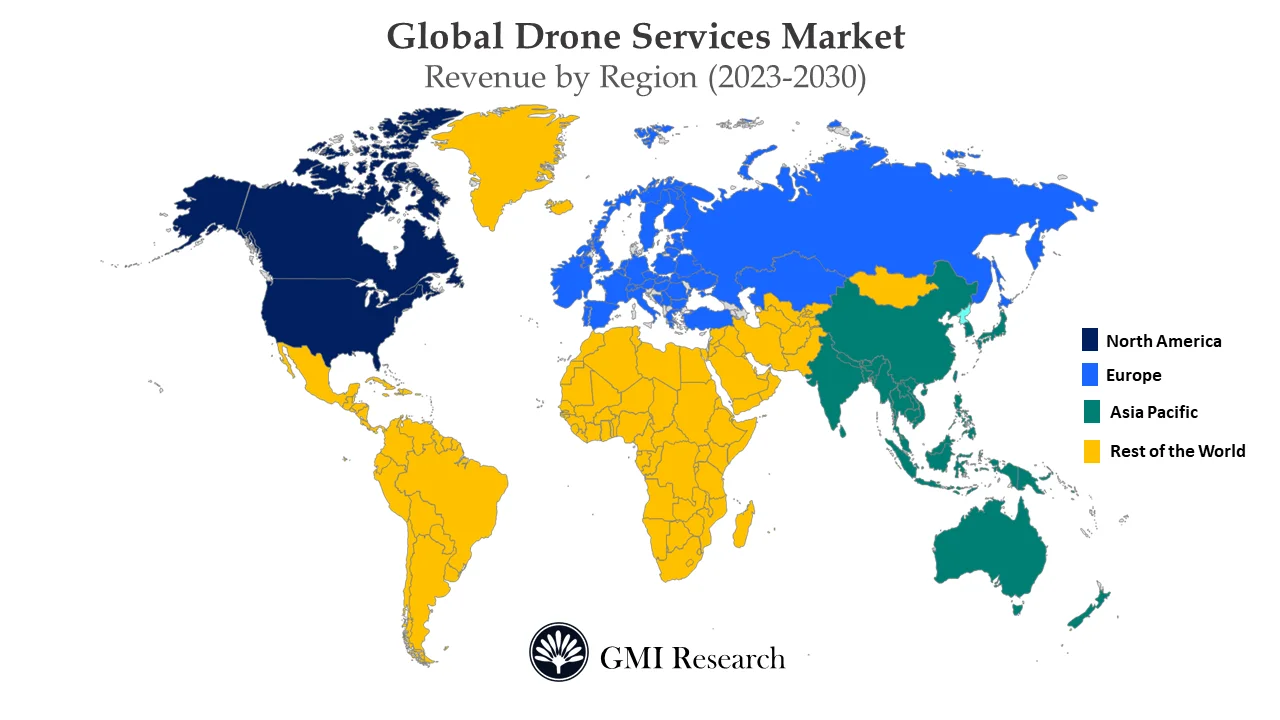

Based on Region, North American region is expected to capture the largest market share.

North American drone services market is driven by growing popularity of online shopping platforms, favourable regulations set by Federal Aviation Administration (FAA) in United States and growing investments by key companies to help start-ups for developing parcel service platforms. Some of the major US consumer drone manufacturers are focussing to launch innovative products. For instance, in August 2021, Autel Robotics launched its consumer drone Autel EVO lite in United States, which is equipped with thermal imaging camera.

Drone as a Service Companies

Some of the key drone service providers are Aerodyne Group, CYBERHAWK, Flirtey, Hemav Technology S.L, Matternet, MEASURE, Skylark Drones, Terra Drone Corp., Verity, and Zipline, among others.

Key Developments:

-

- In February 2023, Aerodyne Group, a leading drone solution provider made strategic investment in Aiviewgroup of Italy. Through this partnership, company plans to expand its technology markets in the new markets of European Union (EU).

- In July 2021, Skylark a leading drone platform company based in India announced that it has raised USD 3 million to boost its international expansion. With this funding company plans to expand its product offering.

- In November 2019, CYBERHAWK completed the acquisition of Florida Pest Control, which is a pest management company based out of United States. Through this acquisition, the company plans to increase customer density and expand its footprint in the North American market.

Segments Covered in the Report:

The global drone services market has been segmented on the basis of type, application, end-use industry, solution and regions. Based on type, the market is segmented into Platform Service, Maintenance Repair Overhaul and Simulation & Training. Based on application, the market is segmented into aerial photography, delivery & pick-up, surveillance and inspection, data acquisition and analytics, remote sensing and environment monitoring, others. Based on end-use industry, the market is segmented into Agriculture, Infrastructure, Oil & Gas, Logistics and Others. Based on Solution, the market is segmented into End-to-End and Point.

For detailed scope of the “Drone Service Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 14.7 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Application, By End-Use Industry, By Solution, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Aerodyne Group, CYBERHAWK, Flirtey, Hemav Technology S.L, Matternet, MEASURE, Skylark Drones, Terra Drone Corp., Verity, Zipline, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Drone Service Market by Type

-

- Platform Service

- Maintenance Repair Overhaul

- Simulation & Training

Global Drone Service Market by Application

-

- Aerial Photography

- Delivery & Pick-Up

- Surveillance and Inspection

- Data Acquisition and Analytics

- Remote Sensing and Environment Monitoring

- Others

Global Drone Service Market by End-Use Industry

-

- Agriculture,

- Infrastructure,

- Oil & Gas,

- Logistics

Global Drone Service Market by Solution

-

- End-to-End

- Point

Global Drone Service Market by Region

-

-

-

North America Drone Service Market (Option 1: As a part of the free 25% customization)

- By Type

- By Application

- By End-Use Industry

- By Solution

- US Market All-Up

- Canada Market All-Up

-

Europe Drone Service Market (Option 2: As a part of the free 25% customization)

- By Type

- By Application

- By End-Use Industry

- By Solution

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Drone Service Market (Option 3: As a part of the free 25% customization)

- By Type

- By Application

- By End-Use Industry

- By Solution

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Drone Service Market (Option 4: As a part of the free 25% customization)

- By Type

- By Application

- By End-Use Industry

- On Solution

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

-

Major Players Operating in the Drone Service (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Aerodyne Group

- CYBERHAWK

- Flirtey

- Hemav Technology S.L

- Matternet

- MEASURE

- Skylark Drones

- Terra Drone Corp.

- Verity

- Zipline

Frequently Asked Question About This Report

Drone Services Market [UP1741-001001]

Drone service market size was estimated at USD 14.7 billion in 2022.

Drone services market is estimated to grow at a CAGR of 21.1% over the forecast period 2023-2030.

Delivery & Pick-Up segment is forecast to dominate the market.

North American region is expected to lead the market.

- Published Date: Jul-2023

- Report Format: Excel/PPT

- Report Code: UP1741-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Drone Services Market Size, Share, Growth Opportunities, Trends Analysis & Industry Forecast Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research