Press Release

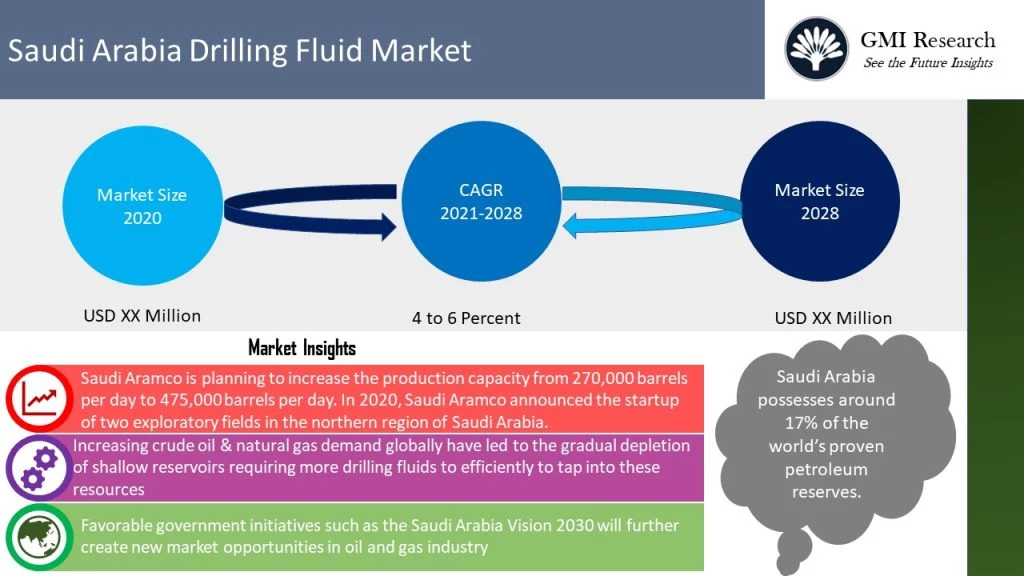

As per the GMI Research forecasts, the rising demand for oil and gas stands to be one of the major factors contributing to the growth of the Saudi Arabia drilling fluids market. The market is predicted to reach USD xx million by the end of 2030, while growing at a CAGR of 8.5% to 11% during the forecast period (2023-2030).

The Increasing crude oil & natural gas demand globally have led to the gradual depletion of shallow reservoirs requiring more drilling fluids to efficiently to tap into these resources. Lower global oil demand in 2020 may have slowed down the consumption of drilling fluid, but global fuel consumption will increase later in 2021 as global economic activities are back on track. Marjan Oil Field Expansion is playing a key role in catering to the increasing oil & gas demand. Saudi Aramco is planning to increase the production capacity from 270,000 barrels per day to 475,000 barrels per day. In 2020, Saudi Aramco announced the startup of two exploratory fields in the northern region of Saudi Arabia. The two exploratory fields include a gas field called “Hadbat Al-Hajarah” and an oil and gas field called “Abraq Al-Tuloul”.

To have an edge over the competition by knowing the market dynamics and current trends of “Saudi Arabia Drilling Fluids”, request for Sample Report here

The demand for energy will rapidly increase in the coming decades because of population and economic growth, especially in emerging market economies. As still most of the demands are met by reliance on fossil fuels as oil remaining the dominant source. Therefore, drilling operations are important and vital. Saudi Arabia has been taking several steps to increase its upstream oil and gas capabilities, particularly in drilling equipment and services. Saudi Arabia looks forward to drilling joint ventures to advance local capacity.

In terms of barriers, environmental risk and concerns related to drilling fluid stands to be one of the major factors impacting the market. With regards to drilling fluids, all oil-based drilling fluids, toxic fluids, and cuttings from toxic drilling fluids must be hauled back to an approved onshore disposal site. For alternative oil-based fluids, LC-50 toxicity tests shall be run to determine toxicity of the cuttings. If fluids are toxic, then fluids and cuttings should be disposed in an approved disposal site.

By product type, water-based fluids contributed to be the largest market in 2020. Low cost of water-based fluids compared to oil-based fluids stands to be one of the key market drivers. Among these, viscosifiers and filtrate control stands to witness the highest demand. Additional advantages such as the capability to easily block the layers of very low permeability is further surging the growth. Filtration control is an important property of a drilling fluid, particularly when drilling through permeable formations (transmit fluids readily, such as sandstones,). Filtrate control additives are used in well cement compositions to reduce the fluid loss to permeable formations into or through which cement compositions are pumped.

Key Developments:

- In 2019, Baker Hughes Company announced the introduction of its new non-aqueous formulation, DELTA-TEQ low-pressure-impact drilling fluid, which allows operators working in narrow pressure windows to meet their drilling objectives by considerable decreasing the risks associated with operational activities.

- In 2017, Halliburton announced the introduction of BaraShale Lite Fluid System, which is a water-based drilling fluid system for unconventional and mature plays. It is a high-performance water-based fluid created to maintain full salt saturation with reduced density, reduce waste disposal costs, and help in preventing lost circulation.

The Saudi Arabia drilling fluid market is segmented into product type and application. Based on the product type, the market is segmented into Oil-based fluids (OBF) (Emulsifiers, Filtrate Control, Wetting Agents, Rheology Modifiers, Viscosifiers, Lost Circulation Materials, Lubricants, Others), Water-Based Fluids (WBF) (Lubricants, Thinners, Filtrate Control, Viscosifiers, Lost Circulation Materials, Defoamers, Shale Inhibitors, Others) Synthetic-Based Fluids (SBF) (Synthetic Hydrocarbons, Ethers, Esters, Acetals, Others) and others. Based on application, the market is segmented into onshore and offshore.