Automotive Finance Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2021-2028

Automotive Finance Market Size & Analysis Report by Provider Type (Banks, OEMs and Other Financial Institutions), By Type (Direct and Indirect), By Purpose Type (Loan, Leasing and Others), By Vehicle Type (Commercial and Passenger) and By Region – Global Opportunities & Forecast, 2021-2028

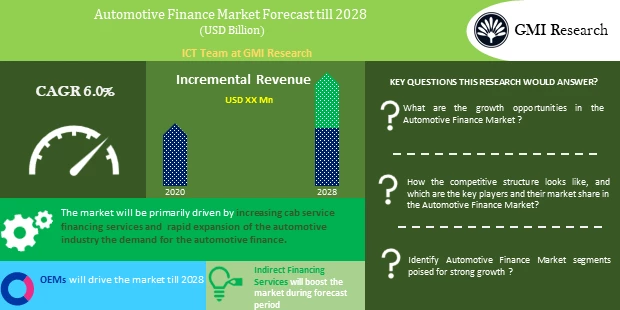

Automotive Finance Market was estimated at USD 213 Billion in 2020 and predicted to grow at a 6.0% CAGR during the forecast period.

Introduction of the Automotive Finance Market Report

Automotive finance is a service provide by the private and government owned companies and subsidiaries, which refers to financial products available for consumers to buy a car without the need pay it with a full-cash single lump payment. With the increasing number of vehicles globally the market is anticipated to increase.

To have an edge over the competition by knowing the market dynamics and current trends of “Automotive Finance Market”, request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

Rise up in cab service financing services and autonomous vehicles, is a factor which is likely to drive the growth of the market. Due to features like safety and convenience provided by the vehicles to the drivers and increased financial cab services motivates the users to invest in the R&D activities in automotive domain. Wth the rapid expansion of the automotive industry the demand for the automotive finance has surged across the regions. For instance, as stated by “European Automobile Manufacturers Association”, automotive sector represents 7% of the Europe’s total GDP and more than 18.5 million trucks, buses and cars are manufactured per year, which shows the potential of the automotive sector. In addition, technological advancements in the automotive sector, along with continuous upgradation in design of the vehicles, has forced market players to bring out advanced novel products for automotive manufacturers.

Furthermore, in order to invest in vehicles, the end users require financing from credit union, dealers and banks that further boost the need of financing and anticipated to drive the growth of the market. In addition, rising adoption of preowned cars has helped the market in expansion of the market share. Furthermore, strategic initiatives by the key players in the market has helped in changing the landscape of the market. for instance, in 2019 Volkswagen announced the strategic partnership with finance market, which has significantly contributed to the growth of the market.

Restraint in the Automotive Finance Market

However, due to the presence of large number of players in the market, the price of the insurance has been brought down due to tough competition and disruption in the market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Provider Type – Segment Analysis

Based on the provider type, OEMs is witnessed to grow at a higher CGAR in the market over the forecast period. This is due to the accessibility of indistinguishable automobile parts, like that of the vehicle financed, for restoration or substitution. Also, OEMs are deemed as the future of social mobility, owing to their optimistic impact on modern business models. Furthermore, apart from offering products and customer services, OEMs are aiming on intensifying their offerings to include automobile insurance as well.

Finance Type – Segment Analysis

Based on the finance type, indirect financing services is witnessed to grow at higher CAGR in the market over the forecast period. This is due to the profits that it permits customers to take on-site expert guidance from independent finance specialists. Moreover, these specialists make sure that their consumers decide the best method to finance a vehicle as and when required. Also, in implicit auto financing, customers can access and search all loans at once.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

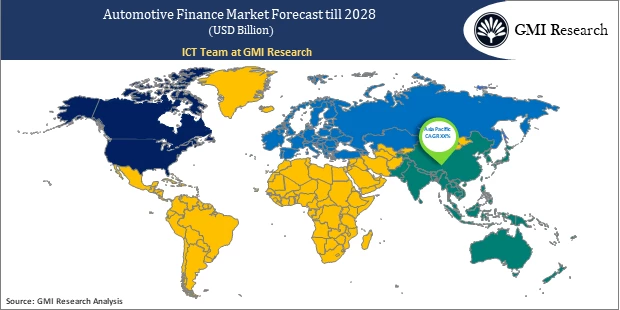

Regional – Segment Analysis:

Based on regional coverage, Asia-Pacific is anticipated to grow at a higher CAGR in the market over the forecast period. During the period of 2016-2020 the Indian automotive industry witnessed a growth rate of 1.29% and sold US$ 24.62 billion cars in 2020 respectively. Furthermore, FDI in the automobile sector was US$ 24.62 billion in 2020, which reflects the huge potential of the automotive sector of India which has boosted the growth of automotive finance in the region.

Top Market Players

Various notable players operating in the market, include, Ally Financial, Bank of America, Capital One, Chase Auto Finance, Daimler Financial Services, Ford Motor Credit Company, Hyundai Motors., Hitachi Capital, Toyota Financial Services, Volkswagen Financial Services, among others.

Key Developments:

-

- In 2019, Hyundai Motor Group, announced the investment of USD 300 million into OLA, for financial services, vehicle quality, etc., leading to the expansion of the market.

Segments covered in the Report:

The global automotive finance market has been segmented on the basis of provider type, type, purpose type, vehicle type and regions. Based on provider type, the market is segmented into banks, OEMs and other financial institutions. Based on type, the market is segmented into direct and indirect. Based on purpose type, the market is segmented into loan, leasing and others. Based on vehicle type the market is segmented into commercial and passenger.

For detailed scope of the “Automotive Finance Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global automotive finance market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in automotive finance market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global automotive finance market?

- Which provider type generated maximum revenues in 2020 and identify the most promising provider type during the forecast period?

- What are the various type areas of global automotive finance market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2020 |

| Market Forecast Period |

2021-2028 |

| Market Revenues (2020) |

USD 213 Billion |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Provider Type, By Type, By Purpose Type, By Vehicle Type, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Ally Financial, Bank of America, Capital One, Chase Auto Finance, Daimler Financial Services, Ford Motor Credit Company, Hyundai Motors., Hitachi Capital, Toyota Financial Services, Volkswagen Financial Services, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Automotive Finance Market by Provider Type

-

- Banks

- OEMs

- Other Financial Institutions

Global Automotive Finance Market by Type

-

- Direct

- Indirect

Global Automotive Finance Market by Purpose Type

-

- Loan

- Leasing

- Others

Global Automotive Finance Market by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Global Automotive Finance Market by Region

-

- North America Automotive Finance Market (Option 1: As a part of the free 25% customization)

- North America Automotive Finance Market by Provider Type

- North America Automotive Finance Market by Type

- North America Automotive Finance Market by Purpose Type

- North America Automotive Finance Market by Vehicle Type

- US Automotive Finance Market All-Up

- Canada Automotive Finance Market All-Up

- Europe Automotive Finance Market (Option 2: As a part of the free 25% customization)

- Europe Automotive Finance Market by Provider Type

- Europe Automotive Finance Market by Type

- Europe Automotive Finance Market by Purpose Type

- Europe Automotive Finance Market by Vehicle Type

- UK Automotive Finance Market All-Up

- Germany Automotive Finance Market All-Up

- France Automotive Finance Market All-Up

- Spain Automotive Finance Market All-Up

- Rest of Europe Automotive Finance Market All-Up

- Asia-Pacific Automotive Finance Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Automotive Finance Market by Provider Type

- Asia-Pacific Automotive Finance Market by Type

- Asia-Pacific Automotive Finance Market by Purpose Type

- Asia-Pacific Automotive Finance Market by Vehicle Type

- China Automotive Finance Market All-Up

- India Automotive Finance Market All-Up

- Japan Automotive Finance Market All-Up

- Rest of APAC Automotive Finance Market All-Up

- RoW Automotive Finance Market (Option 4: As a part of the free 25% customization)

- RoW Automotive Finance Market by Provider Type

- RoW Automotive Finance Market by Type

- RoW Automotive Finance Market by Purpose Type

- RoW Automotive Finance Market by Vehicle Type

- Brazil Automotive Finance Market All-Up

- South Africa Automotive Finance Market All-Up

- Saudi Arabia Automotive Finance Market All-Up

- UAE Automotive Finance Market All-Up

- Rest of world (remaining countries of the LAMEA region) Automotive Finance Market All-Up

- North America Automotive Finance Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Automotive Finance (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Ally Financial

- Bank of America

- Capital One

- Chase Auto Finance

- Daimler Financial Services

- Ford Motor Credit Company

- Hyundai Motors.

- Hitachi Capital

- Toyota Financial Services

- Volkswagen Financial Services

Frequently Asked Question About This Report

Automotive Finance Market [UP2239-001001]

Rise up in cab service financing services and autonomous vehicles, is a factor which is likely to drive the growth of the market. Due to features like safety and convenience provided by the vehicles to the drivers and increased financial cab services motivates the users to invest in the R&D activities in automotive domain.

OEMs is witnessed to grow at a higher CGAR in the market over the forecast period. This is due to the accessibility of indistinguishable automobile parts, like that of the vehicle financed, for restoration or substitution.

Automotive Finance Market was valued at USD 213 Billion in 2020.

Various key players operating in the market, include, Ally Financial, Bank of America, Capital One, Chase Auto Finance, Daimler Financial Services, Ford Motor Credit Company, Hyundai Motors., Hitachi Capital, Toyota Financial Services, Volkswagen Financial Services, among others.

- Published Date: Jul - 2021

- Report Format: Excel/PPT

- Report Code: UP2239-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Automotive Finance Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research