Press Release

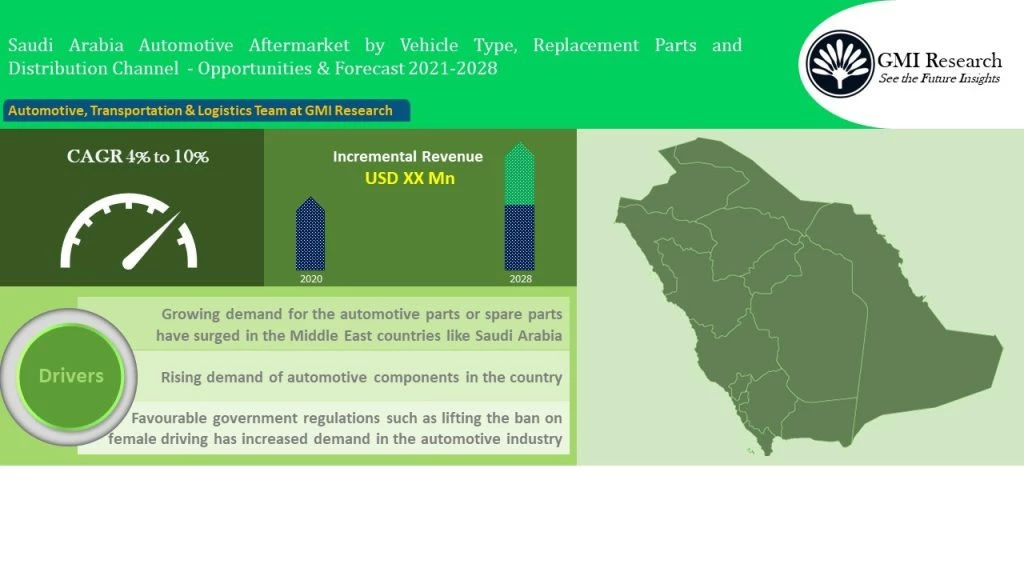

As per the GMI Research forecasts, rising sales of passenger and commercial vehicles in the country stands to be one of the key drivers for Automotive Aftermarket in Saudi Arabia. The market was estimated to be USD xx Million in 2020 and is predicted to reach USD xx Million by the end of 2028, while growing at a CAGR of 4% to 10% during the forecast period (2021-2028).

The growing vehicle parc in the country owing to the surge in expat population, rising standard of living resulting in increasing sales of vehicles in the country are some of the growth drivers in the market. Furthermore, favourable government regulations such as lifting the ban on female driving has created a favourable impact in the automotive industry. In July 2018, ‘Kingdom of Saudi Arabia’, lifted the legal ban on female driving, which will further elevate the vehicle parc in the country and generate new opportunities for the automotive aftermarket players in the country. According to a study conducted by Rice University’s Baker Institute, around 6 million women, 65% of the female driving-age population, could obtain licenses, which will lead to more demand of vehicles leading to the expansion of the automotive aftermarket.

To have an edge over the competition by knowing the market dynamics and current trends of “Saudi Arabia Automotive Aftermarket Market”, request for Sample Report here

Strategic initiatives by the local and international players have further created new growth opportunities in the market. Foreseeing the rising demand of automotive components in the country, leading automotive manufacturers are entering to partnerships to boost the local production and sales in the country. For instance, in 2019, Apollo Tires collaborated with Al-Jomaih tires Company to increase its market presence. The new agreement is focused on bus and passenger car markets. In 2018, Abdul Latif Jameel officially signed a memorandum of understanding (MoU) with Japanese company Kosei Aluminium to explore the feasibility of a joint venture that would manufacture aluminum wheels and components in Saudi Arabia.

Rise in VAT and the impact of Covid-19 has negatively impacted the automotive industry. Effective July 1, 2020, Saudi Arabia hiked its VAT from 5% to 15% as part of measures to address the fiscal imbalance between public revenues and expenditures and counter the financial and economic burden imposed by COVID-19 pandemic. Also, the impact of Covid-19 has further dented the sales of automobiles and spare parts in the country as footfalls in showrooms declined due to the complete lockdown during May and June. In the aftermarket, consumers delayed vehicle maintenance, resulting in a 70%-75% drop in revenues related to periodic maintenance and spare parts purchase. Such factors act as a barrier to the growing automotive and aftermarket industry in the country.

The demand for automotive vehicles and spare parts is majorly fulfilled via imports from countries like USA, Japan, China, Korea, India and other Gulf countries. The ecosystem is made up of big trading organisations who harness their retail and distribution networks across Saudi Arabia to compete in the market for Tier 1 and 2 cities, while majority of rural areas and tier 3 cities still rely on unorganised market for local demand.

Some of the major organized players in the aftermarket service providers in Saudi Arabia include AutoFix, SAC Motor, Castrol, Sheikh Center (SKBMW), 3M Authorized Centre, Car Spa, Shell Fastlube, among others.

Moreover, the boom in the number of online auto-classified platforms such as Speero and Odiggo and the traction of the consumers towards online platforms is contributing to the inclining used car sales in the country, thereby influencing the automotive aftermarket in Saudi Arabia.

On the basis of vehicle type, passenger vehicles is expected to witness high market share over the forecast period owing the growing passenger car sales in the region. Some of the leading passenger car companies operating the market include Nissan, GM, Ford, Kia among others. The commercial vehicle segment is expected to witness high growth in the coming years owing to rising spending in the infrastructure projects and creating demand for light, medium and heavy commercial vehicles. According to National Industrial Development Center (NIDC) in Saudi Arabia, the sale of commercial vehicles in 2018 was 3,40,218 units, which increased to 4,60,373 units in 2019.

On the basis of distribution channel, the online segment is expected to witness higher CAGR in the coming years. The covid-19 impact has impacted the offline sales negatively as there has there been decline in the footfall across number of showrooms which used to be the major mode of sales before pandemic. This has further elevated the online sales penetration in the country. Furthermore, increasing number of start-ups in the online space has further elevated the online auto component sales in the region. For instance, Riyadh-based startup, Speero is used by more than 1,000 registered repair shops and parts suppliers, serving more than 750,000 end customers

Key Developments:

-

- In 2018, Abdul Latif Jameel Motors announced opening of a new Toyota and Lexus service facility in Hofuf, Saudi Arabia. The site hosts a customer-centric indoor showroom and an outdoor area that displays approved used Toyota and Lexus cars, and provides a full spectrum offering of sales, service and spare parts.

- In 2018, Ford added a new distributor in KSA to further enhance its customer reach in the country. The company announced Yousuf Naghi Motors Co., as the second distributor and will join the existing distributor Al Jazirah Vehicles Agencies Co.

The Saudi Arabia Automotive Aftermarket is segmented into vehicle type, by replacement parts, by distribution channel. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, HVAC, lighting and electronic components, exhaust components, engine components and others. By distribution channel, the market is split between offline and online.