Plant-based Meat Market Size, Share, Analysis and Growth Report – Global Opportunities & Forecast, 2023-2030

GMI Research analysis indicates that the Plant-based Meat Market size was estimated at USD 5,642.4 million in 2022 and is slated to register a double digit CAGR of 15.6% over the forecast period, and is projected to reach USD 17,994.1 million in 2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Plant-based Meat Market”, request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Plant-based Meat Market”, request for Sample Report here

Major Plant-based Meat Market Drivers

Global Plant-Based Meat Market is primarily driven by rising public health awareness benefits of plant-based meat and the rise in flexitarian and vegan populations globally. Growing interest of customers in plant-based diets, accompanied by the growing awareness of animal welfare through diverse welfare unions is propelling market for global plant-based meat. The significant rise in health concerns over diabetes, obesity, cardiovascular diseases, and several other diseases because of the high-fat content of animal-based meat goods is predicted to foster plant-based meat demand shortly. Government entities in different countries are motivating the acceptance of plant-based meat substitutes because of their health advantages and the environmental issues connected to animal-based meat. In addition, governmental authorities are actively investing in research and product development activities for plant-based meat products, which results in an increasing global aim for sustainable and healthier food options. In 2022, the Department of Agriculture in the US has confirmed the rising market for plant-based meat products.

The growth in government initiatives alongside a high number of investments and a high rise in demand for plant-based meat products alike jackfruit, soy, and others are propelling the market growth in the forecast period. Europe has spent in plant-based protein, with substantial commitments from countries such as Switzerland, Sweden, and Denmark, totaling over $150 million in research and development. Thus, these investments led to the global plant-based meat products market growth. For instance, the market players are significantly focusing on developing the foodstuffs by increasing their shelf life, feel and fragrance will drive the global plant-based meat industry growth. Market players and manufacturers in the market are establishing new goods to meet the rising need for plant-based meat products. In 2021, Taco Bell joined hands with Gold&Green Pulled Oats to introduce a brand-new plant-based range that will be perfect for customers wanting to go meat-free. It will provide some new taste, smell, and feel to the meat lovers also.

Growing health issues and a need for healthy and tasty food selections are attributed to the global plant-based non-veg market growth. High increase in culinary variety and development, and rise in retail and food service incorporation, are growth aspects influencing plant-based meat demand. The growing prevalence and availability of these products in restaurants, grocery stores, and fast-food chains has made these substitutes more available to a widespread client base. In addition, Collaborations, strategic acquisitions, and partnerships between food service and plant-based meat producer establishments contributed to the market growth globally. In 2020, Danone announced an acquisition of Whitewave Foods Company for USD 12.5 Million to develop its presence on a global level and meet the growing demand for plant-based meat products.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Soya-based meat segment expected to hold the largest market share.

The soya-based meat segment dominated the global plant-based meat market because it is used increasingly as a substitute for animal-based meat and has a wide variety of applications. Soya is rich in branch amino acids and is estimated to witness consistent growth in the forecast period. This is accredited to its ability to develop customer exercise performance, aid in post-workout recovery, and encourage the development and strengthening of muscle mass. Although, it is very clear that many individuals suffer from soy allergies, developing issues and queries concerning its widespread acceptance as a meat substitute. Even though, soya is a leading competitor in the extending global plant-based meat market.

Pea-based segment is estimated to observe the fastest growth rate in near future.

Additionally, pea-based meat products are predicted to rise at the highest CAGR rate during the forecast period because it is a viable substitute for chicken with high protein content and easy availability. Different characteristics including the regularity of meat and resemblance in texture, quick preparation, and different applications, specifically in burgers, contribute to its leading position in the market.

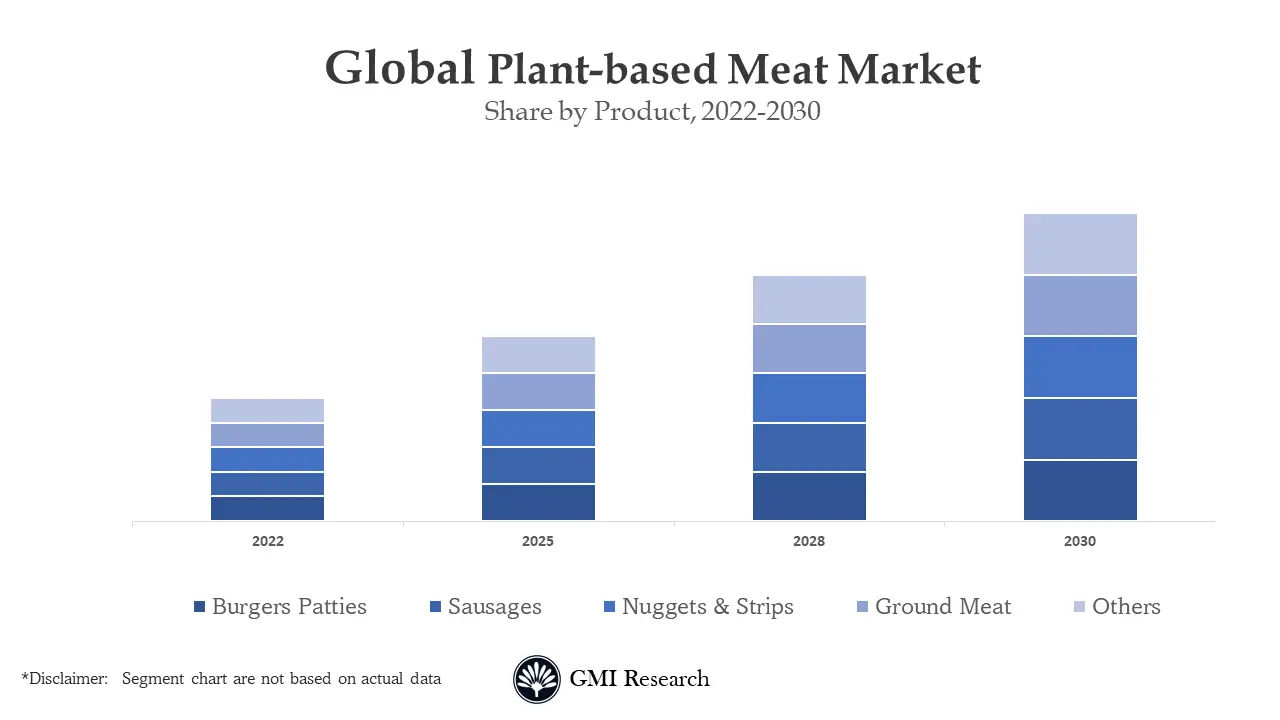

Plant-based burger segment is predicted to register highest market growth.

Plant-based burgers market segment dominated a high value of market share of global revenue because demand for plant-based burgers is on the increase due to their taste and customer prevalence. Hence, due to their growing prevalence, giant market players are aiming to develop their product portfolios by encompassing varieties of plant-based burgers. All these key factors together are estimated to contribute to the high market share of this segmentation in the forecast period. Moreover, the feature of providing a similar sensory experience to non-vegetarian customers, essentially replicating the mouthfeel of meat attracts a wide client base across the alternative meat market, including people who choose meat taste but look for sustainable alternatives.

Plant-based chicken segment is estimated to dominate the market

The plant-based chicken market segment registered the market and held a high percentage of global revenue share. Globally, chicken is prevalent in meat and is a key ingredient in different variety of products such as cutlets, strips, burgers, and others. Hence, plant-based meat substitutes are witnessing high demand, driven by the growing prevalence of healthier and sustainable food selections among consumers. Non-veg has high protein content due to which its demand and consumption are growing. The plant-based meat chicken products usually have similar content and taste to real non-veg, while other nutrients may differ, making it an excellent alternative for vegan customers.

HORECA registered market growth in near future

The HORECA (Hotel, Restaurants, and Café) segment dominated the market due to growing need for customized food services and shifting customer preferences. The growing adoption of vegan and flexitarian diets has prompted different restaurants, casual dining venues, and fast-food chains to allocate a distinct section of their menu to ‘meat-free’ choices. This trend is predicted to drive the market growth. For example, in 2019, Amy’s Kitchen Inc. opened its third plant-based meat and vegan-friendly ‘Amy’s Drive-Thru’ restaurant across Walnut Creek, California to meet the rising demand for plant-based dining choices.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

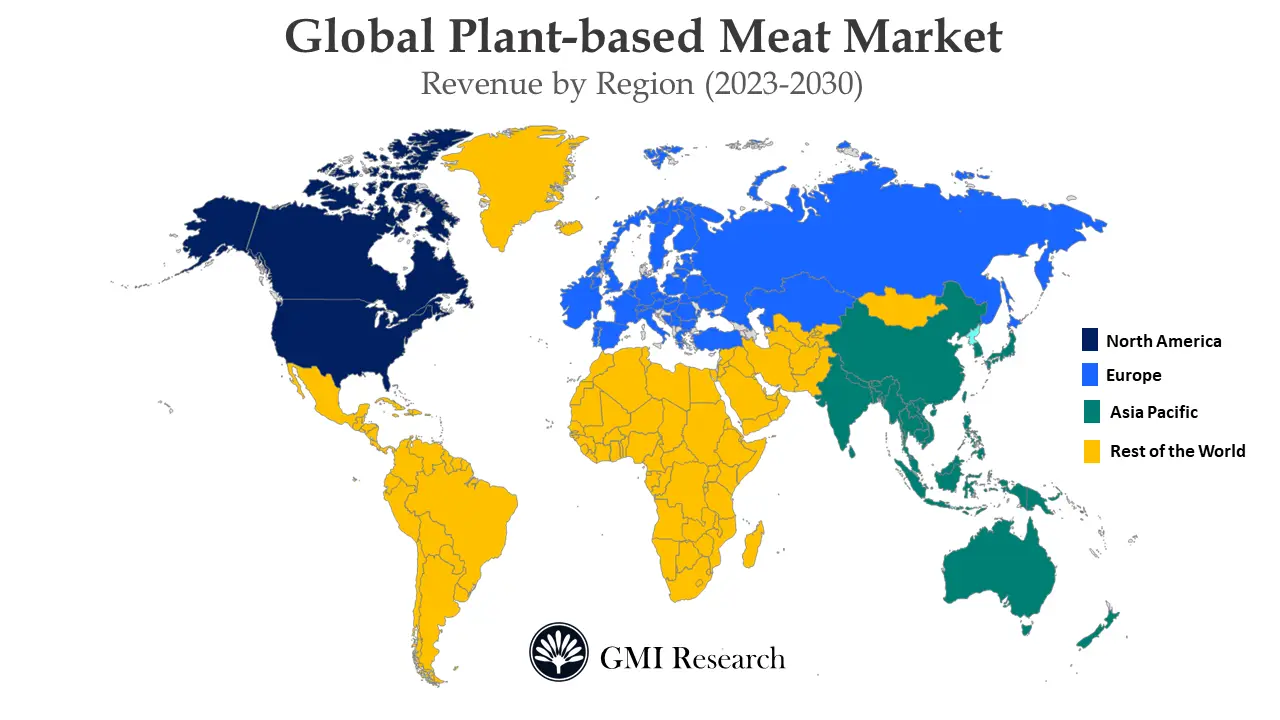

North America to account for the largest market size in the forecast period.

North America dominated the global market due to the growing prevalence of plant-based meat in the U.S. and the growing emphasis on health-related issues. Growing prevalence of cardiovascular diseases and the significant rise in the popularity of vegan diets are the key factors to present positive growth of the vegan meat market in the region. Rapid changes in the diets of customers and growing consumption of meatless meat products have contributed to the growth of plant-based meat market. Also, endorsements by celebrities to motivate consumers to eat vegetarian or plant-based meat products are another foremost driver predicted to propel the North America plant-based meat market growth. Although, Canada has developed as a universal leader by offering substantial public assistance for plant-based proteins in research and development, regulatory policy initiatives, and commercialization.

Europe is the speediest-growing market for plant-based meat market

Europe is estimated to observe the fastest growth rate due to rising customer interest in health benefits and environmental awareness. The positive outlook of customers toward vegan meat and vegetarian products is predicted to boost market growth. The market players across the region are adopting different strategies to expand their presence and increase their percentage of market share with sales and accomplish a competitive edge in the Europe plant-based meat market.

Top Market Players

The major plant based meat companies operating in the market are Beyond Meat Inc., Tyson Foods Inc., The Vegetarian Butcher, Gold & Green Foods Ltd., Pinnacle Foods Inc. (Subsidiary of Conagra Brands, Inc.), MorningStar Farms (Division of Kellogg Company), Impossible Foods Inc., Maple Leaf Foods Inc., Quorn Foods, Amy’s Kitchen, among others.

Key Developments:

-

- In 2023, Wakao Foods announced the inauguration of India’s largest plant-based meat shipment to the US to expand its reach to the US.

- In 2023, Livekindly acquired Alpha Foods to expand its market around Europe, the US, and South Africa. This acquisition allows them to expand their presence in the meat substitutes space.

- In 2023, Switch Foods inaugurated Abu Dhabi’s first plant-based meat factory across the Khalifa Industrial Zone to make available vegan kebabs, minced meat, and other products at supermarkets.

- In 2022, Beyond Meat partnered with Pizza Hut in Canada to address the growing customer demand for plant-based choices. They introduced a permanent menu item, the Beyond Italian sausages crumble by Beyond Meat, catering to the increasing interest in plant-based protein choices among consumers.

- In 2022, Impossible Foods launched two new products, i.e., Chicken Nuggets and Sausage Patties made from plants in the UK. The company will expand its presence across the UK region through this expansion.

- In 2022, Beyond Meat expanded its product portfolio by introducing Beyond Burger and Beyond Meatballs at approx. 2,000 across the globe. The company will strengthen its position by providing more plant-based meat options to consumers.

- In 2021, The Vegetarian Butcher launched plant-based meat alternative products for food service in China. The company planned to cater to consumer’s growing demand for plant-based eating options.

- In 2021, Greenleaf Foods SPC, a subsidiary of Maple Leaf Foods planned to expand its plant protein production in Indianapolis, US.

Segments covered in the Report:

The global Plant-based meat Market has been segmented on the basis of Product, source, type, end-user, and regions. Based on the Source, global plant-based meat market has been segmented into soy, pea, wheat, and others. Based on the Product, global plant-based meat market has been segmented into burger patty, sausages, Nuggets & strips, ground meat and others. Based on the Type, global plant-based meat market has been segmented into Chicken, Pork, Beef, Fish and Others. Based on End-User, the market has been segmented into Retail and HORECA.

For detailed scope of the “Plant-based Meat Market Report” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 5,642.4 million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Source, By Product, By Type, By End-User, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

|

Plant Based Meat Brands/Companies Profiled

|

Beyond Meat Inc., Tyson Foods Inc., The Vegetarian Butcher, Gold & Green Foods Ltd., Pinnacle Foods Inc. (Subsidiary of Conagra Brands, Inc.), MorningStar Farms (Division of Kellogg Company), Impossible Foods Inc., Maple Leaf Foods Inc., Quorn Foods, Amy’s Kitchen, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Plant-based Meat Market by Source

-

- Soy

- Wheat

- Pea

- Others

Global Plant-based Meat Market by Product

-

- Burger patty

- Sausage

- Nugget

- Ground Meat

- Others

Global Plant-based Meat Market by Type

-

- Beef

- Chicken

- Pork

- Fish

- Others

Global Plant-based Meat Market by End-Users

-

- HoReCa

- Household/Retail

Global Plant-based Meat Market by Region

-

- North America Plant-based Meat Market (Option 1: As a part of the free 25% customization)

-

-

- By Source

- By Product

- By Type

- By End-User

- United States of America (US) Market All-Up

- Canada Market All-Up

- Europe Plant-based Meat Market (Option 2: As a part of the free 25% customization)

- By Source

- By Product

- By Type

- By End-User

- United Kingdom (UK) Market

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Plant-based Meat Market (Option 3: As a part of the free 25% customization)

- By Source

- By Product

- By Type

- By End-User

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Plant-based Meat Market (Option 4: As a part of the free 25% customization)

- By Source

- By Product

- By Type

- By End-User

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Plant-based Meat Leading Market Players (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Beyond Meat Inc.

- Tyson Foods Inc.

- The Vegetarian Butcher

- Pinnacle Foods Inc. (Subsidiary of Conagra Brands, Inc.)

- MorningStar Farms (Division of Kellogg Company)

- Impossible Foods Inc.

- Maple Leaf Foods Inc.

- Amy’s Kitchen

- Quorn Foods

- Gold & Green Foods Ltd.

Frequently Asked Question About This Report

Plant-based Meat Market [FB09A-00-1119]

The increasing vegan population across the globe is the major driver of the global plant-based meat market.

Global plant-based meat market has been segmented into soy, pea, wheat, and others. Pea segment is projected to grow at the fastest rate in the next seven years owing to its unique properties such as a good source of minerals, easy availability, high protein content, and gluten and lactose-free.

Plant Based Meat market reached USD 5,642.4 million in 2022.

Plant Based Meat market growing at a CAGR of 15.6% during 2023-2030.

- Published Date: Mar -2023

- Report Format: Excel/PPT

- Report Code: FB09A-00-1119

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Plant-based Meat Market Size, Share, Analysis and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research