Oil & Gas Analytics Market Size & Analysis Report by Application, By Service and By Region – Global Opportunities & Forecast, 2021-2028

Oil & Gas Analytics Market Size & Analysis Report by Application (Upstream, Midstream, and Downstream), By Service (Professional, Cloud, Integration), and By Region – Global Opportunities & Forecast, 2021-2028

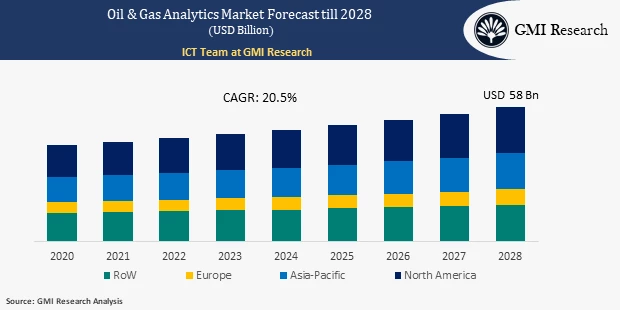

Oil & Gas Analytics Market is estimated to be USD 58 billion in 2028 and projected to grow at 20.5% CAGR during the forecast period.

Introduction of the Oil & gas analytics Market Report

Oil and gas companies are facing challenges in obtaining insight from an enormous amount of data to make better, more informed decisions. By applying artificial intelligence and advanced analytics, oil and gas companies can identify trends and forecast events throughout processes to quickly respond to disturbance and improve efficiencies. To improve capabilities further, implementing automation and AI helps the oil and gas industry exceed human limitations to enable the type of decision making that keeps operations running at full speed while optimizing drilling and production.

To have an edge over the competition by knowing the market dynamics and current trends of “Oil & gas analytics Market”, request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The factors driving the global oil & gas analytics market include depletion of oil and gas reserves worldwide. The rising global demand for fuel, and government regulation with falling crude oil reserves is creating new opportunities. Oil & gas analytics will better analyse the data being generated by the resource to efficiently manage the remaining resource. For instance, in 2021, Baker Hughes signed an agreement to use Lytt’s analytics software. The collaboration will combine Lytt’s fibre-optics data analytics and cloud-based software with Baker Hughes completion and well intervention hardware.

Furthermore, the growth of the oil and gas analytic market is fuelled by a significant increase in the investment done in the oil and gas sector. The investment in the sector is made to further urbanize and digitalize the sector in several countries. For instance, in 2021, Prime Minister Mr. Narendra Modi announced that the government of India plans to invest Rs 7.5 trillion in oil and gas infrastructure in the next five years.

Restraint in the Oil & gas analytics Market

However, high government regulations on oil and gas production due to production of toxic gases like carbon dioxide and carbon monoxide can hamper the global oil & gas analytics market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Application – Segment Analysis

Based on the application, the upstream oil and gas analytics market is expected to lead the global Oil & gas analytics market during the forecast due to increasing offshore and unconventional drilling. For instance, according to Baker Hughes, in 2021, the average number of oil rig count across the U.S. is 533, which is 264 more when compared to 2020. Analytics tool enables the upstream sector to obtain real-time data at a lower cost and manage the operation in a better way through new capabilities, which will surge analytics demand in an upstream application. For instance, in 2021, Schlumberger and AVEVA signed an agreement to integrate edge, AI, and cloud digital solutions to help operators improve oil and gas production. The companies will work together to streamline how energy operators acquire, process, and action field data for better wellsite efficiency and performance

Service – Segment Analysis

Based on the service, cloud service is projected to capture the largest market share over the forecast period in the global oil & gas analytics market due to providing faster and more valuable result compared to other technologies and help in reducing infrastructure cost. For instance, Halliburton company has been awarded a contract from Kuwait Oil Company to allow KOC to accelerate their data-to-decisions cycle by designing and operating digital twins of the field to automate work processes, supported by DecisionSpace 365, a cloud-based subscription service for E&P applications.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Regional – Segment Analysis:

Based on the region, the North American region is expected to capture a significant market share in the global oil & gas analytics market owing to the expansion of exploration and production of unconventional resources. According to the report by EIA (Energy Information Administration), dry natural gas production in 2020 was about 33.5 trillion cubic feet, and most of the production increased since 2005 are the result of horizontal drilling and hydraulic fracturing technique which can likely surge the demand for oil and gas analytics market

Top Market Players

Various notable players operating in the market, include, Tech Mahindra Limited, Chevron Corporation., Exxon Mobil Corporation, SAP, TIBCO Software Inc, Teradata, Northwest Analytics Inc, Hitachi Ltd, Repsol, Equinor ASA, among others.

Key Developments:

-

- In 2021, Vine Energy deployed Baker Hughes’s advanced analytics to enhance gas production and curtail methane emissions, across 100 natural gas wells in Louisiana’s Haynesville Shale.

- In 2019, Saudi Aramco Energy Ventures invested in Norwegian Artificial Intelligence Software Provider Earth Science Analytics. Earth Science Analytics is spearheading the development of the next generation petroleum geoscience software based on artificial intelligence.

Segments covered in the Report:

The global oil & gas analytics market has been segmented on the basis of application, service, and regions. Based on application, the market is segmented into upstream, midstream and downstream. Based on Service, the market is segmented into professional, cloud, integration.

For detailed scope of the “Oil & gas analytics Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global oil & gas analytics market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in oil & gas analytics market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global oil & gas analytics market?

- Which application generated maximum revenues in 2020 and identify the most promising application during the forecast period?

- What are the various service areas of global oil & gas analytics market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2020 |

| Market Forecast Period |

2021-2028 |

| Market Revenues (2020) |

USD Million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Application, By Service, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Tech Mahindra Limited, Chevron Corporation., Exxon Mobil Corporation, SAP, TIBCO Software Inc, Teradata, Northwest Analytics Inc, Hitachi Ltd, Repsol, Equinor ASA, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Oil & gas analytics Market by Application

-

- Upstream

- Midstream

- Downstream

Global Oil & gas analytics Market by Service

-

- Professional

- Cloud

- Integration

Global Oil & gas analytics Market by Region

-

- North America Oil & gas analytics Market (Option 1: As a part of the free 25% customization)

- North America Oil & gas analytics Market by Application

- North America Oil & gas analytics Market by Service

- US Oil & gas analytics Market All-Up

- Canada Oil & gas analytics Market All-Up

- Europe Oil & gas analytics Market (Option 2: As a part of the free 25% customization)

- Europe Oil & gas analytics Market by Application

- Europe Oil & gas analytics Market by Service

- UK Oil & gas analytics Market All-Up

- Germany Oil & gas analytics Market All-Up

- France Oil & gas analytics Market All-Up

- Spain Oil & gas analytics Market All-Up

- Rest of Europe Oil & gas analytics Market All-Up

- Asia-Pacific Oil & gas analytics Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Oil & gas analytics Market by Application

- Asia-Pacific Oil & gas analytics Market by Service

- China Oil & gas analytics Market All-Up

- India Oil & gas analytics Market All-Up

- Japan Oil & gas analytics Market All-Up

- Rest of APAC Oil & gas analytics Market All-Up

- RoW Oil & gas analytics Market (Option 4: As a part of the free 25% customization)

- RoW Oil & gas analytics Market by Application

- RoW Oil & gas analytics Market by Service

- Brazil Oil & gas analytics Market All-Up

- South Africa Oil & gas analytics Market All-Up

- Saudi Arabia Oil & gas analytics Market All-Up

- UAE Oil & gas analytics Market All-Up

- Rest of world (remaining countries of the LAMEA region) Oil & gas analytics Market All-Up

- North America Oil & gas analytics Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Oil & gas analytics (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Tech Mahindra Limited

- Chevron Corporation.

- Exxon Mobil Corporation

- SAP

- TIBCO Software Inc

- Teradata

- Northwest Analytics Inc

- Hitachi Ltd

- Repsol

- Equinor ASA

Frequently Asked Question About This Report

Oil & gas analytics market [UP1406A-00-0620]

The major factor driving the Oil & Gas Analytics Market is the rising global demand for fuel, and government regulation with falling crude oil reserves is creating new opportunities.

The growth rate of Oil & Gas Analytics Market is expected to be 20.5% during the forecasted period.

Upstream segment is expected to lead the Oil & gas analytics market during the forecast due to increasing offshore and unconventional drilling.

The leading players in the Oil & Gas Analytics Market are Tech Mahindra Limited, Chevron Corporation., Exxon Mobil Corporation, SAP, TIBCO Software Inc, Teradata, Northwest Analytics Inc, Hitachi Ltd, Repsol, Equinor ASA, among others

- Published Date: Feb-2022

- Report Format: Excel/PPT

- Report Code: UP1406A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Oil & Gas Analytics Market Size & Analysis Report by Application, By Service and By Region – Global Opportunities & Forecast, 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research