Banking as a Service Market Size & Analysis Report by Organization Size, By End User and By Region – Global Opportunities & Forecast 2021-2028

Banking as a Service Market Size & Analysis Report by Organization Size (Large Enterprise and Small & Medium Enterprise), By End User (Banks, Investment Firms, Government, FinTech Corporation and Others) and By Region

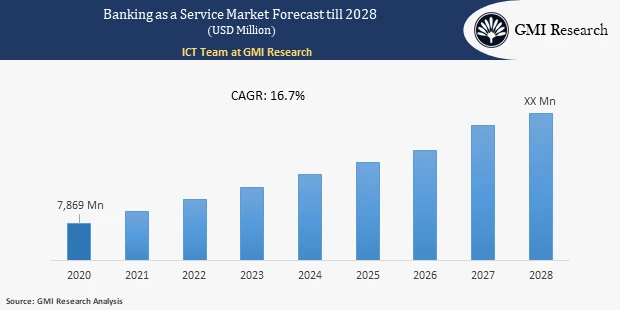

Banking as a Service Market is accounted for USD 7,869 million in 2020, growing at a robust CAGR of 16.7% during forecast period.

To have an edge over the competition by knowing the market dynamics and current trends of “Banking as a Service Market”, request for Sample Report here

Key Drivers and Emerging Trends

The banking as a service market is projected to witness a notable growth over the forecast period, owing to the rapid digitalization, expansion of fintech industries, and growing adoption of digital services. The growing awareness towards internet banking and increasing adoption of Banking as a service by banks and FinTech to simplify their financial services and improve customer experience has also strengthened the global banking as a service market size. With the increasing inclination towards online banking to access several services which include check balance, cash transfer, account statements, and online purchases, the fintech companies are emphasizing on offering improved digital services to customers for convenience and satisfaction, which stands to be a major factor driving the global banking as a service market.

Increasing collaboration between telecommunication companies and banks to provide advanced services to the customers is projected to offer enormous opportunities to the market. For example, in 2022, Bharti Airtel entered into a partnership with Axis Bank to offer financial services and a co-branded credit card for the subscribers of the telecom services company. Also, the companies will provide pre-approved instant loans, ‘buy now pay later’ offerings, and other services to the users. However, the high deployment cost of the technology is projected to impede their adoption across small entities, primarily because of the lack of resources and capital to invest in IT hardware and software, thus, restraining the market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Organization Size – Segment Analysis

Based on the Organization Size, the large organization is expected to grow at a higher CAGR in the global banking as a service market during the forecast period. The increasing digitalization has made the large fintech organization and multinational bank adopt advanced service platforms, thereby fuelling the market growth. Additionally, the growing preference among the organization for effective and efficient service platforms and automation capability is boosting the growth of this market.

End-User – Segment Analysis

Based on the End User, fintech corporation projected to grow at a higher CAGR in the global banking as a service market during the forecast period. It offers various benefits such as greater scalability, less regularity, legal headaches, better data accessibility. Moreover, it provides greater financial transparency, which boosts the growth of this market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Regional – Segment Analysis:

Geographically, the Europe region is expected to grow at a higher CAGR in the global banking as a service market during the forecast period due to the increased use of digital payment systems, online banking, and financial services in this area which boosts the growth of this market. For instance, according to European Banking Federation, in 2020, online and mobile banking grew by 67 %, and 38.2 million clients had access to online banking services. Thus, this factor is attributed to the growth of this market.

Top Market Players

Various notable players operating in the market, include, Green Dot Bank, Solarisbank AG, PayPal, Fidor Bank, Moven Enterprise, Currencycloud, MatchMove Pay Pte Ltd, Bnkbl Ltd, Treezor, Boku Inc, among others.

Key Developments:

-

- In Jan 2022, Temenos, the banking software company, announced the launch of its Buy-Now-Pay-Later banking service. This offering will open new revenue opportunities for the banks and fintech, help them reach new markets, and cement their relationships with both the consumers and merchants through alternative credit products.

- In 2022, Temenos, the banking software company, launched Buy-Now-Pay-Later banking service, to provide new opportunities to banks and fintech by helping them reach new markets, and strengthen their relationships with both the consumers and merchants through alternative credit products.

- In 2021, HSBC launched a Banking as a Service (BaaS) offering to help the customers create and provide business banking services through their own platforms.

- In 2021, OpenPayd, a banking-as-a-service solution provider, entered into a partnership with SwissBorg, a blockchain-based crypto wealth management platform, to offer a full suite of financial services to SwissBorg clients.

- In oct 2021, HSBC is to launch a Banking as a Service (BaaS) offering that will enable the customers to create and provide business banking services through their own platforms.

Segments covered in the Report:

The global Banking as a Service Market has been segmented on the basis of Organization Size, End User, and regions. Based on Organization Size, the market is segmented into Large Enterprise and Small & Medium Enterprise. Based on End User, the market is segmented into Banks, Investment Firms, Government, FinTech Corporation and Others.

For detailed scope of the “Banking as a Service Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global Banking as a Service Market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in Banking as a Service Market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global Banking as a Service Market?

- Which Organization Size generated maximum revenues in 2020 and identify the most promising Organization Size during the forecast period?

- What is the various End User of global Banking as a Service Market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2020 |

| Market Forecast Period |

2021-2028 |

| Market Revenues (2020) |

USD 7,869 Million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Organization Size, By End User, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Green Dot Bank, Solarisbank AG, PayPal, Fidor Bank, Moven Enterprise, Currencycloud, MatchMove Pay Pte Ltd, Bnkbl Ltd, Treezor, Boku Inc, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Banking as a Service Market by Organization Size

-

- Large Enterprise

- Small & Medium Enterprise

Global Banking as a Service Market by End User

-

- Banks

- Investment Firms

- Government

- FinTech Corporation

- Others

Global Banking as a Service Market by Region

-

- North America Banking as a Service Market (Option 1: As a part of the free 25% customization)

- By Organization Size

- By End User

- US Market All-Up

- Canada Market All-Up

- Europe Banking as a Service Market (Option 2: As a part of the free 25% customization)

- By Organization Size

- By End User

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Banking as a Service Market (Option 3: As a part of the free 25% customization)

- By Organization Size

- By End User

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Banking as a Service Market (Option 4: As a part of the free 25% customization)

- By Organization Size

- By End User

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Banking as a Service Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Market Name (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Green Dot Bank

- Solarisbank AG

- PayPal

- Fidor Bank

- Moven Enterprise

- Currencycloud

- MatchMove Pay Pte Ltd

- Bnkbl Ltd

- Treezor

- Boku Inc

Frequently Asked Question About This Report

Banking as a Service Market [UP2950-001001]

The growth rate of Banking as a Service Market during forecast period is 16.7%.

The top players in the Banking as a Service Market are, Green Dot Bank, Solarisbank AG, PayPal, Fidor Bank, Moven Enterprise, Currencycloud, MatchMove Pay Pte Ltd, Bnkbl Ltd, Treezor, Boku Inc, among others.

The Europe region is expected to grow at a higher CAGR in the banking as a service market during the forecast period due to the increased use of digital payment systems, online banking, and financial services in this area which boosts the growth of this market.

The fintech corporation projected to grow at a higher CAGR in the banking as a service market during the forecast period. It offers various benefits such as greater scalability, less regularity, legal headaches, better data accessibility.

- Published Date: Apr-2022

- Report Format: Excel/PPT

- Report Code: UP2950-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Banking as a Service Market Size & Analysis Report by Organization Size, By End User and By Region – Global Opportunities & Forecast 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research