Riyadh

Jeddah

Dammam

NEOM

OVERVIEW

If Saudi Arabia market is on your business expansion radar and entering KSA market as part of your global expansion strategy, you need a research & consulting firm which has deep roots and has a solid understanding of the Saudi market as the KSA market is complex for local companies and too complex for international companies.

As there are a number of factors which will influence your Saudi entry strategy, GMI Research with its deep understanding of the market can help to formulate a Saudi entry strategy and support you in every step from identifying the total addressable market size, valuable insights on competition, to figure out the right entry strategy whether to enter into limited liability partnerships/joint venture, to set up a greenfield plant or to enter via other strategies and to identifying and set up a distribution network.

Entering Saudi Arabia by setting up a greenfield manufacturing plant has its own share of challenges such as too many regulations, confusing land laws, uncertainty in raw material supply, labor issues, lack of intellectual property rights and others. Government regulations along with market complication, requires the help of Saudi entry strategy consultants. GMI Research having decades of Saudi market knowledge coupled with its expertise in analyzing the potential market opportunity, strategy execution, and deal structuring should be your preferred partner of choice for Saudi Arabia entry strategy implementation.

A successful approach to Saudi Arabia market expansion goes beyond assessing standard business factors, such as market size, growth, market intelligence and competitive landscape. However, it should also cover in-depth understanding of the market in light of reason behind expanding into KSA market.

With our rich Saudi market knowledge owing to our exposure and experience tracking and helping our clients on Saudi Arabia market for decades, we provide hands-on, practical support to International companies planning to expand and to start operation into KSA market. GMI Research helps our clients in formulating hands-on business model to develop the most effective KSA market entry strategy covering all the required aspect from Market, Business & Competitive Intelligence, and research, due diligence of a prospect partner and so on.

Contact GMI Research for your Saudi Market Entry Plan

- Total Addressable Market

- Demand Drivers & Entry Barriers

- Growth Outlook

- Government Policies

- Government Incentives

- Competitive Landscape

- Demand Supply Gap Analysis

- Key Success Factors

- Key Risks

- Identification of Key Potential Customers and Suitable Business Partners

After completing market attractiveness study phase, now we know that the market is attractive from the demand point of view, but would it make financial sense to enter into the market, how much investment is required to start a Greenfield facility, would the investment generate expected ROI, what product mix we should have, what distribution channel to go with. Depending on our client’s goals, risk appetite, investment size, we prepare a full-fledge business plan which includes products and services, financial planning, marketing strategy and analysis, financial planning, and a budget.

Vendor Selection: Identify raw material suppliers, service providers, logistics companies etc.

Company Formulation & Regulatory Compliance: Saudi Arabia Entity Incorporation – from name approval of new business entity to regulatory approvals (such as VAT, import/export number, Tax etc.) to opening of bank accounts.

M&A & JV activities: Target identification and support on deal structuring.

Greenfield Setup: Setup From selection of plant location to project management, to hire right C level executives, to statutory approval consent for operation from state and central government bodies etc.

Vendor Selection: Identify raw material suppliers, service providers, logistics companies etc.

Company Formulation & Regulatory Compliance: Suadi Entity Incorporation – from name approval of new business entity to regulatory approvals (such as PAN, TAN, import/export number, tax etc.) to opening of bank accounts.

M&A & JV activities: Target identification and support on deal structuring

Greenfield Setup: From selection of plant location to project management, to hire right C level executives, to statutory approval consent for operation from state and central government bodies etc.

We Serve our clients across various industries with particularly deep experience in the following industries

Information Communication & Technology

Automotive & Transportation

Chemical & Materials

Food & Beverages

Building & Construction

Agriculture

Energy & Power

Aerospace & Defense

Contact GMI Research for your Saudi Market Entry Plan

Why Saudi Arabia Should be on your Market Expansion Radar?

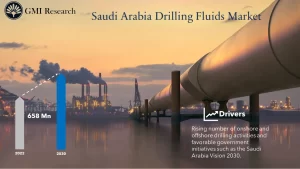

Saudi Arabia is the largest economy in the Middle East, the economy was amongst one of the world’s fastest-growing economies in 2022 owing to comprehensive pro-business reforms, rise in oil prices and production recovery from a Covid-19 pandemic induced recession in 2020. As per IMF the GDP grew at a whopping 8.3% in 2022 due to higher crude oil price which reaches over USD 100 per barrel and surge in non-oil activities. Government budget surplus owing to higher oil prices has boosted government revenues eventually increasing reserves which government is using for massive development projects to transform Saudi economy from oil based to non-oil based.

The government is developing private sector to transform and diversify economy from oil-based economy to non-oil based in order to have a more sustainable economy growth under the Vision 2030. Under the vision 2030 the government has successfully implemented many initiatives and structural reform to push this economic transformation. Under this transformation the government put efforts to enhance local content, to develop local industries, and increasing the role for private sectors.

Public Investment Fund (PIF) a Saudi Arabian government investment arm has launched its strategy for the next five years, the plan is to work on multiple goals but one of the major goal is to Inject around 150 billion SAR annually into the local economy and local companies until 2025, with an aim to increase its assets to 4 trillion SAR and create 1.8 million jobs, directly and indirectly, and focus on 13 vital and strategic sectors by the end of 2025. Under Vision 2030 the government has been assisting financing for small and medium businesses and creating bold capital funds for companies who wants to launch or enter into Saudi market.

Saudi Arabia Automotive Industry is predicted to observe significant growth due to a high rise in the average income of the population and an increase in the number of SMEs. New developments in lifting women driving laws, increasing investment schemes concerned with digitization, and high emphasis on Saudi nationals are further attributed to the market growth. In Saudi Arabia, there have been 452,544 new vehicles sold. Nearly 3 million new women drivers in Saudi Arabia automotive market by 2020 have created numerous opportunities for investors and market players. Also, market players to do business in the region could benefit from the Greater Arab Free Trade Agreement, enabling duty-free access to 17 countries in the MENA if the local value added is 40% or exceeds. Moreover, the Saudi government focuses on an even wider reach, capitalizing on its strategic location between Africa, Europe, and Asia.

Saudi government is investing heavily in infrastructure projects such as developing transportation system, energy sector and massive construction projects under the Vision 2030 creating immense opportunities for global and local companies operating in these industries.

Saudi Arabia Healthcare sector has continued to increase due to the rising investment and increasing spending in healthcare sector. KSA has been witnessed by the improvement in the healthcare infrastructure to provide better quality of care across the country. The Saudi government planned to invest more than USD 65 billion to develop healthcare infrastructure under Vision 2030. It further aimed to increase private sector contribution to 65% from 40% by 2030. In addition, the government aiming the privatization of and 2,300 primary health centers and 290 hospitals. Saudi Arabia is highly dependent on the foreign pharmaceutical manufacturers. The government is actively promoting foreign companies to build plants in KSA pharmaceutical through public-private partnerships and joint ventures.