Sustainable Aviation Fuel Market Size, Share, Trends and Growth Report – Opportunities & Forecast, 2023-2030

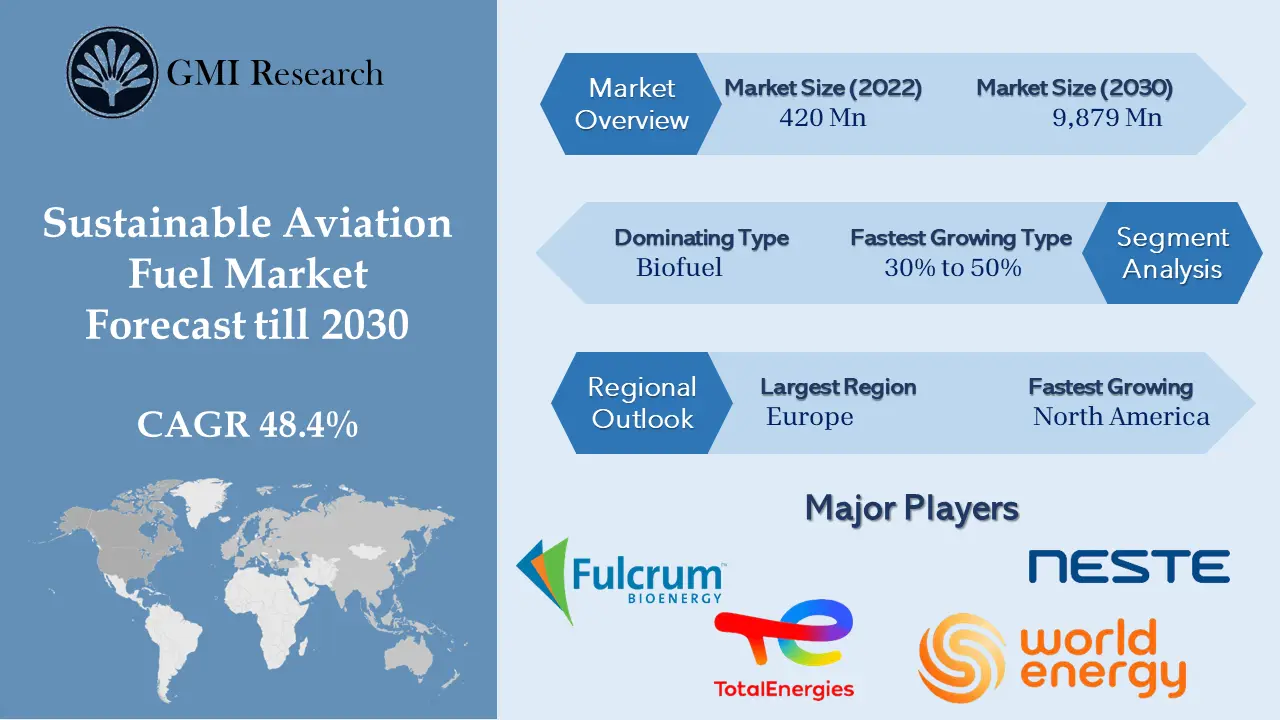

GMI Research analysis indicates that the Sustainable Aviation Fuel Market size was estimated at USD 420 million in 2022 and is slated to register a single digit CAGR of 48.4% over the forecast period, and is projected to reach USD 9,879 million in 2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Sustainable Aviation Fuel Market” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Sustainable Aviation Fuel Market” request for Sample Report here

Sustainable Aviation Fuel Market Overview

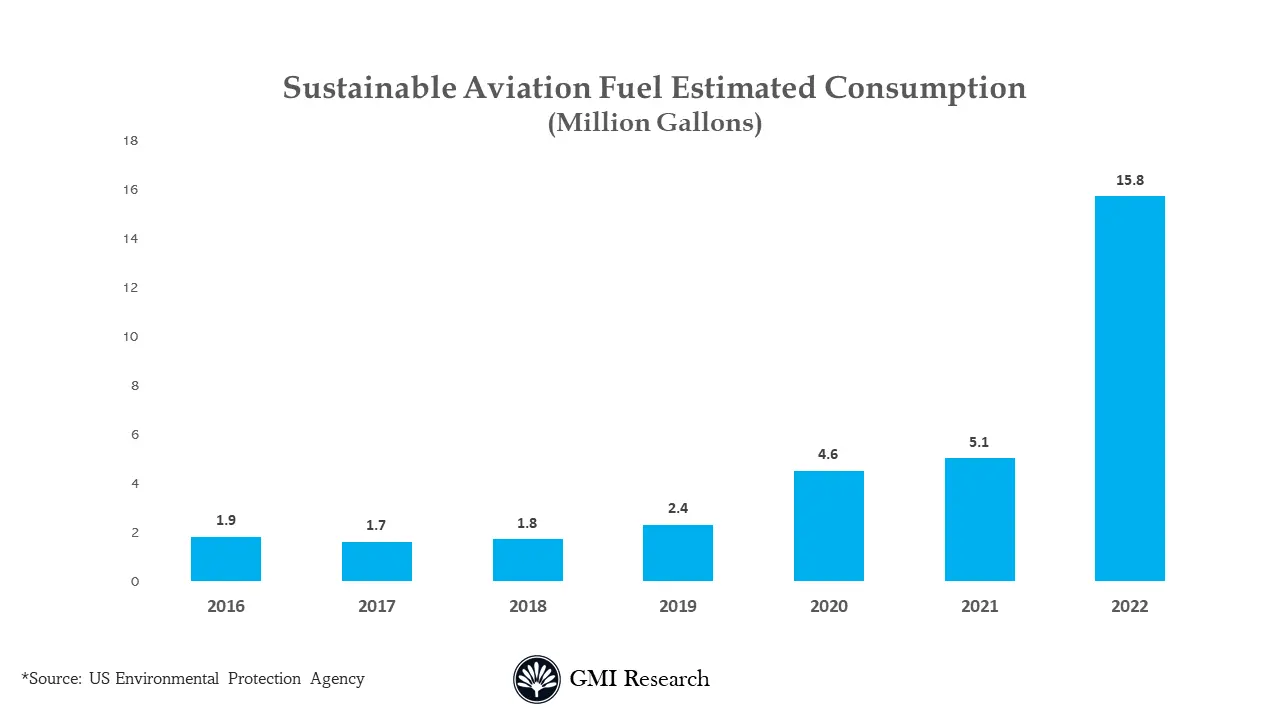

The global sustainable aviation fuel market is estimated to witness the CAGR of 48.4% in the forecast period, due to growing demand for sustainable fuel across the aviation industry, a high rise in investment in sustainable energy, and rising concerns regarding climate change. The growth is also propelled by growing need for sustainable fuels across the commercial and military aviation industry. This trend is strengthened by government initiatives and tax deductions in Europe, North America, and Asia. Based on the International Civil Aviation Organization, over 360,000 commercial flights have utilized sustainable aviation fuel at 46 different airports, with a significant concentration around the U.S. and Europe. Moreover, based on the International Air Transport Association statistics, Asia Pacific airlines witnessed a significant rise in full-year foreign traffic, growing by nearly 363.3% in 2022 compared to 2021, keeping highest year-over-year growth, with capacity increasing by 129.9%.

Major Sustainable Aviation Fuel Market Drivers

Sustainable aviation fuels market is fostered by different factors. The government is taking steps to motivate and require the usage of sustainable aviation fuel through policies such as the European Union’s ReFuelEU proposal, which sets a target of 63% market share for SAF by 2050. In the United States, initiatives such as the SAF Grand Challenge are striving to produce 3 billion gallons of SAF per year by 2030. Social organizations, corporate environmental, and governance initiatives are delivering airlines with clear market demand signals and emphasizing the value of decarbonization. Also, although present standards limit blending to 50% for certain SAF procedures, jet engine producers are functioning on certifying that all future engines can function on 100% pure SAF. These innovations propel the sustainable aviation fuel market growth in the forecast period.

In addition, driving factors that are estimated to propel the SAF market growth include the growing pollution caused by the aviation industry and a significant increase in investment in new aircraft and aviation sector. In 2023, United Airlines, along with 5 corporate partners including Air Canada, GE Aerospace, Boeing, JPMorgan Chase, and Honeywell, announced a joint investment of $100 million to contribute to the development of sustainable aviation fuel. However, contamination of lubricants and variations in crude oil prices are factors that are predicted to hinder the market growth in the forecast period. Whereas, advancements in environment-friendly and preventive aviation lubricants, rise in passenger traffic, and increasing growth in demand for low-density lubricants for reducing weight are the drivers to drive sustainable aviation fuel industry growth and create numerous growth opportunities in the forecast period. With a rapid rise in passenger traffic, many airline companies globally are swiftly extending their commercial aircraft fleet. To address their substantial carbon footprints, these airlines are turning to cutting-edge technologies. They are formulating carbon emission reduction targets and ensuring agreements for sustainable aviation fuel to decrease their environmental impact. For instance, Delta Airlines has set ambitious sustainable aviation fuel objectives, focusing on accomplishing 10% sustainable aviation fuel usage by 2030, and eventually reaching at least 95% SAF usage by 2050.

The usage of aircraft in logistics applications is speedily growing. Each year it is predicted that airlines transport over 52 million metric tons of goods. International Air Transport Association reported that approx 90% of global trade cargo is transported by sea, while only around 0.5% is moved by air. However, despite its minimal capacity, air cargo signifies nearly 35% of global trade by value, which is approx. $6 trillion. With increasing demand for international products, the requirement for safe and efficient air services is predicted to significantly increase in the coming period.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

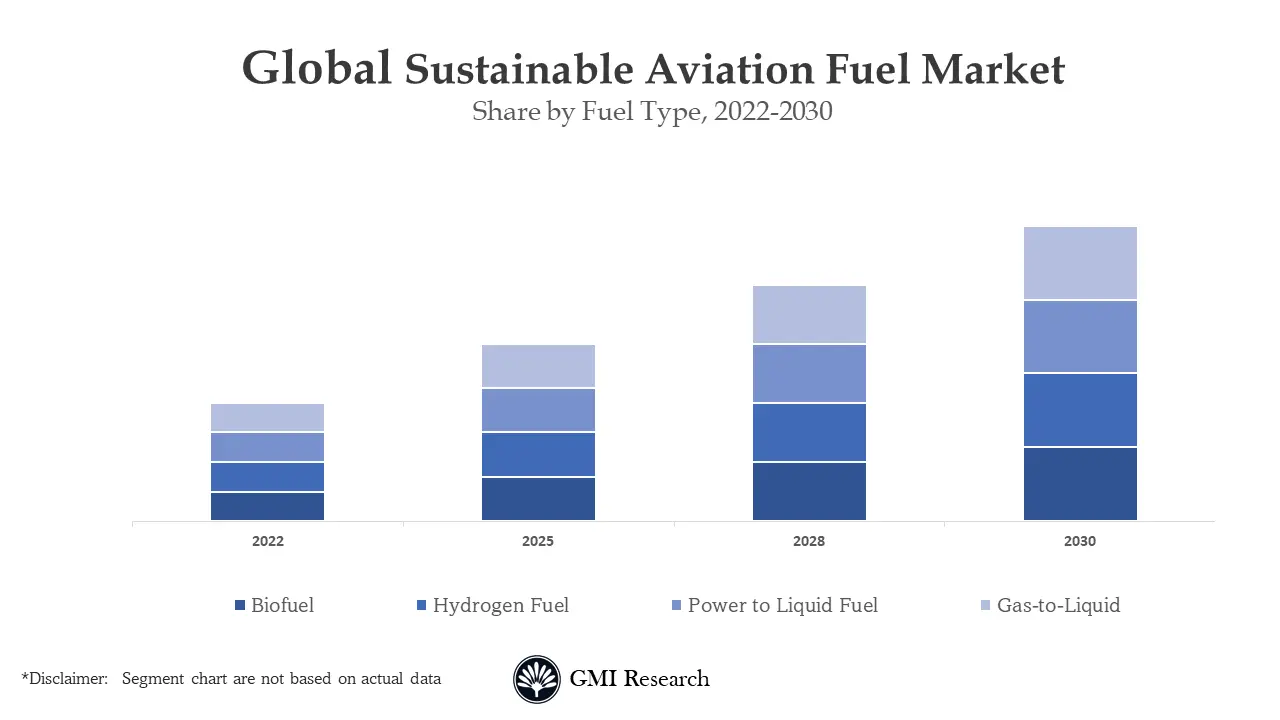

Based on type, Biofuel Segment accounts for the largest market size

Biofuel segment leads the market growth in the global sustainable aviation fuel market because it has extensive usage as a substitute fuel for jet fuel in technological and commercial pathways. The significant growth of aviation biofuel segment can be attributed to the growing popularity of biofuels in aviation. The International Energy Agency stated that the first mixed biofuel flight took place during 2008, and since then, biofuels have been utilized on over 150,000 flights around the globe. In 2018, nearly 15 M liters of aviation biofuel were produced effectively. Additionally, initiatives by airports to supply biofuels and sustainable energy aviation are predicted to further propel the growth of this segment.

Based on Biofuel Blending Capacity, 30% to 50% segment registered market growth

The 30% to 50% segment is predicted to increase at the highest CAGR in the forecast period due to extending research and development activities. The primary factor driving the growth of this segment in the global sustainable aviation fuel market is a significant increase in demand from both commercial and military aviation. Furthermore, the significant growth in research and development in advanced pathways helps in developing the blending ability of sustainable aviation fuel with traditional aviation fuel which further leads to different market growth opportunities.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

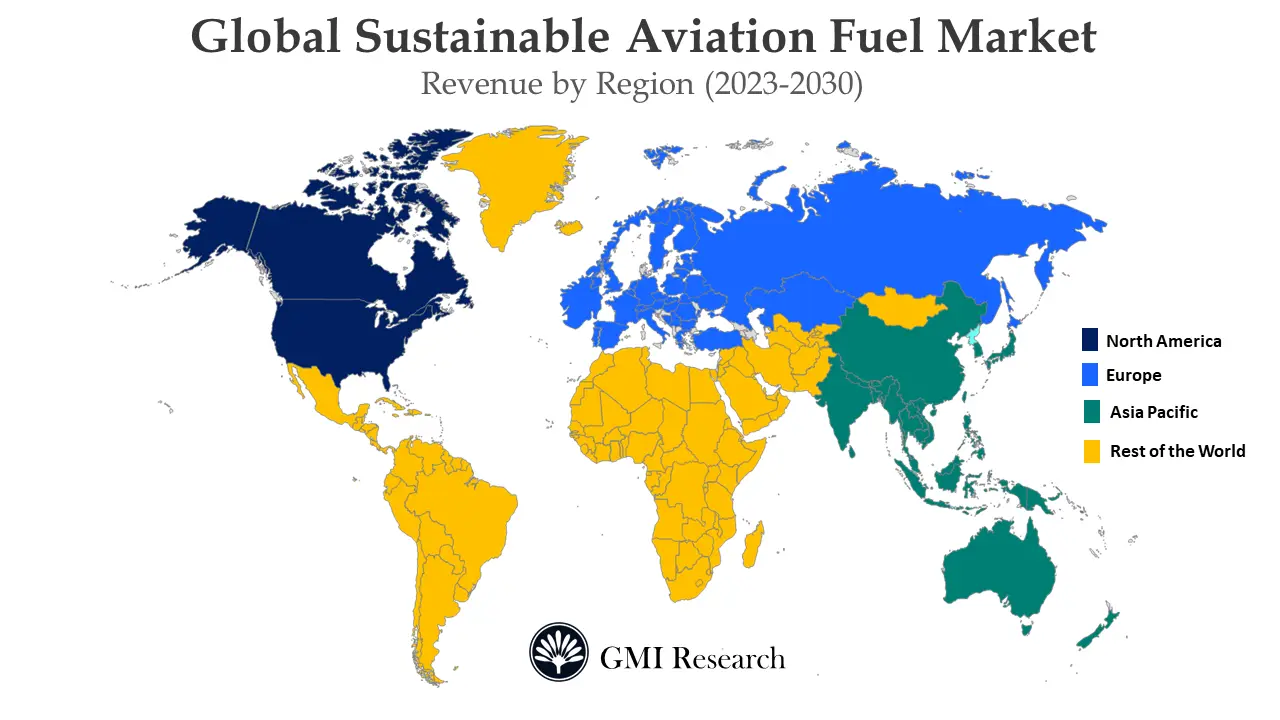

Based on region, North America sustainable aviation fuel market is predicted to expand its market share

North America region is predicted to register significant growth in the forecast period due to an increase in demand from industrialized nations, the existence of some giant market players, and a rise in government measures. All the foremost airlines in North America such as Delta Air Lines, American Airlines, and others have their headquarters in the region and are renowned in their respective areas. The existence of these airlines in North America emphasizes the region’s demand for sustainable aviation fuel. Also, the U.S. Department of Energy Bioenergy Technologies Office enables energy market players and aviation investors by backing research and development, and demonstrations aimed at overcoming barriers to the vast disposition of low-carbon sustainable aviation fuel. The U.S. Department of Energy is functioning with the U.S. Department of Agriculture, the U.S. Department of Transportation, and other federal government firms to progress new comprehensive strategies to scale up new technologies for the commercial production of SAF.

Market players in the aviation sector are enthusiastic about lessening their net CO2 emissions by 2050. In a significant move, IATA member airlines committed to accomplishing net-zero carbon emissions by 2050. Furthermore, in 2021, during the 77th International Air Transport Association Annual General Meeting in Boston, USA, IATA member airlines issued a resolution compelling to accomplish net-zero carbon production from their functioning by 2050.

Also, projects like the Commercial Aviation Alternative Fuel Initiative and Midwest Aviation Sustainable Biofuels Initiative contribute to the advancement and growth of sustainable aviation fuel. Additionally, Canada’s Biojet Supply Chain Initiative, commenced by the country, leads the region in this domain. The project aims to validate elements of the Canadian biojet supply chain and present the practicality of functions, contributing to the advancement of SAF solutions.

Europe sustainable aviation fuel market holds the largest market share

Europe is estimated to dominate over the forecast period due to growing initiatives by the EU to decrease the effects of greenhouse gas emissions. Furthermore, increasing public investments in advancing aviation facilities in emerging nations will contribute the market growth in the coming period. Also, different European governments have implemented rules and legislation to encourage the advancement and usage of SAF. The EASA has recognized different SAFs, leading to their augmented usage in the aviation sector. European airlines have pledged to develop SAF adoption, and there is a rising aim for SAF research and investment in the region.

Top Market Players

Various notable players operating in the market include Neste, Fulcrum BioEnergy, World Energy, TotalEnergy, LanzaTech, Preem, OMV, Atmosfair , Wastefuel, Prometheus Fuels, Red Rocks Biofuel, Northwest Advanced Biofuels among others.

Key Development

-

- In 2023, Emirates and Neste have strengthened their partnership, outlining plans to provide more than 3 million gallons of mixed Neste MY Sustainable Aviation Fiel during 2024 and 2025. This SAF, blended with conventional jet fuel, will be supplied for Emirates flights departing from Singapore Changi and Amsterdam Schipol airports.

- In 2023, ZeroAvia signed an agreement with Absolut Hydrogen to discover liquid hydrogen storage, production, and refueling at airports.

- In 2023, Neste established a unified Sustainable Aviation Fuel supply chain to serve Singapore Changi Airport to make products available across several international and regional airlines and support Singapore in accomplishing its impressive emission reduction goals.

- In 2023, World Fuel Services and Neste extend significantly the accessibility of Nest MY sustainable aviation fuel in Europe to aid the aviation industry in accomplishing its objective of net-zero carbon emissions.

- In 2023, ZeroAvia joined hands with Green Aerolease to deliver ZA600 hydrogen-electric engines.

- In 2023, Neste collaborated with Vopak to extend its capacity to supply renewable fuels to clients on the West Coast of the US.

- In 2023, TotalEnergies spent on sustainable aviation fuel to meet the growing demand from aviation clients and increase SAF production.

- In 2023, Lufthansa collaborated with First Movers Coalition to push the development of sustainable aviation fuels globally and dissociate CO2 emissions from international and local aviation.

- In 2023, LanzaJet collaborated with Technip Energies to increase the deployment of SAF globally and to develop engineering and project development efforts to tackle the decarbonization challenge globally.

- In 2022, ZeroAvia acquired HyPoint to strengthen its leadership position in hydrogen-electric powertrain advancement for aviation.

- In 2022, Red Rock Biofuels LLC has partnered with GLC Advisors & Co. to seek a development partner for financing the completion of its biofuel facility.

Segments covered in the Report:

The Sustainable Aviation Fuel Market has been segmented on the basis of Fuel type, Biofuel Blending Capacity, Biofuel Manufacturing Technology and Platform. Based on the Fuel type, the market is segmented into Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid. Based on the Biofuel Blending Capacity, the market is segmented into Below 30% to 50%, 30%, Above 50%. Based on the Biofuel Manufacturing Technology the market is segmented into HEFA, Alcohol to Jet, Gasification/ FT, Power to Liquid. Based on the Platform, the market is segmented into Commercial Aviation, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicle.

For detailed scope of the “Sustainable Aviation Fuel Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 420 Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Fuel type, By Biofuel Blending Capacity, By Biofuel Manufacturing Technology, By Biofuel Manufacturing Technology and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Neste, Fulcrum BioEnergy, World Energy, TotalEnergy, LanzaTech, Preem, OMV, Atmosfair , Wastefuel, Prometheus Fuels, Red Rocks Biofuel, Northwest Advanced Biofuels. among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Sustainable Aviation Fuel Market by fuel type

-

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

Global Sustainable Aviation Fuel Market by Biofuel Blending Capacity

-

- Below 30%

- 30% to 50%

- Above 50%

Global Sustainable Aviation Fuel Market by Biofuel Manufacturing Technology

-

- HEFA

- Alcohol to Jet

- Gasification/ FT

- Power to Liquid

Global Sustainable Aviation Fuel Market by Platform

-

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

Global Sustainable Aviation Fuel Market by Region

-

-

North America Global Sustainable Aviation Fuel Market (Option 1: As a part of the free 25% customization)

- By Fuel type

- By Biofuel Blending Capacity

- By Biofuel Manufacturing Technology

- By Platform

- US Market All-Up

- Canada Market All-Up

-

Europe Global Sustainable Aviation Fuel Market (Option 2: As a part of the free 25% customization)

- By Fuel type

- By Biofuel Blending Capacity

- By Biofuel Manufacturing Technology

- By Platform

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Global Sustainable Aviation Fuel Market (Option 3: As a part of the free 25% customization)

- By Fuel type

- By Biofuel Blending Capacity

- By Biofuel Manufacturing Technology

- By Platform

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Global Sustainable Aviation Fuel Market (Option 4: As a part of the free 25% customization)

- By Fuel type

- By Biofuel Blending Capacity

- By Biofuel Manufacturing Technology

- By Platform

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Sustainable Aviation Fuel Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Neste

- Fulcrum BioEnergy

- World Energy

- TotalEnergy

- LanzaTech

- Preem

- OMV

- Atmosfair

- Wastefuel

- Prometheus Fuels

- Red Rocks Biofuel

- Northwest Advanced Biofuels.

- Published Date: Oct - 2023

- Report Format: Excel/PPT

- Report Code: UP3545-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Sustainable Aviation Fuel Market Size, Share, Trends and Growth Report – Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research