Automotive Carbon Thermoplastic Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

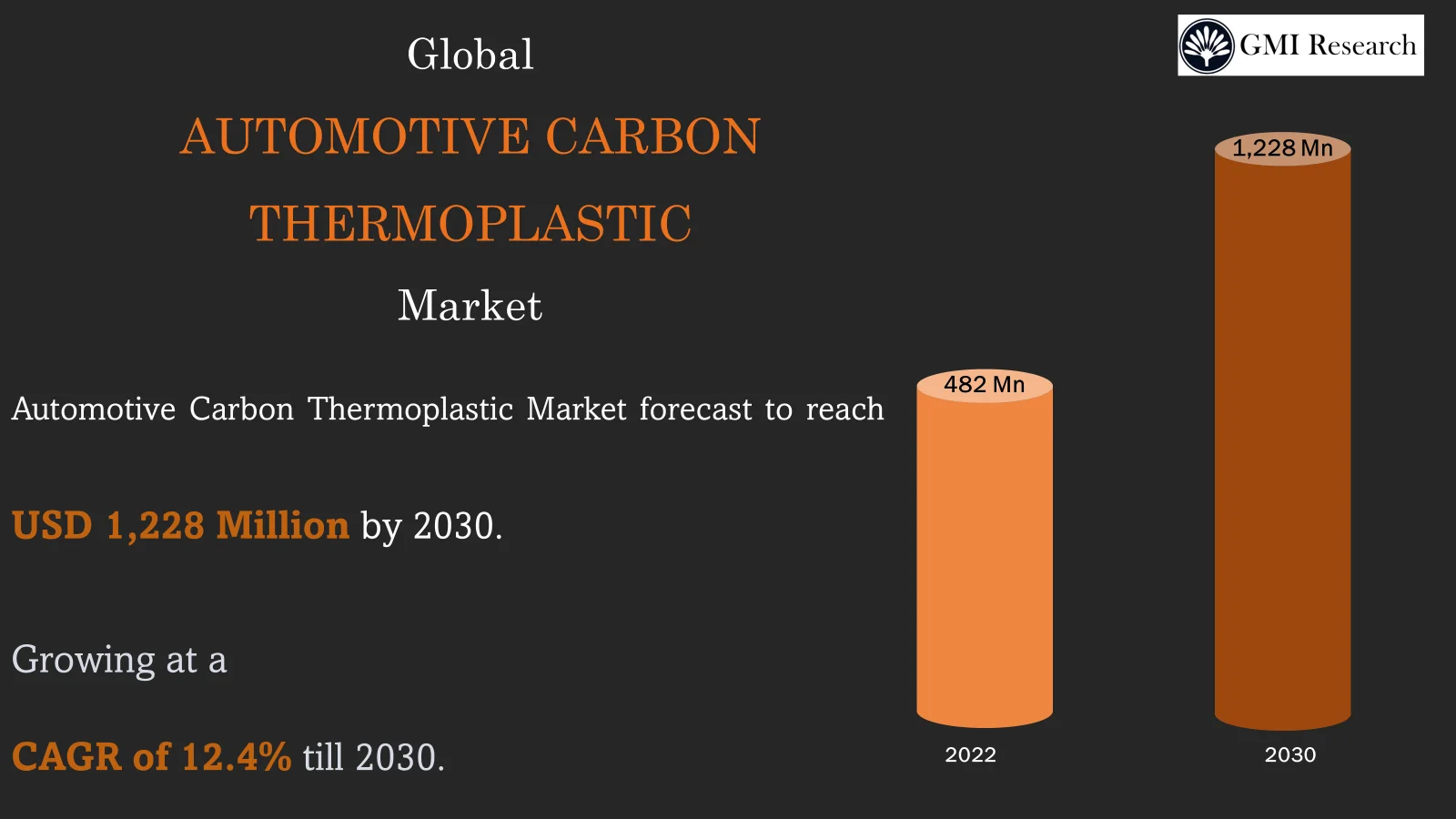

Automotive Carbon Thermoplastic Market registered a revenue of USD 482 million in 2022 and is projected to reach USD 1,228 million in 2030, growing at a very high CAGR of 12.4% during the forecast period from 2023-2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Automotive Carbon Thermoplastic Market” request for Sample Report here

Major Automotive Carbon Thermoplastic Market Drivers

The automotive carbon thermoplastic market is predicted to grow significantly due to the growing need for lightweight automobiles, increasing population majorly in emerging nations, expansion of aerospace and defense, and change in customer preferences. The automotive market faces ongoing pressure to lower carbon emissions and reduce fuel consumption by decreasing vehicle weight while simultaneously developing safety. This trend is rising the integration of electric drive technology, the pursuit of lighter automobiles, the enhancement of hybrid cars or multi-materials, and the enforcement of stricter environmental legislation, and corresponding traffic regulations. Thermoset composites have found extensive utilization in the construction of racing cars and luxury sports cars for numerous years. However, their processing potential has not yet reached the industrial production speed required by the automobile industry, which functions at high capacities. Automated production procedures are essential for larger volumes of cars, where the time demanded to produce a component should be no more than about one minute. The usage of lightweight thermoplastic composites leads to accomplishing this possible effectiveness.

Meanwhile, significant investments and the establishment of research laboratories, specifically led by Oak Ridge National Laboratory, are underway to develop new technologies for cost-effective carbon fiber production. Automobile OEMs are heavily investing in the widespread acceptance of carbon fiber composites within the automotive industry. In automotive industry, carbon thermoplastic is prevalent because it decreases vehicle weight, develops fuel effectiveness, and manages performance and safety features. The goal of using sustainable materials in automobiles can be accomplished through the usage of carbon thermoplastic. These materials are increasingly used in the development of exterior, interior, and structural elements of automobiles. The usage of carbon thermoplastics extends to end-use including powertrain systems, body panels, wheels, and chassis in the automotive sector. The growing need for lightweight automotive carbon fiber components, coupled with the benefits of improved composites in precise applications, contributes to probable cost and performance advantages. The increasing emphasis on environmentally friendly manufacturing and materials further develops the performance and cost-effectiveness of carbon thermoplastics. Challenges in the automotive carbon thermoplastic market include price volatility during production and precise environmental concerns. However, the market exhibits growth opportunities through automotive carbon thermoplastics production with improved properties. In addition, the expanding aim of electric vehicles presents promising prospects in the automotive carbon thermoplastic market.

Although, the manufacturing of carbon fiber is capital-intensive, requiring substantial investments. Ongoing projects aim to develop new technologies to introduce low-cost carbon fiber, focusing on commercializing end products. The manufacturers focus on decreasing manufacturing costs through innovations in technologies and procedure solutions. Industry professionals highlight that the production procedure of carbon fiber is complex and time-consuming compared to alternative products. Developing simpler and cost-effective technologies for the commercial production of low-cost thermoplastic composites remains a foremost challenge for governments, carbon fiber automotive body parts manufacturers, and research and development laboratories globally.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Whereas, automotive structural composites are important materials for automotive OEMs, used in both structural and non-structural elements. Higher volume utilization has historically faced challenges including lengthy production cycles, restricted automation, and high material costs. However, the landscape is predicted to reduce the cost of carbon fiber and the implementation of automated procedures featuring shorter cycle times for large-volume automotive component production.

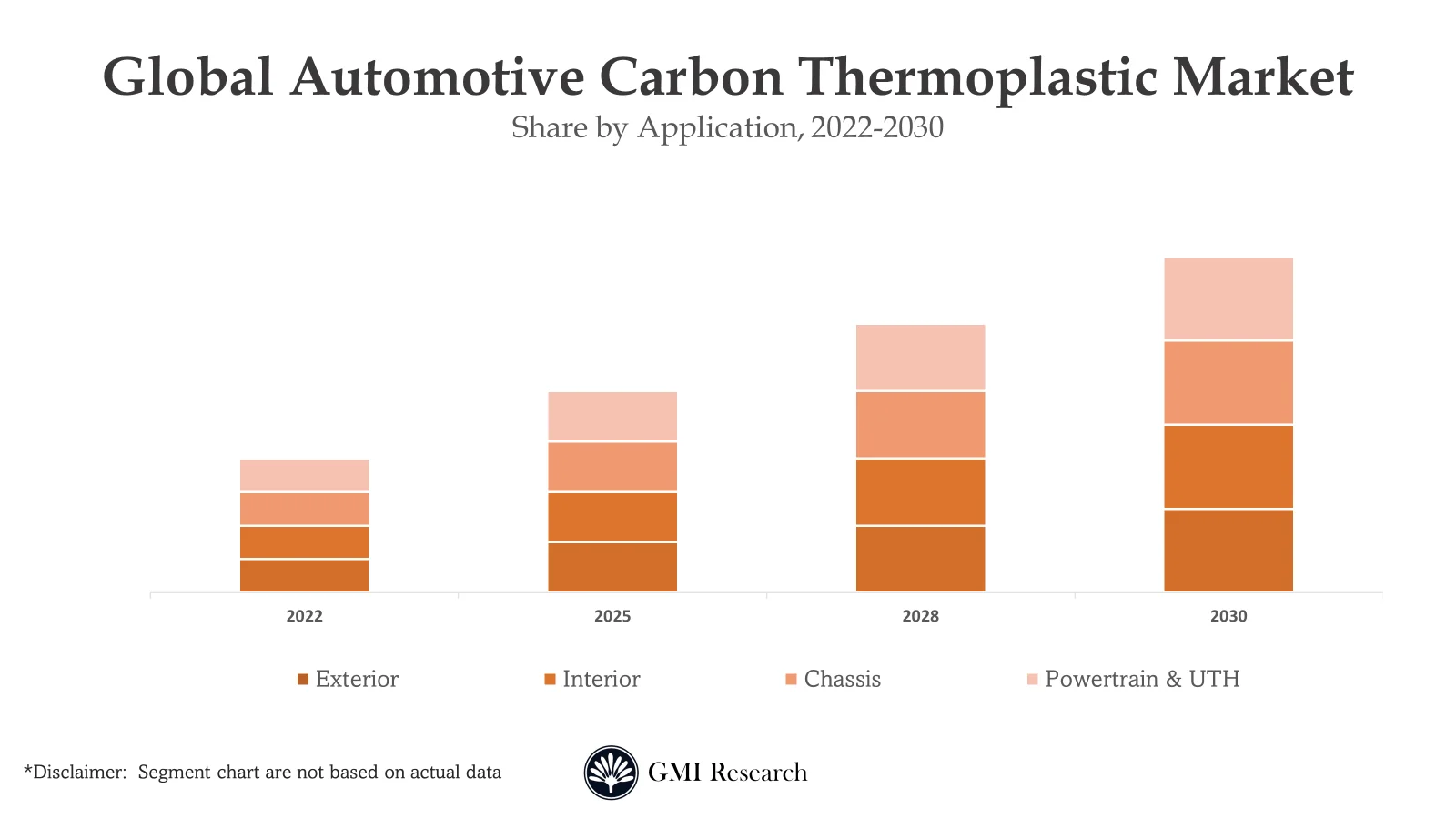

Interior segment is predicted to register the largest market size in the global automotive carbon thermoplastic market in the forecast period

Automotive producers have implemented CFRP composites for different interior components including package trays, dashboards, setbacks, headliners, and many more. Ongoing innovations in technology, and collaboration between Tier I and Tier II automotive suppliers and carbon fiber manufacturers, aim to integrate Carbon fiber-reinforced polymers (CFRPs) automotive components into interior trim. The application of CFRP materials in sports and luxury car interior trim is a logical extension, leveraging their notable strength-to-weight ratio. Carbon fiber is commonly utilized in crafting interior items such as knobs, door sills, steering wheels, and consoles, developing the aesthetic and performance aspects of car interiors.

PA resign is estimated to dominate the largest revenue share in the global automotive carbon thermoplastic market

Polyamide is a robust contender for the polymeric matrix in carbon fiber-strengthened thermoplastic composites. Its benefits include a low dielectric constant, chemical inertness, good dimensional stability, heat resistance, high mechanical strength, and cost-effectiveness up to 2400C. CF/PA composites find application in automobile air intake manifolds, substituting conventional metal counterparts. These alternative decreases weight of up to 60%, lowers system costs through integrated parts, and contributes to developed fuel effectiveness in automotive.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

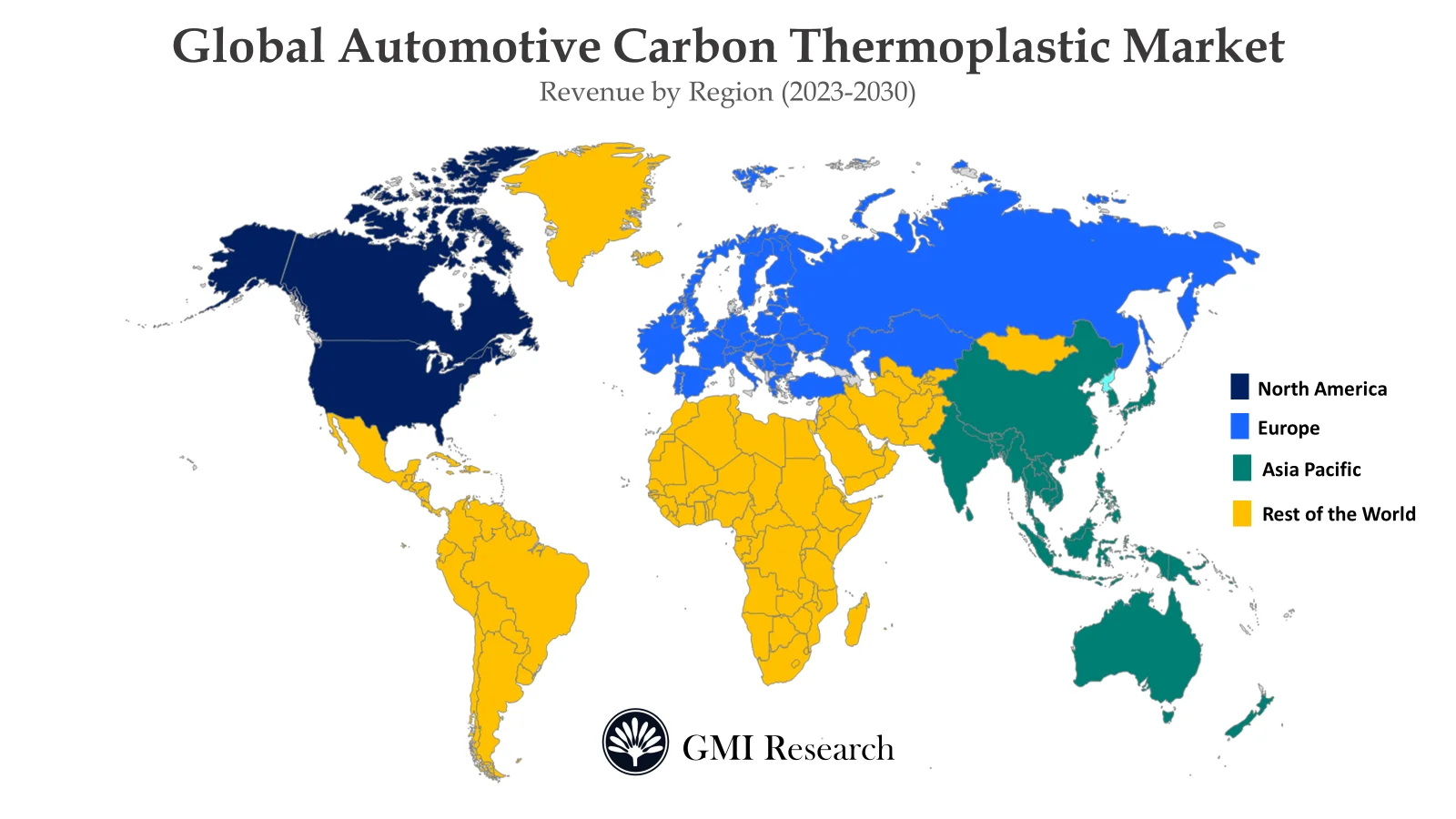

Europe is anticipated to register the highest CAGR in the global automotive carbon thermoplastic market in the forecast period

Europe is predicted to register the largest market size due to different factors including the existence of well-established automobile producers, continuous technological developments, and industrial expansion within the automotive industry in the region. The robust European automotive industry, registered by well-established automakers, has attained strength compared to other regions. In addition, the European Union Commission’s stringent environmental targets, focusing on a 50% to 55% reduction in CO2 emission by 2030, are propelling the implementation rate of thermoplastic composite parts for vehicles because it increased fuel-effective requirements within the region.

Top Market Players

Various notable players operating in the market include BASF SE, Solvay, Avient Corporation, Celanese Corporation, Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Group Corporation, SGL Carbon, Asahi Kasei Corporation, CompLam Material Co., Ltd., Ensinger, and Jiangsu QIYI Technology Co., Ltd. among others.

Key Developments

-

- In 2023, Toray Industries, Inc. announced an expansion of the Frech subsidiary to increase production and help accomplish a carbon-neutral country by 2050.

- In 2023, Avient Corporation and BASF joined hands to offer effective-colored grades of Ultrason high-quality base polymers to the international market.

- In 2023, Toray Industries, Inc., announced a rapid development of integrated molding technology to assemble the huge panels in an individual press shot.

- In 2023, Fujitsu and Teijin announced the launch of a joint project to develop the environmental value of recycled resources to produce the frames of bicycle along with V frames GmbH.

Segments covered in the Report:

The Global Automotive Carbon Thermoplastic Market has been segmented on the basis of Resin Type and Application. Based on the Resin Type, the market is segmented into PA, PEEK, PPS, PC, PP, Others. Based on the Application, the market is segmented into Exterior, Interior, Chassis, Powertrain & UTH.

For detailed scope of the “Automotive Carbon Thermoplastic Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 482 Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Resin Type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | BASF SE, Solvay, Avient Corporation, Celanese Corporation, Toray Industries, Inc. , Teijin Limited, Mitsubishi Chemical Group Corporation, SGL Carbon, Asahi Kasei Corporation, CompLam Material Co., Ltd., Ensinger, and Jiangsu QIYI Technology Co., Ltd., among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Automotive Carbon Thermoplastic Market by Resin Type

-

- PA

- PEEK

- PPS

- PC

- PP

- Others

Global Automotive Carbon Thermoplastic Market by Application:

-

- Exterior

- Interior

- Chassis

- Powertrain & UTH

Global Automotive Carbon Thermoplastic Market by Region

-

-

North America Automotive Carbon Thermoplastic Market (Option 1: As a part of the free 25% customization)

- By Resin Type

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Automotive Carbon Thermoplastic Market (Option 2: As a part of the free 25% customization)

- By Resin Type

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Automotive Carbon Thermoplastic Market (Option 3: As a part of the free 25% customization)

- By Resin Type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Automotive Carbon Thermoplastic Market (Option 4: As a part of the free 25% customization)

- By Resin Type

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Automotive Carbon Thermoplastic Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- BASF SE

- Solvay

- Avient Corporation

- Celanese Corporation

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Group Corporation

- SGL Carbon

- Asahi Kasei Corporation

- CompLam Material Co., Ltd.

- Ensinger

- Jiangsu QIYI Technology Co., Ltd.

Related Reports

- Published Date: Nov-2023

- Report Format: Excel/PPT

- Report Code: UP3582-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Automotive Carbon Thermoplastic Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research