Oil and Gas Pumps Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

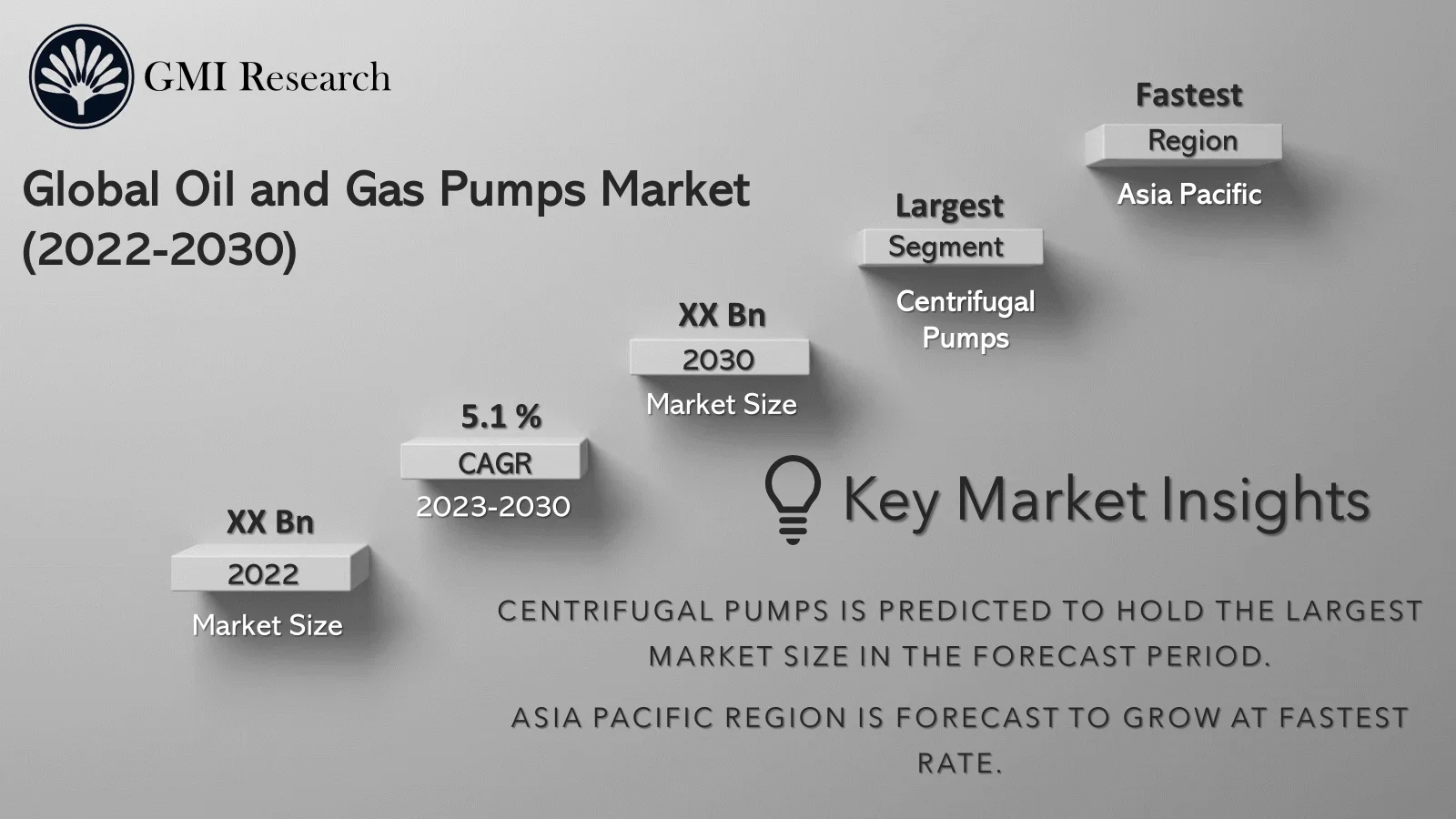

The Oil and Gas Pumps Market is projected to grow at a CAGR of 5.1% during the forecast period, 2023-2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Oil and Gas Pumps Market” request for Sample Report here

Major Oil and Gas Pumps Market Drivers

Increase in demand for oil and gas from a diverse range of industries, rapid urbanization, and industrialization, rise in demand for pumps for applications in exploration and refineries, and favorable government initiatives are primary drives that propels the global oil and gas pumps market. The market for oil and gas pumps including moving or transporting, processing, and extraction of oil and gas resources. It includes a different series of pump designs personalized to meet the demand of the sector. Market growing is predicted to grow with the rising need for oil and gas, development in transportation infrastructure, industry dynamics, and economic requirements. The market is growing because of automation, digitalization, and different technological advantages that boost productivity and safety.

The global market for gas and oil pumps is propelled by different key factors. The primary driver is the demand for oil and gas, fueled by economic growth, transportation needs, and industrial development. The increase in production and exploration activities, especially in developing economies significantly impacts the need for pumps. In addition, the innovations in technology such as advanced and automated pumping systems contribute to improved operational productivity and effectiveness. The market is further driven by the need for efficient and reliable pumps to tackle challenging situations such as deep-sea exploration, and the extraction of unconventional resources. Moreover, the investment in pipeline pumps infrastructure, petrochemical projects, and refinery upgrades introduce different opportunities for pump suppliers and manufacturers in the global oil and gas pumps market.

Despite this, the growth of gas terminals due to the growing demand globally for cleaner energy sources, with natural gas for energy transition. These terminals function as crucial points in the transportation network, overseeing the regasification, storage, and liquefaction of natural gas. The complex functions within these terminals demand improved pumping systems to guarantee the secure and seamless flow of gas in the entire supply chain. Improved technologies in oil and gas pumps are good to optimize the performance of terminals. They are essential in different procedures, from unloading liquefied natural gas from transporters to distributing regasified gas to users. The increasing demand for natural gas driven by environmental concerns and the move to cleaner energy alternatives, makes advanced pumping solutions even more important. To meet the unique requirement of gas terminal operations, industry stakeholders are investing in research and development initiatives, focusing on raising the technological capabilities of oil and gas pumps. Thereby, as the need for natural gas rises, the networks for gas transportation are expanding.

During the liquefied natural gas production procedures, gas extracted from the field is directed to the liquefaction facility, where it has different steps to transform into a liquefied state. Pumps play an important role in this procedure, being employed to measure amine and enable reflux for scrub rows and fractionation towers. Recently, there has been prevailing commercial transportation for both CO2 and natural gas. A proficient gas transport network requires substantial compressors and pumping stations capable of managing high-pressure volumes. The materials used in manufacturing these pumps must endure elevated pressures and possess corrosion resistance. For instance, in 2020, Polskie LNG agreed to the expansion of prevailing liquefied natural gas regasification installation. The expansion included the addition of a submerged combustion vaporizer regasifier, carefully designed and assembled alongside cryogenic pumps. This investment develops the functionality and technical capabilities of the Swinoujscie terminal by incorporating two SCV devices. This increased the regasification volume to 7.5 billion m3/year of natural gas per year.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Additionally, the U.S. is estimated to establish 30 new gas terminals during the coming decade to address the extended need for natural gas. The popularity of Floating LNG terminals is significant, given their developed flexibility and cost-effectiveness compared to conventional land-based terminals. The strategic placement of FLNG terminals closer to offshore gas field lead to cost savings in transporting natural gas to the market. The establishment of these new terminals is predicted to introduce employment, stimulate economic growth, and contribute to addressing the growing need for energy. The planned expansions in gas transport networks are boost the pumps market growth within the oil and gas market globally.

By application, downstream is predicted to be the fastest growing in the forecast period

Downstream pumps in the oil and gas sector are used in primary processing solutions, secondary processing solutions, as well as storage and transfer systems. Downstream procedures in the oil and gas industry occur after the midstream phase but before the final product is sold. This phase involves refining by-products such as diesel, gasoline, and natural gas liquids, which are conducted by refining companies. Consequently, companies engaged in the downstream procedure to refining, sale, marketing, and distribution of the end products based on oil.

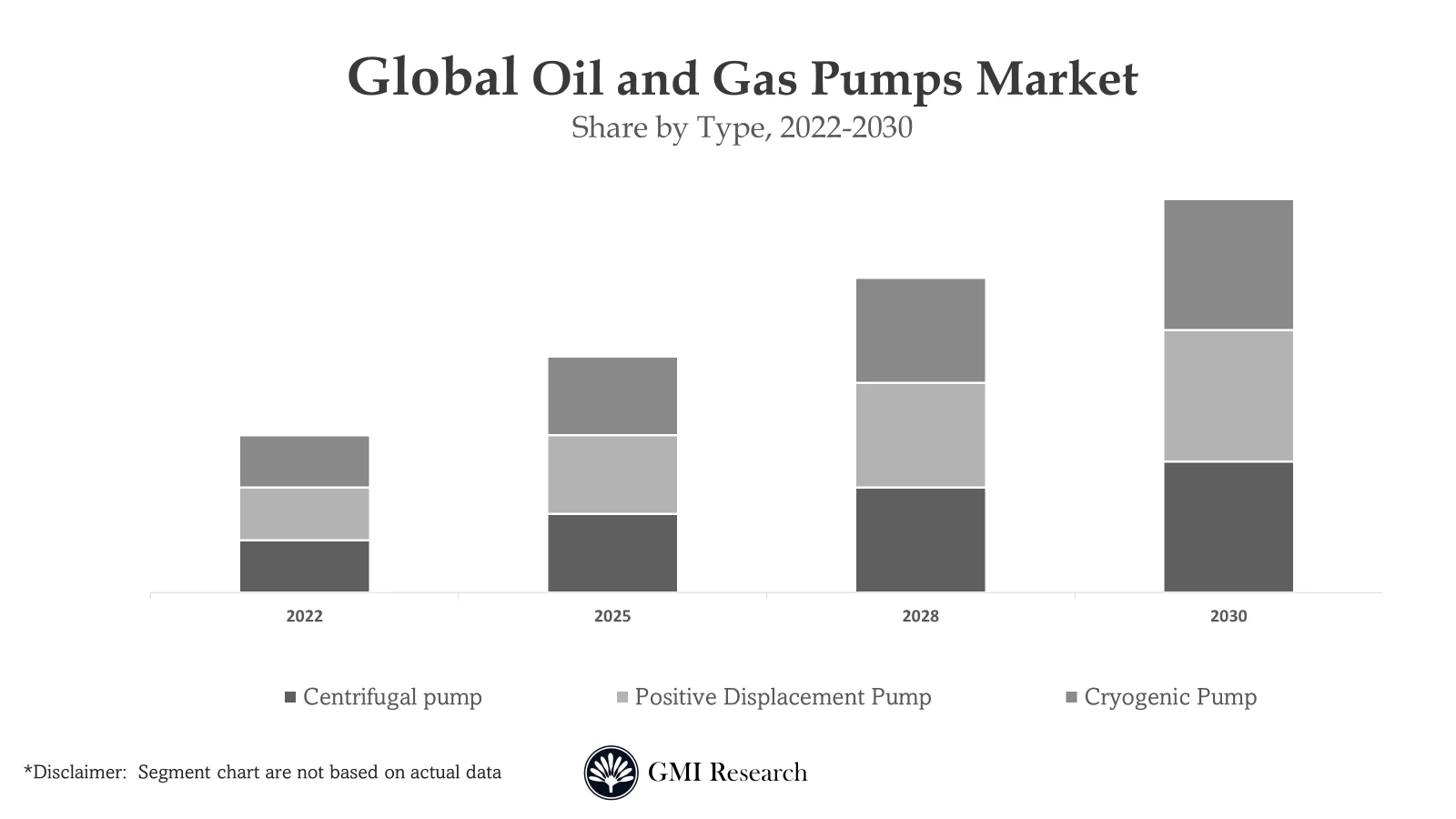

Centrifugal Pumps Segment is predicted to dominate the largest revenue share in the global market

The oil and gas industry is observing a rapid growth in the demand for submersible pumps within the centrifugal pumps category due to their ability to function as effective water and oil separators. Centrifugal pumps utilizing extensively in the transportation of crude oil in different countries due to the growing need for crude oil.

Producers of oil and gas pumps are concentrating on developing centrifugal pumps to advance performance and accomplish significant energy savings. In addition, the procedure of dehydrating gas before its transportation through the high-pressure pipelines involves the usage of centrifugal pumps, helping in the recycling and separation of glycol. Thereby, the adoption of specialized and high-speed centrifugal pumps is predicted to gain high prevalence in the forecast period.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Asia Pacific region is predicted to register the largest CAGR in the forecast period

The Asia Pacific region is a fastest-growing region in the oil and gas pumps market in the forecast period, with North America, and MEA. Nations within this regional market including India, Australia, South Korea, China, and rest of Asia region. Despite holding less than 9.0% of the world’s proven reserves, the region signified a high rate of oilfield redevelopment and rehabilitation. The increase in oil demand is attributed to population growth, industrialization, and advancements in deepwater, and ultra-deepwater drilling pumps technologies. The growing energy consumption and infrastructural enhancement in Asia Pacific, it is predicted to emerge as the fastest-rising market for oil and gas pumps.

Top Market Players

Various notable players operating in the market include Arkema Group, 3M, Ashland Inc., Associated industries Inc., BASF SE, Braskem, Chemtura Corporation, Covestro, Croda International PLC, Elantas GmbH, Endurance Technologies Limited, Evonik Industries AG among others.

Key Developments

-

- In 2023, KSB SE & Co. KGaA announced an addition of 19 sizes to its series type of MegaCPK to provide a wide variety of applications and allow customers to choose from a variety of sizes.

- In 2022, Atlas Copco acquired Geveke B.V. and LEWA GmbH a combined worth of MEUR 670 to offer high-performance pump solutions for a high number of industries.

- In 2022, Atlas Copco announced an acquisition of Pumpenfabrik Wangen GmbH to be competitive in the global market and address the growing demand of customers and partners.

Segments covered in the Report:

The Oil and Gas Pumps Market has been segmented on the basis of Type and Application. Based on the Type, the market is segmented into Centrifugal pump, Positive Displacement Pump, Cryogenic Pump. Based on the Application, the market is segmented into Upstream, Midstream, Downstream.

For detailed scope of the “Oil and Gas Pumps Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Xylem Inc., Flowserve Corporation, Weir Group PLC, Sulzer AG, Alfa Laval AB, Grundfos Holding A/S, KSB SE & Co. KGaA, ITT Inc., Gardner Denver Holdings Inc, Baker Hughes Co, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Oil and Gas Pumps Market by Type

-

- Centrifugal pump

- Positive Displacement Pump

- Cryogenic Pump

Oil and Gas Pumps Market by Application

-

- Upstream

- Midstream

- Downstream

Global Oil and Gas Pumps Market by Region

-

-

North America Oil and Gas Pumps Market (Option 1: As a part of the free 25% customization)

- By Type

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Oil and Gas Pumps Market (Option 2: As a part of the free 25% customization)

- By Type

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Oil and Gas Pumps Market (Option 3: As a part of the free 25% customization)

- By Type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Oil and Gas Pumps Market (Option 4: As a part of the free 25% customization)

- By Type

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Oil and Gas Pumps Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Xylem Inc.

- Flowserve Corporation

- Weir Group PLC

- Sulzer AG

- Alfa Laval AB

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- ITT Inc.

- Gardner Denver Holdings Inc

- Baker Hughes Co

Related Reports

- Published Date: Dec-2023

- Report Format: Excel/PPT

- Report Code: UP3616-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Oil and Gas Pumps Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research