Mining Chemicals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

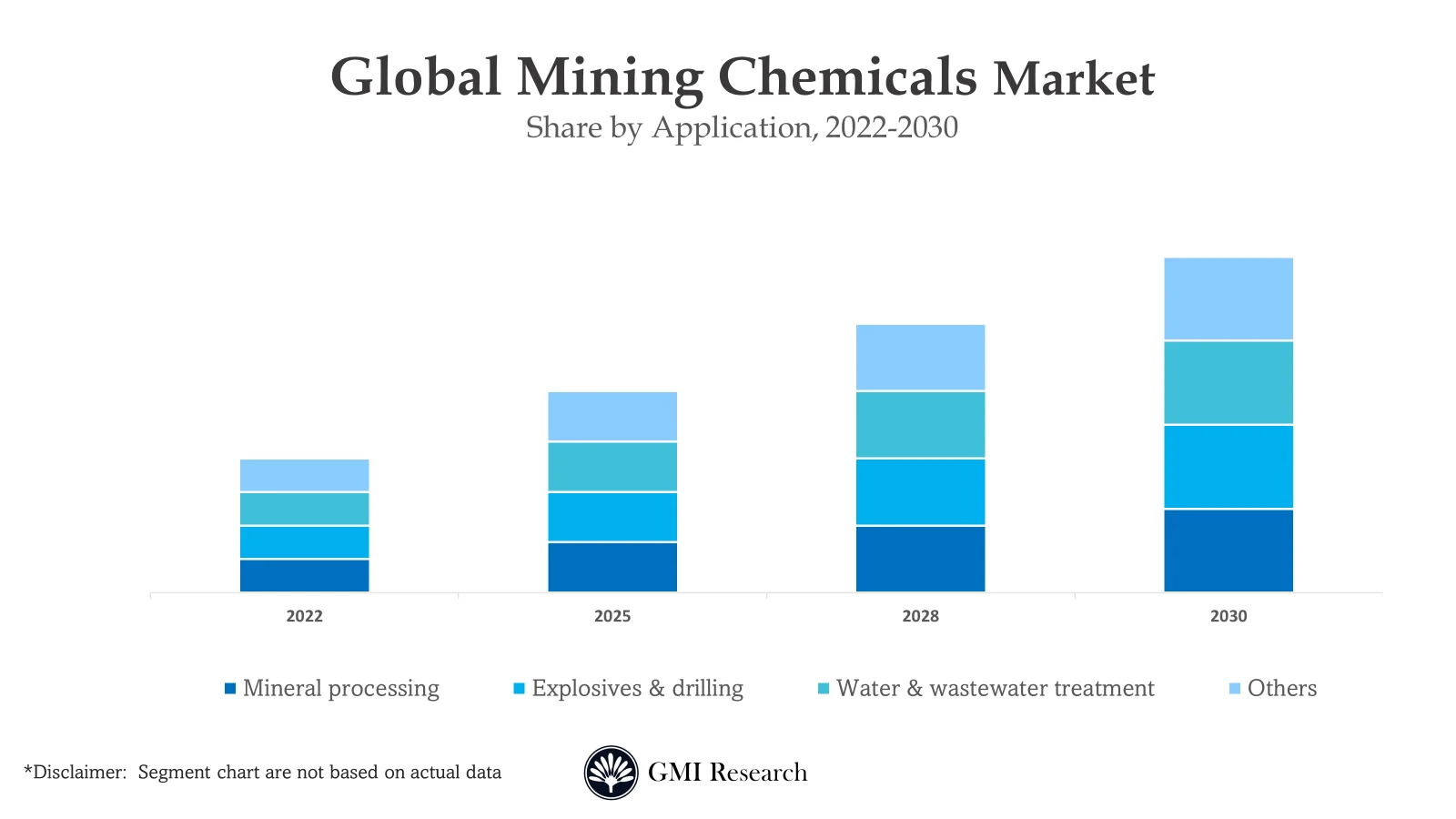

GMI Research analysis indicates that the Mining Chemicals Market size was estimated at USD 9.5 billion in 2022 and is slated to register a single digit CAGR of 5.8% over the forecast period, and is projected to reach USD 14.9 billion in 2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Mining Chemicals Market” request for Sample Report here

Major Mining Chemicals Market Drivers

The primary drivers propel the mining chemicals market are rising need for minerals in different end-user industries including medical equipment, electronics, paints, coatings, and others surging investment in mining projects across emerging nations, and growing demand for specialty chemicals for mining procedures. Mining chemicals enhance the efficiency of mining and mineral processing industries. These modified agents, often used in the flotation process of sulfied ores to deliver performance benefits and contribute to sustainable advantages. This is especially true in complex ores, where the separation of two or more valuable materials is necessary. These chemicals benefit in various aspects including dewatering, and aiding infiltration, developing grade and recovery, enhancing capacity, managing slurry and pumps, sorting minerals, and decreasing both expense per ton, and bulk. Moreover, commonly used mining chemicals include collectors, and frothers, solvent extractants, wet and dry-grinding aids, theology modifiers, and flocculants. These chemicals hold importance in mineral ore processing. Specialty chemicals find deployment in every stage of the complex mining process, contributing to its simplification. The mining sector has shifts in production approaches, transitioning from tunneling to open-pit mining, enabling the extraction of ores with decreasing grades and decreasing overall costs. This shift increasing usage of these chemicals in the mining processes is estimated to foster the global mining chemicals market growth in the forecast period.

The global mining chemicals market experiences growth propelled by the growing demand for metals and minerals in the manufacturing of high-end products. This mining chemicals demand is particularly propelled by innovations in the automotive, electronics, and aerospace industries, where metals, minerals, and rare earth elements are important in high-end product manufacturing. The increased metals demand drives a rise in mining activities to extract and produce necessary raw materials. This, in turn, results in the widespread usage of mining chemicals to access ore deposits, fragment rocks and remove impurities. Additionally, as the demand for metals continues to grow, mining chemicals companies are increasing importance on developing safety measures and functional effectiveness in their procedures. This includes innovations in mining explosive technologies and formulations to optimize blasting operations. In the automotive sector, the manufacturing of high-end vehicles, including sports cars, uses lightweight metals including high-strength steel, titanium, and aluminum. In the past years, the need for aluminum has increased due to rise in lightweight materials production for internal combustion electric and engine vehicles.

Moreover, Canada holds a prominent position in global mining operations, standing among the top 5 countries in the production of 14 primary minerals and metals. In 2019, the country witnessed a steady year-over-year increase of USD 8 billion in the value of planned and under-construction mining projects from 2019 to 2029. Ontario emerged as a leader in mining activities, boasting nearly 252,876 functioning mining sites as of 2019, and hosting over 200 ongoing mineral exploration projects. Several major mining corporations are actively looking for exposure in Canada, conducting feasibility studies for capital growth. In addition, the Canadian Government is initiating different initiatives to attract additional investors, encouraging exploration of the country’s untapped mineral resources. Furthermore, the collaboration between the Canadian federal-provincial and territorial governments has introduced the CMMP, a strategic initiative focused on sustaining Canada’s position as a global mining leader. This initiative drives mining chemicals market size.

Meanwhile, the mining chemicals industry faces challenges such as the high cost of extraction equipment and the complexity of mining procedures. Industries are exploring a series of substitutes for these components to consider their costliness and the ecological impact of extraction. In addition, potential risks associated with the extraction method are other factors that could restrain the revenue growth of the market in the forecast period.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Whereas, Africa is making the most attractive investment prospects globally, due to its abundant mineral deposits. It is renowned for its vast mineral wealth, the continent hosts some of the world’s largest deposits of precious commodities including platinum, diamonds, copper, and gold. Mining activities across Africa have witnessed growth due to the growing global need for metals, and minerals, coupled with higher investments in the African mining sector. The mining chemicals industry in Africa holds development potential due to the emergence of new mining projects and the extension of prevailing functions. African governments have made their mining regulations to attract foreign direct investment in the sector. Governments have initiated investor-friendly policies, simplified regulatory processes, and provided tax incentives, propelling a market growth opportunity for mining enterprises. With the growing number of mining projects results in rising need for mining chemicals such as collectors, solvent extractants, flocculants, frothers, and depressants. Since 2014, the AFC has spent over USD 900 million on African mining ventures. The region is observing strong company financials and returns on investments, propelling increased investment in mines. This rise in production is predicted to introduce opportunities for expansion of the mining chemicals market in the forecast period due to the rise in demand for chemicals to support mining activities.

Flocculants segment is predicted to grow at the fastest rate in the forecast period

Flocculants are essential for water filtration by causing particles to come together and settle out of the solution during the procedure. These chemicals, available in lightweight, heavy polymer forms, and medium-weight, function as an advanced agent that binds the coagulated particles, facilitating their removal from the filtered water. Moreover, Flocculants come in various charges forms, densities, and molecular weights. Natural polymers, such as crushed nuts have been used as flocculants by some Central African tribes since prehistoric times. They are substances that accelerate the aggregation of colloidal particles, resulting in the formation of floccules. Furthermore, this decreases sediments in water systems and develop pollution removal effectiveness. These agents find widespread usage in water and wastewater purification processes. The most effective flocculating agents can remove impurities of the lowest concentration and in the shortest amount of time for efficient water and wastewater treatment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

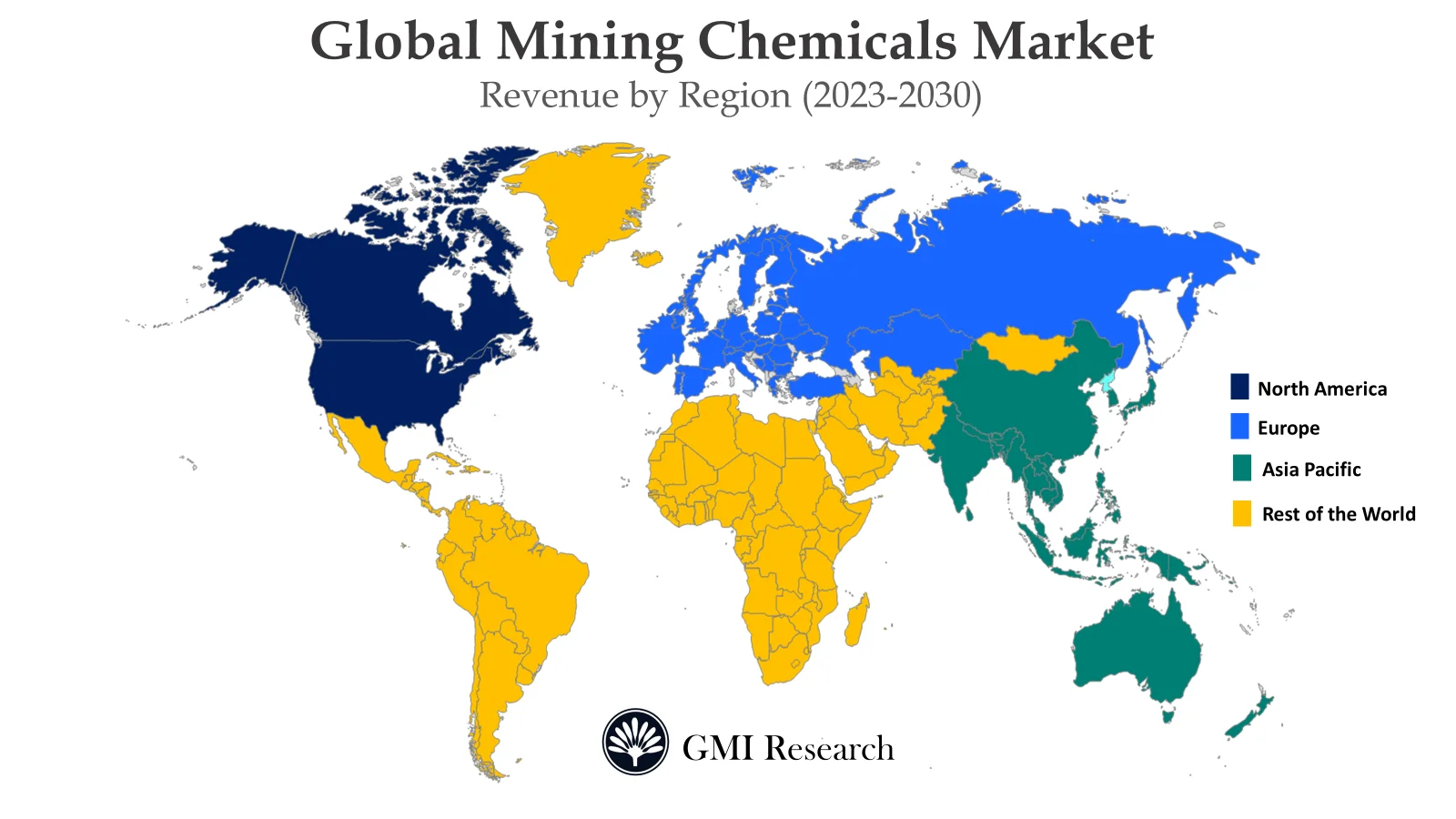

Asia Pacific region registered the largest CAGR in the global mining chemical market

This Asia Pacific region registered the market growth due to rising activities in mineral processing across nations such as China, India and several others which are estimated to increase the optimum utilization of the product around the APAC region in the forecast period. Whereas China dominates the regional mining chemicals market. With more than 10,000 mines, China holds a significant portion of the industry. As the world’s largest producer of coal, gold, and different earth minerals. China is also a leading end-user of mining products. Mining chemicals are essential in the mining industry, contributing to procedures such as the purification of certain minerals, separating impurities, recovering minerals from slurry, and other applications within the sector. Countries in the APAC region have made investments in the mining industry, with a strong importance on minerals such as nickel, cobalt, and lithium, crucial components in battery technologies. As the international move toward cleaner technologies gains potential, these nations are predicted to dominate the market, specifically in the expanding battery market.

Top Market Players

Various notable players operating in the market include AECI Mining Chemicals, BASF SE, Ashland, Dow, Kimleigh Chemicals, Cytec Solvay Group, Arkema, Clariant, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V. among others.

Key Developments

-

- In 2023, BASF launched two new innovative product brands Luproset and Luprofroth to expand its product range and mark a foremost action towards becoming a prominent solution provider in the mining industry.

- In 2022, BASF joined hands with the Catholic University of the North to encourage innovation, research, and development in mining.

- In 2022, BASF announced a partnership with Moleaer to combine the efficiency in gas transfer, nanobubble technology, hydrometallurgy, and mineral processing to enhance innovative procedures for mining.

Segments covered in the Report:

The Global Mining Chemicals Market has been segmented on the basis of Product Type and Application. Based on the Product Type, the market is segmented into Frothers, Flocculants, Collectors, Solvent extractants, Grinding aids. Based on the Application, the market is segmented into Explosives & drilling, Mineral processing, Water & wastewater treatment, Others.

For detailed scope of the “Mining Chemicals Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 9.5 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | AECI Mining Chemicals, BASF SE, Ashland, Dow, Kimleigh Chemicals, Cytec Solvay Group, Arkema, Clariant, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V. among others; a total of 13 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Mining Chemicals Market by Product type

-

- Frothers

- Flocculants

- Collectors

- Solvent extractants

- Grinding aids

Global Mining Chemicals Market by Application

-

- Mineral processing

- Explosives & drilling

- Water & wastewater treatment

- Others

Global Mining Chemicals Market by Region

-

-

North America Mining Chemicals Market (Option 1: As a part of the free 25% customization)

- By Product type

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Mining Chemicals Market (Option 2: As a part of the free 25% customization)

- By Product type

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Mining Chemicals Market (Option 3: As a part of the free 25% customization)

- By Product type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Mining Chemicals Market (Option 4: As a part of the free 25% customization)

- By Product type

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Mining Chemicals Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- AECI Mining Chemicals

- BASF SE

- Ashland

- Dow

- Kimleigh Chemicals

- Cytec Solvay Group

- Arkema

- Clariant

- Nowata

- Kemira

- Shell Chemicals

- Quaker Chemical Corporation

- Akzo Nobel N.V.

Related Reports

- Published Date: Dec-2023

- Report Format: Excel/PPT

- Report Code: UP3163-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Mining Chemicals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research