Rubber-Processing Chemicals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

Rubber-Processing Chemicals Market registered a revenue of USD 5.9 billion in 2023 and is projected to reach USD 8.1 billion in 2031, growing at a CAGR of 4.0% during the forecast period from 2024-2031.

To have an edge over the competition by knowing the market dynamics and current trends of “Rubber-Processing Chemicals Market” request for Sample Report here

Major Rubber-Processing Chemicals Market Drivers

The growth drivers of the rubber-processing chemicals market are a rising need for rubber in the tire industry, increasing need from end-use industries such as building and construction, and the automotive segment, and growing requirements for road safety. In addition, end-use products fall into two main segments such as tires. The growth of the rubber-processing chemicals market is influenced by the tire industry which includes both natural and synthetic rubber. The natural applications of rubber, such as molding ability and elasticity, are important in the automotive industry. These qualities enable tires to grip roads effectively in challenging conditions and continue substantial wear and tear, resulting in rising global demand for rubber. In addition, the growing demand for different types of vehicles, particularly in emerging countries, is propelling an increase in the demand for rubber processing chemicals. Beyond their primary usage in the tire industry, these chemicals are increasingly applied in different other industries such as footwear, hoses, belts, and latex products. This wider application spectrum is contributing to the revenue growth in the global rubber processing chemicals market. Additionally, global car sales crossed 96 million units in 2019, and this trend is predicted to drive the market for rubber processing chemicals in the forecast period.

The rubber processing chemical market across the U.S. is observing an increase due to the increasing domestic need for automobiles and a wider network of automotive manufacturers. The U.S. holds a dominant position for both vehicle sales and production. The Auto Alliance stated that the U.S. automotive industry is at the forefront of innovation, with nearly a 5th of global research and development investment across the automotive sector.

The global market demand for passenger vehicles, coupled with the rising electrification of vehicles and strengthening prominence on improving vehicle performance, has driven the growth of rubber processing chemicals. Stringent safety regulations and an increasing aim for road safety have further fostered the product’s usage in the tire manufacturing market. Accelerators are important in rubber compounds by increasing vulcanization speed at lower temperatures, delivering improved effectiveness. Primary accelerators are chemicals that help in medium to fast cure, scorch delay, and effective modulus development in the vulcanization procedure. Thiazoles and Sulfenamides are commonly used as primary vulcanization accelerators, valued for their wide vulcanization plateau and high aging resistance. Secondary accelerators such as Thiurams, Guanidines, and Dithiocarbamate deliver faster curing while improving durability, tensile strength, and elasticity.

Processing chemicals have attained increased acceptance in different applications to develop the processing characteristics of rubber without altering its physical properties. These aids, when used with rubber, deliver superior properties including strength, softening, stabilization, and lubrication. In addition, they contribute to filler dispersion, viscosity deduction, and improved extrusion attributes in rubber-derived products. Additionally, the global market for rubber-processing chemicals sales is driven by economic growth in countries including India, Japan, and China, coupled with rising industrialization and an increasing demand for automobiles in the Asia Pacific region. Global market players are extending into these countries to influence the market potential propelled by the industrial, construction, and automotive segments, thereby further propelling market growth.

Changing lifestyles, a rapid rise in applications of the manufacturing sector, growing per capita income, and increasing investment in the automotive market would result in different market growth opportunities in the forecast period. New product development, technological innovations, and a rise in strategic collaborations by giant market players in the global market reinforce the rubber processing chemical market globally.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

While, market demand in the rubber processing chemicals sector is restrained by the complexity of regulatory compliance, imposing demanding requirements on producers. Adhering to evolving environmental and safety standards, including EPA and REACH regulations, demands significant investments in testing, research, and documentation, which are predicted as challenges faced by the industry. The complexities linked with regulatory compliance can elevate production costs, and limit product innovation in the rubber processing chemicals market. Concerns about the environmental impact act as a restraint, particularly concerning the emission of volatile organic compounds during manufacturing procedures, contributing to air pollution and environmental degradation. The growing regulations focused on limiting emissions and decreasing the industry’s carbon footprint necessitate costly process modifications.

Rising consumer awareness of sustainability and being environmentally friendly is propelling the need for greener substitutes. Producers are required to adjust to these environmental pressures to support regulatory guidelines and modify customer preferences, affecting market insights. Increased concerns about environmental impact, specifically emissions such as VOC during manufacturing, have led to increased scrutiny and regulatory actions. Adhering to these stringent environmental standards often demands expensive modifications to production procedures and the introduction of eco-friendly substitutes impacting the dynamics of the industry.

Whereas the specialized formulations in the rubber processing chemicals market are driving the need by delivering personalized solutions to different industries. Personalized rubber compounds are introduced to meet precise performance, environmental criteria, and durability, addressing unique challenges and establishing robust value propositions. Introducing tailored solutions advances partnerships with the end-users and develops the loyalty of customers. The potential to offer customized solutions not only develops market competitiveness but also stimulates increased demand, as industries look for high-performance rubber materials accurately fitted to their specific requirements. Also, optimizing the supply chain in the rubber processing chemicals market fosters demand by confirming a dependable supply of raw materials and timely supplies. Streamlined logistics and decreased production disruptions lead to stable product accessibility, instilling confidence in clients and fostering increased necessity for these required chemicals in the market.

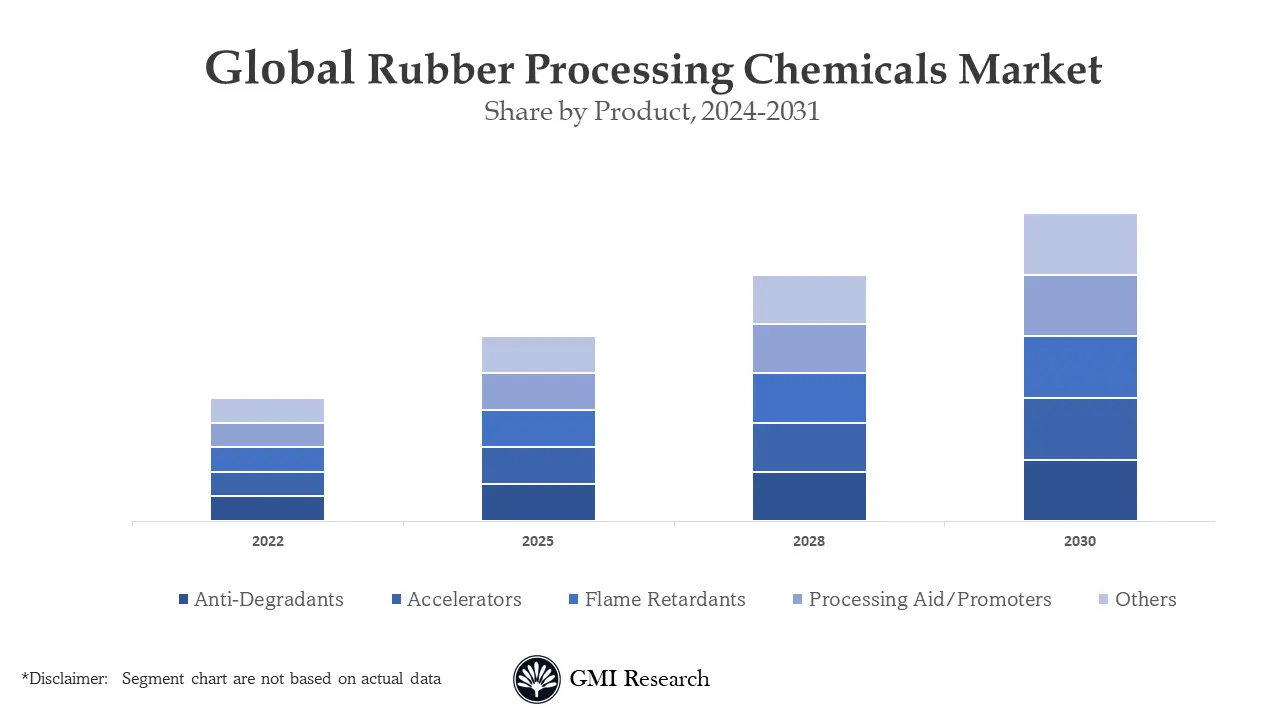

The anti-degradant segment registered the largest market size in the global rubber processing chemicals market

The anti-degradant segment held the largest market size. In the process of vulcanization, natural rubber is combined with anti-degradants to accomplish improved outcomes, including increased tensile strength, improved finishing, and increased resistance to heat. The selection of foremost anti-degradants in the vulcanization procedure differs based on the precise product demands and formulation differences. Moreover, a trend in the rubber processing chemicals market is the increasing request for environmentally friendly anti-degradants coupled with sustainability objectives. Producers are formulating solutions that offer robust protection while decreasing environmental effects. In addition, progress in nanotechnology is boosting the effectiveness of anti-degradants, delivering superior performance features in rubber goods.

Tire Manufacturing is the largest application segment in the global rubber-processing chemicals market

Different types of rubber serve distinct determinations, with tire manufacturing being the largest application segment. Automotive tires play an essential role in resisting abrasion, delivering grip, and safely transporting loads with optimal performance. A key driver for the rubber processing chemicals market is the substantial increase in the number of vehicles, specifically in the APAC region.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

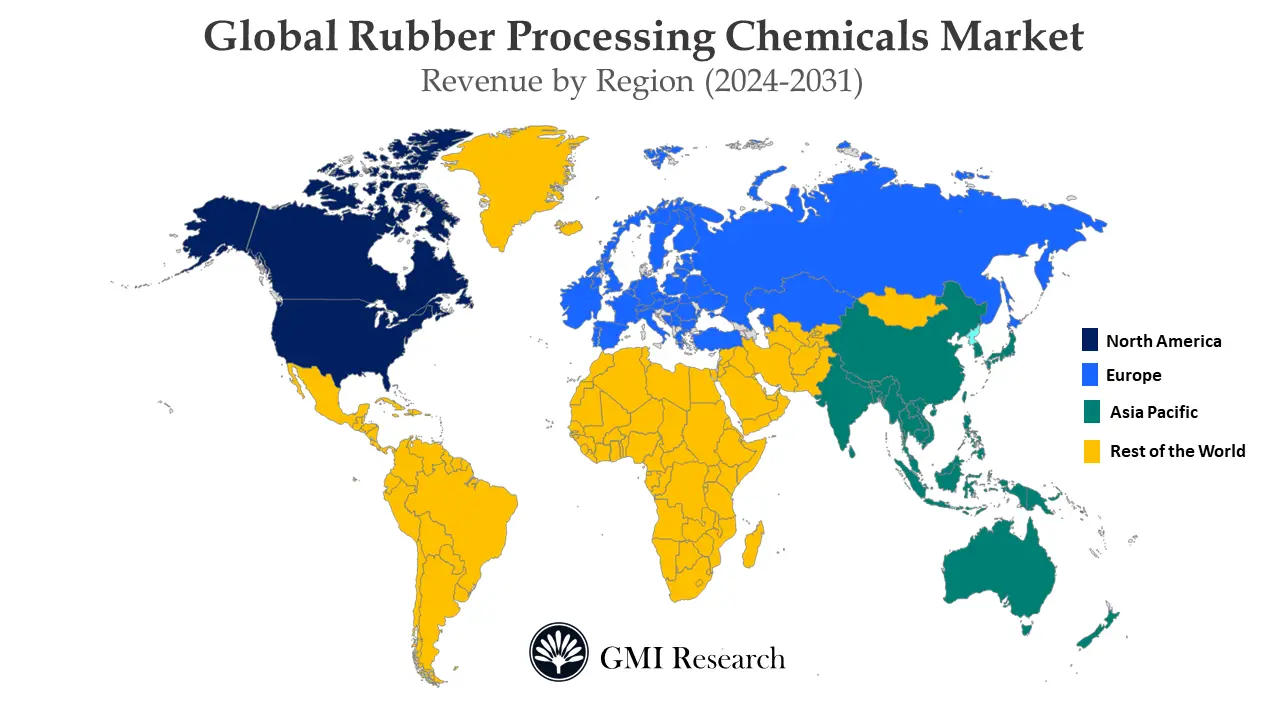

Asia Pacific region dominated the largest market size in the global market by region

Asia Pacific held the leading position as the largest market for rubber processing chemicals in terms of volume share. This prominence is attributed to the increasing demand from the automotive and construction industries. In addition, the region serves as a significant trader of natural rubber to other markets within the country. China led the global market in both production and consumption within the rubber processing chemicals market. In addition, other influential producers around the region include Malaysia, India, Indonesia, and Thailand. The easy accessibility of raw materials, specifically in nations including China, is predicted to influence production facilities and could potentially lead to the move of production facilities to the Asia Pacific region. However, producers are facing challenges due to stringent environmental regulations, compelling them to look for alternatives to prevailing products restricted by regulatory bodies including REACH.

In India, the rubber processing chemicals market is being propelled by factors such as the expansion of automobile production capacities and the growing demand for high-performance and quality automotive tires around the region. This increase is predicted to foster the need for rubber processing chemicals in the forecast period. Moreover, the growth of the automotive industry is being propelled by growing exports of natural rubber and the rising purchasing power of customers. This, in turn, supports the extension of the rubber-processing chemical market.

Top Market Players

Various notable players operating in the market include Solvay, Lanxess, Akzo Nobel N.V., BASF SE, Arkema, Eastman Chemical Company, R.T. Behn Meyer, Vanderbilt Holding Company, Inc., KUMHO PETROCHEMICAL, China Petrochemical Corporation, Paul & Company, Merchem Limited. among others.

Key Developments

-

- In 2020, Arkema acquired Fixatti to improve its potential in thermoplastic elastomer and rubber applications and reinforce its position across the market of specialty chemicals.

- In 2018, AkzoNobel successfully acquired the acquisition of Polinox to extend its accessibility and product offering in the thermoset and rubber markets.

Segments covered in the Report:

The Global Rubber-Processing Chemicals Market has been segmented on the basis of Product and Application. Based on the Product, the market is segmented into Accelerators, Anti-degradants, Processing Aid/Promoters, Flame Retardants, Others. Based on the Application the market is segmented into Tire, Non-Tire.

For detailed scope of the “Rubber-Processing Chemicals Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 5.9 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Solvay, Lanxess, Akzo Nobel N.V., BASF SE, Arkema, Eastman Chemical Company, R.T. Behn Meyer, Vanderbilt Holding Company, Inc., KUMHO PETROCHEMICAL, China Petrochemical Corporation, Paul & Company, Merchem Limited, among others; a total of 9 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Rubber-Processing Chemicals Market by Product

-

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/Promoters

- Others

Global Rubber-Processing Chemicals Market by Application

-

- Tire

- Non-Tire

Global Rubber-Processing Chemicals Market by Region

-

-

North America Rubber-Processing Chemicals Market (Option 1: As a part of the free 25% customization)

- By Product

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Rubber-Processing Chemicals Market (Option 2: As a part of the free 25% customization)

- By Product

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Rubber-Processing Chemicals Market (Option 3: As a part of the free 25% customization)

- By Product

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Rubber-Processing Chemicals Market (Option 4: As a part of the free 25% customization)

- By Product

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Rubber-Processing Chemicals Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Lanxess, Solvay

- Akzo Nobel N.V.

- BASF SE, Arkema

- Eastman Chemical Company

- R.T. Vanderbilt Holding Company, Inc.

- Behn Meyer, KUMHO PETROCHEMICAL

- Paul & Company

- China Petrochemical Corporation

- Merchem Limited

Related Reports

- Published Date: Feb-2024

- Report Format: Excel/PPT

- Report Code: GR24AB-01-005

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Rubber-Processing Chemicals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research