Press Release

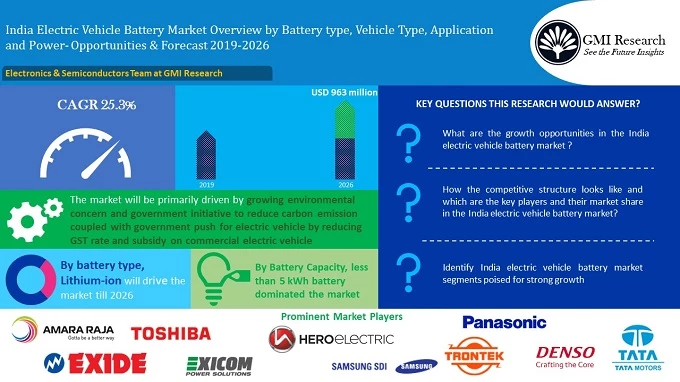

A new analysis from GMI Research expects the India Electric Vehicle Battery Market to reach USD 963 million in 2026 from USD 126 million in 2018. The market would be growing at a whopping CAGR of 25.3% through 2026.

With the growing concern of the environment, the government of India is taking the initiative to reduce carbon emission by providing incentives on the purchase of electric vehicles for a commercial purpose is creating demand for the electric vehicle battery market. In addition, an increase in the production of EV battery and standardizing battery components will further drive the market growth during the forecast period. Moreover, with an increase in raw material supply and continuous innovation in battery technology, electric vehicle battery price is decreasing every year, which is also thriving the demand for an electric vehicle battery.

Li-ion battery segment captured the largest market share in 2018, and it is projected to dominate the market share through 2026 due to continuous drop in li-ion battery prices coupled with its fast charging feature, government’s Modified Special Incentive Package Scheme(M-SIPS) scheme and tax benefits for manufacturing li-ion battery in India. Moreover, Li-ion dominance in electric four-wheelers owing to its range, safety, high performance, the larger life span will further drive the demand for Li-ion batteries. Some of the companies eying this lucrative market are Suzuki, Toshiba, Denso, Exide, Amara Raja Batteries. For instance, Suzuki Motor Corporation (SMC) is partnering with Denso and Toshiba to set-up a li-ion battery manufacturing plant in Gujrat.

Li-ion battery segment is further segmented into Lithium Nickel Manganese Cobalt Oxide, Lithium Manganese Oxide, Lithium Iron Phosphate, and others. Lithium Nickel Manganese Cobalt Oxide holds the largest market share and is projected to grow at a significant growth rate during the forecast period as it provides a longer lifecycle, high energy density, and more stability at a low cost as compared to other li-on battery types.

The electric two-wheeler vehicle segment held the largest market share in 2018 as India is the largest two-wheeler market in the world. Electric two-wheelers are getting popular due to low per Km cost and have a higher penetration rate in India. According to Fame India, 113,180 sales are electric two-wheeler sold in the Indian market in 2018.

However, the electric four-wheeler battery market will grow at the fastest CAGR during the forecast period owing to high growth of Electric four-wheelers in the coming years. The continuous drop in Lithium-Ion battery prices will make electric cars more affordable. Moreover, the government is working on a proposal to offer a subsidy to states to set up 5,000 charging station across the country will further boost the demand of Electric four-wheelers eventually driven the demand for electric vehicle battery packs.

Battery Electric Vehicle (BEV) held the largest market share, and it is expected to grow at the fastest CAGR during the forecast period owing to the increase in sales of BEV vehicles.

Greater than the 15kWh battery capacity segment is projected to grow at the fastest CAGR during the forecast period as customers are demanding electric vehicles that can cover more distance and have a higher speed.

Key Market Development:

- In Aug 2019, Amara Raja launched an electric vehicle (EV) charging stations and battery swapping stations in Tirupati, Andhra Pradesh, in collaboration with Tirupati Municipal Corporation (TMC) as part of the Smart Cities program.

- In Jun 2018, Exide Industries announced a joint Venture with Leclanché SA to manufacture Li-ion batteries and energy storage solutions in India. Leclanché will provide its expertise and intellectual property for lithium-ion cells, modules, and battery management systems, and Exide Industries will leverage its extensive sales network and brand.

India Electric Vehicle Battery market share is divided by some of the key players, including, Hero Electric Vehicles Pvt. Ltd, Exide Industries Ltd, Amara Raja Batteries Ltd, Suzuki Corporation, Exicom Power Solutions, Samsung SDI Co. ltd., Trontek Group, Panasonic Corporation, Denso Corporation, Tata Motors and among others.

The India Electric Vehicle Battery market has been segmented based on battery type, vehicle type, application, and battery capacity. Based on the battery type, the India Electric Vehicle Battery market has been segmented into Li-ion and lead-acid. Based on the vehicle type, the market has been segmented into two-wheeler, three-wheeler, and four-wheeler. Based on the application, the market has been segmented into battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles. Based on Battery Capacity, the market has been segmented into less than 5 kWh, between 5-15 kWh and greater than 15 kWh.

For more details, browse the Table of Contents: https://www.gmiresearch.com/report/india-electric-vehicle-battery-market-lithium-ion/

Early buyers will get customization upto 25% on report

Contact Sarah Nash

Tel: +353 1 536 3035

U.S Office +1 860 881 2270

Europe Office +353 1 442 8820

Email: enquiry@gmiresearch.com