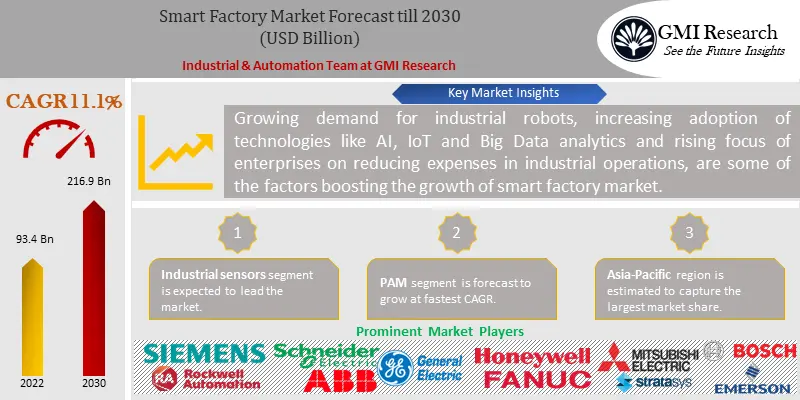

GMI Research analysis indicates that the Smart Factory Market size was estimated at USD 93.4 billion in 2022 and is slated to register a double digit CAGR of 11.1% over the period 2023-2030 and is projected to reach USD 216.9 billion in 2030 attributed to rising demand for high-quality products in various industries.

To have the edge over the competition by knowing the market dynamics and current trends of “Smart Factory Market,” request for Sample Report here

Smart Factory Market Trends and Drivers

Smart factory market is primarily driven by increasing focus of companies on reducing their production cost, surge in the demand for industrial robots, growing adoption of advanced technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) in industrial environments. Adoption of industrial robotics systems is increasing rapidly in various industries such as metals and mining, electronics and automotive in developing countries as the manufacturing wages are rising in these countries.

Growing industrial sector, increasing adoption of latest technologies, and growing per capita incomes, are some of the major factors, propelling the demand for industrial robots in developing countries. China is one of the world’s largest manufacturing countries, as per recent estimates, total sales of industrial robots in the country was estimated to be around USD 65 billion in 2021, which indicates of about 18% as compared to 2020. China’s total industrial robot’s sales was over 50% of total global sales in 2021. Approximately 1,036 units of industrial robots were sold across Brazil in 2021, indicating an increase of 4% as compared to 2017. Industrial robots are critical components of smart factories and various companies worldwide are investing huge amounts of capital on procuring advanced industrial robots, which will create lucrative growth opportunities for smart factory market.

Increasing energy prices around the world, environmental regulations imposed by governments, and growing adoption of sustainable manufacturing practices will boost the demand for products such as machine vision systems and industrial sensors in the future. Moreover, with the deployment of 5G networks, companies can use securely use cellular technologies and create high-speed manufacturing environment in smart factories and leverage advanced technologies such as AI and Augmented Reality (AR) more efficiently. However, inadequate interoperability between informational technology and operational technology, is becoming a major challenge for companies, which is restricting the growth of smart factory market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Component, Industrial sensors segment is forecast to dominate the market.

Sensors deployed in smart factories helps in improving the flow of connectivity throughout the facility. Additionally, increasing use of sensor technologies in modern manufacturing technologies which includes interconnected network of technologies, is boosting the segment’s growth.

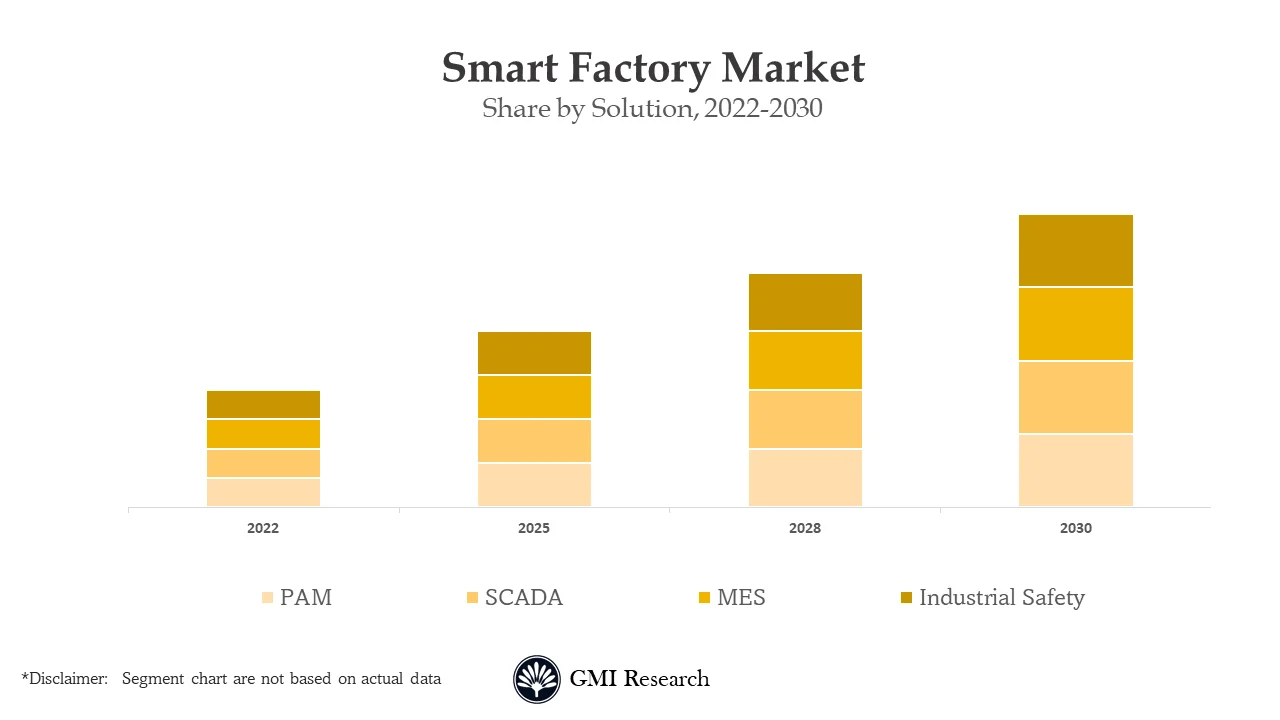

Based on Technology, PAM segment is projected to expand at the fastest rate.

Based on Technology, PAM segment is projected to expand at the fastest rate.

Manufacturing companies worldwide are increasingly adopting plant asset management systems for integrating organizational design, production, and distribution processes, which helps in collecting information on time and making decisions for optimizing competitiveness. Additionally, PAM helps in increasing returns on investments and reduces unplanned downtime.

Manufacturing Execution System (MES) segment is driven by increasing demand for centralize business data in organizations. Small and medium sized enterprises operating in discreet and process industries are increasingly adopting manufacturing execution system owing to its cost-effective features, which is boosting the segment’s growth.

Industry: Segment Analysis

Oil and gas segment is forecast to capture the largest market share, by process industry. Smart factory solutions are widely used in oil and gas industry to increase energy efficiency, improve product quality, and reduce operational cost. Drilling operations in remote offshore locations is creating safety concerns for concerns for oil and gas companies, which is pushing the demand for smart factory solutions in the oil and gas industry to monitor equipment in real time and improve collaboration between workers.

Automotive Industry of estimated to dominate the discrete industry segment. Smart factory solutions are used in automotive industry to increase vehicles production capability by identifying products in assembly process. In addition, major automotive companies like Audi, Renault and Toyota, have already upgraded a major portion of their factories to smart factories.

In case, any of your paint points areas are not covered in the current scope of this report, Request for Customization here

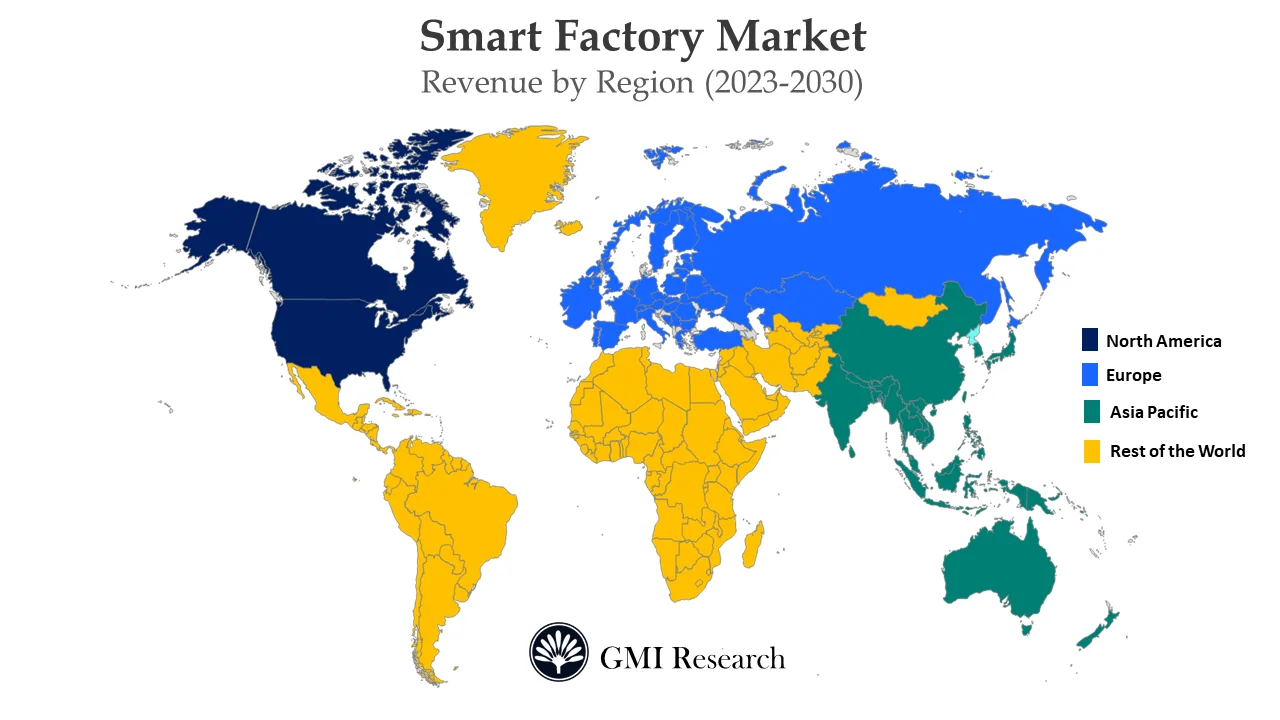

Based on Region, Asia-Pacific region is forecast to hold the largest smart factory market share.

Asia-Pacific smart factory market is driven by growing industrial internet of things market, increasing per capita incomes and rising adoption of automated technologies in different industries such as automotive and manufacturing. Moreover, Indian government launched Make in India initiative, to promote manufacturing sector in the country, which is positively impacting the market growth in Asia-Pacific. Japan is home to some of the leading smart factory companies such as Yokogawa Electric Corporation, Mitsubishi Electric Corporation and FANUC.

Smart Factory Market Players

Smart Factory Market Players

Various notable players in the smart factory market are Siemens AG, Rockwell Automation, Inc. Schneider Electric SE, ABB Group, General Electric Company, Honeywell International Inc., FANUC, Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Robert Bosch GmbH, and Stratasys, Ltd., among others.

Key Developments:

-

- In October 2022, ABB Robotics introduced IRB 1010, to cater increasing demand for smart devices. This is smallest robot ever manufactured by company, designed to help companies to manufacture wide range of devices like smartwatches, sensors and trackers.

- In March 2021, GE Digital, a software industry corporation based out of United States launched CIMPLICITY and Tracker software. CIMPLICITY offers client-server visualization to monitor and control operations more efficiently.

- In March 2021, Stratasys, a leading additive manufacturing company headquartered in Israel introduced a multi-material dental 3D printer. This printer enables technicians to load mixed trays of dental parts.

- In March 2021, ABB announced that it will collaborate with ETH Zurich, which is a Switzerland based University, for advancing research in the field of robotics.

- In March 2021, Stratasys entered into a partnership with Xometry, a marketplace company based out of United States to provide new high-performance nylon material options to of Xonometry’s customers.

- In June 2018, PTC., announced that it has partnered with Rockwell automation to leverage each other’s resources and technologies. Under this partnership Rockwell will make an equity investment worth USD 1 billion in PTC.

Segments Covered in the Report:

Global Smart Factory market has been segmented based on the component, solution, industry, and region. Based on components, the market is segmented into Industrial Sensors, Industrial Robots, Industrial 3D Printing and Machine Vision. Based on solution, the market is segmented into PAM, SCADA, MES and Industrial Safety. Based on Industry, the market is segmented into process industry and discrete industry.

For detailed scope of the “Smart Factory Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 93.4 billion |

| Market Base year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Component, By Industry, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Siemens AG, Rockwell Automation, Inc. Schneider Electric SE, ABB Group, General Electric Company, Honeywell International Inc., FANUC, Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Robert Bosch GmbH, Stratasys, Ltd., among others |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Smart Factory Market by Component

-

- Industrial Sensors

- Industrial Robots

- Industrial 3D Printing

- Machine Vision

Global Smart Factory Market by Solution

-

- PAM

- SCADA

- MES

- Industrial Safety

Global Smart Factory Market by Industry

-

- Process Industry

- Discrete Industry

Global Smart Factory Market by Region

-

-

North America Smart Factory Market (Option 1: As a part of the free 25% customization)

-

-

-

- By Component

- By Solution

- By Industry

- US Market All-Up

- Canada Market All-Up

-

-

-

Europe Smart Factory Market (Option 2: As a part of the free 25% customization)

- By Component

- By Solution

- By Industry

- Spain Market All-Up

- Netherlands Market All-Up

- Germany Market All-Up

- UK Market All-Up

- France Market All-Up

- Rest of Europe Market All-Up

-

-

-

Asia-Pacific Smart Factory Market (Option 3: As a part of the free 25% customization)

- By Component

- By Solution

- By Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Malaysia Market All-Up

- Australia Market All-Up

- Rest of APAC Market All-Up

-

-

-

ROW Smart Factory Market (Option 4: As a part of the free 25% customization)

- By Component

- By Solution

- By Industry

- Brazil Market All-Up

- Argentina Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Leading Market Players (Option 5: As a part of the free 25% customization – Profiles of 5 Additional Companies of your Choice)

-

- Siemens AG

- Rockwell Automation, Inc

- Schneider Electric SE

- ABB Group

- General Electric Company

- Honeywell International Inc.

- FANUC

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Robert Bosch GmbH

- Stratasys, Ltd.

Frequently Asked Question About This Report

Smart Factory Market [UP283A-00-0220]

Smart factory market size reached USD 93.4 billion in 2022.

Smart factory market is projected to expand at a CAGR of 11.1% over the forecast period 2023-2030.

Forecast period for the smart factory market is 2023-2030.

Asia-Pacific region is projected to dominate the market.

- Published Date: Mar-2023

- Report Format: Excel/PPT

- Report Code: UP283A-00-0220

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Smart Factory Market Share, Size & Trends Analysis – Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research