Military Sensor Market By Type, By Platform, By Application and By Region – Global Opportunities and Forecast, 2022-2029

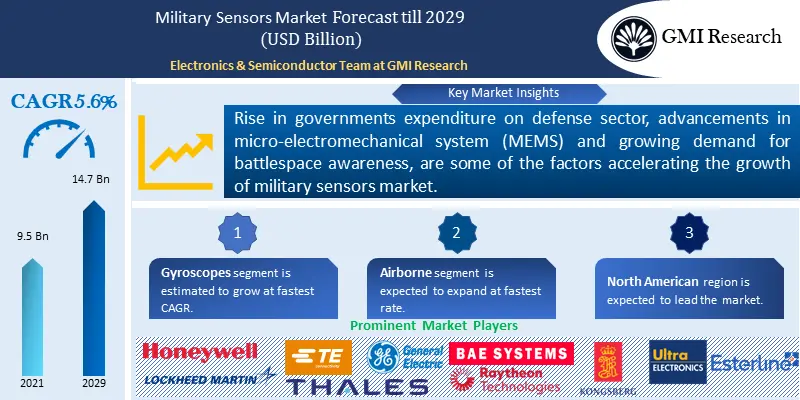

Military Sensors Market size reached USD 9.5 billion in 2021 and is estimated to reach USD 14.7 billion in 2029 and the market is estimated to grow at a CAGR of 5.6% from 2022-2029 attributed to increasing terrorism activities worldwide and advancements in MEMS technology.

Introduction of Military Sensors Market Report

Advance military & defence environment requires demonstrated, reliable, and versatile technologies. Sensors are the important part of the technologies as it provides complex controls, monitoring, and executions to the entire military & defence system. Military & defence system comprises of aircrafts, ships, marine systems, satellites, rockets, and military vehicles. Military security relays on the smart sensor technology for combat operation, surveillance, and intelligence. These sensors are widely used in flight controls, weaponry controls, and for communication as well as in security systems, crime detection system, explosive detection system, and battlefield surveillance systems. There are many types of sensors used in military such as Infrared cameras, radars, speed sensors, and magnetic sensor for various application such as intelligence & reconnaissance, navigation, monitoring, combat operation, electronic warfare and others.

To have the edge over the competition by knowing the market dynamics and current trends of “Military Sensors Market,” request for Sample Report here

Main Military Sensors Market Drivers

Primary factors driving military sensors market are growing military modernization drives around the world, advancement in micro-electromechanical system (MEMS), rising adoption of UAVs in modern warfare, and increasing requirement for battlespace awareness among defence force. Battlespace situational awareness nowadays is becoming more critical tracking movements of enemies and communicating important information to military personnels. Militaries worldwide are increasingly deploying sensor systems like electro optics/infrared sensors to strengthen their defense equipment capabilities. These systems enable militaries to continuously monitor the battlefield in full-motion videos in real-time and helps in detecting and tracking enemies. Rise in the usage of electro optics/ infrared sensors in surveillance applications, is positively impacting the military sensors market growth.

Demand for nuclear-capable ballistic missiles and hypersonic are increasing rapidly due to increasing geopolitical tensions between countries, growing focus of governments on improving deterrence capabilities of militaries and strengthening national security. As of January 2023, U.S army is developing long-range hypersonic weapon (LRHW), which will be armed with hypersonic missiles that can travel more than 3,800 miles per hour and missile component of LRHW is currently being develop by Lockheed Martin and Northrop Grumman. Indian military in December 2022, tested Agni-V, which is a nuclear capable ballistic missile in the Indian ocean region. This missile can hit targets, which are beyond the range of 5,000 km. Increasing deployment of such types of missiles and systems, will create lucrative growth opportunities for military sensors manufacturing companies to expand their business.

Increasing adoption of MEMS based devices leads to the development of micro gyros for navigation and positioning, micromirrors for steering laser beams and microbolometers for infrared imaging. MEMS fabrication techniques empower framework engineers to miniaturize mechanical components and coordinated them with microelectronics, subsequently empowering modern capabilities and upgrading execution at the same time. Moreover, increasing demand for new generation missile and air defence system and rising integration of anti-jamming features with navigation systems are further propelling the growth of military sensors market. Growing need to analyse mental health of soldiers, incorporation of advanced technologies such as Internet of Things (IoT) and Augmented Reality (AR) and increasing demand for lightweight and small sized sensors are supplementing the growth of military wearable sensors market. However, increasing cybersecurity concerns and lack of accuracy and operation complexities associated with MEMS navigation sensors are restricting the growth of military sensors market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

According to Military Sensors Market Report, Gyroscope segment is expected to expand at fastest rate.

Surge in the demand for inertial navigation systems and growing adoption of drones by militaries for reconnaissance, surveillance and search and rescue operations, is propelling the segment’s growth. For instance, In June 2019, U.S Missile Defense Agency (MDA) awarded 3-year contract worth USD 4.4 million to Vector Atomic to develop micro-flatpack accelerometer gyroscope sensor, under MDA’s hypersonic defense component technology program.

As per Military Sensors Market Analysis, Airborne segment is forecast to grow at fastest CAGR.

Growing adoption of drones for surveillance, increasing investments by countries around the world for procuring or developing advanced fighter aircraft fleets which comes with modern sensor technologies, changing geopolitical landscape, emerging threats of terrorism and on-going military modernization drives, are some of the factors accelerating the adoption of airborne sensors in the defense sector.

Based on Application, Electronic warfare segment is projected to fastest rate.

Advancements in sensors and equipment in military equipment coupled with growing need to improve ground surveillance and rising usage of unmanned ariel vehicles systems, are accelerating the segment’s growth.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

Based on Region, North American region is estimated to capture the largest market share.

North American military sensors market is propelled by growing demand for lightweight sensors, rise in research and development activities and increasing investments by defense companies for developing warfare sensors. In addition, North American region is home to some of the leading military sensors manufacturing companies like Honeywell International Inc., Lockheed Martin Corporation and General Electric Company. Asia-Pacific military sensors market is driven by increasing procurement of defence systems by countries such as China and India, ongoing defense programs in Japan and Australia and growing demand for threat detection systems.

Top Market Players

Major key players in the military sensors market are Honeywell International Inc., Lockheed Martin Corporation, TE Connectivity Ltd., Kongsberg Gruppen, Raytheon Company, Thales Group, Ultra Electronics Holdings, General Electric Company, Esterline Technologies Corporation, and BAE Systems PLC, among others.

Key Developments:

-

- In July 2021, QinetiQ Inc, a leading denfese company based out of United Kingdom announced that it was awarded contract worth USD 24 million by U.S Army for developing 3 SPECTRE next generation full spectrum hyperspectral prototype sensors.

- In April 2019, BAE systems, a major Aerospace company based out of United Kingdom introduced 360 multifunction vehicle protection (MVP) sensor, which is designed to provide military armoured vehicles and crews 360* visibility, threat, and situational awareness.

Segments Covered in the Market

Global Military Sensors Market has been segmented based on the type, platform, application, and region. Based on type, the market is segmented into imaging sensors, seismic sensors, acoustic sensors, magnetic sensors, pressure sensors, temperature sensors, torque sensors, speed- sensor, position or displacement sensors, accelerometers, gyroscopes, level sensors, flow sensors, force sensors, AOA sensors, altimeter sensors, GPS sensor and proximity sensors. Based on platform, the market is segmented into Airborne, Land, Naval, Space, and Munitions. Based on Application, the market is segmented into intelligence, surveillance & reconnaissance (ISR), communication & navigation, combat system, electronic warfare, command and control, weapon and fire control system wearable, cybersecurity, simulation and training and engine and operations system.

For detailed scope of the “Military Sensors Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 9.5 billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Value (USD Billion) |

| Market Segment | By Type, By Platform, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Honeywell International Inc., Lockheed Martin Corporation, TE Connectivity Ltd., Kongsberg Gruppen, Raytheon Company, Thales Group, Ultra Electronics Holdings, General Electric Company, Esterline Technologies Corporation, BAE Systems PLC; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Military Sensors Market by Type

-

- Imaging sensors

- Seismic sensors

- Acoustic sensors

- Magnetic sensors

- Pressure sensors

- Temperature sensors

- Torque sensors

- Speed- sensor

- Position Or displacement sensors

- Accelerometers

- Gyroscopes

- Level sensors

- Flow sensors

- Force sensors

- AOA sensors

- Altimeter sensors

- GPS sensor

- Proximity sensors

Global Military Sensors Market by Platform

-

- Airborne

- Land

- Naval

- Satellite

- Munitions

Global Military Sensors Market by Application

-

- Intelligence, surveillance & reconnaissance (ISR)

- Communication & navigation

- Combat system

- Electronic warfare

- Command and control

- Weapon and fire control system

- Wearable

- Cybersecurity

- Simulation and training

- Engine and operations system

Global Military Sensors Market by Region

-

- North America Military Sensors Market (Option 1: As a part of the free 25% customization)

- By Type

- By Platform

- By Application

- United States of America (US) Market All-Up

- Canada Market All-Up

- Europe Military Sensors Market (Option 2: As a part of the free 25% customization)

- By Type

- By Platform

- By Application

- United Kingdom (UK) Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Military Sensors Market (Option 3: As a part of the free 25% customization)

- By Type

- By Platform

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- ROW Military Sensors Market (Option 4: As a part of the free 25% customization)

- By Type

- By Platform

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Military Sensors Market (Option 1: As a part of the free 25% customization)

Military Sensors Market Leading Players (Option 5: As a part of the free 25% customization – Profiles of 5 Additional Companies of your Choice)

-

- Honeywell International Inc.

- Lockheed Martin Corporation

- TE Connectivity Ltd.

- Kongsberg Gruppen

- Raytheon Company

- Thales Group

- Ultra Electronics Holdings

- General Electric Company

- Esterline Technologies Corporation

- BAE Systems PLC

Frequently Asked Question About This Report

Military Sensors Market [UP699A-00-0620]

Military sensors market size was estimated at 9.5 billion in 2021.

Forecast period of the military sensors market is 2022-2029

Military sensors market is forecast to expand at a CAGR of 5.6% over the period 2022-2029.

North American region is projected to dominate the market.

- Published Date: Oct-2021

- Report Format: Excel/PPT

- Report Code: UP699A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Military Sensor Market By Type, By Platform, By Application and By Region – Global Opportunities and Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research