Biopesticides Market by Type, by Mode of Application, by End-Use and by Geography – Forecast 2022-2029

Biopesticides Market by Type (Bioinsecticide, Biofungicide, Bioherbicides & Bionematicide and Others), by Mode of Application (Dry Formulation & Wet Formulation), by Source (Microbials, Biochemicals and Beneficial Insects), by End-Use (Fruits & Vegetables, Cereals & Row Crops, Seed Treatment, Non-Crops and Foliar Spray) and by Region

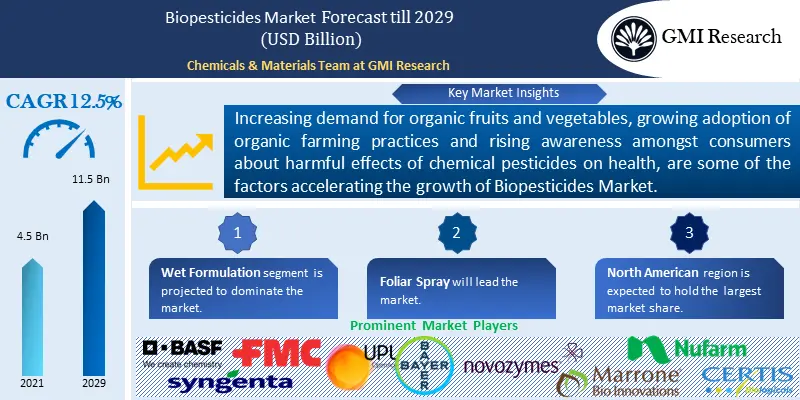

GMI Research analysis indicates that the Biopesticides Market size reached USD 4.5 billion in 2021 and is slated to register a double digit CAGR of 12.5% over the period 2022-2029 and is projected to reach USD 11.5 billion in 2029 attributed to growing demand for organic fruits and vegetables and advancements in farming practices.

To have an edge over the competition by knowing the market dynamics and current trends of “Biopesticides Market”, request for Sample Report here

Important Biopesticides Market Drivers

Biopesticides Market is majorly driven by increasing use of biopesticides in organic farming, strict regulatory framework and rising awareness amongst consumers about harmful effects of chemical pesticides on health. Consumers in many countries are becoming more health conscious and are preferring to eat organic food item over conventional products as conventional food item contains chemical preservatives which can negatively impact their health. This change in consumers preference, is encouraging farmers to grow crops through organic farming techniques, which is expected to increase the demand for biopesticides in the coming few years. Moreover, strict regulations imposed by governments to reduce pest residue in food products, is expected to create more growth opportunities for the Biopesticides Market. For instance, federal government of United States introduced Food Quality Protection Act (FQPA) in 1996, under which Environment Protection Agency (EPA) ensures that adequate amounts of pesticides are used in food products. Over the years, EPA has improved the safety standards in FQPA and has lowered permissible pesticide residue levels in children’s food products including apples, potatoes, and grapes. Such regulations will increase the demand biopesticides in upcoming years.

Major companies across different regions are making advancements in microbial and RNA Interface technologies. Extensive research by market players indicates that these technologies can help in reducing disease and pest resistance and increase yield of farmers. These advancements in microbial research, will create lucrative opportunities for companies. In addition, growing demand for environment friendly pest control methods and incorporation of advanced technologies such as GPS and drones by growers, are propelling the growth of Biopesticide Market. However, biological products have limited shelf and are prone to contamination by bacteria, fugus and viruses, which are restricting the market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

By Mode of Application, Wet Formulation segment is expected to capture the largest market share attributed to rapid growth in foliar mode of application.

Manufacturers are preferring to use wet formulations as these are more convenient and easier to apply. Wet formulations are considered to be more effective as compared to dry formulations as the microbial active ingredients are more viable in these formulations.

Foliar Spray is expected to hold a major share in the Biopesticides Market owing to increasing demand for horticultural crops.

Foliar spray is considered is considered to most effective for controlling pest in short term as foliar sprays can rapidly correct pest attacks when they are visible on the plant. In addition, horticultural crops such as fruits and vegetables are widely consumed by consumers around the world. Application of foliar sprays are expected to increase in these crops, which is one of the major factors accelerating the segment’s growth.

Microbial segment is expected to lead the market.

Microbial biopesticides are gaining traction in the market as it helps in controlling pest without affecting the environment, possess longer lifecycle as compared to beneficial insects and are cost effective. Additionally, residues of microbial biopesticides are non-toxic in nature and are safe to use in plantation stages, which is one of the major reasons increasing its adoption in market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

North American region is forecast to capture the largest market share.

North America Biopesticides Market is driven by increasing adoption of green agricultural practices, growing consumption of biopesticides in greenhouses across United States and favourable government regulations. Biopesticides Market in India is driven by increasing adoption of organic cultivation in the country, growing awareness about food safety amongst consumers and rising demand for environment friendly pesticides. As per Agriculture Processed and Processed Food Products and Export Development Authority (APEDA), area under organic certification process in India is estimated to be 9119865.91 ha during 2021-22.

Top Market Players:

Some of the notable players operating in the Biopesticides Market includes BASF SE, Syngenta AG, FMC Corporation, UPL Limited, Bayer AG, Novozymes, Marrone Bio Innovations, Nufarm, Certis Biologicals and Bionema.

Key Developments:

-

- In June 2022, FMC Corporation, a major agriculture sciences company launches a new brand ‘Biologicals by FMC’ for its plant health business. This brand launch represents company’s efforts to expand its presence globally in the Biopesticides Market.

- In January 2022, Syngenta Crop Protection AG, a leading agriculture company announced that it has acquired two next generation bioinsecticides, NemaTrident and UniSpore, from Bionema Limited. This acquisition will help company to combat the increasing resistance and wide range of insects and pests across horticulture and ornamentals, turf amenity, and forestry.

- In 2022, Bayer AG’s Crop Science Division announced that its Minuet fungicide was approved as soil-applied biologicals for potatoes and other vegetable crops.

- In June 2021, Marrone Bio Innovations partnered with ATP nutrition, a major plant nutrient company based out of Canada, to distribute Stargus bio fungicide on Canadian crops including dry beans, peas, soybeans and canola.

- In May 2021, FBSciences, one of the leading plant healthcare technology developers, announced plans to expand its biopesticide category. Company is focussing to increase the sales of its recently approved Nematicide FBS 500.

- In March 2021, Bayer AG unveiled the launch of its Vynyty citrus, which is a biological and pheromone-based crop protection product, specifically designed to control pest on citrus farms.

- In March 2021, BASF introduced biofungicide “Howler”, which it plans to market across Europe and some major countries in Middle East and Africa. Howler is effective against Fusarium, Rhizoctonia and Botrytis. This product launch enabled the company to expand its BioSolutions portfolio, provided by Agriculture solutions division.

- In March 2021, BASF collaborated with AgBiome to launch introduce new biological fungicide across Europe, Middle East, and Africa.

- In 2020, Simbiose Agrotecnologia Biológica, entered in partnership with Embrapa to launch its first biopesticides for controlling the soybean looper in Brazil.

Segmentation Covered in the Report

Global Biopesticides Market is segmented on the basis of Type, Mode of Application, by Source, by End-Use and by Region. Based on Type, the market is segmented into Bioinsecticide, Biofungicide, Bioherbicides & Bionematicide and Others. On the basis of Mode of Application, the market is segmented into Dry Formulation & Wet Formulation. Based on Source, the market is segmented into Microbials, Biochemicals and Beneficial Insects. On the basis of End-Use, the market is segmented into Fruits & Vegetables, Cereals & Row Crops, Seed Treatment, Non-Crops and Foliar Spray.

For detailed scope of the “Biopesticides Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 4.5 billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Mode of Application, By Source, By End-Use, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | BASF SE, Syngenta AG, FMC Corporation, UPL Limited, Bayer AG, Novozymes, Marrone Bio Innovations, Nufarm, Certis Biologicals and Bionema., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Biopesticides Market by Type

-

- Bioinsecticide

- Biofungicide

- Bioherbicide & Bionematicide

- Others

Global Biopesticides Market by Mode of Application

-

- Dry Formulation

- Wet Formulation

Global Biopesticides Market by Source

-

- Microbials

- Biochemicals

- Beneficial Insects

Global Biopesticides Market by End-Use

-

- Fruits & Vegetables

- Cereals & Row Crops

- Seed Treatment

- Non-Crops

- Foliar Spray

Global Biopesticides Market by Region

-

-

North America Biopesticides Market (Option 1: As a part of the free 25% customization)

- By Type

- By Mode of Application

- By Source

- By End Use

- US Market All-Up

- Canada Market All-Up

-

-

-

Europe Biopesticides Market (Option 2: As a part of the free 25% customization)

- By Type

- By Mode of Application

- By Source

- By End Use

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Biopesticides Market (Option 3: As a part of the free 25% customization)

- By Type

- By Mode of Application

- By Source

- By End Use

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Biopesticides Market (Option 4: As a part of the free 25% customization)

- By Type

- By Mode of Application

- By Source

- By End Use

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Countries with high growth opportunity for Biopesticides Revenue Forecast, 2029

-

- USA

- Canada

- Germany

- France

- U.K.

- China

- India

- Japan

Global Biopesticides Market Competitive Landscape & Company Profiles

-

- Major Players and their Market Share Analysis

- New product launches

- Mergers and acquisitions

- Collaborations, partnerships, agreements and joint ventures

Frequently Asked Question About This Report

Biopesticides Market [CF03A-00-0717]

Biopesticide Market size touched USD 4.5 billion in 2021.

Biopesticides Market is expected to grow at a CAGR of 12.5% over the forecast period (2022-2029).

North American region is forecast to dominate the market.

Foliar Spray is expected to hold the largest market share.

- Published Date: Nov-2021

- Report Format: Excel/PPT

- Report Code: CF03A-00-0717

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Biopesticides Market by Type, by Mode of Application, by End-Use and by Geography – Forecast 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research