Corrugated Boxes Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

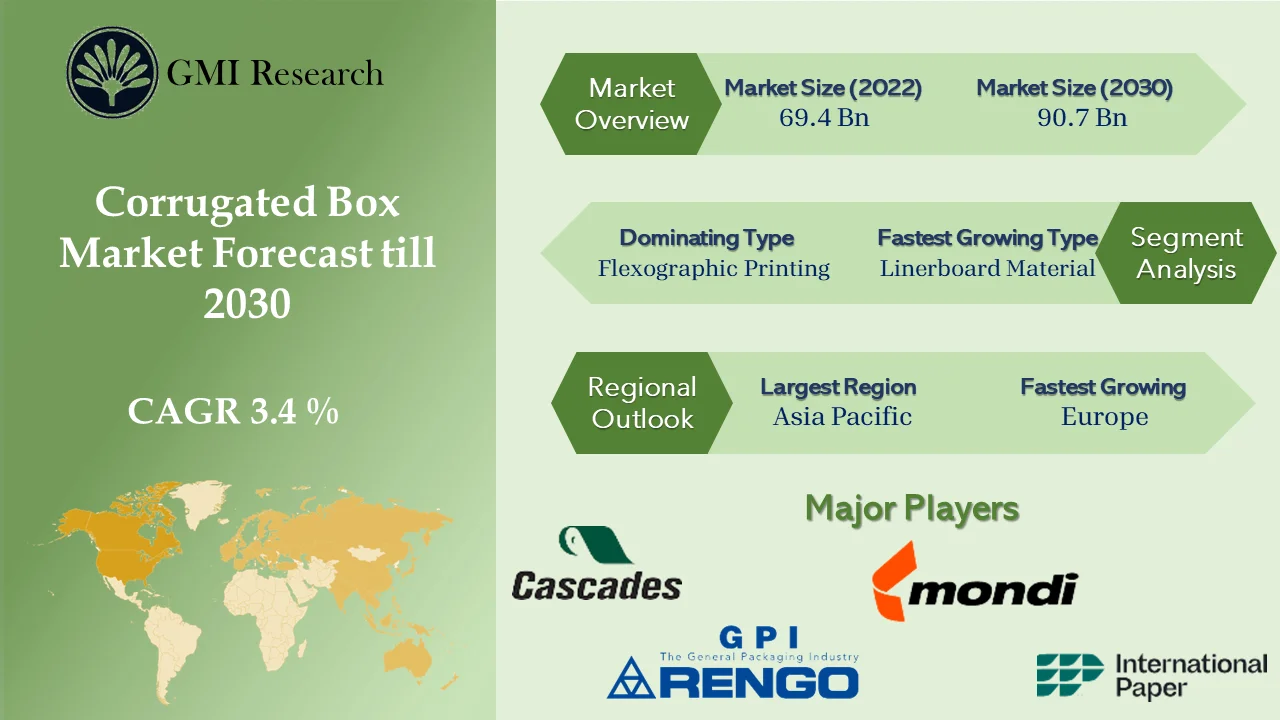

Corrugated Box Market size reached USD 69.4 billion in 2022 and is estimated to reach USD 90.7 billion in 2030 and the market is estimated to grow at a CAGR of 3.4% from 2023-2030.

Corrugated Boxes Market Overview

Corrugated boxes are the paper-based boxes that are used for the packaging of industrial and consumer goods. They play a significant role in the packaging and distribution chain management. The corrugated boxes are flexible, durable, lightweight, easy to customize, and are highly cost-effective. They are used for the packaging of electronic items, soaps & cosmetics, crockery, automobile components, pharmaceuticals, and other types of products. These boxes are made up of 70-100% recycled material and are environment-friendly since they are manufactured without the use of any harmful chemicals.

To have an edge over the competition by knowing the market dynamics and current trends of “Corrugated Boxes Market,” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Corrugated Boxes Market,” request for Sample Report here

Key Corrugated Boxes Market Drivers

The global corrugated boxes market size and growth is observing a rise due to increasing demand for these boxes from different industries such as electronics, the e-commerce sector, food and beverages, and others, a rise in per capita income, and an increase in the trend of online shopping. Around 45% of consumers across Central and Eastern Europe have shifted to online shopping owing to the occurrence of the COVID pandemic, which led to a rise in new online buyers are probably to continue in this trend. Moreover, approximately 80% of the population in this region values the implementation of a sustainable approach and eco-friendly materials in corrugated boxes, appreciating a strong preference for environmentally conscious packaging practices. A significant 77% of customers opt for sustainable corrugated packaging solutions in their online shopping, and nearly 57% express a willingness to pay a premium for customizable and sustainable choices. The online business has witnessed an increase after COVID-19, with an increasing emphasis on sustainability. Growing customer concern and vocal support for sustainable products leading the market for such packaging solutions.

The market is driven by the growth of the food and beverage industry. The growing requirement for corrugated boxes for protection, product promotion, transportation, and storage, is a key driver propelling the global market growth. The different benefits of corrugated solutions, including lightweight nature, effective protection, cost-effectiveness, and strength throughout the shipment, foster the demand for corrugated boxes. In addition, ongoing innovations in packaging design and printing technology allow the production of both visually fascinating and functional corrugated boxes, serving as a significant driver for market growth. Furthermore, the rising customer awareness concerning environmental concerns connected to non-biodegradable and plastic-derived packaging materials is hastening the adoption of recyclable corrugated boxes in the market. The rise in activities of research and development to enhance the eco-friendly properties, dimensional stability, and chemical resistance of corrugated boxes is presenting a positive market outlook in the forecast period.

The rise in online shopping has increased the demand for packaging materials and corrugated boxes have emerged top choice for transporting and delivering goods to clients in the e-commerce sector. Their prevalence rises due to their versatility, cost-effectiveness, and durability. The growing need for personalized packaging solutions further fuels the growth of the global market. Companies in the E-commerce industry recognize the importance of creating and branding a distinctive unboxing experience, made possible by the personalization capabilities of corrugated boxes that are easily enhanced with company graphics, logos, designs, and others, these boxes allow businesses to increase their brand identity and make a durable impression on customers. Additionally, the e-commerce industry has increased the concern on product protection throughout the transportation of corrugated boxes to propose structural integrity, and excellent cushioning checking the goods reach securely at their destination.

The rising awareness and prominence of environmental sustainability have resulted in an increased demand for eco-friendly packaging choices, propelling the extensive adoption of corrugated boxes. Moreover, these boxes are produced from renewable and recyclable materials, principally sourced from trees in the form of paperboard, further positioning with eco-conscious exercises. With an increasing awareness of the ecological influence, customers and businesses are actively looking for packaging solutions that decrease their environmental mark. Corrugated boxes are easily recyclable and result in waste reduction, coupled with the promotion of a more sustainable economy as they can be recycled after use. Also, the corrugated boxes are lightweight by nature leading to energy effectiveness through shipping, are fuel-efficient, and create fewer releases of carbon throughout shipping fostering the global corrugated boxes industry.

The increasing demand for customization and branding in different industries has driven the extensive acceptance of corrugated boxes. Businesses in segments including retail, cosmetics, food, and beverages, and e-commerce are admitting it as an effective marketing tool. Moreover, corrugated boxes offer easy customization with branding elements, graphics, and logos empowering companies to establish a unique visual identity and foster brand recognition. The flexibility to tailor packaging to precise products and brand aesthetics has positioned corrugated boxes as a favored choice. This capability enables businesses to deliver a distinctive unboxing experience, connecting with customers and reinforcing their brand image effectively.

Meanwhile, flexible plastic packaging is predicted to be a superior choice for producers and retailers, offering the benefit of decreased packaging weight. This reduction shifts into lower transporting and warehousing costs also requiring less storage space. Consumers benefit from flexible plastic packaging, including single-serve portions and easy-to-open choices. Furthermore, foot-in-retort pouches often propose a superior taste compared to traditional tin cans. Also, flexible packaging incurs a 40% lower overall packaging cost, leading to a significant 50% reduction in landfill waste and a 62% decrease in greenhouse gas emissions compared to rigid packaging. Thereby, factors including sustainability, convenience, health benefits, and cost-effectiveness are leading product packaging producers and packaging converters to take steps towards standard strict materials to flexible materials.

Whereas, Smurfit Kappa, a leading producer of corrugated packaging solutions, has taken significant steps in digitizing the corrugated industry. The company has introduced a variety of paper designed to be compatible with both digital and flexography printers, presenting a commitment to advancing technology in the packaging sector. The introduction of multi-purpose paper by Smurfit Kappa focused on propelling unified collaboration between printers and packaging materials. This innovation expands the scope of optimal digital printing, predicted to increase the capabilities and potential of digital printing technologies in the corrugated boxes industry. Customized graphic design has proven to provide benefits such as increased sales and improved flexibility within the industry. Smurfit Kappa’s aim on develop new and effective solutions and enhance prevailing sustainable technologies in driving the digitalization of the paper-derived packaging sector, presenting substantial potential for market growth.

By type, slotted boxes dominated the largest market size in the global corrugated boxes market

The slotted boxes segment registered the market growth because they are crafted from a single piece of corrugated board, these boxes are commonly assembled using taping, gluing, and stitching methods. The initials blank or tray is scored and designed for folding, enabling the boxes to be transported flat to the end-user for efficient storage and transportation. To introduce a box involves squaring it up, inserting the product, and sealing the flaps. The flute orientation, parallel to the depth, confirms optimal loading strength. The slotted box stands out for its effective design, decreasing waste in the manufacturing procedure. This type of corrugated box is well-suited for transporting different items such as mugs, cups, books, and many more.

The linerboard segment exhibited the largest market size in the global corrugated boxes by material

The market is classified by material, including linerboard, medium, and many more. Linerboard, particularly Kraft liner, dominates both in terms of value and volume. Kraft liner, composed of at least 80% virgin kraft pulp fibers, is prized for its robust strength and resistance to moisture. It finds extensive usage as an outer, intermediate ply in the construction of corrugated boxes. Kraft linerboard is dominantly employed in introducing premium color-printed corrugated boxes for industries including home & personal care, food & beverages, among others. In contrast, recycled linerboard, often referred to as test liner, comprises less than 80% virgin kraft pulp fiber, serving as an alternative material in different packaging applications. Recycled linerboard is also used for both outer and intermediate plies in corrugated board, but it results in lower strength compared to kraft liner owing to higher recycled fiber content. While it is less robust, recycled fiber content. While it is less robust, recycled linerboard proves cost-effective, making it a budget-friendly substitute for kraft liner. Recycled materials for its production often include double-line kraft clippings and old corrugated containers.

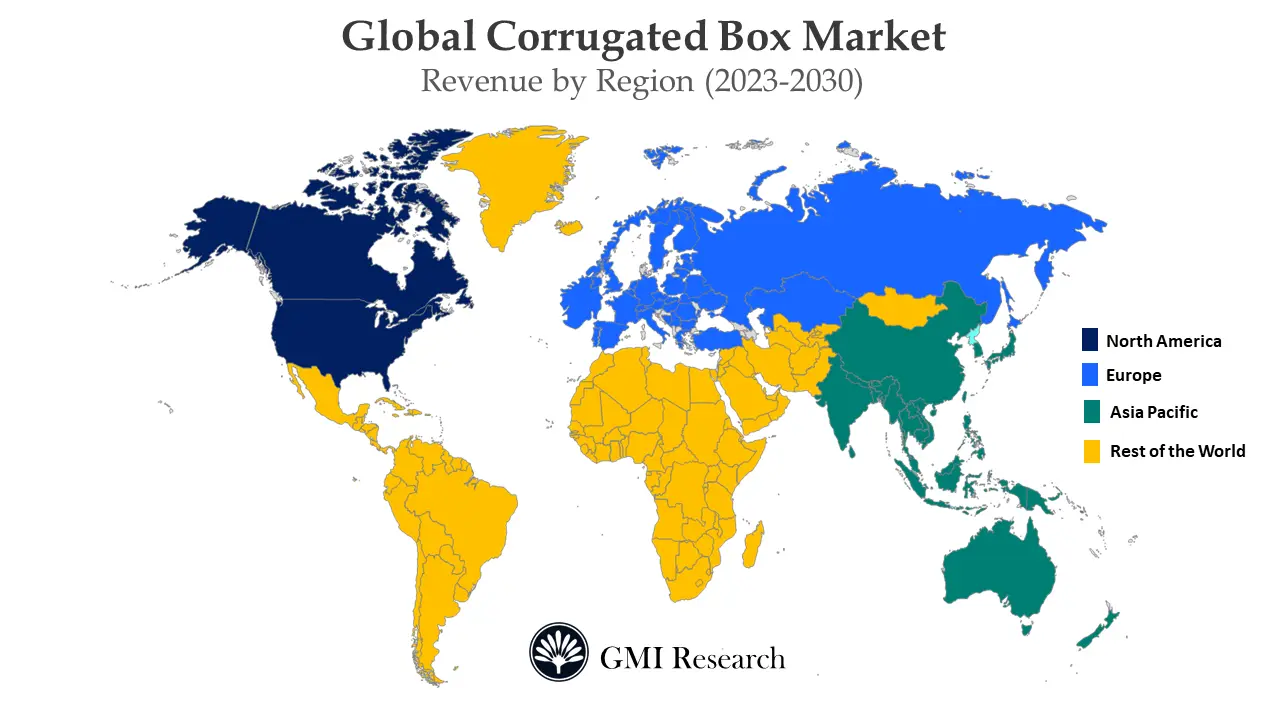

By Region, APAC dominated the largest market revenue share in the global corrugated boxes market

The Asia Pacific region is predicted to be the largest market in terms of value, with estimations of the highest CAGR in the forecast period. The growth in APAC is attributed to the efficient demand and supply dynamics within industries such as electronics, personal care, and food & beverage, specifically in countries such as Japan, India, and China. The growth of e-commerce is a key driver for the market in the APAC region. Moreover, APAC is an industrial hub with a high market size, coupled with growing demand for customer goods and continuous innovation in electronics and other sectors, which is anticipated to propel the regional corrugated box market size growth in the forecast period.

Top Market Players

Various notable players operating in the market include Mondi PLC, International Paper Company, Westrock Company, Smurfit Kappa Group, Rengo Co. Ltd., Cascades Inc., DS Smith PLC, Packaging Corporation of America, Georgia-Pacific LLC, Kapstone Paper and Packaging Corporation, among others.

Key Developments:

-

- In 2023, WestRock Company acquired Greenfield Packaging to address the growing demand for corrugated packaging.

- In 2021, Rengo Co., Ltd joined hands with Vina Kraft Paper Co., Ltd., to establish a new containerboard production facility.

- In 2021, Mondi Group announced an expansion of its corrugated box production facility in Szczecin, Poland by installing an innovative equipment to reinforce and expanding portfolio of packaging and production procedure.

- In 2019, Rengo Co. Ltd acquired 80% of shares of Nishihara-Shigyo Co., Ltd. in Japan and worked as a subsidiary of Rengo Co. Ltd. The company will strengthen its corrugated packaging business through this acquisition.

- In 2018, DS Smith PLC signed an agreement to acquire Corrugated Container Corporation (CCC) to expand packaging capacity in the North America region.

- In 2018, Mondi PLC planned to invest €30 million in its Czech Corrugated Plant to increase production facility.

Segments covered in the Report:

The Global Corrugated Box Market has been segmented on the basis of Material Type, Board type, Grade type, Product Type and End-Use Industry. Based on the Material Type, the market is segmented into Virgin, Recycled. Based on the Board type, the market is segmented into Single Face Board, Double Wall Board, Triple Wall Board. Based on the Grade type, the market is segmented into Liner, Fluting Medium. Based on the Product Type, the market is segmented into Slotted Box, Folder Box, Telescope Box, Die Cut Box. Based on the End-Use Industry, the market is segmented into Electronic Goods, Food & Beverage, Chemicals, Paper Products, Home & Personal Care Goods, Textile Goods and Others.

For detailed scope of the “Corrugated Boxes Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 69.4 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Value (USD Billion) |

| Market Segment | By Product Type, By Printing Ink, By Printing Technology, By Material, By End-Use Industry, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Mondi PLC, International Paper Company, Packaging Corporation of America, Westrock Company, DS Smith PLC, Smurfit Kappa Group, Rengo Co. Ltd., Cascades Inc., Georgia-Pacific LLC, Kapstone Paper and Packaging Corporation; A total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Corrugated Boxes Market by Material Type

-

- Virgin

- Recycled

Global Corrugated Boxes Market by Board type

-

- Single Face Board

- Double Wall Board

- Triple Wall Board

Global Corrugated Boxes Market by Grade type

-

- Liner

- Fluting Medium

Global Corrugated Boxes Market by Product Type

-

- Slotted Box

- Folder Box

- Telescope Box

- Die Cut Box

Global Corrugated Boxes Market by End-Use Industry

-

- Food & Beverage

- Electronic Goods

- Home & Personal Care Goods

- Chemicals

- Textile Goods

- Paper Products

- Others

Global Corrugated Boxes Market by Region

-

-

North America Corrugated Boxes Market (Option 1: As a part of the free 25% customization)

- By Material Type

- By Board type

- By Grade type

- By Product Type

- By End-Use Industry

- United States of America (US) Market All-Up

- Canada Market All-Up

-

Europe Corrugated Boxes Market (Option 2: As a part of the free 25% customization)

- By Material Type

- By Board type

- By Grade type

- By Product Type

- By End-Use Industry

- United Kingdom (UK) Market All-Up

- Germany All-Up Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Corrugated Boxes Market (Option 3: As a part of the free 25% customization)

- By Material Type

- By Board type

- By Grade type

- By Product Type

- By End-Use Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Corrugated Boxes Market (Option 4: As a part of the free 25% customization)

- By Material Type

- By Board type

- By Grade type

- By Product Type

- By End-Use Industry

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Corrugated Boxes Market All-Up

-

Major Players Operating the Corrugated Boxes (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Mondi PLC

- International Paper Company

- Westrock Company

- DS Smith PLC

- Smurfit Kappa Group

- Rengo Co. Ltd.

- Cascades Inc.

- Packaging Corporation of America

- Georgia-Pacific LLC

- Kapstone Paper and Packaging Corporation

- Published Date: Feb-2023

- Report Format: Excel/PPT

- Report Code: UP425A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Corrugated Boxes Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research