Press Release

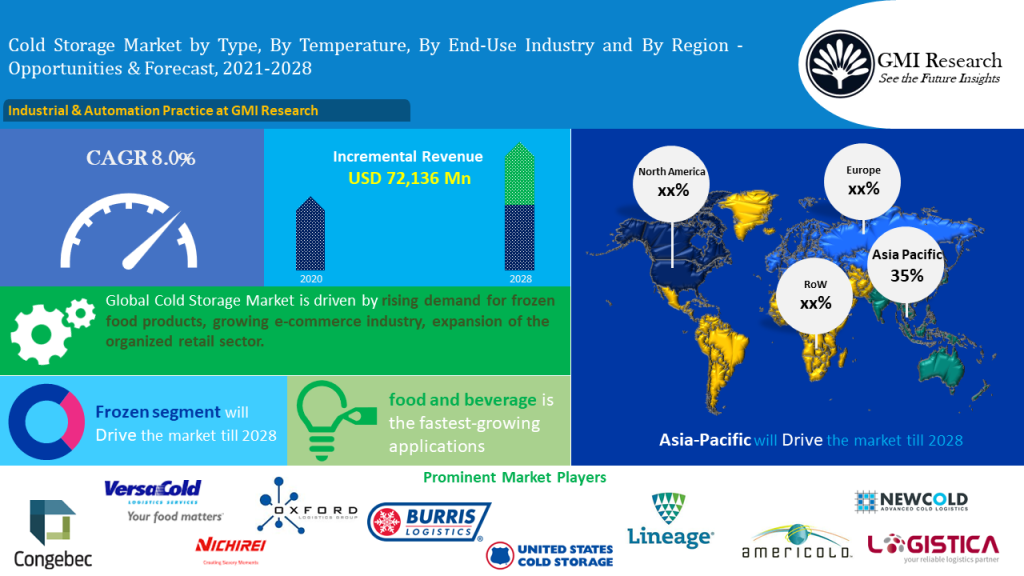

As per the GMI Research forecasts, the increasing refrigerated warehouse capacity across Asia-pacific countries like China and India is a major factor that has driven the cold storage market share. For instance, according to The Federation of Indian Chambers of Commerce & Industry, the warehouse refrigerators’ capacity has increased by 2.67% from 2016-2018, respectively, which has boosted the demand for frozen food. The market was estimated to be USD 78,172 Million in 2020, while growing at a CAGR of 8.0% during the forecast period (2021-2028).

The global cold storage market size is likely to experience strong demand for frozen food and increasing consumer acceptance due to the hectic lifestyle of the end-users. In addition, according to a report published by American Frozen Food Institute in 2020, 90% of consumers consumed more meals prepared at home than pre-pandemic. More than 73% of consumers take more time to prepare food than usual, which is an opportunity for the frozen food sector. Large food retail chains such as Tesco, Walmart, Spar, and 7-Eleven are expanding their outlets in developed and emerging markets such as the US, UK, Germany, Brazil, China, and Argentina. For instance, Walmart is one of the largest American multinational retail corporations with more than operational 11,000 stores in more than 27 countries. It has a large fleet for the logistics of perishable goods and an effective distribution network.

To have an edge over the competition by knowing the market dynamics and current trends of “Middle East Digital Payments Market”, request for Sample Report here

Government-supportive regulations have also pushed the organized sector to expand the cold storage market. For instance, bilateral free trade agreements and The World Trade Organization (WTO) have supported the market’s growth. The North America Free Trade Agreement (NAFTA) and European Union Free Trade Agreement (FTA) have created scope and space for exporters in Europe and the US to push trade of perishable foods in a manner free of import duties. Furthermore, as per the cold storage market report, the strategic expansions and partnerships with the Industry Veterans have aided the market’s growth. For instance, in 2020, Don Schoenl announced the launch of Agile Cold Storage LLC. Agile is planning to develop a nationwide conventional temperature-controlled warehouse and network of greenfield automated in partnership with North American food manufacturers, processors, and growers, which is likely to push the market’s growth in the forecast period.

Based on type, the public warehouse segment is expected to lead the global cold storage market during the forecast period. Most of the leading food manufacturing companies depend on public warehouses for storage, which has helped the segment in dominating the market. For instance, companies like Los Angeles cold storage company in Downtown, Americold, LOGISTICA Egypt, and others are offering public frozen food warehouse services.

Key Developments:

- In 2021, Lineage Logistics officially announced the acquisition of Frigorificos de Navarra, one of the leading operators of refrigerated storage facilities based in Spain. This strategic acquisition has helped the company enter the Spanish cold chain market and expand storage services and capacity.

- In 2021, Lineage Logistics announced the acquisition of Hanson Logistics, which comes under the top 15 players of North America in temperature-controlled warehousing and logistics, as stated by the “International Association of Refrigerated Warehousing.” This strategic acquisition will help the player reach out to 60% of the total US population.

- In 2021, Lineage Logistics strategically acquired a cold storage operation in Denmark, a controlled industrial real estate investment trust (REIT) and logistics provider. This strategic step has helped the company in entering the Denmark cold storage market.

The global Cold Storage Market is segmented into type, temperature, and end-use industry. Based on the type, the market has been segmented into private and semi-private warehouses and public warehouses. Based on the temperature, the market has been segmented into chilled and frozen. Based on the end-use industry, the market is segmented into food and beverage, pharmaceutical industry, and others.