Press Release

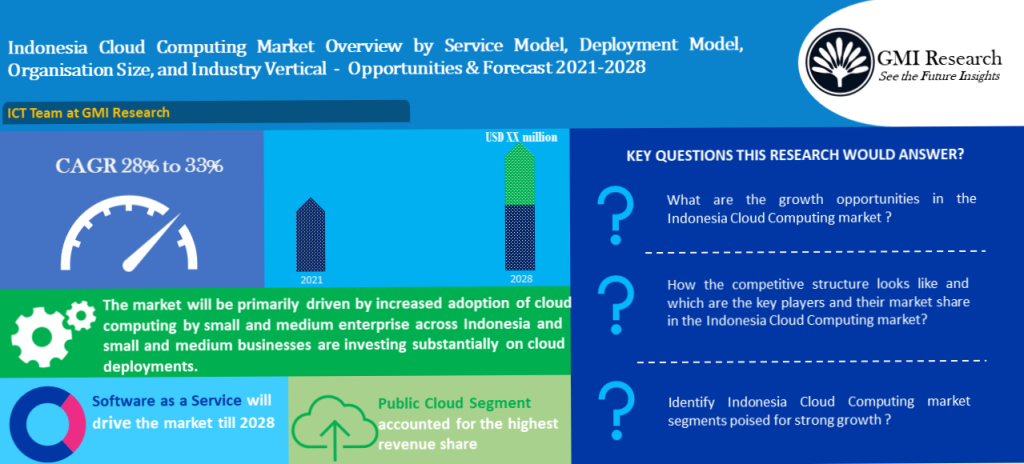

As per the GMI Research, the accelerating adoption of cloud computing by the small and medium enterprises along with favourable government policies and rising cloud investment in the region are some of the major factors fuelling the growth of the Indonesia Cloud Computing Market. The market is expected to reach XX Million by 2028 while growing at a CAGR of 28% to 33% during the forecast period (2021-2028).

With the outbreak of the COVID-19, there has been an upsurge in the demand for cloud-based solutions and tools, particularly among the SMEs. Large organizations as well as small and medium enterprises are increasingly deploying cloud owing to its various benefits such as enhanced security, increased flexibility, among others. Despite the uncertainty caused by the COVID-19 impact, Indonesia continues to be the fastest growing digital economy in South-East Asia, which has enabled significant cloud adoption. In addition, pace of start-ups in SaaS offering has also driven the market.

To have an edge over the competition by knowing the market dynamics and current trends of “Indonesia Cloud Computing Market”, request for Sample Report here

The rising need for improved business analytics and artificial intelligence by the small and medium enterprises have made them invest a substantial amount on cloud deployments. In addition, adoption of digital tech policies by the Indonesia is further supporting growth. These developments have caught the eye of the French government, which, through its finance ministry and banking institutions, plans to provide USD 190 million to fund a feasibility study for Indonesia’s national data centre project.

Furthermore, strategic initiatives and the launch of data centers in the country by the leading players are further surging market growth. Strategic initiatives by the Indonesia government for the expansion of data centres in cloud has facilitated the expansion of public sector in Indonesian cloud market. For instance, in 2020, the government has announced plan to form an integrated data center, which will be called the national government data center which is going to be fulfilled by the end of 2023.

Based on industry vertical, the BFSI segment is expected to grow at a CAGR of 30.9% during the forecast period. The rising focus on digitalization due to the introduction of various initiatives such as “Indonesian digital bank Mambu’s SaaS banking platform as its foundation”, and other projects, the leading banks and financial institutions have been increasingly opting for cloud-based software and solution to meet the customer expectations and sustain in the highly competitive market.

Key Developments:

-

- In 2020, Alibaba Cloud announced to launch its third data centre in Indonesia by the end of 2021. The expansion comes after Alibaba Cloud Indonesia built its first datacentre in 2018, with the second datacentre constructed in 2019. Upon completion of the third, Alibaba Cloud will have 64 availability zones across 21 regions worldwide

- In 2020, Google and XL Axiata entered in partnership to connect Indonesian businesses to Google’s global network infrastructure. XL Axiata has adopted Anthos‒Google Cloud’s modern application management platform, to automate, manage and scale workloads across its hybrid- and multi-cloud environments in a secure, consistent manner.

The Indonesia Cloud Computing market is segmented into service model, deployment model, organization size, and industry vertical. Based on the service model, the market has been segmented into Infrastructure as a Service, Platform as a Service, Software as a Service. Based on the Deployment Model, the market has been segmented into Public Cloud, Private Cloud and Hybrid Cloud. Based on the organization size, the market has been segmented into Small and Medium Enterprises and Large Enterprises. Based on Industry Vertical, the market has been segmented into Manufacturing, Healthcare and Life Sciences, IT & Telecom, Retail and Consumer Goods, Energy and Utilities, Media and Entertainment, BFSI, Government and Public Sector and Others.