Press Release

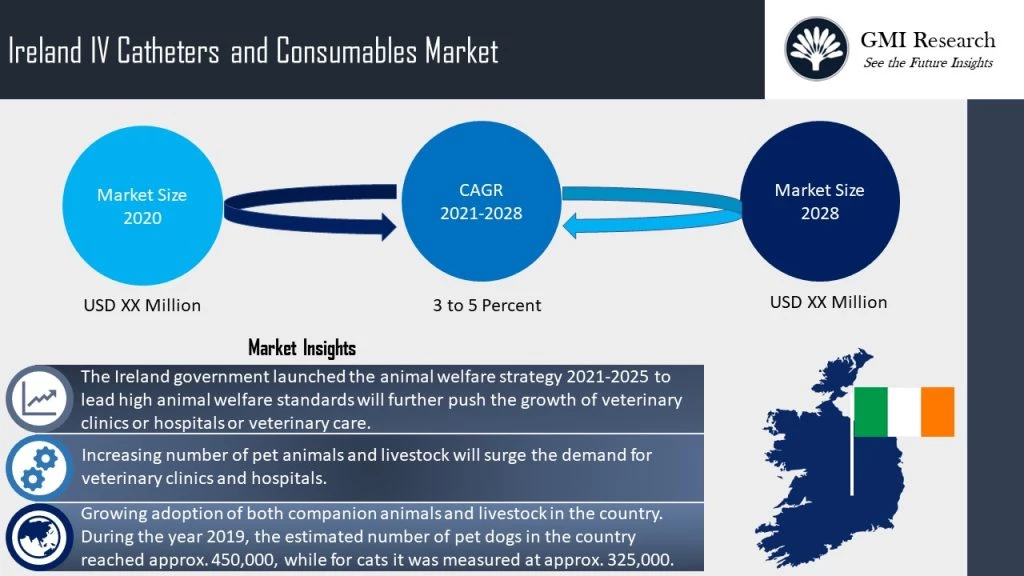

As per the GMI Research forecasts, growing pet pollution in the country stands to be one of the major factor contributing to the growth of the Ireland IV Catheters and Consumables market. The market was estimated to be USD xx Million in 2019 and is predicted to reach USD xx Million by the end of 2027, while growing at a CAGR of 3% to 5% during the forecast period (2020-2027).

Increasing number of pet animals and livestock will surge the demand for veterinary clinics and hospitals and will further drive the demand for IV catheters. In 2019, the estimated number of pet dogs in Ireland was around 450,000 while the cat population in households was estimated at around 325,000. Furthermore, in 2019, the number of certified veterinary practice premises also increased to 765 in 2019, up from 748 from the previous year.

To have an edge over the competition by knowing the market dynamics and current trends of “Ireland Veterinary IV Catheter Market”, request for Sample Report here

Giving priority to animal health by the government, will further push the growth of veterinary clinics or hospitals or veterinary care. The Ireland government launched the animal welfare strategy 2021-2025 to lead high animal welfare standards. The strategy sets out five broad, cohesive principles that will facilitate respectful dialogue, enhance cooperation, increase capacity, improve coordination and thus improve animal welfare in a wide variety of situations. This investment of €77 Million reflects the country ongoing commitment to the prioritization of animal health, growth potential of this important sector, and to the modernization of farming in Ireland.

Pet owners are increasingly treating their cats, dogs and even small mammals like members of their family. Pet humanization is set to continue to drive sales of pet products and services in Ireland. As per the 2018 Allianz pet insurance survey, its estimated that each mutt and feline costs their owner an average of €1,250 a year between food, toys, grooming and treats. Hence, rising increasing focus on animal health and spending on treatment will boost the market for IV catheters and other consumables.

Furthermore, owing to the current discomfort associated with animals regarding the usage of existing IV catheters, researchers are focused on product and design innovation. Development of high-quality catheters with minimal discomfort will enhance market development.

Stringent regulatory standards to follow by the IV Catheters manufactures stands to be a restraining factor in the market. The regulatory framework for the commercialization of medical products is one of the major restraints in the country such as getting the license or adopting strict policies can be very tedious and difficult task for the manufacturers of IV catheters.

On the basis of product type, the IV catheters segment is expected to dominate the market during the during the forecast period. The major factor supplementing the growth of the IV catheters is the rising prevalence of cardiovascular diseases and kidney diseases in animals. The increasing number of surgical procedures on pets, which include cataract, dental, spay or neuter, wound repair, and hip dysplasia is driving the demand. Moreover, the growing number of veterinary practitioners, rising adoption of companion animals, increasing demand for animal health insurance, and government initiatives to prevent zoonotic diseases, are some other factors that play a vital role in supplementing the growth of the market.

The Veterinary IV Catheters market is segmented into product type, animal type and end-user. Based on the product type, the market has been segmented into IV Catheters, Tapes, Bandages and Absorbents, Stitch Cutters. Based on the Animal Type, the market has been segmented into Companion, and Livestock. Based on the end-user type, the market has been segmented into Hospitals, Clinics, Home Care and Mobile Veterinary Services.