5G Chipset Market Size, Growth Opportunities, Outlook, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2022-2029

5G Chipset Market Size & Analysis Report by Type (Modem and RFIC), By End Use (Telecommunication, Mobile Devices, Non-Mobile Devices, and Automobile), By Frequency (Sub-6 GHZ, 24-39 GHZ, and Above 39 GHZ), By Process Node (Less than 10 NM, 10-28 NM, and Above 28 nm) and By Region

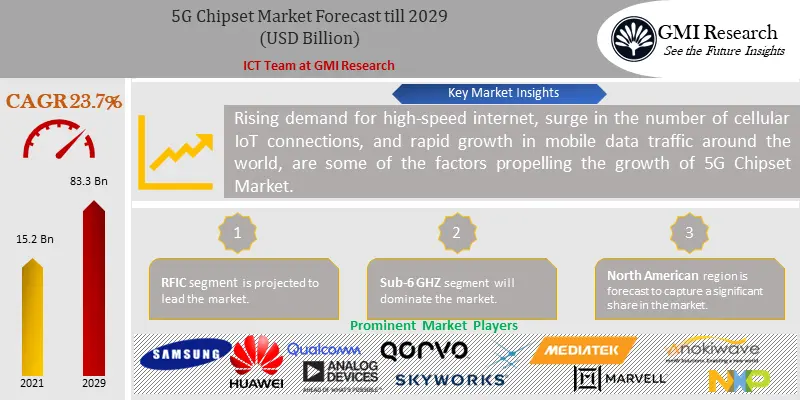

GMI Research analysis indicates that the 5G Chipset Market size reached USD 15.2 billion in 2021 and is slated to register a double digit CAGR of 23.7% over the period 2022-2029 and is projected to reach USD 83.3 billion in 2029 attributed to rising demand for high-speed internet and broad network coverage.

To have an edge over the competition by knowing the market dynamics and current trends of “5G Chipset Market”, request for Sample Report here

Significant 5G Chipset Market Drivers

Primary factors driving the 5G Chipset Market are growing demand for high-speed internet, surge in the number of cellular IoT connections, emerging need for smart technologies and rapid growth in mobile data traffic around the world. Over the years, smartphone ownership rates have significantly increased worldwide. And Increasing smartphone userbase coupled with surge in the data consumption due to improvements in the performance of deployed networks, are some of the factors propelling the mobile traffic growth. As per recent estimates, monthly average usage per smartphone is expected to be around 19 GB in 2023. This figure is projected to increase by 142% by 2028 and majority of data traffic will shift towards 5G.

Major telecommunication companies are increasingly deploying 5G networks because 5G technology offers low latency and consumes less power as compared to 4G, which is accelerating the 5G chipset market share in the 5G market. Application of 5G technology will increase in self-driving cars and intelligent transportation systems, as they require low latency. Moreover, rise in the launch of new products, growing adoption of M2M technologies for better connectivity, and partnerships and collaborations between key industry players, will create lucrative opportunities for 5G Chipset Market. For instance, in November 2018 Nokia signed contract with three Chinese operators, China Unicom, China Telecom and China Mobile to deploy technologies for developing high-speed network infrastructure in China. However, high cost of 5G Chipset for mobile devices and challenges faced in designing RF devices, which operates at higher frequency, are hindering the market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Type, RFIC segment is projected to capture the largest 5G Chipset Market share.

RFICs are gaining traction in the 5G networks owing to their increasing use in the production of consumer electronic devices and radio access products. Moreover, some of the major 5G Chip Companies across United States such as Qualcomm, Broadcom, and Analog Devices, have already started developing RFICs for 5G communication.

Automobile segment is forecast to grow at the fastest rate.

5G is expected to create more applications in the automobile industry, some of them includes, vehicle-to-infrastructure (V2I), vehicle-to-pedestrian (V2P) and vehicle-to-vehicle (V2V). As the development of 5G is progressing at a rapid pace, 5G is expected to be create new business models and services including Autonomous Vehicles and AI based platforms, which will bring more autonomy in manufacturing applications. In addition, 5G Chipsets are gaining popularity in the Telecommunication industry due to increasing investments by major telecom companies for developing 5G chipset modules for telecom base stations and broadband gateway devices coupled with rising demand for high-speed data connectivity for conducting virtual meetings.

Based on Frequency, Sub-6 GHZ segment will dominate the market.

5G devices under the Sub-6 GHZ spectrum band are expected to play a critical role for delivering widespread coverage. Some of the major Huawei and ZTE completes most of their work in sub-5GHZ frequency. While 24-39 GHZ spectrum is a combination of licenced and unlicensed spectrum. Surge in the demand for wireless data bandwidth, is one of the major factors propelling the growth of 24-39 GHZ spectrum.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

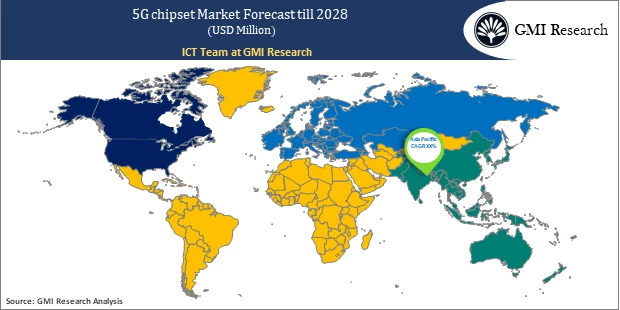

Based on Region, North American region is estimated to capture a significant market share.

North America 5G Chipset Market is driven by increasing consumers inclination towards adopting advanced technologies, and presence of the leading market players such as Qualcomm Technologies, Inc., Analog Devices, Inc., and Qorvo, Inc. Asia-Pacific 5G Chipset Market is driven by increasing investments by enterprises for developing 5G-enabled smartphones and growing demand for smart manufacturing across India and China.

Top 5G Chip Makers

Some of the leading players operating in the market include Qualcomm Technologies, Inc., Analog Devices, Inc., Qorvo, Inc., Skyworks Solutions, Inc., SAMSUNG, Huawei Technologies Co., Ltd., MediaTek Inc., Marvell, Anokiwave, and NXP Semiconductors, among others.

Key Developments:

-

- In October 2022, Media Tek, a leading semiconductor manufacturer, announced the launch of its latest Dimensity 1080 chipset for 5G enabled smartphones, which comes with upgraded camera features.

- In September 2022, Qualcomm developed two new mobile chipsets namely, Snapdragon 6 Gen 1 and Snapdragon 4 Gen 1. Through this product launch, company targets to enter mid-range and entry level smartphone markets of countries such as India.

- In April 2022, Analog Devices launched mmw 5G front end chipset, which is designed to reduce complexities for producing faster radios. This chipset works on a frequency of 24-47 GHz radio waves.

- In June 2021, Samsung launched wide range of chipsets which will be incorporated in its next generation 5G solutions.

- In September 2020, Qualcomm Technologies, Inc., developed a new 5G mobile platforms in the 7-series, the Snapdragon 750G 5G Mobile platform, which allows smooth HDR gaming and on-device AI.

- In January 2020, MediaTek Inc., launched its Dimensity 800 Series 5G chipset, which comes with flagship features, power, and performance to new premium mid-range 5G smartphones.

- In September 2019, Samsung Electronics introduced Exynos 980 mobile processor, which is equipped with a 5G modem that provides a downlink speed of up to 2.55Gbps. The integration of modem and mobile processor in a single chip uses less space and enhances power efficiency.

Segments covered in the Report:

The global 5G Chipset market has been segmented on the basis of Type, End Use, Frequency, Process Node and regions. Based on Type, the market is segmented into Modem and RFIC. Based on End Use, the market is segmented into Telecommunication, Mobile Devices, Non-Mobile Devices, and Automobile. Based on Frequency, the market is segmented into Sub-6 GHZ, 24-39 GHZ, and Above 39 GHZ. Based on Process Node the market is segmented into Less than 10 NM, 10-28 NM, and Above 28 nm.

For detailed scope of the “5G Chipset Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 15.2 billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By End Use, By Frequency, By Process Node, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Qualcomm Technologies, Inc., Analog Devices, Inc., Qorvo, Inc., Skyworks Solutions, Inc., SAMSUNG, Huawei Technologies Co., Ltd., MediaTek Inc., Marvell, Anokiwave, and NXP Semiconductors, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global 5G Chipset Market by Type

-

- Modem

- RFIC

Global 5G Chipset Market by End Use

-

- Telecommunication

- Mobile Devices

- Non-Mobile Devices

- Automobile

Global 5G Chipset Market by Frequency

-

- Sub-6 GHZ

- 24-39 GHZ

- Above 39 GHZ

Global 5G Chipset Market by Process Node

-

- Less than 10 NM

- 10-28 NM

- Above 28 nm

Global 5G Chipset Market by Region

-

- North America 5G Chipset Market (Option 1: As a part of the free 25% customization)

- By Type

- By End Use

- By Frequency

- By Process Node

- US Market All-Up

- Canada Market All-Up

- Europe 5G Chipset Market (Option 2: As a part of the free 25% customization)

- By Type

- By End Use

- By Frequency

- By Process Node

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific 5G Chipset Market (Option 3: As a part of the free 25% customization)

- By Type

- By End Use

- By Frequency

- By Process Node

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW 5G Chipset Market (Option 4: As a part of the free 25% customization)

- By Type

- By End Use

- By Frequency

- By Process Node

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America 5G Chipset Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the 5G Chipset (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Qualcomm Technologies, Inc.

- Analog Devices, Inc.

- Qorvo, Inc.

- Skyworks Solutions, Inc.

- SAMSUNG

- Huawei Technologies Co., Ltd.

- MediaTek Inc.

- Marvell

- Anokiwave

- NXP Semiconductors

Frequently Asked Question About This Report

5G chipset market [UP2212-001001]

The increasing demand for high-speed internet and large network coverage for applications, including distance learning, multiuser gaming, videoconferencing, augmented reality, and autonomous driving stands to be the key factors driving the growth of the 5G chipset.

Automobile segment is projected to grow at the fastest CAGR over the forecast period.

5G Chipset Market size touched USD 15.2 billion in 2021.

Which type segment projected to grow at higher CAGR in 5G Chipset Market during the forecast period?

RFIC segment is estimated to dominate the market.

Sub-6 GHZ segment is projected to lead the market during the forecast period.

5G Chipset Market is forecast to grow at a CAGR of 23.7% over the forecast period (2022-2029).

- Published Date: Jul - 2021

- Report Format: Excel/PPT

- Report Code: UP2212-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

5G Chipset Market Size, Growth Opportunities, Outlook, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research