Automated Material Handling (AHM) Market Size, Share, Growth Opportunities, Trends Analysis & Global Industry Forecast Report, 2024-2031

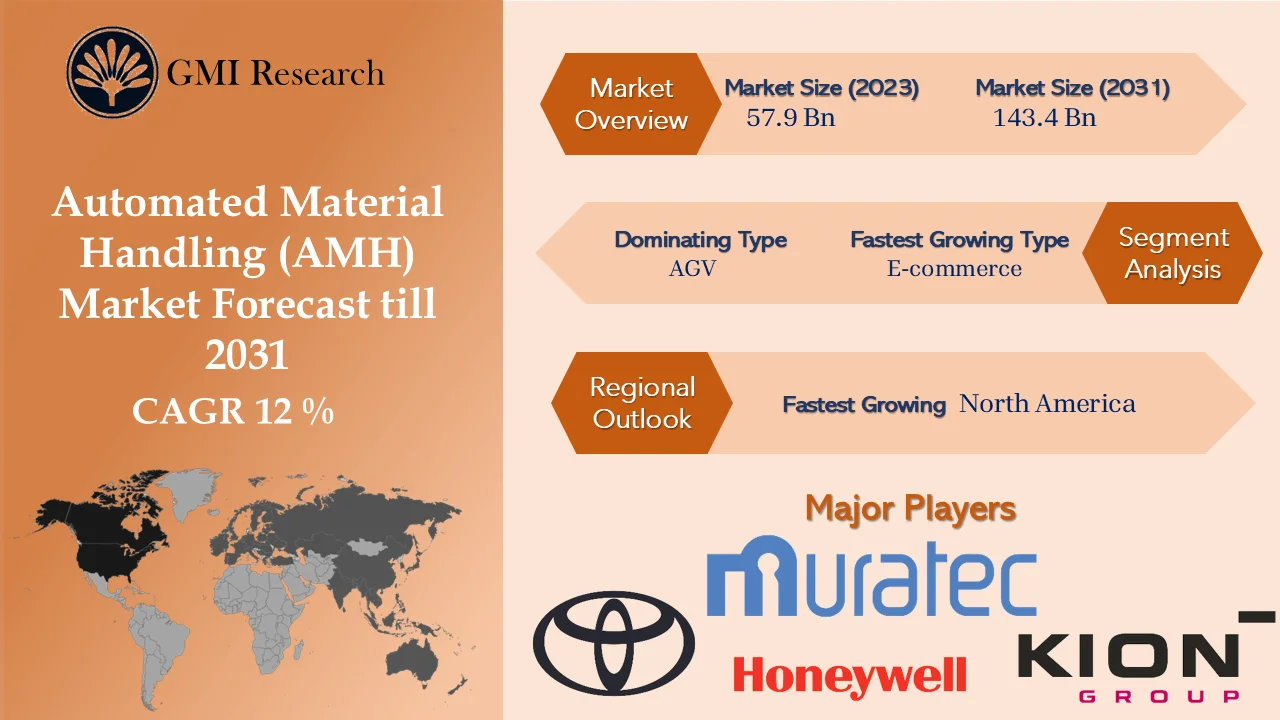

Analysts at GMI Research estimates that the Automated Material Handling (AMH) Market size was worth USD 57.9 billion in 2023, and forecast to touch USD 143.4 billion in 2031, growing at a high CAGR of 12.0% from 2024-2031.

Automated Material Handling (AMH) Market Overview

Automated materials handling (AMH) refers to a mechanism that ensures efficient transportation of material from one place to another in the manufacturing area. The automated materials handling systems are primarily used for sorting material, procuring raw material, and delivering finished goods to the intended consumer.

Major Automated Material Handling (AMH) Market Drivers

The automated material handling market is predicted to grow due to a considerable increase in technological innovations, growing productivity and effectiveness of manufacturing and logistics companies, rapid increase in safety concerns, rising need for automated industries, establishments of startups, growing requirement for high-performance robots in warehousing and logistics facilities, and high rates of labor. Based on the automated material handling (amh) market analysis, different producers and professionals in the warehouse industry globally are already advising extensive implementation of industrialized automated material handling equipment during the coming period. Additionally, a considerable increase in international demand for fulfilling online orders, a rise in the implementation of automated material handling systems in cold storage, and the placement of semi-automatic material handling solutions around SMEs are a few drivers propelling the global automated material handling market.

In recent times, companies have aimed to automate manufacturing procedures to decrease the cost of labor and develop effectiveness and productivity. In modern production systems, automated materials handling confirms efficient movement, protection of materials, and storage of products for a streamlined workflow. The material handling procedure is integral to the complete lifecycle of products, including manufacturing, allocation, utilization, and dumping. It has a substantial impact on the comprehensive performance of the system. A well-designed material handling system has the potential to reduce labor costs, develop product efficiency, and mitigate equipment expenses. Choosing the appropriate variety of equipment empowers manufacturers to facilitate a seamless flow of products and materials during the process of production. This, in turn, increases the speed of production, reduces the risk of material and products brokerage, and develops the security of personnel. Consequently, material handling equipment stands as an important investment for production and manufacturing businesses focusing on streamlining functions and optimizing effectiveness.

Sample Request

To have an edge over the competition by knowing the market dynamics and current trends of “Automated Material Handling Market” request for Sample Report here

For instance, in large warehouses, associates often cover substantial distances to position SKUs and provide orders to packing and shipping locations. Annually, an average warehouse expends many weeks on pointless walking and other movements and millions of working hours which incur huge costs. Collaborative robots decrease the necessity for extensive walks between functional spaces throughout every stage of the selection procedure. The increased demand for material handling technology is predicted to significantly foster market growth.

The automated material handling industry is anticipated to capitalize on the growing trend toward smart and automated facilities. Improvements in motion control have enhanced the responsiveness and precision of robots, allowing them to productively manipulate products or workpieces and execute a variety of tasks. To develop effectiveness and decrease waste, it is important to monitor manufacturing procedures, encompassing sorting, selecting, and carrying systems. Smart and automated factories which are integrated with automated systems facilitate real-time supervising of each step. Moreover, cloud-based software, machine learning, and the Internet of Things are driving the industry forward by facilitating real-time data checking and evaluating, enhancing functions, and pinpointing inefficiencies.

Additionally, outdated warehouse management systems pose challenges including restricted scalability, technical restraints, on-premises systems functions, and the threat of cybersecurity. The challenges posed by outdated warehouse management systems are predicted to be addressed by the adoption of cloud-based warehouse management systems (WMS) and transportation management software (TMS), utilization, transitioning functions, and maintenance from on-premise solutions to web-based platforms.

The adoption of cloud-based WMS and TMS is being propelled by their ability to replace all-inclusive suites of applications and streamline warehouse and supply chain management procedures, covering everything from procurement to final delivery. This move towards cloud-derived platforms focuses on optimizing capital spending while delivering extensive functionality, contributing to the increasing acceptance of cloud-based TMS and WMS.

Request Research Methodology

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

While, the substantial upfront investments demanded for automated material handling equipment pose a significant challenge for companies. Costs linked with installation, assimilation of intelligent sensors and software solutions, coupled with after-sales facilities and timely maintenance, contribute to the overall ownership costs. These financial considerations can make it challenging for companies to readily invest in AMH tools. SMEs encounter challenges when transitioning from conservative material handling to automated solutions due to factors such as slow production output, challenges in accomplishing significant investment returns, the need for restructuring prevailing warehouses, and adjustments to facility designs. These factors contribute to the complexity of adopting material handling and automation systems for these businesses.

Whereas, the rapid rise in the acceptance of industrial lifting equipment to develop efficiency and productivity, and decrease injuries and brokerage further propel the automated material handling (amh) market growth. Additionally, an inclination for IC-engine forklift trucks in emerging nations helps in the development of the market. Furthermore, considerable evolution in urbanization, change in the living standards of customers, development in infrastructure, and rise in the buying power of customers positively impact the growth of global automated material handling industry trends in the forecast period.

By Product, ASRS registered the largest revenue share in the global AMH market

ASRS segment registered the market because these solutions provide different benefits such as decreased labor usage, efficiency in the supply chain, decreased cost of inventory management, and optimum usage of space, coupled with growing demand for advanced ASRS solutions because of growing requirements for optimal space utilization. This rise in demand is attributed to the expanding e-commerce industry, stimulated by rising digitalization. In addition, there is a growing need for ASRS in different segments including personal care, pharmaceutical, and food and beverage. The adoption of ASRS is on the rise, as these systems aid warehouses and manufacturing companies in developing their production capacity and accomplishing higher-order accuracy. Driven by these factors, different warehouses and distribution centers have embarked on warehouse consolidation to better meet their client’s demands- a trend predicted to be embraced by more warehouse operatives. The establishment of warehouses leads to the efficient storage of different packages in a confined space, thereby fostering the need for ASRS within the automated material handling market.

By System Type, Unit Load Material Handling register the highest growth in the global market

The unit load material handling systems aim to transport and store a singular entity, encompassing items like pallets and containers. This equipment deals with a unified load, handling the whole of the load despite the distinct items constituting it. Unit load system carriers prove to be cost-effective and expedient in moving different items simultaneously, offering a swifter alternative to handling each item individually. Additionally, the growing need for automated material handling systems around the e-commerce sector is predicted to propel the market for unit load material handling systems within the market of automated material handling equipment in the forecast period.

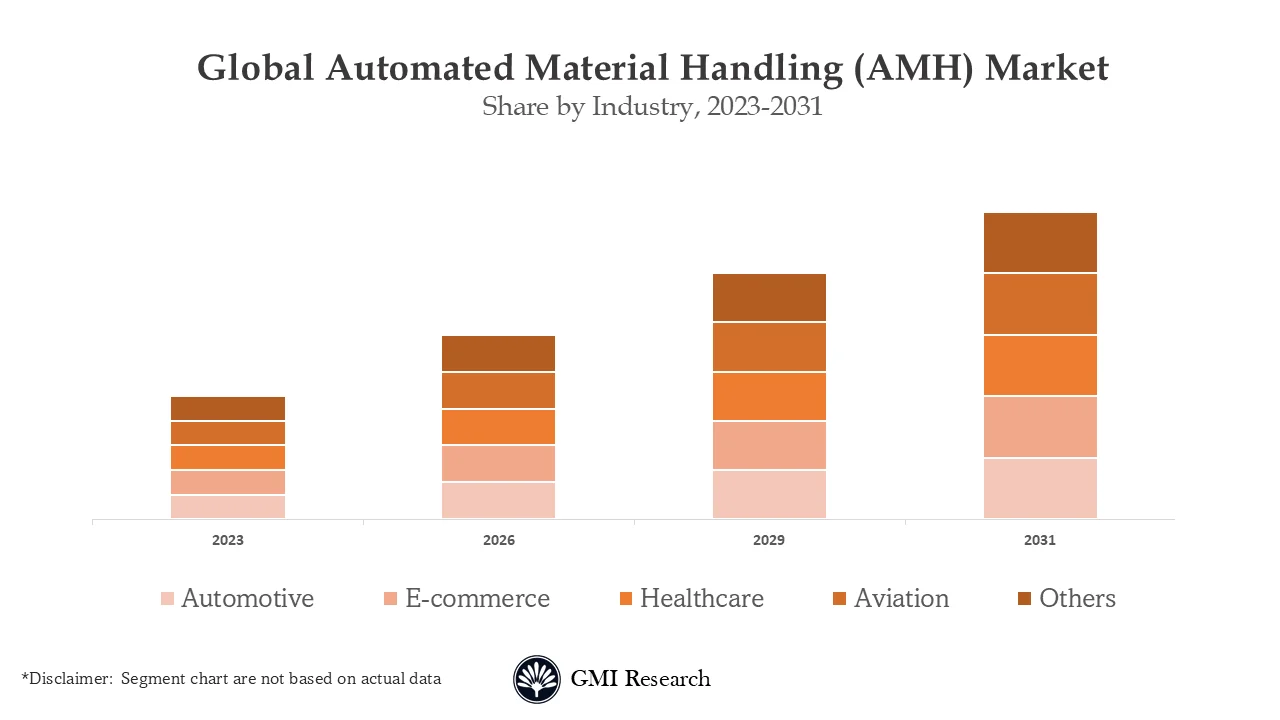

By Vertical, Automotive segment accounts for the highest CAGR in the global market

The automotive segment registered the market because it is one of the most innovative segments in terms of utilizing automated equipment to streamline different parts of automotive and fulfillment functions. The requirement for consistent accessibility of spare parts, and components, deduction in the cost of ineffective personnel, and real-time delivery of materials are fostering the automotive industry segment growth more significantly.

Request for Customization

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

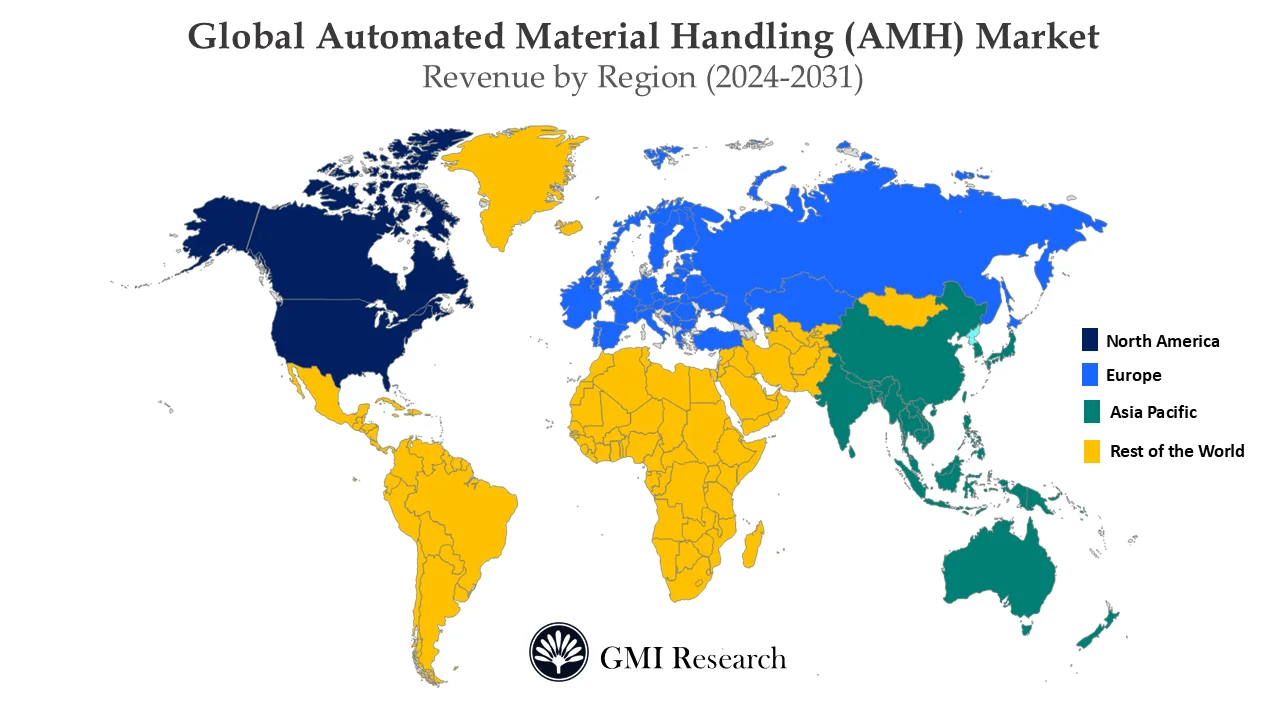

By Region, Asia Pacific is the largest region in the automated material handling market

Asia Pacific exhibits the largest revenue share in the global market because this region is predicted to offer different market growth opportunities for automation players due to development in factory automation, and industrial control, and significant advancement in inventory management in the warehouse industry around the region. Additionally, a considerable rise in awareness connected to automated warehouses, and the growing prominence of leading nations including Japan and China on robotics are the foremost drivers presenting a positive boost in the APAC market. Around the nations in the Asia Pacific, opportunities for universal trade of different products such as food and beverage are growing because of the existence of a large customer base and robust potential of exporting products around the region.

Top Market Players

Several Leading players operating in the market, include, Schaefer Systems International Limited, Daifuku Co., Ltd., Kion Group AG, Honeywell International Inc., Toyota Industries Corporation, Hyster-Yale Material Handling, Inc., John Bean Technologies Corporation, KUKA AG, KNAPP AG, and Murata Machinery, Ltd. among others.

Key Developments:

-

- In 2022, Daifuku Co., Ltd announced a plan to build a new manufacturing plant in Hyderabad, India to increase the production potential and develop its portfolio.

- In 2022, RightHand Robotics announced the launch of a partner integrator program to fulfill the international requirements of e-commerce orders.

- In 2022, Murata Machinery USA, Inc. announced an expansion of its logistics & automation product offerings to solve customer challenges and strengthen its product portfolio.

- In 2022, KION Group launched an IMOCO research project to allow intelligent trucks to route autonomously around the warehouse or factory.

- In 2020, Schaefer Systems International Limited partnered with Co-operative Group Limited (Coop), one of the leading food retailers in Sweden, for providing energy-efficient and highly automated logistics solution for Coop’s new distribution unit in Eskilstuna, Sweden. The company will handle the distribution of goods to Coop’s 800+ stores around the country.

Sample Request

For detailed scope of the “Automated Material Handling Market” report request a Sample Copy of the report

Segments covered in the Report:

The global Automated Material Handling (AMH) Market has been segmented on the basis of product, system type, industry, and key regions. Based on product, the market is segmented into Automated Storage and Retrieval System (ASRS), Automated Conveyors & Sortation Systems, Automated Guided Vehicle (AGV), and others. Based on system type, the market is segmented into unit load material handling systems and bulk load material handling systems. Based on industry, the market is segmented into automotive, semiconductor & electronics, metals & heavy machinery, food & beverages, e-commerce, healthcare, aviation, and others.

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 57.9 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By System Type, By Industry, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Schaefer Systems International Limited, Daifuku Co., Ltd., Kion Group AG, Honeywell International Inc., Toyota Industries Corporation, Hyster-Yale Material Handling, Inc., John Bean Technologies Corporation, KUKA AG, KNAPP AG, and Murata Machinery, Ltd. among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Automated Material Handling (AMH) Market by Product

-

- Automated Storage and Retrieval System (ASRS)

- Automated Conveyors & Sortation Systems

- Automated Guided Vehicle (AGV)

- Others

Global Automated Material Handling (AMH) Market by System Type

-

- Unit Load Material Handling Systems

- Bulk Load Material Handling Systems

Global Automated Material Handling (AMH) Market by Industry

-

- Automotive

- Semiconductor & Electronics

- Metals & Heavy Machinery

- Food & Beverages

- E-commerce

- Healthcare

- Aviation

- Others

Global Automated Material Handling (AMH) Market by Region

-

-

North America Automated Material Handling (AMH) Market (Option 1: As a part of the free 25% customization)

- By Product

- By System Type

- By Industry

- US Market All-Up

- Canada Market All-Up

-

Europe Automated Material Handling (AMH) Market (Option 2: As a part of the free 25% customization)

- By Product

- By System Type

- By Industry

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Automated Material Handling (AMH) Market (Option 3: As a part of the free 25% customization)

- By Product

- By System Type

- By Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Automated Material Handling (AMH) Market (Option 4: As a part of the free 25% customization)

- By Product

- By System Type

- By Industry

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Automated Material Handling (AMH) Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Schaefer Systems International Limited

- Daifuku Co., Ltd.

- Kion Group AG

- Honeywell International Inc.

- Toyota Industries Corporation

- Hyster-Yale Material Handling, Inc.

- John Bean Technologies Corporation

- KUKA AG

- KNAPP AG

- Murata Machinery, Ltd.

Frequently Asked Question About This Report

Automated Material Handling (AHM) Market [UP2064-001001]

The rising digitization of supply chain processes in manufacturing industries, increasing adoption of robotics technology in production units, and warehousing facilities, growing need for automation in logistics management in industries including e-commerce, automotive, healthcare, aviation, and electronics are some of the major factors driving the growth of the automated material handling market.

E-commerce is expected to hold a prominent share in the Automated Material Handling market owing to the rising B2B and B2C online shopping platforms and increasing adoption of automation systems for efficient management of supply chains in e-commerce industries.

North America is expected to hold a notable share in the market primarily due to increasing adoption of warehouse automation, rising cost labour, and the growing e-commerce industry.

Automated Material Handling Market was estimated at USD 57.9 billion in 2023.

Related Reports

- Published Date: Dec- 2024

- Report Format: Excel/PPT

- Report Code: UP2064-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Automated Material Handling (AHM) Market Size, Share, Growth Opportunities, Trends Analysis & Global Industry Forecast Report, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research