Global Cyber Security Insurance Market Share, Size and Trends Analysis – Growth Opportunities & Industry Forecast, 2023-2030

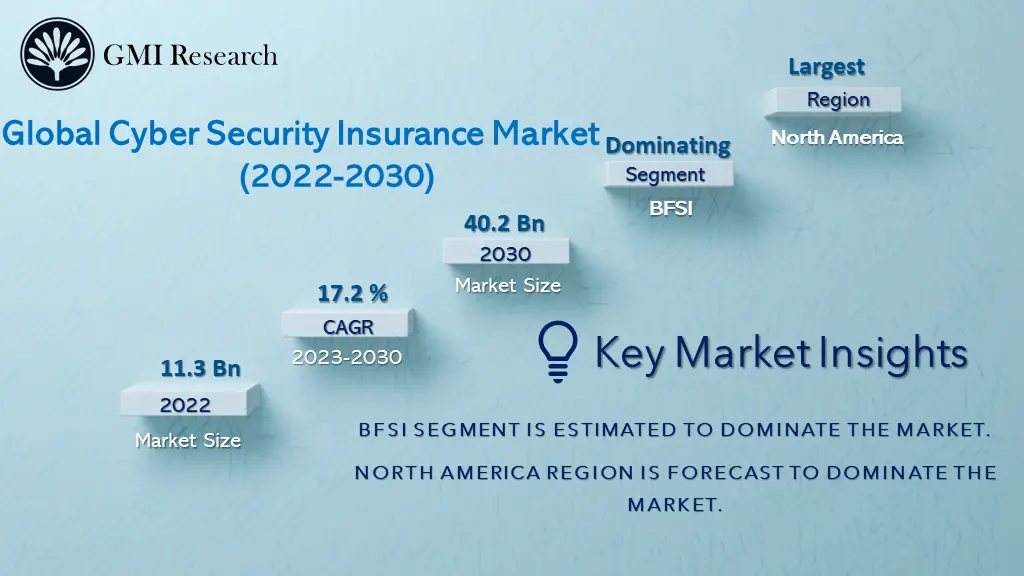

Cyber Security Insurance Market was valued at USD 11.3 billion in 2022 and is forecast to touch USD 40.2 billion in 2030, and the market is expected to grow at a CAGR of 17.2% from 2023-2030.

Overview of the Cyber Security Insurance Market Report

Cyber security insurance refers to the type of insurance policy that safeguards online users from damages and losses arise due to unauthorized disclosure of personal and financial data online. It protects commercial businesses against cyber exposures associated with e-business, internet, networks and information assets. The cyber security policy usually covers risks associated with fraudulent activities such as identity theft, malware attacks, IT theft loss, cyber stalking, data breach, and social media liabilities.

To have an edge over the competition by knowing the market dynamics and current trends of “Cyber Security Insurance Market”, request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The increasing use of the internet, rising web presence of companies and dependency on technology for storing private & confidential information, and growing incidences of security breaches and digital frauds are some of the major factors driving the growth of the global cyber insurance market size. In addition, growing IT connectivity and increasing adoption of technologies including the cloud computing, Big Data, IoT, and artificial intelligence (AI), in businesses and society is further propelling the demand for cyber insurance security. Moreover, growing adoption of cyber insurance products as a risk mitigation strategy in different end-users, including banking, healthcare, retail, utilities, telecommunication, and others, are fuelling the market growth. Furthermore, according to the Identity Theft Resource Center (ITRC), in the first six months of 2020, there were 540 data breaches and approximately 164 million people affected, including those who received more than one breach notice. This is likely to contribute to the cyber security insurance market growth.

Restraint in the Cyber Security Insurance Market

However, low awareness and high cost of cyber insurance may hamper the size of cyber security insurance market. Moreover, lack of standardized policies is further projected to limit the market growth of global cyber security insurance market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Efficiency – Segment Analysis

Based on organization size, the small and medium enterprises segment is expected to grow at a significant rate during the forecast period owing to the increasing digitization and rapid adoption of cyber insurance solutions for securing and managing their enterprise sensitive data. Moreover, according to the World Bank Group, small and medium enterprises represent about 90% of businesses worldwide and it is estimated to provide 600 million jobs by 2030.

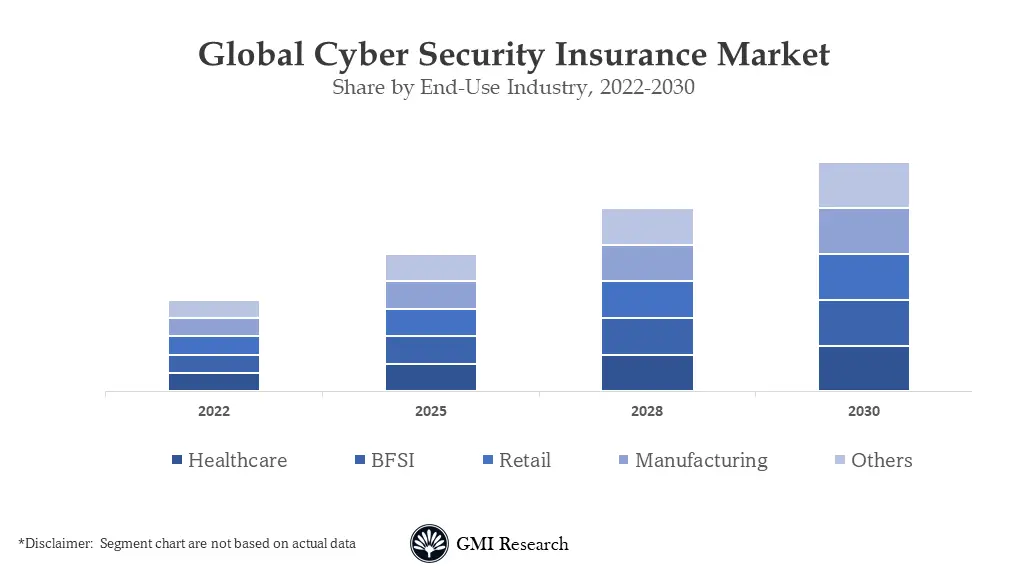

End-Use Industry – Segment Analysis

Based on end-use industry, BFSI segment is anticipated to account for a prominent share in the market. This can be attributed to rising number of financial institutes globally, growing online transactions by individuals and companies, and increasing incidences of data breaches related to customers data & employee information including bank account & personal identification numbers, credit & debit cards, and other confidential details.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Regional – Segment Analysis:

Based on region, North America is anticipated to hold a major market share primarily due to the large number of industries including banking, retail, and healthcare, increased awareness about the importance of cyber insurance, and growing harmful cyber activities in companies such as Facebook Inc., Apple Inc., and Marriott International, Inc. In addition, the presence of companies including American International Group, Inc., Berkshire Hathaway, Inc., and Chubb Limited is further expected to support the growth of the cyber security insurance market size in the region.

Top Market Players

Several Leading players operating in the market, include, American International Group, Inc., AXA SA, Berkshire Hathaway, Inc., Zurich Insurance Group Ltd., Chubb Limited, Aon PLC, Munich Re Group, Lockton Companies LLP, Security Scorecard, and Allianz Group among others.

Key Developments:

-

- In 2019, AXA XL partnered with Accenture Plc for providing cybersecurity services to AXA XL’s underwriters, brokers and clients to strengthen their cyber capabilities to combat and recover from cyberattacks. With this partnership, Accenture Plc will provide cyber threat assessments, post-breach response and other security services to AXA XL.

Segments Covered in the Report:

The global Cyber Security Insurance Market has been segmented on the basis of organization size, end-use industry, and key regions. Based on organization size, the market is segmented into small medium enterprises (SMEs) and large enterprises. Based on the end-use industry, the market is segmented into, healthcare, retail, BFSI, IT and telecom, manufacturing, and others.

For detailed scope of the “Cyber Security Insurance Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global Cyber Security Insurance Market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in Cyber Security Insurance Market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global Cyber Security Insurance Market?

- Which end-use industry generated maximum revenues in 2019 and identify the most promising end-use industry during the forecast period?

- What are the various organization sizes of global Cyber Security Insurance Market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Organization Size, By End-Use Industry, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | American International Group, Inc., AXA SA, Berkshire Hathaway, Inc., Zurich Insurance Group Ltd., Chubb Limited, Aon PLC, Munich Re Group, Lockton Companies LLP, SecurityScorecard, and Allianz Group, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Cyber Security Insurance Market by Organization Size

-

- Small Medium Enterprises (SMEs)

- Large Enterprises

Global Cyber Security Insurance Market by End-Use Industry

-

- Healthcare

- Retail

- BFSI

- IT and Telecom

- Manufacturing

- Others

Global Cyber Security Insurance Market by Region

-

-

North America Cyber Security Insurance Market (Option 1: As a part of the free 25% customization)

- By Organization Size

- By End-Use Industry

- US Market All-Up

- Canada Market All-Up

-

Europe Cyber Security Insurance Market (Option 2: As a part of the free 25% customization)

- By Organization Size

- By End-Use Industry

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Cyber Security Insurance Market (Option 3: As a part of the free 25% customization)

- By Organization Size

- By End-Use Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Cyber Security Insurance Market (Option 4: As a part of the free 25% customization)

- By Organization Size

- By End-Use Industry

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Cyber Security Insurance Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- American International Group, Inc.

- AXA SA

- Berkshire Hathaway, Inc.

- Zurich Insurance Group Ltd

- Chubb Limited

- Aon PLC

- Munich Re Group

- Lockton Companies LLP

- SecurityScorecard

- Allianz Group

- Published Date: Sep- 2022

- Report Format: Excel/PPT

- Report Code: UP2013-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Global Cyber Security Insurance Market Share, Size and Trends Analysis – Growth Opportunities & Industry Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research