Frozen Food Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

Frozen Food Market Size & Insights

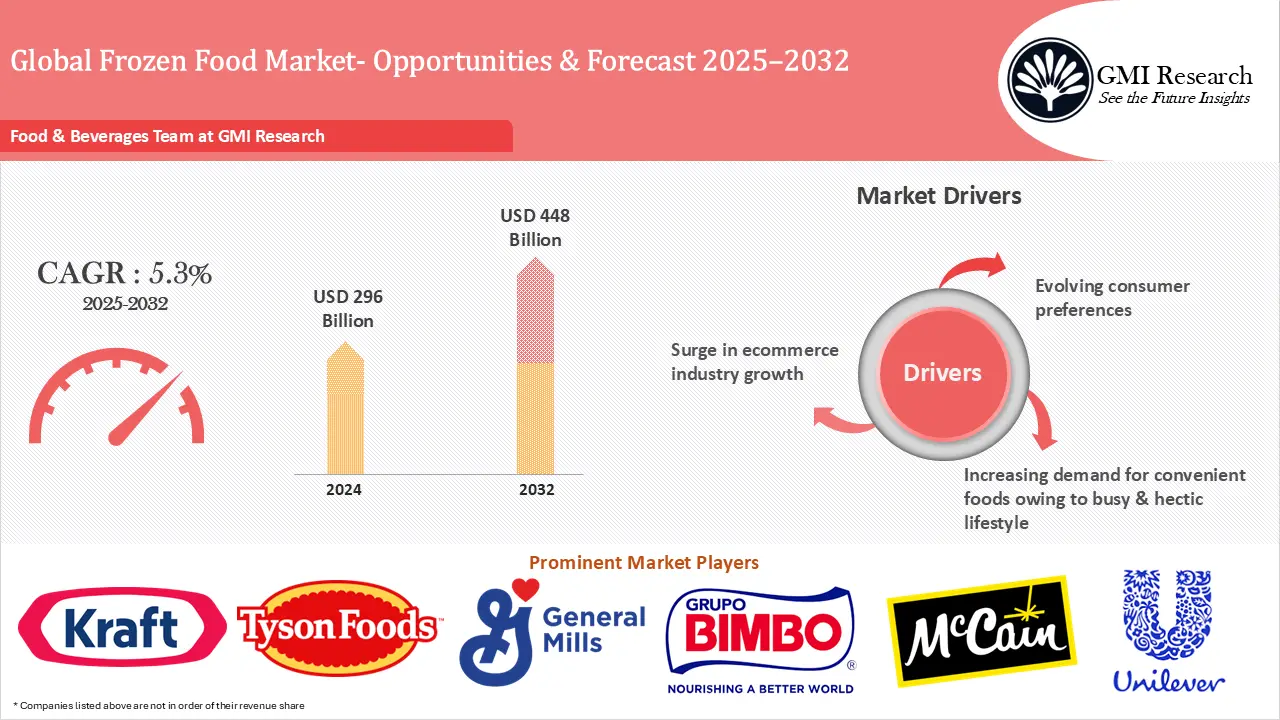

Frozen Food Market size was valued at USD 296.1 billion in 2024 and is forecast to touch USD 447.6 billion in 2032 and the market is expected to grow at a CAGR of 5.3% from 2025–2032 driven by evolving consumer preferences & increasing demand for convenient foods, busy & hectic lifestyle and surge in ecommerce industry growth

Frozen Food Industry Analysis Overview

Frozen foods undergo a preservation method where the products are kept at low temperatures to extend shelf life by slowing down enzymatic and microbial processes which prevent spoilage. The growing demand for convenient and processed foods drives impulse buying that contributes to the frozen food market size growth.

Global Frozen Food Market Drivers

Evolving Consumer Preferences & Increasing Demand for Convenient Foods

Evolving consumer preferences are driving the growing demand for packaged food as modern consumers seek out products that are convenient and have long shelf lives. These products provide a convenient option for families and individuals looking for easy meal solutions within the packaged food category. With rising incomes particularly in developing countries, more people now have the purchasing power to buy food with higher quality which is expected to boost the demand for frozen food. The global increase in female employment in recent years has further made it more challenging for women to prepare meals which results in a growing preference for frozen food. Additionally, the strong distribution channels and effective marketing strategies enable frozen food to reach a broader audience.

Surge in Ecommerce Industry Growth

The surge in ecommerce has also accelerated the frozen food market growth with online platforms making it simpler for consumers to access and purchase the products. As internet access becomes more widespread and smartphone technology advances the ecommerce sector has undergone substantial expansion. Increased digital access allows people to more easily add these foods into their daily meal preparation. Moreover, the growing regulations and government support aimed at overseeing the online shopping sector are anticipated to accelerate its growth in the coming years.

Challenges Faced by Frozen Food Market Players

However, the growing interest in natural and fresh food options is limiting market growth. As consumers become more focused on health they prefer options that are seen as less processed. This shift is driven by a desire for better nutritional content and fewer artificial ingredients in their food.

Frozen Food Market Analysis

Product Insights: Ready meals segment registered the largest market share

The ready meals category dominates the market and is anticipated to maintain its lead in the forecast period largely due to the widespread consumption by working-class consumers around the world. The fruits & vegetables category is expected to witness the fastest growth as consumers increasingly shift toward these products which offer convenience by eliminating the need for washing or peeling in response to the rise in lifestyle diseases.

Type Insights: Ready-to-eat segment accounted for the largest market share

The segment leads the market as they become more popular in response to evolving lifestyles and greater disposable income. These meals are particularly popular among working professionals since they require less time to prepare than traditional options. The segment is also expanding due to growing global population and more women entering the workforce.

Raw frozen food is also growing rapidly because of its adaptability and wide consumer interest. With a range of products such as seafood and meats, it gives consumers the freedom to make personalized meals. The foods maintain their natural flavor and nutritional value which often surpass their processed alternatives. With the increasing focus on health and convenience, raw frozen foods perfectly cater to consumer needs as they allow for the preparation of fresh and healthy meals with ease.

Freezing Technology Insights: Blast freezing segment registered the largest revenue share

Blast freezing technology is preferred for its capability to quickly chill food products while maintaining their nutritional value and freshness. That makes it ideal for freezing various products such as meat and vegetables. Quickly cooling food is essential in order to kill bacteria and prevent further growth. This is why blast freezers are extensively used in the food sector particularly in processing plants and are also found in numerous commercial kitchens.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Distribution Channel Insights: Retail segment dominated the largest revenue share

The retail segment led in revenue share especially in offline distribution channels such as supermarkets, convenience stores, and others. The expansion of these stores across different regions has contributed to a sharp increase in availability and distribution of frozen foods. The focus on customer convenience in supermarkets and hypermarkets is a driving force. Manufacturers are making efforts to display their products within these retail environments to tap into this demand.

The online distribution segment is expected to grow the fastest with e-commerce platforms in developing and developed countries pushing manufacturers to adapt their retail approaches. The digital shift in retail has led to a significant rise in e-commerce and online shopping fueled by evolving consumer preferences along with the demand for convenience. Online platforms provide a broader range and variety of frozen food options than traditional physical stores which accommodate various dietary preferences.

The additional benefit of home delivery along with the option to compare products and prices online make it a highly appealing choice for busy consumers. As technology progresses and online platforms are increasingly easier to use, the online distribution is poised for significant growth as it delivers exceptional convenience and easy access for consumers.

Region Insights: Europe dominated the market share

Europe leads the market fueled by hectic lifestyles coupled with an increasing demand for affordable and convenient food prices. Increasing incomes and evolving dietary habits are driving the growth of this market as consumers increasingly adopt plant-based diets. Growing public recognition regarding the nutritional benefits of frozen vegetables is increasing demand particularly among younger consumers. Manufacturers in the UK are fueling market growth by consistently launching new and inventive products including gourmet and international cuisines to align with shifting consumer demands.

The market in Asia Pacific is anticipated to grow at the fastest rate fueled by the rising availability of frozen foods that offer high protein and low fats which meet various dietary requirements.

North America is also experiencing rapid growth fueled by the increasing preference for frozen foods particularly among millennials who appreciate single-serving portions and easy preparation. The FDA has also implemented several regulations that reduce the use of harmful chemicals like trans fats in food products. Prepackaged foods need little cooking since they are prewashed and precut which makes them convenient and gives them a longer shelf life that contributes to market growth in the region.

Frozen Food Market Major Players & Competitive Landscape

Several leading companies are Grupo Bimbo S.A.B. de C.V., Kraft Heinz Company, Nestle SA, Unilever, Kellogg Company, General Mills, Inc., Conagra Brands, Inc., McCain Foods Limited, Associated British Foods plc, and Ajinomoto, Nomad Foods, among others.

Frozen Food Market News

-

- In 2024 a leading frozen food brand Stouffer’s has unveiled its latest product which is the single portion White Cheddar Mac & Cheese. These new products are crafted to simplify cooking using different methods. It can use a microwave or steamer.

- In 2023 Conagra Brands introduced more than fifty new products across its frozen food categories. Their frozen meal portfolio features various prices and flavor options through its numerous brands.

- In 2023 Nestle reached an agreement with PAI Partners to set up a partnership initiative centered around its frozen pizza operations in Europe.

- In June 2021, Tyson foods announced addition of its new plant-based product line under the brand name First Pride, which it plans to distribute in the retail markets and e-commerce across Asia Pacific.

- In June 2021, Richard Pilgrim’s pride corporation completes the acquisition of Kerry Group’s Meats and Meals business in United Kingdom and Ireland for €819 million.

- In April 2021, Frostkrone announced that it has acquired Abergavenny Fine Foods Ltd., a leading British retail and food service company. Through this acquisition Frostkrone plans to expand its presence in the international markets by adding diversified finger food and snack food items to its product portfolio.

- In January 2021, Imperial Tobacco Company (ITC), a major conglomerate dealing in various verticals such as FMCG and hospitality based out of India announces that its frozen snack business grew by three times since covid, adding 10 new products to its portfolio during the same period.

- In June 2020, Nestle SA, a major food and beverage company based out of Switzerland partnered with Tajin International Corp., to introduce Tajin’s first frozen snack “Outshine Mango with Tajin” in the US. Through this partnership, Tajin aims to create a family-friendly brand image of their organization.

Frozen Food Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 296.1 Billion |

| Market Revenue Forecast in 2032 |

USD 447.6 Billion |

| CAGR |

5.3% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025–2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Type, By Freezing Technology, By Distribution, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Grupo Bimbo S.A.B. de C.V., Kraft Heinz Company, Nestle SA, Unilever, Kellogg Company, General Mills, Inc., Conagra Brands, Inc., McCain Foods Limited, Associated British Foods plc, and Ajinomoto, Nomad Foods among others; a total of 11 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Frozen Food Market Research Report Segmentation

The Global Frozen Food Market has been segmented on the basis of Product, Type, Freezing Technology, Distribution, and Regions. Based on the Product, the market is segmented into Fruits & Vegetables, Potatoes, Ready Meals, Meat, Fish/Seafood, Dairy Products, Bakery Products, Others. The Fruits & Vegetables segment is further segmented into [Fruits {Berries, Tropical Fruits, Citrus Fruits, Grapes, Stone Fruits, Others}, Vegetables {Peas, Broccoli, Cauliflower, Carrot, Bell Pepper, Beans, Mushroom, Avocado, Corn, Others}. Based on the Type, the market is segmented into Raw Material, Half-cooked, and Ready-to-Eat. Based on the Freezing Technology, the market is segmented into Individual Quick Freezing (IQF), Blast Freezing, and Belt Freezing. Based on the Distribution, the market is segmented into Food Service and Retail. The Retail segment is further segmented into Hypermarkets & Supermarkets, Convenience Stores, Online, Others.

Global Frozen Food Market by Product

-

- Fruits & Vegetables

- Fruits

- Berries

- Tropical Fruits

- Citrus Fruits

- Grapes

- Stone Fruits

- Others

- Vegetables

- Peas

- Broccoli

- Cauliflower

- Carrot

- Bell Paper

- Beans

- Mushroom

- Avocado

- Corn

- Others

- Potatoes

- Ready Meals

- Meat

- Fish/Seafood

- Dairy Products

- Bakery Products

- Others

- Fruits

- Fruits & Vegetables

Global Frozen Food Market by Type

-

- Raw Material

- Half-cooked

- Ready-to-Eat

Global Frozen Food Market by Freezing Technology

-

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

Global Frozen Food Market by Distribution

-

- Food Service

- Retail

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Global Frozen Food Market by Region

-

-

North America Frozen Food Market (Option 1: As a part of the free 25% customization)

- By Product

- By Type

- By Freezing Technology

- By Distribution

- US Market All-Up

- Canada Market All-Up

-

Europe Frozen Food Market (Option 2: As a part of the free 25% customization)

- By Product

- By Type

- By Freezing Technology

- By Distribution

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Frozen Food Market (Option 3: As a part of the free 25% customization)

- By Product

- By Type

- By Freezing Technology

- By Distribution

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Frozen Food Market (Option 4: As a part of the free 25% customization)

- By Product

- By Type

- By Freezing Technology

- By Distribution

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating the Frozen Food (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Grupo Bimbo S.A.B. de C.V.

- Kraft Heinz Company

- Nestle SA

- Unilever

- Kellogg Company

- General Mills, Inc.

- Conagra Brands, Inc.

- McCain Foods Limited

- Associated British Foods plc

- Ajinomoto

- Nomad Foods

Frequently Asked Question About This Report

Frozen Food Market [UP60A-00-1119]

The Global Frozen Food Market size was estimated at USD 447.6 billion in 2024

Frozen Food Market is driven by the evolving consumer preferences & increasing demand for convenient foods, busy & hectic lifestyle and surge in ecommerce industry growth

Frozen Food Market size is forecast to grow at a CAGR of 5.3% from 2025–2032

Major frozen food manufacturing companies are Grupo Bimbo S.A.B. de C.V., Kraft Heinz Company, Nestle SA, Unilever, Kellogg Company, General Mills, Inc., Conagra Brands, Inc., McCain Foods Limited, Associated British Foods plc, and Ajinomoto, Nomad Foods, among others.

Europe leads the market fueled by hectic lifestyles coupled with an increasing demand for affordable and convenient food prices.

Ready meals category dominates the market and is anticipated to maintain its lead in the forecast period

Related Reports

- Published Date: Dec-2024

- Report Format: Excel/PPT

- Report Code: UP60A-00-1119

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Frozen Food Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research