RegTech Market by Component, By Application, By Deployment Type, By Organization Size, By Vertical and By Region – Global Opportunities & Forecast, 2023-2030

Analysts at GMI Research estimates that the Regtech Market was worth USD 7.4 billion in 2022, and forecast to touch USD 31.6 billion in 2030, growing at a CAGR of 19.9% from 2023-2030.

To have an edge over the competition by knowing the market dynamics and current trends of “RegTech Market”, request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “RegTech Market”, request for Sample Report here

RegTech Market Key Drivers

The global RegTech market is projected to become more mainstream over the forecast period. The growing cost of compliance, along with the increasing requirement for faster transactions, are the two major factors that are surging the demand of the market in the coming years. Moreover, the regulatory sandbox approach to support the RegTech innovations and lower entry barriers with the Software-as-a-Service (SaaS) offerings is further driving the market growth. With the rising focus on data protection rules, companies now need to strictly adhere to compliances and monitor transparency in money transactions as laid down by the regulatory bodies to avoid huge penalties. In addition to this, the growing government initiatives for the adoption of RegTech by mandating KYC (Know Your Customer) to keep complete records and manage the identity of the customers creating the account is further propelling the demand for RegTech solutions.

In addition, growing cases of fraudulent activities over the internet have resulted in huge data and financial losses, which, in turn, is contributing to market growth. Also, RegTech helps in accurately detecting the unauthorized activities by minimizing the risk of errors caused due to human intervention, thus, increasing the adoption of RegTech in non-finance industries to automate the process of compliance data management, employee surveillance, fraud prevention, and AML activities, is estimated to pave the way for market. Furthermore, the increasing integration of connected devices with artificial intelligence (AI) and the internet of things (IoT)solutions will bolster the market growth.

The BFSI industry operates in a highly regulated environment and continuously facing new regulations to prevent money laundering and restrict terrorist funding. Thus, the adoption of RegTech software by fintech industry to simplify the implementation of regulations for financial institutions has increased, driving the market growth. On the other edge of the spectrum, the increasing concern related to cybersecurity and privacy is a major factor that is likely to hamper the growth of the global RegTech market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Application Segment Analysis

Regulatory intelligence application is predicted to grow at a higher CAGR during the forecast period. The regulatory intelligence allows identification and interpretation of the regulatory changes, enables financial institutions to effectively manage the regulatory environment and eliminate the risk of non-compliance. Increasing adoption of regulatory intelligence application across banking, financial services, and insurance sectors, to monitor, collect, and interpret regulatory data and track down developments in a rapidly changing environment, which will fuel the market growth. The process allows flexible research analysis while supervising the regulatory environment and ensuring compliance.

Component Segment Analysis

Component Segment Analysis

Solutions are projected to lead the market over the forecast period. RegTech solutions allows financial institutions to optimize and manage Know Your Customer data collection procedures, automate anti-money laundering, and interpret laws and associated changes over time. Moreover, they are not confined to single and help with reporting, identification of fraud, and regulatory intelligence, which has stimulated the market growth.

Organization Size Segment Analysis

Large enterprise is anticipated to lead the market over the forecast period. The continuous changes in rules and regulation according to the sector and region is surging the need to track all the processes, which in turn, is encouraging the large organizations to opt for RegTech solutions and services. Furthermore, the service and consulting vendors such as Deloitte, IBM, Thomson Reuters, and PwC, help the large companies to realize the advantages of efficiently managing their business functions while meeting the compliance mandates by allowing them to effectively implement RegTech solutions according to their business needs. The Small and Medium Enterprises (SMEs) segment is estimated to hold a larger share over the forecast period owing to the surging demand for identity and control management and risk and compliance management solutions.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

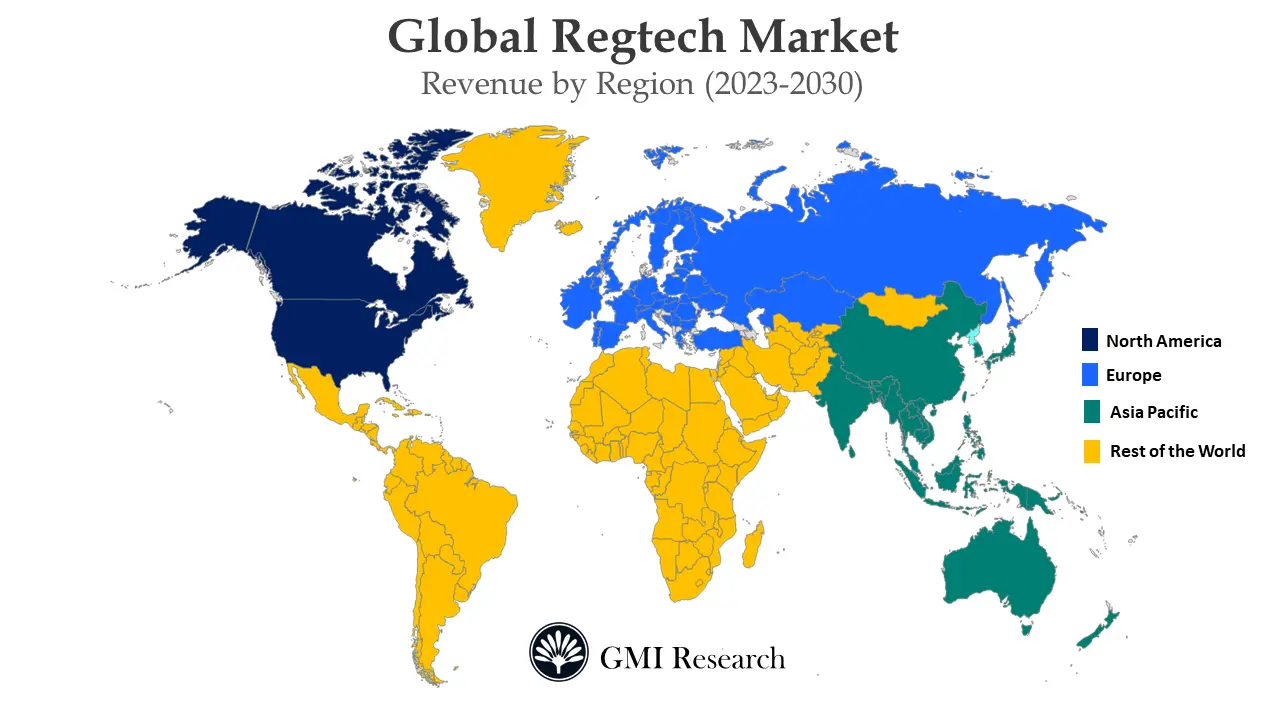

Regional Analysis

North America is expected to dominate the market over the forecast period. The early adoption of RegTech solutions by various financial institutions to decrease the compliance cost by leveraging advanced technologies which include machine learning, blockchain, cloud computing, Artificial Intelligence, and big data. The increasing demand for RegTech in the U.S. and Canada is driving the market size. Furthermore, the need to cater with strict norms to reduce the fraudulent activities is driving the market growth.

Various notable players operating in the market include ACTICO GmbH, Broadridge Financial Solutions, Inc., Deloitte, IBM, Jumio, MetricStream Inc., NICE, PwC, Accuity, and Thomson Reuters, among others.

Key Developments:

-

- In 2020, Accuity acquired the Apply Financial to offer real-time straight through processing and account validation payment solutions. Through this acquisition, Apply Financial will support the Accuity’s strategy of providing banks, corporates, and fintechs.

- In 2020, Broadridge Financial Solutions, Inc., announced to acquire FundsLibrary, a leader in fund document and data dissemination in the European market. Through this acquisition, Broadridge Financial Solutions, Inc., will increase its regulatory communications and digital data platform.

- In 2020, MetricStream Inc., expanded its presence in Asia-pacific region with an aim to increase its volume and velocity of risk and regulatory changes around the globe. It has also allowed the company to cater to Asian clients with its Governance, Risk and Compliance (GRC) products and solutions.

The global RegTech Market has been segmented on the basis of Component, Application, Deployment Type, Organization Size, vertical, and key regions. Based on component, the market is segmented solutions and services. The services segment is further categorized into professional services and managed services. Based on application, the market is segmented into risk and compliance management, identity management, regulatory reporting, anti-money laundering and fraud management, and regulatory intelligence. Based on deployment type, the market is segmented into cloud and on-premises. Based on organization size, the market is segmented into large enterprises, small and medium-sized enterprises. Based on vertical, the market is segmented into banking and capital markets, insurance, and non- finance.

For detailed scope of the “RegTech Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is the global RegTech Market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in the RegTech market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global RegTech market?

- Which component generated maximum revenues in 2022 and identify the most promising component during the forecast period?

- What are the various application areas of the global RegTech Market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 7.4 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Component, By Application, By Deployment Type, By Organization Size, By Vertical, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | ACTICO GmbH, Broadridge Financial Solutions, Inc., Deloitte, IBM, Jumio, MetricStream Inc., NICE, PwC, Accuity, and Thomson Reuters, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global RegTech Market by Component

-

- Solutions

- Services

- Professional Services

- Managed Services

Global RegTech Market by Application

-

- Risk and Compliance Management

- Identity Management

- Regulatory Reporting

- Anti-money laundering and Fraud Management

- Regulatory Intelligence

Global RegTech Market by Deployment Type

-

- Cloud

- On-premises

Global RegTech Market by Organization Size

-

- Large Enterprises

- Small and Medium-sized Enterprises

Global RegTech Market by Vertical

-

- Banking And Capital Markets

- Insurance

- Non- Finance

Global RegTech Market by Region

-

- North America RegTech Market (Option 1: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Type

- By Organization Size

- By Vertical

- US Market All-Up

- Canada Market All-Up

- Europe RegTech Market (Option 2: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Type

- By Organization Size

- By Vertical

- UK RegTech Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific RegTech Market (Option 3: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Type

- By Organization Size

- By Vertical

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW RegTech Market (Option 4: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Type

- By Organization Size

- By Vertical

- Brazil RegTech Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America RegTech Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the RegTech Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- ACTICO GmbH

- Broadridge Financial Solutions, Inc.

- Deloitte

- IBM

- Jumio

- MetricStream Inc.

- NICE

- PwC

- Accuity

- Thomson Reuters

Frequently Asked Question About This Report

RegTech Market [UP29A-00-1119]

The growing cost of compliance, along with the increasing requirement for faster transactions, are the t major factors driving the growth demand of the market.

The regulatory intelligence segment is predicted to grow at a higher CAGR during the forecast period as it allows identification and interpretation of the regulatory changes, enables financial institutions to effectively manage the regulatory environment and eliminate the risk of non-compliance.

The North America region is expected to dominate the RegTech market over the forecast period due to the early adoption of RegTech solutions by various North American financial institutions to decrease the compliance cost by leveraging advanced technologies such as machine learning, blockchain, cloud computing, Artificial Intelligence, and big data.

The growth rate of RegTech Market during 2023-2030 is 19.9%.

- Published Date: Mar - 2023

- Report Format: Excel/PPT

- Report Code: UP29A-00-1119

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

RegTech Market by Component, By Application, By Deployment Type, By Organization Size, By Vertical and By Region – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research

Component Segment Analysis

Component Segment Analysis