Industrial Fasteners Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

GMI Research analysis indicates that the Industrial Fastener Market size was estimated at USD 94.3 billion in 2022 and is slated to register a single digit CAGR of 4.5% over the forecast period, and is projected to reach USD 134.1 billion in 2030

To have an edge over the competition by knowing the market dynamics and current trends of “Industrial Fasteners Market,” request for Sample Report here

Major Industrial Fasteners Market Drivers

The market is primarily driven by the increase in global investment in the construction industry. In the construction and automotive industry, industrial fasteners are speedily utilized because they are mechanical and include anchors, rods, bolts, nuts, sockets, and others. Industrial fasteners have wide applications in different industries such as electronics, building, aerospace industry, and others will result in higher demand for industrial fasteners globally, the element is witnessed to drive the global industrial fasteners market growth. Rising industrialization globally, growth in the production of machinery, speed innovation in technology in the aviation sector, and growing demand for automobiles result in higher global fasteners market growth. Also, government intervention through a governing framework compels manufacturers to provide standardized products with better performance characteristics. European Automobile Manufacturers Association stated that the European auto industry is an international player, carrying quality ‘Made in Europe’ goods globally, and for the EU it generated a USD 85.50 Bn trade surplus.

Rising research and development activities and programs positively drives the market for new and developed industrial fasteners. Growing population in emerging nations, upsurge in residential and commercial development, growth in infrastructure development, and increasing spending in different industries alike telecommunications, and renewables are propelling the construction segment. The significant rise in development across the construction industry remarkably impacted the global industrial fasteners market size. Every construction project necessitates a variety of fastening items to guarantee protective and stable structures. Most of these items are crafted from carbon steel owing to its cost-effectiveness, ease of manipulation, and strength. Whereas, stainless steel stands out as the favoured construction material due to its resistance to corrosion, and heat, and impressive strength, increasing the demand for industrial fasteners globally. For instance, the Indian Government’s Smart Towns Mission, focusing on establishing 100 intelligent towns nationally, is set to introduce substantial funds for infrastructure and construction projects. The Government of India has initiated other projects such as the Pradhan Mantri Awar Yojana for superior housing and the Sagarmala Project, to develop the maritime industry, which fosters the demand for industrial fasteners extensively.

The global demand for industrial fasteners is highly impacted by regional and national government investments and programs in oil and gas, and infrastructure development. Frequent private and public investments assist infrastructure projects. The global industrial fasteners market share is accelerated by infrastructural developments and public and private assistance in oil and gas. Although, based on the International Energy Agency, the worldwide oil demand is projected to rise by 5.4 million barrels daily from 2021 to 2023, fostering the fasteners demand actively optimized in the oil and gas sector. However, the market growth for industrial fasteners might be restrained owing to the growing trend of substituting metal fasteners with tapes, and adhesives, especially in bonding and NVH applications, primarily within the automotive industry.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

By Raw Material, the Metal Fasteners segment holds the largest market size during the forecast period

The metal fasteners segment holds the largest share of global industrial fasteners industry due to its east availability and high mechanical strength. In the market, there are different types of fasteners such as bronze, steel, titanium, alloy, and others. Whereas, screws, bolts, river clamps, and others are industrial equipment which are made up of metal. The easy accessibility of metal materials at competitive rates develops the segment’s growth. There are different applications of metals such as strength capacity, and better resistance than other fasteners fostering demand for metal fasteners for construction and industrial use.

Plastic Fasteners segment is anticipated to grow at the fastest CAGR

The plastic fasteners segment is projected to grow due to its chemical-resistive and lightweight application. Plastic fasteners offer different properties such as cost-effectiveness, high chemical, and corrosion resistance, and lightweight due to which this segment gaining prevalence in the automotive industry.

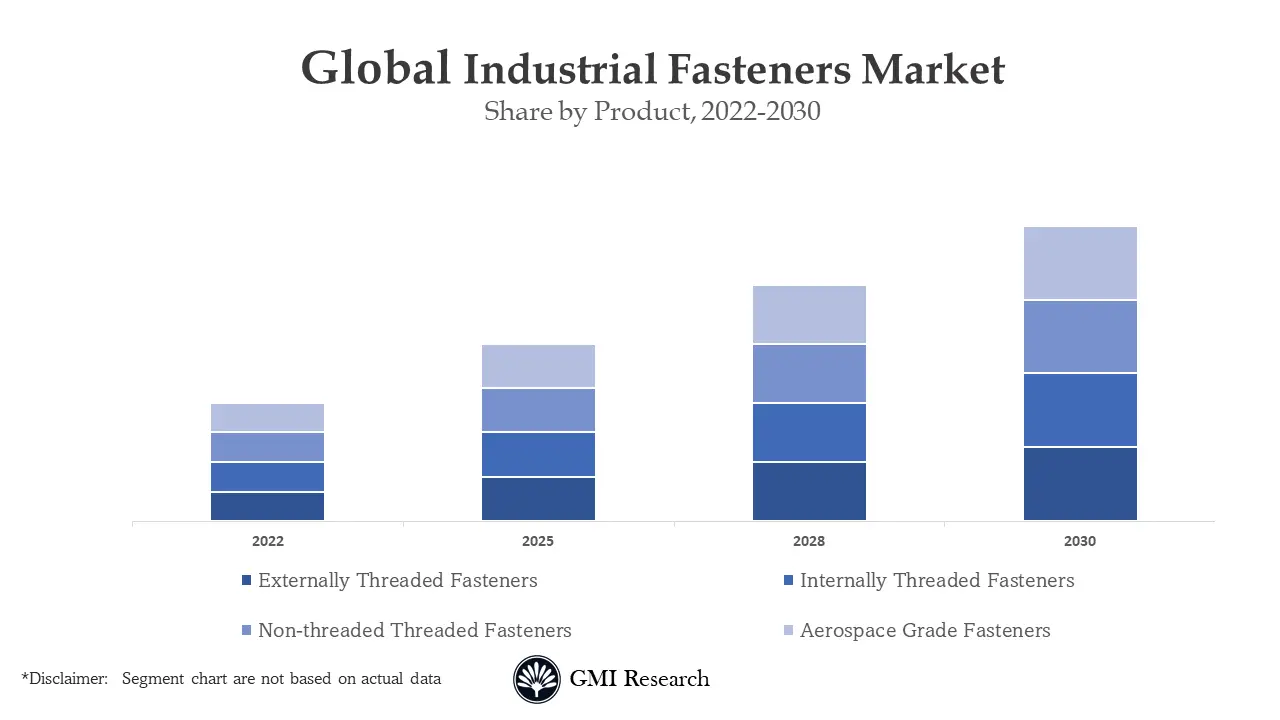

By Product, externally threaded segment registered the market growth

The externally threaded segment is predicted to hold the highest market share because it is extensively used by the different industries’ requirements. Screws, bolts, and studs are among the different types of threaded fasteners. Bolts when used with washers, nuts, and additional accessories, are commonly engaged to introduce robust yet transient connections that can be conveniently eliminated when necessary. When the nut on a bolt is tightened, it introduces a clamp load and friction, effectively preventing the fastener in place.

Non-Threaded segment is estimated to observe significant growth

The non-threaded segment is predicted to rise at the fastest CAGR due to its significant increase in demand in the construction industry. The non-threaded fasteners present a wide variety of applications across the construction industry such as roofing, decking, and subflooring. Moreover, great innovations in non-threaded fasteners to carry better execution are anticipated to have a positive impact on global demand for non-threaded fasteners in the industrial fasteners market.

By Application, Automotive segment dominated the highest revenue share

The automotive segment registered global market growth due to growing production of electric vehicles and passenger automobiles. A significant increase in automotive manufacturing plants globally will predict to rise in the demand for industrial fasteners across the automotive industries. Fasteners alike panels, bolts, rivets, nuts, screws, studs, and others are progressively used in the automotive industry. The automotive fasteners market segment is expected to maintain its dominance during the forecast period, driven by the high rise in demand for industrial fasteners. The rising production of electric vehicles emphasizes the requirement for lightweight fasteners, anticipated to further drive the market growth in the coming period.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

By Region, North America industrial fasteners market holds the largest market share

North America is predicted to register market growth in the forecast period due to growing need for commercial buildings and speedy extension of manufacturing functions across the nations. The U.S. is anticipated to dominate the global industrial fasteners market due to the existence of giant market players. Market players are considerably investing in different research and development activities to maintain the high competition in the global market. Additionally, the significant growth in the production of electric vehicles coupled with plastic fastening items across the U.S. is attaining high significance in the automotive sector, which further drives the North America market growth.

Asia Pacific industrial fasteners market is anticipated to witness the fastest growth

The Asia Pacific is predicted to be the fastest-growing region due to the expansion of the local market and an increase in public investments in residential and commercial construction projects. The Asia Pacific market is estimated to develop quickly due to the presence of OMEs. Whereas, it is predicted that in APAC, China holds the majority of the market share in the global market. Emerging nations such as China and India, high rise in disposable income of consumers, and substantial development and growth in the automotive industry are key drivers propelling the Asia Pacific industrial fasteners market.

Top Market Players

Various notable players operating in the market include Acument Intellectual Properties, LLC, Arconic, Dokka Fasteners, ATF Inc., Nifco Inc, LISI Group, MW Industries, Inc., Hilti Corporation, Sesco Industries, and Birmingham Fastener and Supply Inc., among others.

Key Developments:

-

- In 2023, Stanley Black & Decker Inc., launched the next generation flextorq impact driver bits through its subsidiary i.e., Dewalt.

- In 2023, MW Industries completed the acquisition of Western Wire Products Company through its subsidiary i.e., MW components to bolster its existence in the wire form market. This acquisition helps expand their portfolio to include metal components, involving industrial fasteners, solidifying their position in the industry.

- In 2023, Supply Inc and Birmingham Fasteners announced the acquisition of Pacific Coast Bolt Corp to diversify their manufacturing capabilities, reinforcing their standing in the industrial fasteners market & developing customer services for partners in America.

- In 2023, Birmingham Fastener inaugurated its newest brand, Phoenix Fasteners to expand its footprint across West Coast.

- In 2023, MW Components acquired Elgin Fastener Group to make bigger MW Components’ prevailing US-base manufacturing locations, empowering them to deliver fasteners and metal components for distribution globally, strengthening their global presence in the market.

- In 2022, Dokka Fasteners expanded to Lithuania to strengthen its supply chain and meet growing demand for Dokka Fasteners.

- In 2020, Birmingham Fastener and Supply Inc. acquired Atlanta Rod and Manufacturing, a domestic manufacturer of fasteners in Georgia. Through this acquisition, the company planned to expand its footprint in the United States.

- In 2020, Hilti Corporation launched smart fasteners which enable the digital documentation and unique identification on the job site. These products increase job productivity across the application chain and offer traceability from design to installation.

Segments covered in the Report:

The global industrial fasteners market has been segmented on the basis of Product, Application, Raw material and Region. Based on the raw material, the market is segmented into plastic fasteners and metal fasteners. Based on the product, the market is segmented into internally threaded fasteners, externally threaded fasteners, aerospace grade fasteners, and non-threaded fasteners. Based on the application, the market is segmented into aerospace, automotive, industrial machinery, building & construction, lawns & gardens, home appliances, furniture, motors & pumps, plumbing products, and others.

For detailed scope of the “Industrial Fasteners Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 94.3 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Raw Material, By Product, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Acument Intellectual Properties, LLC, Arconic, Dokka Fasteners, ATF Inc., Nifco Inc, LISI Group, MW Industries, Inc., Hilti Corporation, Sesco Industries, and Birmingham Fastener and Supply Inc., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Industrial Fasteners Market by Raw Material

-

- Plastic Fasteners

- Metal Fasteners

Global Industrial Fasteners Market by Product

-

- Internally Threaded Fasteners

- Externally Threaded Fasteners

- Aerospace Grade Fasteners

- Non-Threaded Fasteners

Global Industrial Fasteners Market by Application

-

- Aerospace

- Automotive

- Industrial Machinery

- Building & Construction

- Lawns & Gardens

- Home Appliances

- Furniture

- Motors & Pumps

- Plumbing Products

- Others

Global Industrial Fasteners Market by Region

-

-

North America Industrial Fasteners Market (Option 1: As a part of the free 25% customization)

- By Raw Material

- By Product

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Industrial Fasteners Market (Option 2: As a part of the free 25% Customization)

- By Raw Material

- By Product

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Industrial Fasteners Market (Option 3: As a part of the free 25% Customization)

- By Raw Material

- By Product

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Industrial Fasteners Market (Option 4: As a part of the free 25% Customization)

- By Raw Material

- By Product

- By Application

- Brazil Market All-Up

- South Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Industrial Fasteners Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Acument Intellectual Properties, LLC

- Arconic

- Dokka Fasteners

- ATF Inc.

- Nifco Inc

- LISI Group

- MW Industries, Inc.

- Hilti Corporation

- Sesco Industries

- Birmingham Fastener and Supply Inc.

Frequently Asked Question About This Report

Industrial Fasteners Market [UP1070A-00-0620]

The industrial fasteners market is mainly driven by various factors, including the rising demand for industrial fasteners across various industry verticals, along with the rise in the industrial activities across numerous countries.

The Metal Fasteners segment is expected to increase at a higher CAGR during the forecast period owing to the rising adoption of this type of raw material for the production of industrial fasteners, which can be used across various application areas.

Asia-Pacific is anticipated to dominate the market during the forecast period owing to the rising adoption of industrial fasteners as a result of the rapid expansion in industrial activities.

The market size of Industrial Fasteners Market in 2022 was USD 94 billion .

- Published Date: Mar-2023

- Report Format: Excel/PPT

- Report Code: UP1070A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Industrial Fasteners Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research