Blockchain in Energy Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2021-2028

Blockchain in Energy Market Size, By Type (Private and Public), By Component (Platform and Services), By Application (Supply Chain Management, Grid Management, Energy Trading and Payment Schemes), By End-User (Renewable Energy, Power, Oil & Gas, Electric Vehicle Charging, Trading, Security and Others) and By Region – Global Opportunities & Forecast, 2021-2028

Blockchain in Energy Market was valued at USD 1,597 million in 2020 and is expected to register a CAGR of 78.9% during the forecast period.

Introduction of the Blockchain in Energy Market Report

Blockchain in Energy is distributed ledger technology that has the potential to improve efficiencies of the utility providers with the help of chain for grid materials. Block chain offers unique solutions for renewable energy distribution for provenance tracking to facilitate consumer’s greater efficiency and control the energy sources. Additionally, blockchain in energy provides immutable ledger to secure real-time updates of energy usage.

Blockchain in energy industry is a decentralized ledger technology that enables consumers for distributing and trading energy among them. Blockchain technology enables renewable energy such as wind, solar and hydro energy producers for connecting with consumers or investors who can buy and sell renewable energy for a certain price.

To have an edge over the competition by knowing the market dynamics and current trends of “Blockchain in Energy Market”, request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The factors driving the global blockchain in energy industry market include the rising adoption of the advanced technology to transform the energy sector such as rooftop solar, smart metering, power, and electric vehicles into the cheapest form. Further, increasing adoption of the cryptocurrency by the energy sectors providers and firms have impelled the market growth. For example, the Energy Web Foundation has utilized Ethereum, Truffle developer tools, and Gnosis multi-signature wallets for building its energy platform so as to reduce the operational cost. Also, several countries are utilizing Blockchain into the renewable energy to lower traditional retail energy cost.

Further, rising security concern in the energy sector with surge in focus on the software development toolkits, decentralized identities, renewable energy markets, and grid integration of distributed energy resources of the leading players have witnessed potential market growth.

For instance, in 2019, Energy Web Foundation has launched the World’s First Public, Open-source, Enterprise-grade Blockchain for tailoring to the energy sector. This energy platform will facilitate the Energy Web Chain with the help of enterprise-grade blockchain in power sectors including utilities, grid operators, and live networks. These Blockchain technology is currently having 17 decentralized applications (dApps) running on Energy Web test networks to transition the live network which may strengthen the market growth.

Restraint in the Blockchain in Energy Market

However, high capital cost and skilled workforce require for building and adopting the blockchain technology in the energy sector which may hamper the market growth. Blockchain technology has lack of set of regulatory standards and hence facing uncertain potential challenges and limitations for a number of use cases.

Moreover, increase in the rapid adoption of the emerging decentralized technology ranging from peer-to-peer (P2P) energy trading and Internet of Things (IoT) applications, for decentralised marketplaces with rising adoption of electric vehicle charging and e-mobility services is expected to create ample opportunity for the growth of the global Blockchain in energy market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Component- Segment Analysis

Based on the component, services segment is expected to grow at the fastest rate in the global blockchain in energy market during the forecast period in 2020, owing to increasing demand by the several government and private companies for meeting the demand with cheap electricity for people around the globe.

Type – Segment Analysis

Based on the type, public segment is projected to have the largest market share over the forecast period in the global blockchain in energy market in 2020, owing to rising demand and government initiatives & funding to digitalize the energy sector with the help of the advanced technology such as Blockchain and IoT. For instance, in 2018, the Chilean National Energy Commission (CNE) had launched a blockchain project focusing on energy sector.

Application – Segment Analysis

Based on the type, peer-to-peer energy trading segment is projected to have the largest market share over the forecast period in the global blockchain in energy market in 2020, owing to rising adoption of the blockchain technology for the energy sector to reduce the operational cost. For instance, in 2020, larger energy firms such as British Petroleum p.l.c. (BP) and Austria’s Wien Energy have participated in peer-to-peer energy trading platform trial which will create ample opportunity for the growth of this segment.

End-user – Segment Analysis

Based on the end-user, power segment is projected to have the largest market share over the forecast period in the global blockchain in energy market in 2020, owing to rising energy demand for growing global population and to optimize the power operations.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

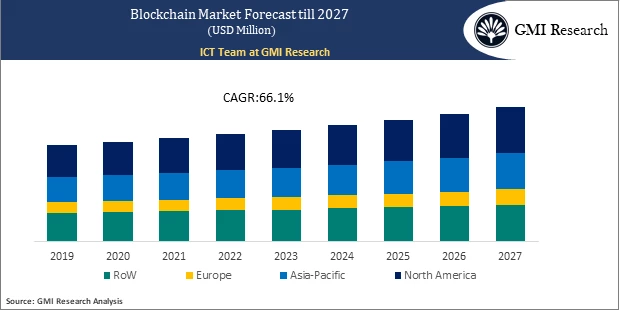

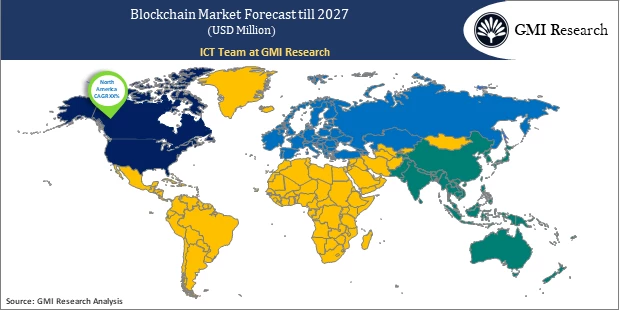

Regional – Segment Analysis:

Based on the region, Europe region is dominated the global blockchain in energy market in 2020, due to increasing government initiatives and funding for energy sector infrastructure sector with increasing energy consumption. For instance, in United Kingdom’s every home and small business has 53 Million electricity and gas smart meters installed in 2020.

Also, it is estimated that in the EU alone, the investment towards a more sustainable and secure energy system is increasing at USD 240 Billion per year for generation, network and energy efficiency development using the advanced technology such as Blockchain, IoT among others

Moreover, the North America region is also growing due to increasing electricity demand for network up-gradation. For instance, in the United States, an estimated USD 2 Trillion will be required for electricity network upgrades by 2030. Thus, such increase in the investments in the energy sectors will boost the blockchain technology in energy sector market growth.

Top Market Players

Various notable players operating in the market, include, IBM, Infosys, Microsoft, Accenture, SAP SE, Nodalblock, Power Ledger Pty Ltd, Oracle Corporation, Grid+, Deloitte, Amazon Web Services, INC, and among others.

Key Developments:

-

- In 2019, Oracle accelerated the adoption of enterprise Blockchain Worldwide that delivers new capabilities to accelerate business benefits. Oracle has added new features for users speed up the development, deployment and integration of new block-chain applications.

Segments covered in the Report:

The global Blockchain in Energy market has been segmented on the basis of type, component, application and key regions. Based on type, the market is segmented into private and public. In terms of the component, the global Blockchain in energy market is divided into platform and services. In terms of application, the global Blockchain in Energy market is divided into supply chain management, grid management, peer-to-peer energy trading and payment schemes. Based on the end-user, the global Blockchain in Energy market is classified as renewable energy, power, oil & gas, electric vehicle charging, trading & security and others.

For detailed scope of the “Blockchain in Energy Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global Blockchain in Energy market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in Blockchain in Energy market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global Blockchain in Energy market?

- Which types generated maximum revenues in 2020 and identify the most promising Component during the forecast period?

- What are the various applications of global Blockchain in Energy market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2019 |

| Market Forecast Period |

2020-2027 |

| Market Revenues (2020) |

USD 1,597 million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Component, By Application, By End-user and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | IBM, Infosys, Microsoft, Accenture, SAP SE, Nodalblock, Power Ledger Pty Ltd, Oracle Corporation, Grid+, Deloitte among others; a total of 10 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Blockchain in Energy Market by Type

-

- Private

- Public

Global Blockchain in Energy Market by Component

-

- Platform

- Services

Global Blockchain in Energy Market by Application

-

- Supply Chain Management

- Grid Management

- Peer-to-peer Energy Trading

- Payment Schemes

Global Blockchain in Energy Market by End-User

-

- Renewable Energy

- Power

- Oil & Gas

- Electric Vehicle Charging

- Trading

- Security

- Others

Global Blockchain in Energy Market by Region

-

- North America Blockchain in Energy Market (Option 1: As a part of the free 25% customization)

- By Type

- By Component

- By Application

- By End-User

- US Market All-Up

- Canada Market All-Up

- Europe Blockchain in Energy Market (Option 2: As a part of the free 25% customization)

- By Type

- By Component

- By Application

- By End-User

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Blockchain in Energy Market (Option 3: As a part of the free 25% customization)

- By Type

- By Component

- By Application

- By End-User

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Blockchain in Energy Market (Option 4: As a part of the free 25% customization)

- By Type

- By Component

- By Application

- By End-User

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Blockchain in Energy Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Blockchain in Energy (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- IBM

- Infosys

- Microsoft

- Accenture

- SAP SE

- Nodalblock

- Power Ledger Pty Ltd

- Oracle Corporation

- Grid+

- Deloitte

- Amazon Web Services, Inc

Frequently Asked Question About This Report

Blockchain in Energy Market [UP1196A-00-0620]

The factors driving the blockchain in energy industry market include the rising adoption of the advanced technology to transform the energy sector such as rooftop solar, smart metering, power, and electric vehicles into the cheapest form.

Which type segment occupied the largest market share in Blockchain in Energy Market over the forecast period?

The market size of Blockchain in Energy Market in 2020 is 1,597 million.

The growth rate of blockchain in energy market is 78.9% during the forecast period.

- Published Date: Jul - 2021

- Report Format: Excel/PPT

- Report Code: UP1196A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Blockchain in Energy Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research