Cold Storage Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

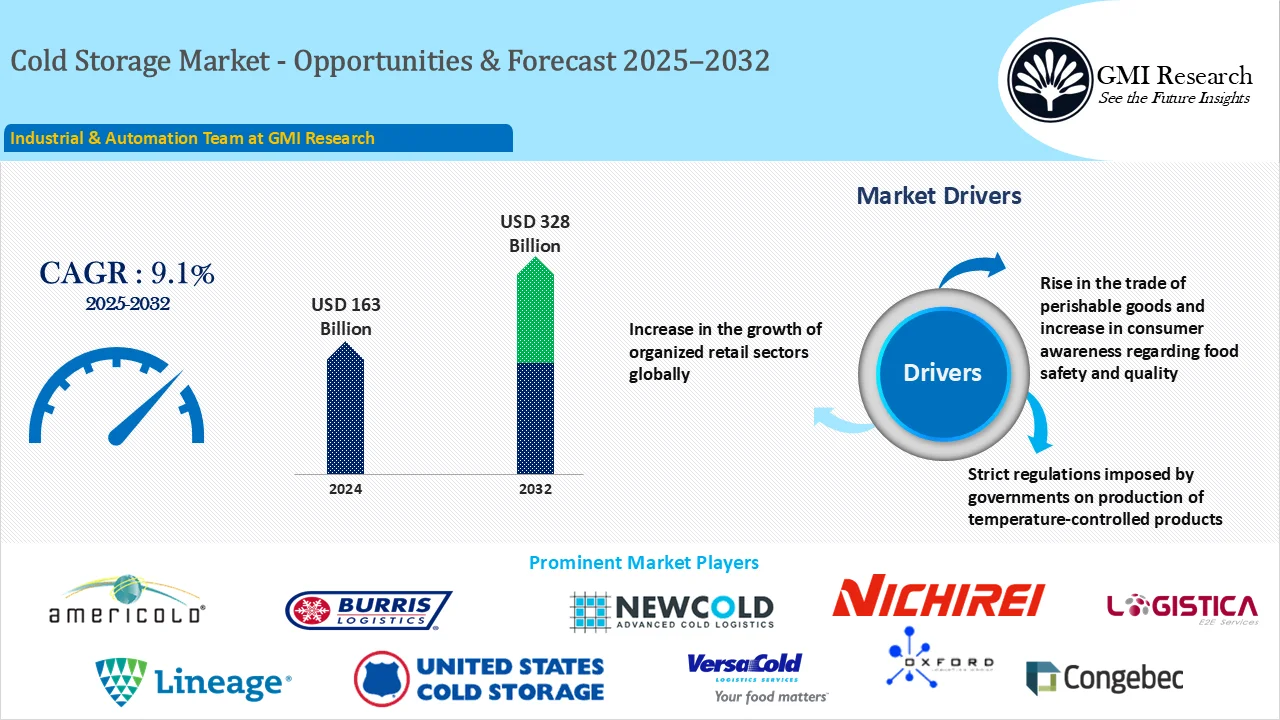

Cold Storage Market size reached USD 163.4 billion in 2024 and is estimated to reach USD 328.0 billion in 2032 and the market is estimated to grow at a robust CAGR of 9.1% from 2025-2032.

Key Cold Storage Market Trends and Drivers

Major factors driving cold storage market are Strict regulations imposed by government regarding production of temperature-sensitive products, surge in the trade of perishable commodities and increasing automation in refrigerated warehouses. Many drugs and medicines are sensitive to temperature and requires immediate supply chains to sustain. As a result, major companies in the pharmaceutical companies are using cold storage facilities to maintain integrity of drug substances and other products. To maintain quality and sustainability, Food and Drug Authority (FDA) of United States have set up regulations which asks distributors of prescription drug products to store these products at adequate temperatures. For setting up cold chain management systems, companies need to provide detailed records of stability data, shipping and storage duration at every point and geographical data like climatic zones. Demand for pharmaceutical products is expected to increase in future, as consumers are relying more on medicines to rising prevalence of diseases, which is expected to create lucrative opportunities for cold storage market.

Moreover, trade of perishable commodities has increased in the last two decades. Demand for perishable commodities such as fresh fruits and vegetables is one of the major factors propelling the trade of perishable goods international markets. As per the data released by government of Canada, in 2021, Canada imported approximately USD 6.9 billion products of fresh and frozen fruit, which indicates a 3.1% increase in year-over-year basis. Trade of perishable goods is expected to increase in future, which will accelerate the requirement of refrigerated solutions. As users and suppliers will need to store these products in temperature-controlled facilities to maintain its sustainability, which will create lucrative opportunities for cold storage market in coming years.

Consumers are increasing preferring to purchase grocery and other essential items through online channels. Witnessing these cold storage industry trends, various companies in the e-commerce vertical are focussing on developing strategies to reduce order delivery time primarily for groceries. For instance, Amazon set up its strategy in 2019 to provide free delivery for grocery items within two hours to all Amazon Prime subscribers. Increasing consumers preference for online channels will accelerate the market growth in coming years. In addition, companies operating in the food and beverage sector needs to make sure quality is up to the mark and comply with various standards. As a result, they will need invest in modern storage facilities and advanced vehicles. Energy prices have become a major concern especially in North American and European region. Requirement for maintaining advanced cold storage infrastructure and increasing energy, are becoming costly affair for companies, which is restricting the market growth.

As per market research report, Public Warehouses segment is projected to capture the largest market share.

In developed countries like U.S public warehouses have huge storage capacities. These types of warehouses can be owned by an individual or an agency and can be run independently. These warehouses offer handling and transportation services for variable or fixed fees to consumers. However, cost of building public warehouses are high, generally big companies plans to build such warehouses as they have higher budgets.

According to market report, Frozen segment is expected to dominate the market.

Frozen food products are gaining traction in developing countries such as India and China as these products can be stored for longer durations and requires less preparation time to cook. Various companies in food and beverage business store frozen food products in warehouses which can maintain temperature of these products within range of -10 to -20°F.

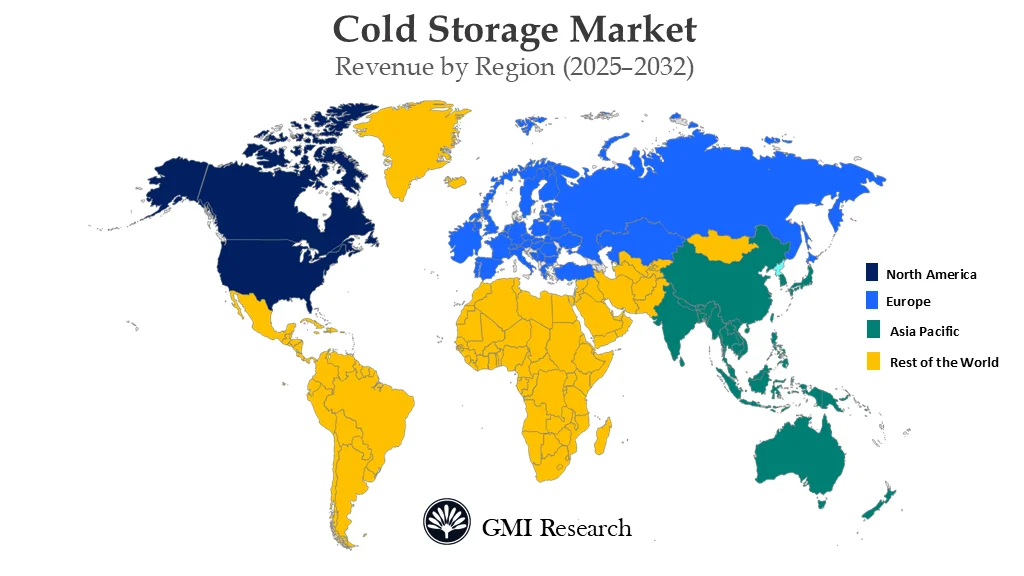

Based on Region, North American region is forecast to hold the largest market share.

Cold storage industry in United States is driven by surge in the demand for food and beverages due to changes in migration patterns, rise in the sales frozen snack and meat products, presence of massive refrigerated storage capacity and growing popularity of online grocery platforms. As the demand for grocery products are increasing, e-commerce share of total grocery sales in the country is expected to rise by more than 12% between 2021-2025.

Cold storage market in India is propelled by increasing demand for processed food items, government schemes supporting the development of cold chain infrastructure, growing need for more warehousing spaces and rising investments by foreign and domestic companies for developing manufacturing plants.

Largest Cold Storage Companies

Various notable players operating in the cold storage market are Lineage Logistics, AmeriCold Logistics LLC, US Cold Storage, Inc, NewCold Advanced Cold Logistics, Nichirei Logistics Group, Inc., VersaCold Logistics Services, Burris Logistics, Congebec, Oxford Logistics Group, and LOGISTICA Egypt, among others.

Key Developments:

-

- In August 2022, Lineage Logistics, a leading manufacturer of temperature-controlled supply chain and logistics solutions based out of U.S, completes acquisition of Frigorificos de Navarra. This strategic acquisition has helped the company enter the Spanish cold chain market and expand its storage services and capacity.

- In May 2021, MAG Capital Partners, LLC completed acquisition of 38,300-square-foot cold storage facility in Phoenix, Arizona.

- In May 2020, Briggs Equipment UK Ltd, a leader in material handling announced it has acquired Barloworld Handling UK assets. Through this acquisition Briggs became authorized dealer of sales and service of Hyster brand lift trucks in portion of Barloworld’s area.

- In October 2020, AmeriCold Logistics LLC announced that it has acquired Agro Merchants Group for USD 1.74 billion, helping the company become the leading player in the cold storage market. Through this acquisition company plans to expand its fresh produce offering and footprint in the European market.

Segments covered in the Report:

The Cold Storage Market has been segmented on the basis of Storage Type, Temperature Range, and Application. Based on Storage Type, the market is segmented into Facilities/Services and Equipment. The Facilities/Services segment is further segmented into Refrigerated Warehouse and Cold Room. Based on Temperature Range, the market is segmented into Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep-frozen (Below -25°C). Based on Application, the market is segmented into Fruits & Vegetables, Dairy, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals and Others.

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD 163.4 billion |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Storage Type, By Temperature Range, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Lineage Logistics, AmeriCold Logistics LLC, US Cold Storage, Inc, NewCold Advanced Cold Logistics, Nichirei Logistics Group, Inc., VersaCold Logistics Services, Burris Logistics, Congebec, Oxford Logistics Group, LOGISTICA Egypt, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Cold Storage Market by Storage Type

-

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Equipment

- Facilities/Services

Global Cold Storage Market by Temperature Range

-

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

Global Cold Storage Market by Application

-

- Fruits & Vegetables

- Dairy, Fish, Meat, & Seafood

- Processed Food

- Pharmaceuticals

- Others

Global Cold Storage Market by Region

-

-

North America Cold Storage Market (Option 1: As a part of the free 25% customization)

- By Storage Type

- By Temperature Range

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Cold Storage Market (Option 2: As a part of the free 25% Customization)

- By Storage Type

- By Temperature Range

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Cold Storage Market (Option 3: As a part of the free 25% Customization)

- By Storage Type

- By Temperature Range

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Cold Storage Market (Option 4: As a part of the free 25% Customization)

- By Storage Type

- By Temperature Range

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Cold Storage Market (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Lineage Logistics

- AmeriCold Logistics LLC

- US Cold Storage, Inc

- NewCold Advanced Cold Logistics

- Nichirei Logistics Group, Inc.

- VersaCold Logistics Services

- Burris Logistics

- Congebec

- Oxford Logistics Group

- LOGISTICA Egypt

Frequently Asked Question About This Report

Cold Storage Market [UP1075A-00-0620]

Cold Storage Market was worth USD 163.4 billion in 2024, and forecast to touch USD 328.0 billion in 2032, growing at a CAGR of 9.1% during 2025-2032.

North American region is forecast to dominate the market.

Some of the leading companies operating in the cold storage market are VersaCold Logistics Services, Burris Logistics, Congebec, Lineage Logistics, AmeriCold Logistics LLC, US Cold Storage, Inc, Oxford Logistics Group, LOGISTICA Egypt, NewCold Advanced Cold Logistics, and Nichirei Logistics Group, Inc., among others.

Public warehouse segment is expected to hold the largest market share.

Related Reports

- Published Date: Mar-2025

- Report Format: Excel/PPT

- Report Code: UP1075A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Cold Storage Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research