Construction Equipment Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

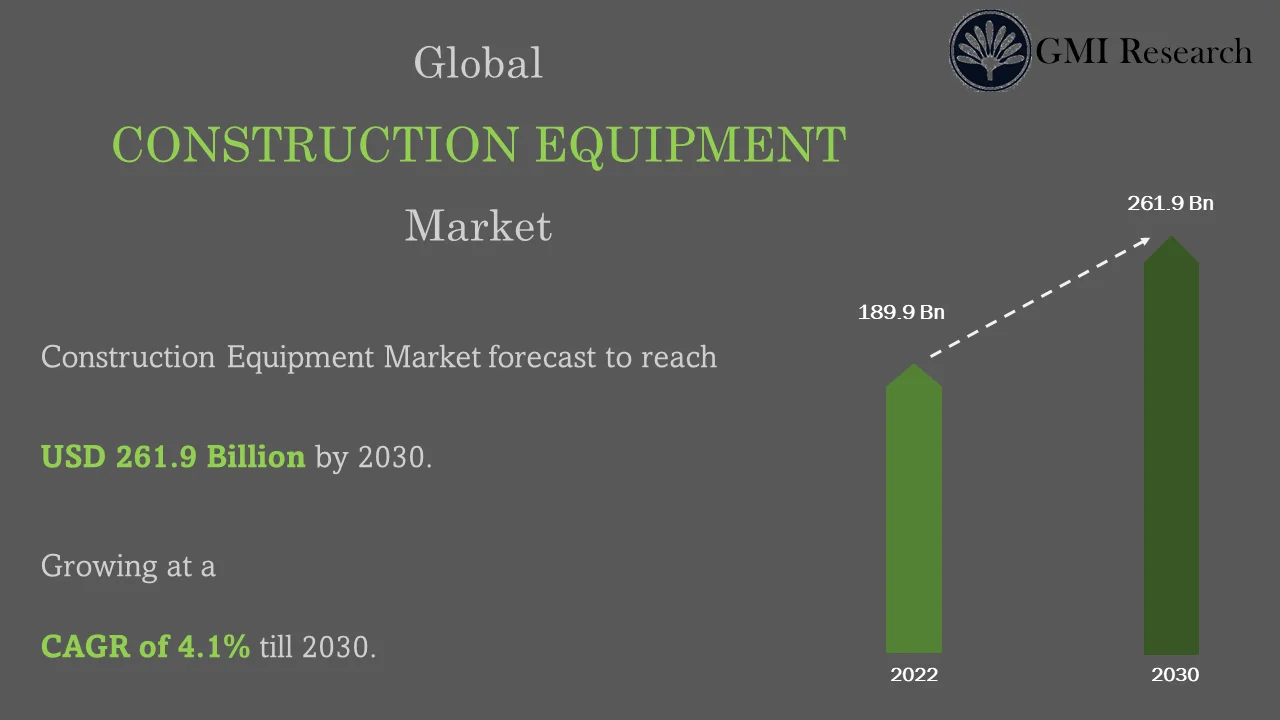

GMI Research analysis indicates that the Construction Equipment Market size was estimated at USD 189.9 billion in 2022 and is slated to register a single digit CAGR of 4.1% over the forecast period, and is projected to reach USD 261.9 billion in 2030

To have an edge over the competition by knowing the market dynamics and current trends of “Construction Equipment Market”, request for Sample Report here

Major Construction Equipment Market Drivers

Major factors driving construction equipment market are increasing investments in infrastructure projects in developing countries, rising urbanization, growing population growth rates and surge in the demand for luxurious and aesthetically pleasing buildings. Construction industry has grown rapidly worldwide in the last two decades, as the demand for new buildings, infrastructure and houses have increased due to rise in population growth rates, economic activities, and urbanization. Governments in many countries are heavily investing in residential, infrastructure and commercial projects to promote economic growth.

Indian government increased the capital investment by 33% on infrastructure to USD 122 billion for the fiscal year 2023-2024, which is equivalent to 3.3% of country’s GDP. This capital expenditure by government will majorly go towards railways, roads, and affordable housing. Of the total spending by Indian government’s budget, approximately 11% will go towards road and railway sector in the country. In the middle-east region, countries like Saudi Arabia and United Arab Emirates, are taking initiatives to diversify their economy to reduce their dependence on oil and gas sector by investing huge amounts of capital on commercial and residential projects to boost tourism industry. UAE is one the major attractive tourist attractive destination in the GCC (Gulf Cooperation Council) region. UAE government is planning to increase the number of hotel guests in the country from 4.1 million hotel guests in 2022 to 40 million by 2031 to boost tourism sector. Under the UAE Tourism Strategy 2031, the government aims to attract USD 27.24 billion in the tourism sector, all of these investments will go towards hospitality, travel and aviation sector to increase tourism in the country. Thus, increasing investments worldwide in infrastructure and commercial sectors will, boost the demand for construction materials and equipment, which will create lucrative growth opportunities for construction equipment market in coming years.

Automated solutions are gaining traction in the construction equipment industry as it boosts the overall production, requires minimum effort and can efficiently complete tasks which are time repetitive and time-sensitive in nature. Various companies are focussing to manufacture autonomous construction equipment to improve the safety and minimize maintenance costs. Moreover, growing need to replace the ageing construction equipment, and government policies promoting Public-Private Partnership models, are propelling the growth of construction equipment market. However, using Internet of Things (IoT) connected devices and remote control software with autonomous construction equipment, can increase the risks of cyber-attacks, which is restricting the market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Type, Excavators & Loaders segment is forecast to dominate the market.

Excavators are increasingly used for digging holes, trenches. Loaders find its application majorly in loading materials like dirt, asphalt, sand and gravel in conveyor belt and dump truck.

According to construction equipment market analysis, Earth Moving Machinery segment is projected to dominate the market.

Construction companies worldwide are increasingly using traditional heavy-duty excavators to construct dams, highways and roads coupled with rise in government’s spending on infrastructure projects, are driving the segment’s growth. Material handling machinery segment is forecast to forecast to grow at a high CAGR owing to increasing use of crawler cranes in manufacturing, and commercial building sectors. In addition, increasing number of construction activities around the world and growing investments in commercial projects, will boost the demand for material handling equipment.

In case, any of your paint points areas are not covered in the current scope of this report, Request for Customization here

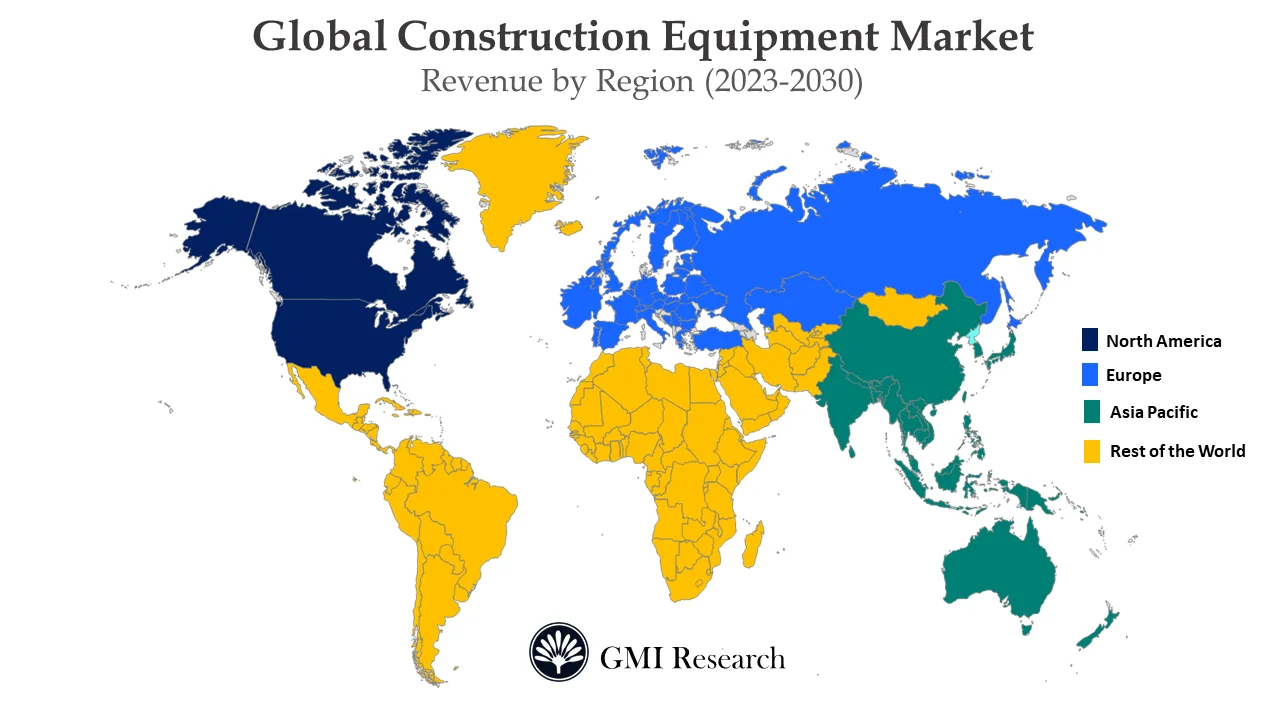

Based on Region, Asia-Pacific region is estimated to hold the largest construction equipment market share.

Asia Pacific construction equipment market is propelled by growing investments in infrastructure projects, increasing economic activities, rapid growth in rail and road infrastructure across India and China and rising urbanization. China construction equipment market is majorly driven by increasing public-private partnerships, government investments in construction projects and rise in the number of rural construction activities. Chinese government announced in 2022 that it will spend USD 1 trillion in construction projects. These funds will be majorly used for constructing greener cities, high-speed rail network, data centers in China, such investments will boost the demand for construction equipment in Asia-Pacific region. Additionally, major companies are focussing are partnering to develop environment friendly construction equipment. For instance, Komatsu, a major manufacturer of construction and heavy-industrial equipment, entered a strategic partnership with Proterra in January 2021 for developing battery-electric middle class hydraulic excavator.

India construction equipment market is driven by rise in government’s expenditure on the construction of smart cities and new houses, growing real-estate sector and increasing economic activities in the country. Additionally, North America construction equipment market is propelled by increasing investments by companies on installing advanced automated equipment in warehouses, growing demand for earthmoving equipment and rising urbanization. Increasing focus of governments on reducing traffic congestion in cities, rise in the cost of manufacturing and growing investments in hyperloop technology, are some of the factors driving Europe construction equipment market.

Construction Equipment Manufacturers

Various notable players operating in the construction machinery industry are Volvo Construction Equipment, Liebherr, Caterpillar, Komatsu, Terex, Zoomlion, CNH Industrial, Hitachi Construction Machinery, John Deere, and JCB, among others.

Key Developments:

-

- In June 2022, Fortescue, a major iron ore company based out of Australia announced that it has partnered with Liebherr Australia Pty Ltd, to manufacture and supply green mining haul trucks. This partnership will support company’s initiative to reduce carbon emissions.

- In January 2022, CanLift Equipment entered a strategic partnership with Xuzhou Construction Machinery Group Co., Ltd., to increase its sales of earthmoving equipment in Ontario. This partnership helped the company to expand its construction machinery equipment product line.

- In January 2022, Hitachi announced that will sell 50% stake of its construction machinery fleet to Itochu for USD 1.6 billion.

- In January 2021, Caterpillar, a leading producer of construction and mining equipment based out of United States announced introduced 3 new large excavators across Europe, Asia and African markets.

- In March 2019, Hyundai Construction Equipment (HCE), a major construction machinery manufacturing company based out of South Korea announced that is partnered with Cummins for developing remote engine technology for excavator engines. With the development of remote engine technology, customers of HCE will be able to check status of engine by using real-time report app.

- In January 2019, Volvo Construction Equipment announced that it will introduce a range of electric compact excavators and wheel loaders by the mid of 2020 and will immediately stope manufacturing diesel engine for these models.

Segments covered in the Report:

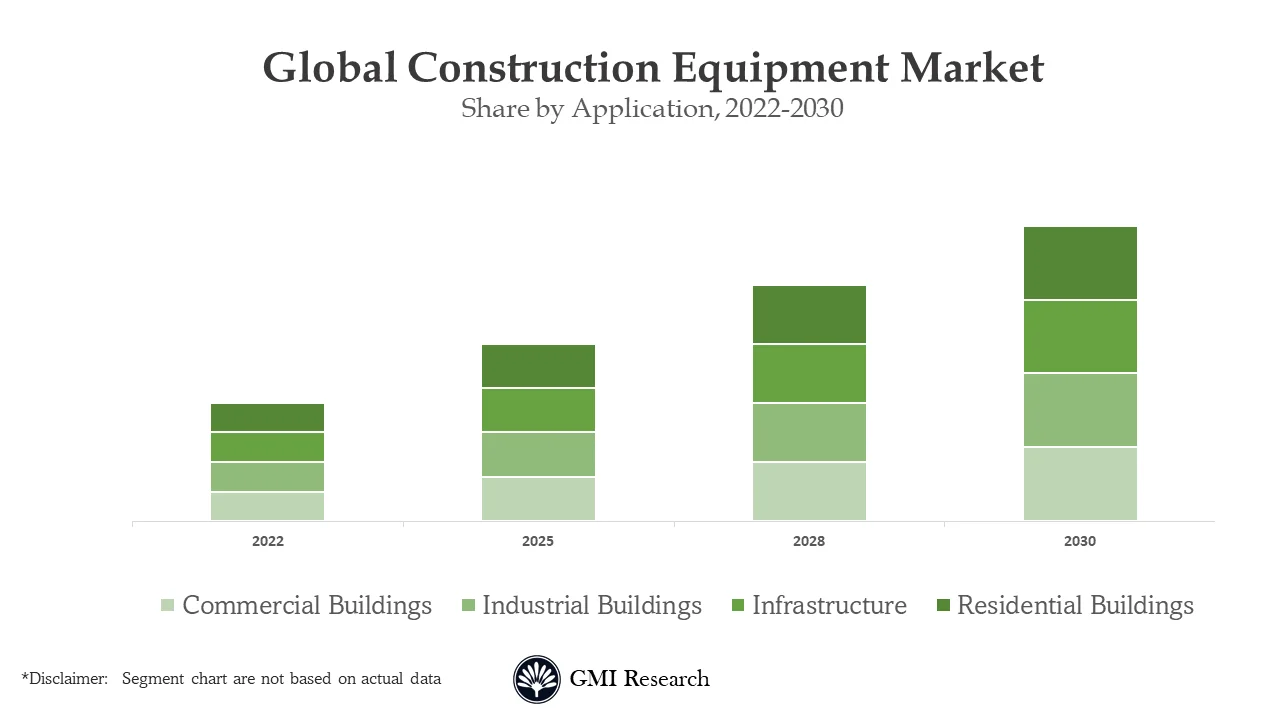

The Global Construction Equipment market is categorized on the basis of type, application, category, propulsion type, power, and key region. Based on the type, the market is segment into Excavators & Loaders, Cranes & Draglines, Dozers & Off-highway Trucks, and Others. Based on the application, the market is segmented into Commercial Buildings, Industrial Buildings, Infrastructure, and Residential Buildings. Based on the category, the market is segmented into Material-Handling Equipment, Earthmoving Equipment, Heavy Construction Vehicles, and Other Equipments. Based on propulsion type, the market is segmented into CNG/LNG/RNG, Diesel, and Gasoline. Based on power output, the market is segmented into <100 Hp, 101-200 Hp, 201-400 Hp and <400 Hp.

For detailed scope of the “Construction Equipment Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) | USD 189.9 billion |

| Market Base Year | 2022 |

| Market Forecast Period | 2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Application, By Category, By Product, By Propulsion Type, By Power Output, and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Volvo Construction Equipment, Liebherr, Caterpillar, Komatsu, Terex, Zoomlion, CNH Industrial, Hitachi Construction Machinery, John Deere, and JCB.; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Construction Equipment market by Type

-

- Excavators & Loaders

- Cranes & Draglines

- Dozers & Off-highway Trucks

- Others

Global Construction Equipment market by Application

-

- Commercial Buildings

- Industrial Buildings

- Infrastructure

- Residential Buildings

Global Construction Equipment market by Category

-

- Material-Handling Equipment

- Earthmoving Equipment

- Heavy Construction Vehicles

- Other Equipment

Global Construction Equipment market by Product

-

- Earth Moving Machinery

- Excavator

- Loader

- Others

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

Global Construction Equipment market by Propulsion Type

-

-

- CNG/LNG/RNG

- Diesel

- Gasoline

-

Global Construction Equipment market by Power Output

-

-

- <100 Hp

- 101-200 Hp

- 201-400 Hp

- >400 Hp

-

Global Construction Equipment market by Region

-

-

North America Construction Equipment Market (Option 1: As a part of the free 25% customization)

-

-

-

- By Type

- By Application

- By Category

- By Propulsion Type

- By Power Output

- United States of America (US) Market All-Up

- Canada Market All-Up

-

Europe Construction Equipment Market (Option 2: As a part of the free 25% customization)

- By Type

- By Application

- By Category

- By Propulsion Type

- By Power Output

- United Kingdom (UK) Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

-

-

Asia-Pacific Construction Equipment Market (Option 3: As a part of the free 25% customization)

-

-

-

- By Type

- By Application

- By Category

- By Propulsion Type

- By Power Output

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

-

-

ROW Construction Equipment market (Option 4: As a part of the free 25% customization)

- By Type

- By Application

- By Category

- By Propulsion Type

- By Power Output

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Construction Equipment Leading market players (Option 5: Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Volvo Construction Equipment

- Liebherr

- Caterpillar

- Komatsu

- Terex

- Zoomlion

- CNH Industrial

- Hitachi Construction Machinery

- John Deere

- JCB

Frequently Asked Question About This Report

Construction Equipment Market [UP624A-00-0620]

Global construction equipment market size was estimated at USD 189.9 billion in 2022.

Construction equipment market is forecast to grow at a CAGR of 4.1% over the forecast period 2023-2030.

Asia-Pacific region is projected to dominate the market.

Earth Moving Machinery segment is forecast to lead the market.

- Published Date: Jun-2023

- Report Format: Excel/PPT

- Report Code: UP624A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Construction Equipment Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research