Endpoint Security Market Size, Share and Analysis Report – Global Opportunities & Forecast, 2024-2031

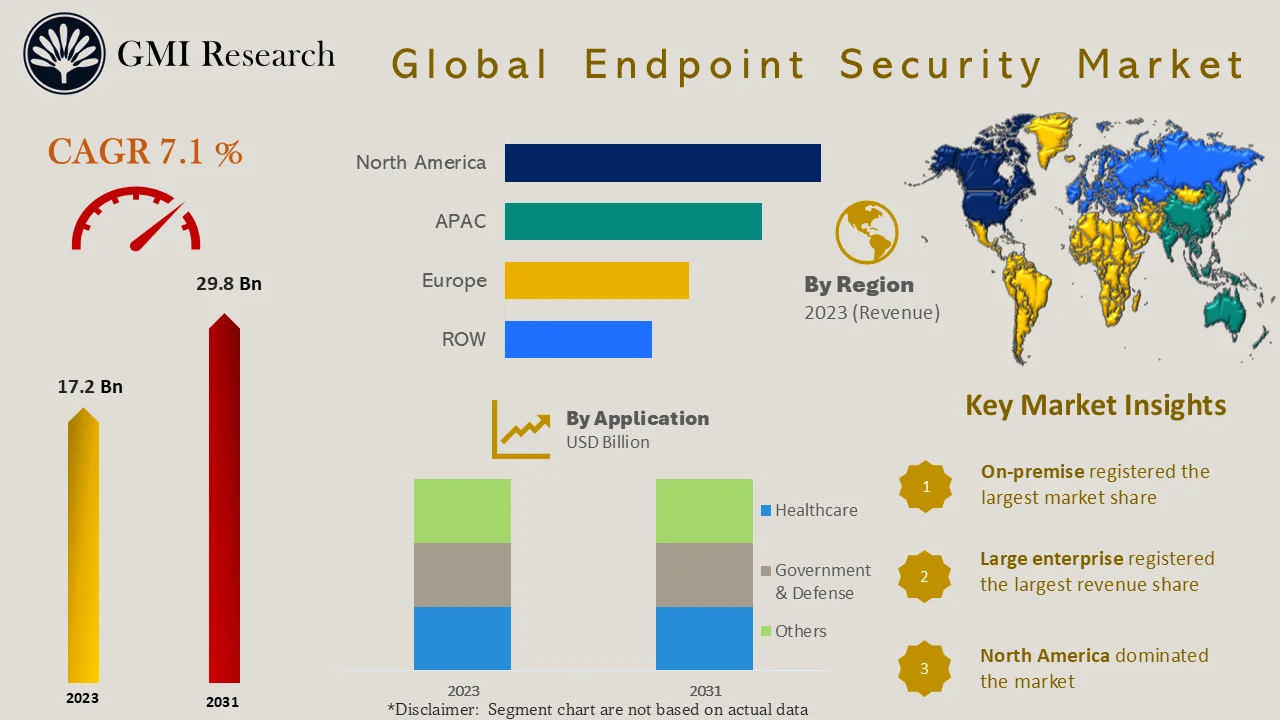

Endpoint Security Market size reached USD 17.2 billion in 2023 and is estimated to reach USD 29.8 billion in 2031, and the market is estimated to grow at a CAGR of 7.1% from 2024-2031 owing to the growing shift toward remote work and a rise in cybersecurity threats.

Major Market Drivers and Emerging Trends

The endpoint security market size expansion is mainly driven by the worldwide shift toward remote working and the increasing adoption of bring your own device (BYOD) policies globally. Companies are increasingly implementing these policies across their departments to offer greater flexibility to their workforce. As organizations adopt more remote servers and connected devices, the number of endpoints they manage has grown significantly. The rising trend of BYOD policies creates a need for endpoint solutions that secure devices and monitor activity which contributes to market growth.

The continuous growth in connected devices coupled with the rise in cyberattacks and threats globally are expected to further drive the need for endpoint security solutions in the coming years. The shift to remote work during covid pandemic has raised the vulnerability of endpoint devices to virus attacks. Due to the rapid digital transformation and the increased adoption of connected devices, network attacks are becoming more prevalent across industries. The widespread implementation of technologies like IoT and smart sensors is also anticipated to lead to a rise in endpoint attacks thereby driving higher demand in the market.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Many major players are incorporating emerging technologies like cloud computing and AI into their sophisticated systems to meet the rising need for security solutions across sectors. Businesses are turning to AI solutions to enhance security and protect their units from cyber threats. Machine learning technology enables organizations to identify illegal activities on endpoint devices and provides alerts in advance while AI is anticipated to be crucial in identifying zero-day attacks. Generative AI is able to simulate virtual environments and generate scripts that analyze network anomalies then pinpoint vulnerabilities. This allows enterprises to strengthen their security strategies effectively.

However, the shortage of qualified technical experts is hindering many organizations from fully updating and managing security systems that are powered by advanced technologies. Continuous training for technical staff is costly especially for SMEs. As technology evolves, this financial burden is likely to limit their ability to adopt endpoint protection systems. Overcoming such obstacles requires organizations to prioritize ongoing digital competency training for their employees.

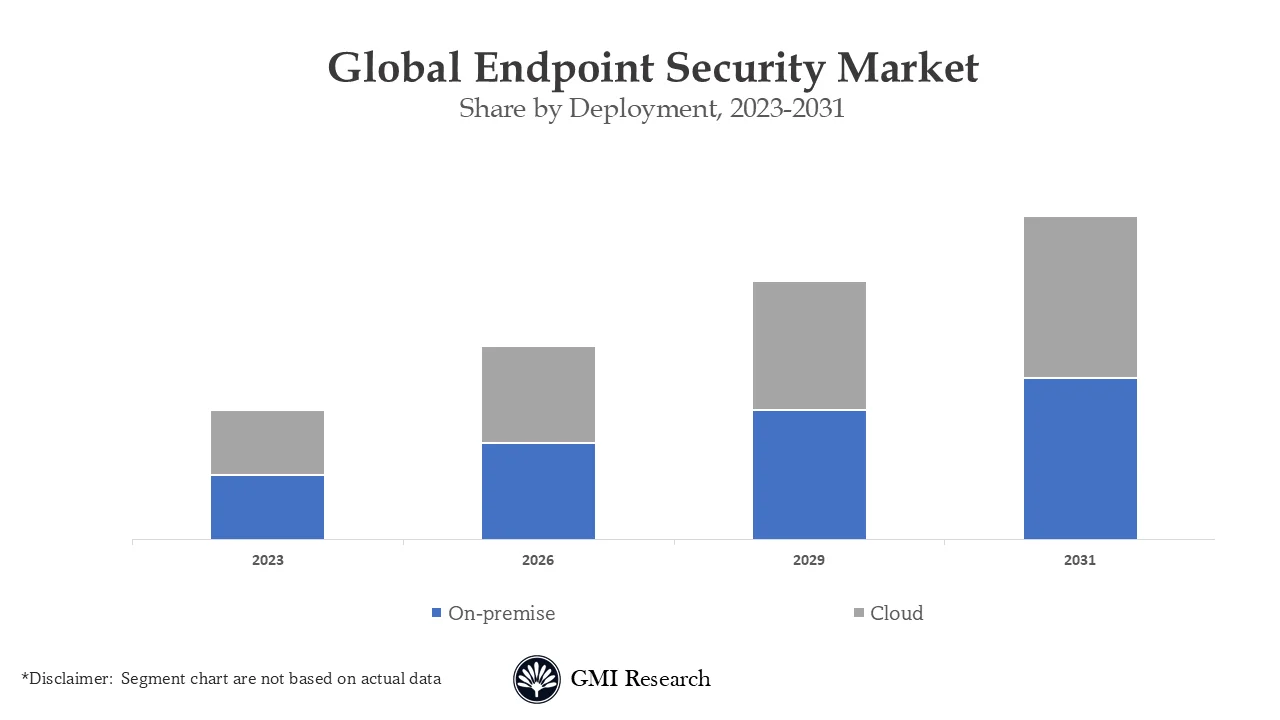

Deployment Insights: On-premise registered the largest market share

On-premise deployment is expected to be fueled by large organizations using in-house IT infrastructure. On-premise solutions allow for more flexibility in customizing and integrating with current IT infrastructure. Companies can personalize their endpoint security to meet their specific needs to ensure a seamless connection with other on-premise tools and systems. The ability to tailor solutions enables better integration with current workflows and business processes which improves the overall efficiency in managing security.

The cloud segment is also growing rapidly due to the increasing number of vendors offering cloud-based security solutions. This delivers an integrated strategy that centralizes threat control while swiftly detecting and preventing intrusions. By incorporating deep learning and predictive analytics, machines can be equipped to effectively counter cybersecurity threats. The solutions are further expected to see growing adoption due to their advantages including easier data maintenance and streamlined management. The cloud deployment allows for web-based management and provides enterprise-class endpoint protection which makes it possible for users to implement security without relying on IT staff for software management.

Organization Size Insights: Large enterprise registered the largest revenue share

The large enterprise holds a dominant market share due to the need to improve current threat prevention solutions while SMEs face challenges in adopting security services due to their reluctance to outsource to third parties. To cater to SMEs, software vendors are creating specialized security solutions that align with industry safety requirements while offering these solutions at much lower cost. This trend is likely to boost product demand within small and medium businesses while the growing recognition of advanced security solutions further accelerates endpoint security market growth.

Application Insights: Government & defense dominated the largest share

Government organizations and defense entities are responsible for safeguarding extremely critical and classified information such as national security or intelligence reports. To protect sensitive information from illegal access or cyberattacks, endpoint security delivers comprehensive defense for government endpoints which preserve data confidentiality and integrity.

As healthcare data is also considered as highly critical, there has been an alarming increase in cyberattacks targeting it worldwide. The growing reliance on sophisticated medical tools and electronic data in healthcare is contributing to the rise in endpoint devices thereby driving the need for robust security solutions. In the BFSI segment, endpoint software ensures the protection of critical data which prevents potential hacking incidents that could lead to massive financial losses.

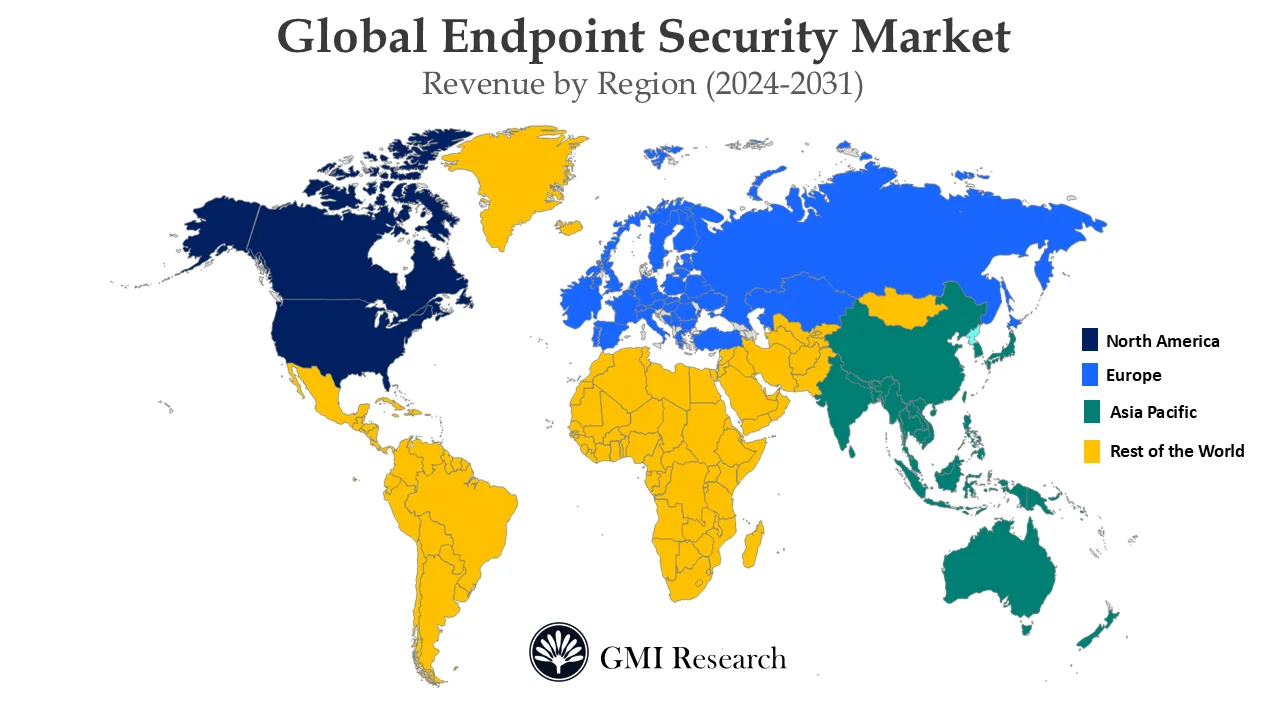

Regional Insights: North America dominated the market

North America led the market with major players offering innovative solutions to industries like BFSI and healthcare supported by the strict regulatory and compliance requirements in the region. Endpoint security is essential for helping organizations meet rigorous privacy regulations and data protection by safeguarding sensitive information while preventing illegal access. The widespread use of this technology in North America is further fueled by the rising application of behavioral analysis and automation in threat identification along with the growing data volume across various industries. There are also growing investments in real-time security measures in the region.

Asia Pacific is also experiencing notable growth driven by organizations that are going beyond regulatory compliance to implement technology solutions aimed at reducing threats to enterprise endpoints. The region also has the highest rate of mobile and connected device adoption which are particularly susceptible to endpoint attacks. China’s rapid development of 5G infrastructure is anticipated to drive a surge in need for endpoint security in the coming decade. This trend is fostering the use of connected devices which thereby boosting the need for endpoint security. Factors such as rising digitalization and increasing national security issues along with the widespread adoption of AI and IoT are further fueling market expansion in China.

Europe is poised for substantial market growth as there is an increasing emphasis on improving cybersecurity infrastructure in the years ahead. The United Kingdom and Germany are set to lead the market as they respond to the rise in cyberattacks with German businesses ramping up their IT spending to strengthen defenses. The UK government has also released guidelines to companies deploying external devices which focus on end-user security.

Top Market Players

Various notable players operating in the market include Bitdefender, ESET, Cisco, IBM, F-Secure, Kaspersky Lab, Panda Security SL, Microsoft, Sophos Ltd, Trend Micro Incorporated, Palo Alto, BlackBerry, Fortinet among others.

The global market is intensely competitive marked by rapid innovations in technology and continuously changing standards. Mergers and strategic partnerships are significant growth strategies for major players in the industry.

Key Developments:

-

- In 2023, Syxsense has collaborated with EVOTEK to offer improved endpoint security and management services utilizing the USEM solutions.

- In 2023, VMware launched advanced security capabilities to combat cyber threats and continued to extend the cloud patch management features which are crucial for maintaining robust endpoint security.

- In 2022 Google disclosed its plans to acquire Mandiant a move that aligns with the broader objective to help businesses protect themselves from the growing This acquisition emphasizes focus on enhancing its cybersecurity capabilities and reinforcing its standing as a reliable provider in the market.

- In 2022 SentinelOne Inc announced the creation of S Ventures which is a USD 100 million capital fund designed to invest in emerging cybersecurity startups that provide crucial support to the rapidly expanding industry.

- In 2019, Microsoft announced the launch of its endpoint manager, which comes with both the capabilities of configuration manager and Intune along with Microsoft products & services. This endpoint solution allows enterprises to manage a large number of devices used by their employees.

- In 2019, Trend Micro Incorporated launched their endpoint security solution, XGen Endpoint Security, which is a combination of cross generational threat defense systems that smartly applies the right solution.

Segments covered in the Report:

The Global Endpoint Security Market has been segmented on the basis of Component, Deployment, Organization Size and Application. Based on the Component, the market is segmented into Solution, Services. Based on the Deployment, the market is segmented into On-premise, Cloud. Based on the Organization Size, the market is segmented into Large Enterprise, SME. Based on the Application, the market is segmented into IT & telecom, BFSI, Industrial, Education, Retail, Healthcare, Government & Defense, Others.

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 17.2 Billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Component, By Deployment, By Organization Size, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Bitdefender, ESET, Cisco, IBM, F-Secure, Kaspersky Lab, Panda Security SL, Microsoft, Sophos Ltd, Trend Micro Incorporated, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Endpoint Security Market by Component

-

- Solution

- Services

Endpoint Security Market by Deployment

-

- On-premise

- Cloud

Endpoint Security Market by Organization Size

-

- Large Enterprise

- SME

Endpoint Security Market by Application

-

- IT & telecom

- BFSI

- Industrial

- Education

- Retail

- Healthcare

- Government & Defense

- Others

Global Endpoint Security Market by Region

-

-

North America Endpoint Security Market (Option 1: As a part of the free 25% customization)

- By Component

- By Deployment

- By Organization Size

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Endpoint Security Market (Option 2: As a part of the free 25% customization)

- By Component

- By Deployment

- By Organization Size

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Endpoint Security Market (Option 3: As a part of the free 25% customization)

- By Component

- By Deployment

- By Organization Size

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Endpoint Security Market (Option 4: As a part of the free 25% customization)

- By Component

- By Deployment

- By Organization Size

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Endpoint Security (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Bitdefender

- ESET

- Cisco

- IBM

- F-Secure

- Kaspersky Lab

- Panda Security SL

- Microsoft

- Sophos Ltd

- Trend Micro Incorporated

Frequently Asked Question About This Report

Endpoint Security Market [UP1759-001001]

Endpoint Security market is expected to grow at 7.1% during the 2024-2031

The endpoint security market size expansion is mainly driven by the worldwide shift toward remote working and the increasing adoption of bring your own device (BYOD) policies globally.

The Asia-Pacific region is projected to grow at a higher CAGR over the forecast period. This is majorly due to the increasing number of connected devices and growing adoption of IoT technologies across various industries

Related Reports

- Published Date: Dec-2024

- Report Format: Excel/PPT

- Report Code: UP1759-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Endpoint Security Market Size, Share and Analysis Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research