Enterprise Collaboration Market Size & Analysis Report by Deployment, By End-Use Industry, By Organization Size and By Region – Global Opportunities & Forecast, 2020-2027

Enterprise Collaboration Market Size & Analysis Report by Deployment (Cloud and On-Premise), By End-Use Industry (IT and Telecom, Banking, Finance, and Insurance, Retail, Education, Healthcare, Manufacturing, and Others), By Organization Size (Small and Medium Enterprises and Large Enterprises), and By Region

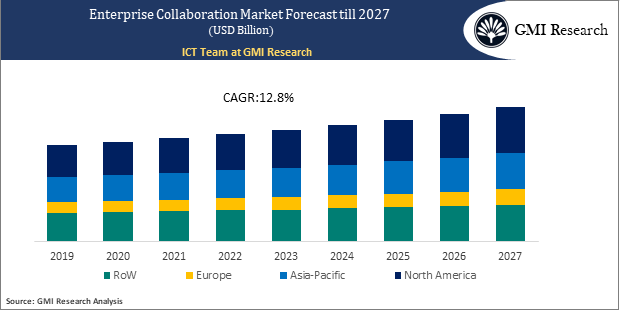

Global Enterprise Collaboration Market is estimated to witness a CAGR of 12.8% over the forecast period, reaching a value of USD 96 Billion by 2027, owing to the growing adoption of bring your own device trend.

To have an edge over the competition by knowing the market dynamics and current trends of “Global Enterprise Collaboration Market”, request for Sample Report here

Key Drivers

The growing emphasis of organizations to improve communication and collaboration across several stakeholders located across different nations is one of the major factors strengthening the enterprise collaboration market growth. Moreover, the increasing demand for real-time and remote collaboration tools, deployment of cloud-based services to expedite collaboration, emerging need to increase competitive advantage are anticipated to propel the market growth. Moreover, enterprise collaboration tools help organizations by improving the operational efficiency and productivity of the employees, thus helping organizations to cater their business goals, driving the market growth. The growing adoption of enterprise collaboration solutions is increasing owing to the growing penetration of social networking websites and increasing use of mobile devices for collaboration.

The growing awareness about the advantages of enterprise collaboration solutions, which include reduction in travel and phone costs, flexibility and agility for organizations, and optimal productivity, bolstering the market growth. Rapid digitalization and growing deployment of cloud-based solutions has significantly bolstered the data volume and data centers in several industry verticals, which is fueling the enterprise collaboration market share in the coming years. Moreover, the growing application of social networking websites and mobile devices for collaboration have enabled individuals to connect with each other, which will offer enormous opportunities to the market. However, the rising safety concerns might hamper the market growth. For example, in October 2019, Cisco’s videoconferencing tools were impacted by automated attacks. Cisco publicized an informal advisory for its Webex enterprise conferencing system and notified users about the online attack technique that allows anyone to join a meeting and listen to a private conversation. Thus, these sorts of threats discourage enterprises to shift to enterprise collaboration solutions, hindering the Enterprise Collaboration Market size.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

End-Use Industry – Segment Analysis

Banking, financial services, and insurance industry is forecast to grow at a faster CAGR over the upcoming years, because of the increasing inclination towards more advanced, agile, customer-driven, and collaborative ways to cater the growing demand for target audience’s demand by enterprise. According to the report by Accenture, 80% of the financial service organizations invest in digital technologies like unified communication, intranet platforms, and video and audio conferencing to expand employee’s efficiency.

Organization Size – Segment Analysis

Large enterprises are projected to lead the market over the forecast period, because of the increasing adoption of various enterprise collaboration solutions to help organizations supervise the progress of different activities related to the business procedures. In addition, the growing number of businesses, and increasing digitization in various industries have encouraged the large enterprises to choose for enterprise collaboration solutions for easy coordination and administration, which will propel the Enterprise Collaboration Market share.

Deployment Mode Segment Analysis

Cloud-based deployment model is anticipated to lead the market over the upcoming years, owing to the continuous growth in data produced. Cloud-based deployment mode offers a pay-per-use service model, which allows enterprises to pay only when a service is used, thus, saving the upfront capital expenditure needed for on-premises deployment. Thus, the use of cloud-based enterprise collaboration solutions helps organizations to adapt a changing business environment. Cloud-based deployment helps the organizations achieve high productivity, with access to real-time data with all application tools, fueling the segment’s growth. The growing adoption of cloud-based collaboration across several end-use industries such as healthcare, media and entertainment, BFSI, and education owing to the ability to offer real-time updates and data access, simplifying workflow and scalability, and improving organizational participation, stands to be one of the major factors propelling the segment’s growth.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Regional Analysis

Asia-Pacific is forecast to emerge as the fastest growing nation during the forecast period, primarily because of the strategic initiatives to encourage the adoption of enterprise collaboration solution. The emerging need for strong collaborations and improved decision-making and the existence of leading players including IBM, Cisco, Microsoft, and Adobe, will offer enormous opportunities for the market.

North America is likely to grow at a higher CAGR over the upcoming years, owing to the early adoption of cloud technologies. The advanced infrastructure and increasing implementation of hybrid cloud strategy to improve the way they operate their collaboration business, will propel the segment’s growth. Companies are personalizing their offerings to maintain their competitiveness in the market. For example, US-based Dropbox launched its latest version in June 2019 which is an enterprise software portal, allowing the users to launch apps with shortcuts for G Suite and use built-in Slack message-sending and Zoom video calls.

Top Market Players

Various notable players operating in the market include IBM Corporation, Microsoft, VMware, Inc., Atlassian, Cisco Systems, Inc., Google LLC, Adobe, Facebook, Igloo Software, and PagerDuty Inc., among others.

Key Developments:

-

- In 2021, Microsoft entered into a partnership with Morgan Stanley to speed up its digital transformation. Microsoft will offer Morgan Stanley with Microsoft Azure, which offers data security and would help in the cloud transformation of the firm.

- In 2021, Google merged with SpaceX to provide a safe global connectivity by using SpaceX’s Starlink to offer faster connection across Google Cloud’ infrastructure. This would offer businesses with flawless and secure access to the cloud.

- In 2020, Adobe decided to acquire Workfront, a leading vendor of Collaborative Work Management Tools. The companies will offer a single system to support planning, merger, and management for organizations to enhance productivity.

- In 2020, BabbleLabs, a leading company designing and developing communication software, was acquired by Cisco to enhance the user’s video meeting experience. The latest AI techniques will help the organization to differentiate human speech from unwanted noise, improving the communication and conferencing applications quality. This feature will help Cisco offer a high quality meeting experience from anywhere and on any device through the Webex application.

- In 2020 – PagerDuty Inc. declared new automation and intelligence capabilities in its Dynamic Service Directory, Business Response, and Intelligent Triage solutions, to support teams in reducing manual work, avoid outages and improve remote collaboration. The platform is established on the cloud platform for real-time critical work. These improvements will help companies be equipped to efficiently accelerate their digital transformation.

- In 2019 – Cisco introduced Webex Control Hub Extended Security Pack to provide Webex customers with strong data safety improvements. The latest safety features Cisco Cloudlock cloud access security broker (or CASB) with support to Data Loss Prevention (or DLP) policies for Webex Teams.

Segments covered in the Report:

The global Enterprise Collaboration Market has been segmented on the basis of deployment, end-use industry, organization size, and regions. Based on deployment, the market is segmented into Cloud and On-Premise. Based on End-Use Industry, the market is segmented into IT and Telecom, Banking, Finance, and Insurance, retail, education, healthcare, manufacturing, and others. Based on Organization Size, the market is segmented into Small and Medium Enterprises and Large Enterprises.

For detailed scope of the “Global Enterprise Collaboration Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Base Year |

2019 |

| Market Forecast Period |

2020-2027 |

| Market Revenues (2027) |

USD 96 Billion |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Deployment, By End-Use Industry, By Organization Size, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | IBM Corporation, Microsoft, VMware, Inc., Atlassian, Cisco Systems, Inc., Google LLC, Adobe, Facebook, Igloo Software, and PagerDuty Inc., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Enterprise Collaboration Market by Deployment

-

- Cloud

- On-Premise

Global Enterprise Collaboration Market by End-Use Industry

-

- IT and Telecom

- Banking, Finance, and Insurance

- Retail

- Education

- Healthcare

- Manufacturing

- Others

Global Enterprise Collaboration Market by Organization Size

-

- Small and Medium Enterprises

- Large Enterprises

Global Enterprise Collaboration Market by Region

-

- North America Enterprise Collaboration Market (Option 1: As a part of the free 25% customization)

- North America Market by Deployment

- North America Market by End-Use Industry

- North America Market by Organization Size

- US Market All-Up

- Canada Market All-Up

- Europe Enterprise Collaboration Market (Option 2: As a part of the free 25% customization)

- Europe Market by Deployment

- Europe Market by End-Use Industry

- Europe Market by Organization Size

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Enterprise Collaboration Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Market by Deployment

- Asia-Pacific Market by End-Use Industry

- Asia-Pacific Market by Organization Size

- China Global Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Enterprise Collaboration Market (Option 4: As a part of the free 25% customization)

- RoW Market by Deployment

- RoW Market by End-Use Industry

- RoW Market by Organization Size

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Enterprise Collaboration Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Global Enterprise Collaboration Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- IBM Corporation

- Microsoft

- VMware, Inc.

- Atlassian

- Cisco Systems, Inc.

- Google LLC

- Adobe

- Igloo Software

- PagerDuty Inc.

Frequently Asked Question About This Report

Enterprise Collaboration Market [UP2049-001001]

The major factors which are driving the growth of the enterprise collaboration market includes the emerging trend of BYOD and other mobility solutions.

The large enterprises segment is expected to dominate the market during the forecast period. This is mainly attributed to the increasing deployment of various enterprise collaboration solutions to allow companies to monitor the progress of various activities related to business procedures.

The Asia-Pacific is predicted to dominate the market during the forecast period. The rising requirement for robust collaborations and improved decision-making in enterprises are the two major factors that are contributing to the regional market growth.

The growth rate of this market during 2020-2027 is 12.8%.

- Published Date: Jan-2020

- Report Format: Excel/PPT

- Report Code: UP2049-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Enterprise Collaboration Market Size & Analysis Report by Deployment, By End-Use Industry, By Organization Size and By Region – Global Opportunities & Forecast, 2020-2027

$ 4,499.00 – $ 6,649.00

Why GMI Research