Agriculture IoT Market size reached USD 14.7 billion in 2023 and is estimated to reach USD 31.7 billion in 2031 and the market is estimated to grow at a high CAGR of 10.1% from 2024-2031 primarily driven by growing demand for fresh produce and increasing adoption of aquaculture monitoring devices.

Major Market Drivers and Emerging Trends

The growth of agricultural IoT market is estimated to drive due to a growing penetration of AI and the IoT embedded technologies across farming sector, a rising need for agricultural output, and increasing government favorable policies to lead the usage of modern agricultural techniques to improve the effectiveness of farming coupled with influencing focus on livestock monitoring. The integration of Internet of Things in agriculture empowers farmers to monitor water levels in tanks in real time, improving the effectiveness of irrigation. The advancements in IoT technology have led to the widespread usage of sensors at different stages of farming, allowing detailed tracking of resources and time required for seed-to-vegetable growth. With an increasing global population, there is a considerable demand to foster farm yields, and practically every aspect of agriculture can now be automated. Furthermore, the rising adoption of drones for precision farming and integrating big data in agriculture are anticipated to influence market growth positively. Projections indicate that agriculture’s usage of drones and robotic equipment could constitute a substantial 80% share of the commercial drone market in the coming period.

In addition, the integration of IoT-based technology enhances the quality and quantity of farming production. Through a unified platform, farmers can interactively share, store information, and analyze, leading to increased effectiveness. The global IoT in the agriculture market is witnessing growth owing to the widespread adoption of the Internet of Things and AI by farmers. Factors such as increased focus on livestock monitoring, increasing need for organic goods, disease detection, diminishing fertile land, population growth, and robust government support for precision farming practices contribute to this positive trend.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

In agricultural practices, the increased adoption of improved agricultural technologies such as remote sensing, variable rate technology (VRT), data management software, and GPS monitoring, is estimated to boost the market size. Additionally, the expanding global population, coupled with an increased need for high-performance food products, is projected to be a propelling factor for the market in the forecast period. Government-driven strategic initiatives promoting modern farming techniques through the integration of big data analytics in smart farming are expected to drive the IoT in the agriculture market. Furthermore, the global demand for food, along with the growing number of population, particularly in developing economies such as India, will generate different growth prospects in the market. It is anticipated that change in climate, and deployment of IoT-based technologies in the agriculture sector has become important to optimize production and moderate the risk of disease.

The increasing usage of smartphones and the Internet among farmers is fostering their adoption of the latest technologies to enhance both the quality and quantity of yield. However, the shortage of easily accessible and management aggregation of standardized data tools coupled with a high initial investment required for agricultural IoT devices, are restraining the market in the forecast period.

Unmanned aerial vehicles (UAVs) or drones are initially used on battlefields and rapidly transitioning to agricultural fields. They capture precise aerial images covering extensive locations in an individual flight, resulting in significant cost savings. Agricultural drones are less costly than surveillance types and are equipped with improved sensors and imaging capabilities. This empowers farmers with innovative approaches to enhance crop yield and decrease resource wastage. Farmers traditionally rely on satellite imagery and plans for crop monitoring, but these methods are time-consuming, with data processing and analysis requiring more time. The Association for Unmanned Vehicle Systems International forecasts that agricultural applications will constitute 80% of the commercial drone market by 2030. This shift indicates an increasing recognition of the effectiveness and efficiency that drones bring to crop monitoring and analysis in comparison to traditional methods. With the establishment of commercial use guidelines by the Federal Aviation Administration, the drone sector is expected to result in more than 100,000 jobs and approximately half a billion in tax revenue by 2025 across the US, with the agriculture sector projected to lead. Drones are effectively capturing real-time data for precision farming, especially for large firms. The widespread integration of unmanned aerial vehicles or drones is foreseen to offer opportunities for the growth of the agriculture IoT market.

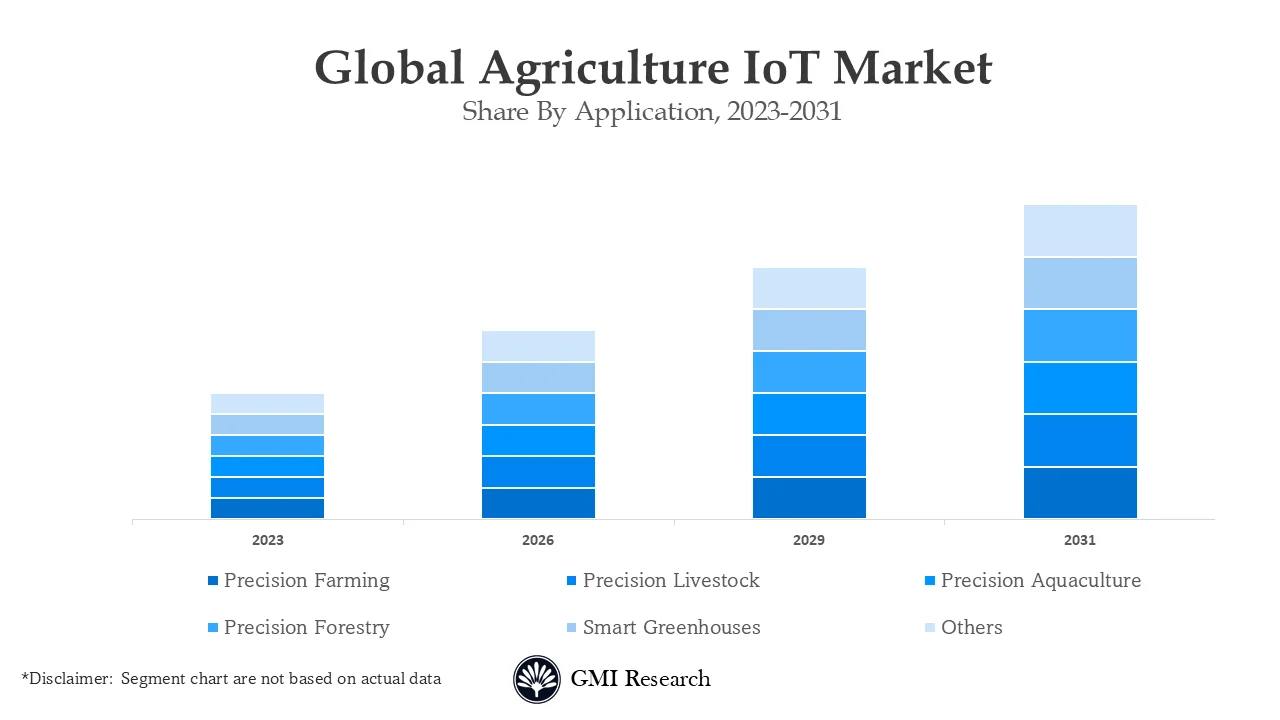

Based on Application, Precision Aquaculture segment is projected to grow at a faster rate.

The growth of the fishing industry segment is driven by an increased requirement for real-time tracking of fishing activities. Government initiatives supporting freshwater aquaculture production coupled with increasing investments in research and product innovations contribute significantly to the segment growth. Precision farming is becoming increasingly prevalent in this sector which offers farmers the ability to apply inputs precisely based on soil conditions and crop demands. This approach improves productivity and profitability. Using different IoT-based software and hardware devices, farmers can gather farm-related information, empowering them to make more informed and efficient decisions.

Based on Farm Type, Small Farms segment is forecast to grow at a higher CAGR.

The market for agriculture IoT for small farms is estimated to witness a maximum CAGR in the forecast period. Small farms are projected to embrace advanced and automated technologies at an increased rate. This trend is attributed to the decreasing cost of farm automation equipment and technological innovations making it increasingly viable to deploy automation equipment on smaller farms, resulting in substantial returns on investments.

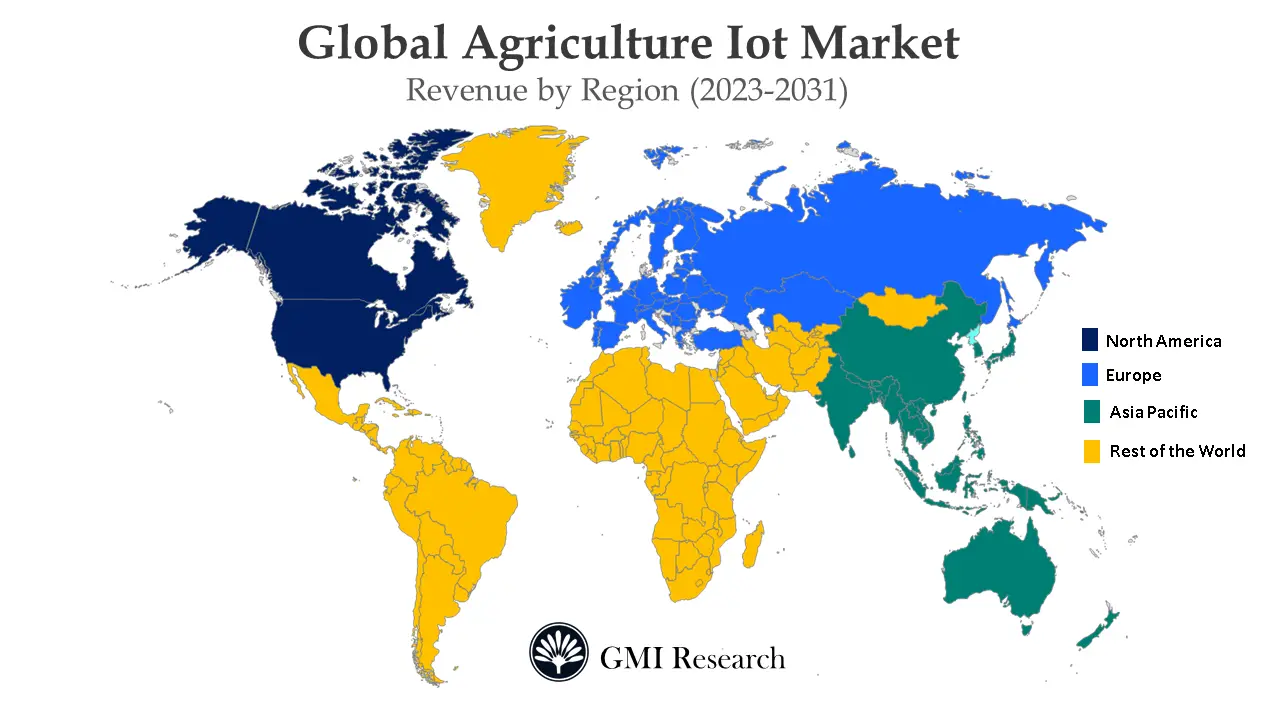

Based on Region, Asia-Pacific region is forecast to grow at the fastest rate.

The agriculture IoT market in Asia Pacific is driven by government policies motivating the adoption of smart agriculture technologies. Factors including the adoption of smart agriculture technologies, increasing population growth rates, high pressure to improve farm yields, and accessibility to arable land further drive regional growth. The Asi, hosting 60% of the world’s population, nearly 4.3 billion individuals, includes highly populous countries like China and India, as per the UNFPA Asia Pacific. Furthermore, the agriculture IoT market in the Asia Pacific benefits from the existence of key market companies and an increasing number of product launches, contributing to APAC market growth. In Europe, the demand for food, shifts in lifestyles, changing climate conditions, and growing shortage of natural resources are presenting a positive impact on the adoption of IoT-based technologies in the agriculture sector. These factors further propel the growth of the agriculture IoT market in the European region. Farmers across the European countries are adopting smart and automated agricultural technologies including yield monitoring, GNSS technology for guidance, and crop scouting. In Germany, the increasing adoption of animal tracking, cattle management, and many other livestock monitoring technologies is gaining traction among customers. These factors, coupled with continuous technological advancements, are key factors for agriculture IoT market growth.

Key Developments:

-

- In 2021, Deere & Company, a major agriculture equipment manufacturer based out of the United States, announced that it has launched the latest version of ExactRate, which is an on-planter technology that fertilizes new crops at a higher speed before and minimizes the amount of fertilizer tank refills necessary during planting.

- In 2021, DeLaval incorporated RC700 and RC550 to their robot collection. These robots were produced with the cow ease and hoof situation on solid flooring. The collector can handle any type of manure due to its advanced rotational intake systems without the need for extra water.

- In 2021, Raven Industries announced the introduction of its first driverless agriculture technology to support farmers to monitor area activities, and others.

- In 2019 AGCO Corporation announced to enter a strategic partnership with Solinftec which is a leading developer and provider for digital agriculture solutions. With this partnership AGCO Corporation’s customers will get access to the solution portfolio of Solinftech such as weather stations and many more.

- In 2019, Raven Industries, Inc., a developer of precision agriculture products based in the United States, announced to agreement with Dot Technology Corp. The agreement focuses on opening a new path to autonomy for farmers and bringing disruptive technologies into the market.

Segments covered in the report:

The Agriculture IoT Market has been segmented on the basis of hardware type, farm type, and application. Based on the hardware type, the market is segmented into precision farming hardware, precision livestock hardware, precision aquaculture hardware, precision forestry hardware, smart greenhouses hardware, and others. By farm type, the market is segmented into large farms, mid-sized farms, and small farms. By application, the market is segmented into precision farming, precision livestock, precision aquaculture, precision forestry, smart greenhouses, and others.

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 14.7 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2023-2031 |

| Base Year & Forecast Units |

Value (USD Billion) |

| Market Segment | By Hardware Type, By Farm Type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Deere & Company, Trimble Inc., AGCO Corporation, Raven Industries, Inc., DeLaval, GEA Group, AgJunction, Merck & Co., Inc., Ponsse Oyj, and Komatsu Forest; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Agriculture IoT Market By Hardware Type

-

- Precision Farming Hardware

- Precision Livestock Hardware

- Precision Aquaculture Hardware

- Precision Forestry Hardware

- Smart Greenhouses Hardware

- Others Hardware

Agriculture IoT Market By Farm Type

-

- Large

- Mid-Sized

- Small Farms

Agriculture IoT Market By Application

-

- Precision Farming

- Precision Livestock

- Precision Aquaculture

- Precision Forestry

- Smart Greenhouses

- Others

Global Agriculture IoT Market by Region

-

-

North America Agriculture IoT Market (Option 1: As a part of the free 25% customization)

-

-

-

- By Hardware Type

- By Farm Type

- By Application

- US Market All-Up

- Canada Market All-Up

-

-

-

Europe Agriculture IoT Market (Option 1: As a part of the free 25% customization)

-

-

-

- By Hardware Type

- By Farm Type

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain All-Up

- Rest of Europe Market All-Up

-

-

-

Asia-Pacific Agriculture IoT Market (Option 3: As a part of the free 25% customization)

-

-

-

- By Hardware Type

- By Farm Type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

-

-

RoW Agriculture IoT Market (Option 4: As a part of the free 25% customization)

-

-

-

- By Hardware Type

- By Farm Type

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Agriculture IoT Leading Market Players (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- Raven Industries, Inc.

- DeLaval

- GEA Group

- AgJunction

- Merck & Co., Inc.

- Ponsse Oyj

- Komatsu Forest

Frequently Asked Question About This Report

Agriculture Iot Market [UP259A-00-1219]

Agriculture IoT market size reached USD 14.7 billion in 2023 and is projected to reach USD 31.7 billion in 2031 and the market is growing at a high CAGR of 10.1% from 2024-2031.

Significant players are prioritizing R&D and engaging in collaborations with other organizations to improve their market presence.

Major players are investing in R&D and forming collaborations with other organizations, including through mergers and acquisitions, to strengthen their market presence.

Projections indicate that agriculture's usage of drones and robotic equipment could constitute a substantial 80% share of the commercial drone market in the coming period.

Related Reports

- Published Date: Nov-2024

- Report Format: Excel/PPT

- Report Code: UP259A-00-1219

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Agriculture IoT Market and Analysis Report – Opportunities and Forecast 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research