Airborne Surveillance Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

Airborne Surveillance Market is projected to grow at a CAGR of 4.9% during the forecast period, 2023-2030.

Major Airborne Surveillance Market Drivers

Major Airborne Surveillance Market Drivers

The global airborne surveillance market is predicted to witness significant growth due to rapid growth in the adoption of unmanned aerial vehicles around the commercial sector, consistent growth in the number of terrorist firms, and a rise in investments by producers to develop innovative UAVs to meet the growing requirement. Additionally, the government of a respective nation is taking different initiatives that drive the global airborne surveillance system market demand. For instance, the Federal Aviation Administration states that in 2020, almost 7 million drones were expected to be carried to the United States. This evaluation involved the sale of nearly 2.7 million commercial drones in 2020, a considerable surge from the 600 thousand sold during 2016. The affordability of these drones presents an opportunity for widespread usage in different commercial applications. Rising concerns about safety and security, coupled with the adoption of digitization and developed technologies in mapping software and high-resolution satellite imagery, are foremost drives anticipated to drive the growth of the commercial drone market. This in turn is predicted to contribute to the expansion of the global airborne surveillance industry. The agriculture sector also is actively integrating drones, employing LIDAR, high-resolution satellites, and Geographic information systems for tasks such as crop health monitoring, soil condition assessment, and crop measurement. In recent years, Trimble Navigation Ltd. has established a robust presence in the agriculture drones market, offering the Trimble UX5 HP high-precision mapping solution as part of its offerings in this segment.

Rising need for improvement in nation-edge security, maritime & national defense surveillance, rising integration of the e-commerce segment, and growing usage in disaster management are the key factors that present a positive impact on global airborne surveillance industry growth. Military firms and government agencies are increasingly using airborne surveillance systems globally to develop security at borders, recognize and prevent threats, examine territorial seas, and attain intelligence in defense functions. Airborne surveillance capabilities are significantly important in counterterrorism functions and law enforcement. They enable monitoring and speedy response to potential threats, and criminal activities from the air, developing situational awareness and advancing response time.

Sample Request

To have an edge over the competition by knowing the market dynamics and current trends of “Title Name” request for Sample Report here

Airborne surveillance system is important in disaster management activities because they offer real-time information throughout natural catastrophes including wildfires, hurricanes, and earthquakes. These systems assess damages, coordinate response activities, and ultimately contribute to life-saving efforts throughout and after disasters. Natural incidences and disasters caused globally are driving the Airborne Surveillance demand around the globe. During 2021, over 40 individuals lost their lives due to a volcanic eruption in Indonesia. In addition, in December of the same year, a series of tornadoes hit Kentucky and caused devastation around additional states, resulting in a total of 92 fatalities with 78 of them occurring in Kentucky. However, the tornado outbreak in 2021, became the most severe in Kentucky’s history, surpassing the impact of an 18th century tornado that claimed 76 lives. In addition, Hurricane Ida, a Category 4 hurricane, made landfall on Louisiana’s Port Fourchon during 2021, causing the loss of 91 lives around the 9 states. Loss and damage of infrastructure due to flooding and heavy winds killed 32 individuals around the Gulf Coast. Whereas, as per the centers for Disease Control and Prevention, additional flooding resulting from Hurricane Ida claimed the lost lives of 56 individuals in the Northeastern US. The airborne surveillance allows remote and easy assessing, even around distant locations, which is one of the foremost propelling drivers for the global airborne surveillance market growth in the forecast period.

Additionally, the effective growth in demand for real-time information for special or security determinations, growing accidents, a rise in demand for drones in different industries because of the IoT, and need for commercial properties, and a surge in technological innovations in airborne surveillance systems are some other foremost factors predicted to foster the global airborne surveillance market growth. Although, the aerial surveillance system contains RADARs, sensors, cameras, and different components. While improved sensors offer specific information, their intricate design makes their advancement expensive. The complexity of the design for aerial surveillance system components arises from their exposure to harsh environmental conditions, leading to increased development costs. The widespread integration of LiDAR sensors is attributed to their exceptional investigative capabilities. However, the high development cost of these sensors is predicted to be a challenge, restraining the market growth. Moreover, the rapid growth in automation and industrialization in the manufacturing units has decreased the drone’s production cost, and easy access to drones in the market at competitive rates is boosting the global market growth significantly.

Request Research Methodology

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

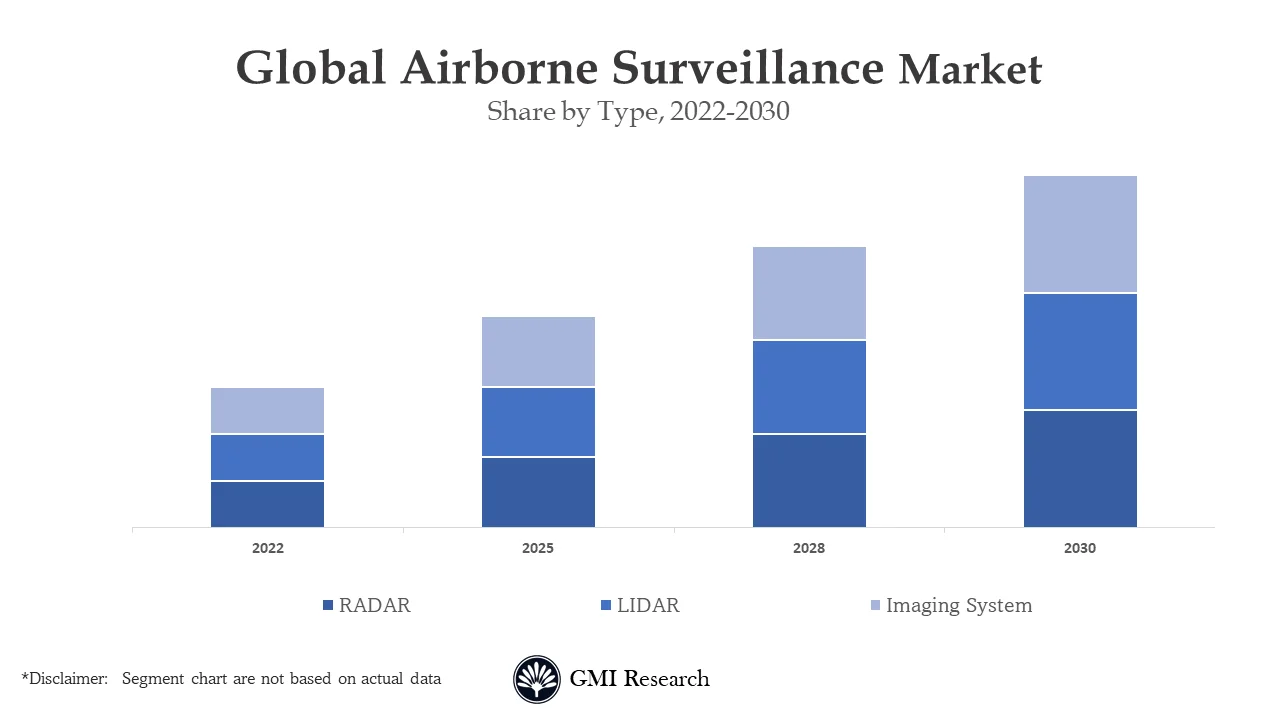

By Type, RADAR registered the highest market share in the global airborne surveillance market

A significant rise in the integration of radar systems in different applications including military, security, and defense driver the segment growth in the airborne surveillance market. The rising usage of radars around the Military Airborne Surveillance Systems is fostering global market growth. In addition, market players in this segment are investing heavily in different research and development activities that result in innovative radars and propel the demand for radar in the market globally.

By Product Type, Unmanned Systems are predicted to be the fastest-growing segment in the global airborne surveillance market

The unmanned system segment is estimated to witness steady growth because unmanned systems are frequently more cost-effective than manned aircraft for surveillance missions. They entail lower member costs, demand fewer crew members, and can be deployed without the expenses linked with piloted flights. The removal of human pilots from airplanes eliminates the risk to human life in possibly hazardous places or throughout risky missions. This is specifically valuable in scenarios involving natural catastrophes, conflict zones, and hazardous chemicals.

By End User, Military and Government segment dominated the largest revenue share in the global market of airborne surveillance

The military and Government segment registered the market growth because of a significant growth in intelligence, surveillance, and investigation. In addition, the growing emphasis on border security and safety, specifically by nations such as China, the U.S., and India, is predicted to further foster the growth of this segment. The significant increase in incidents of cross-border disputes and geopolitical battles has motivated governments worldwide to enhance the capabilities of surveillance in security, defense, and military. This rising trend is estimated to present considerable growth opportunities for the market players globally to flourish. For instance, in 2020, the Indian Government announced an agreement to acquire two Phalcon Airborne Warning and Control Systems from Israel for the Indian Air Force, with a total value of USD 1 billion. This strategy more focuses on developing surveillance capabilities, specifically in the high-altitude region of eastern Ladakh.

Request for Customization

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

By Region, North America held for the largest revenue share in the global market

The existence of giant market players and growing awareness related to the benefits proposed by UAVs is predicted to present a positive market growth in North America airborne surveillance market. The substantial defense budget of the U.S. government has resulted in an increased need for the airborne surveillance systems from the defense industry. Moreover, supportive government policies about the optimization of unmanned aerial vehicles are predicted to further drive the regional market growth in the forecast period. The significant rise in demand for airborne surveillance systems in battle in North America, high growth in security and military intelligence improvement, and increase in demand for local security, national security, and international security around the region foster the market growth in the forecast period significantly.

Top Market Players

Various notable players operating in the market include BAE Systems, Israel Aerospace Industries Ltd., Leonardo, Boeing¸ Leica Geosystems AG, Thales Group, Lockheed Martin Corporation¸ Saab, FLIR Systems Inc., Raytheon Company, UTC Aerospace Systems, L-3 Corporate, Teledyne Technologies, Northrop Grumman, Safran, and Start-Up Ecosystem, among others.

Sample Request

For detailed scope of the “Airborne Surveillance Market” report request a Sample Copy of the report

Key Developments:

-

- In 2023, Poland signed an agreement to purchase 2 Swedish airborne early warning and control Saab 340 AEW-300 planes for nearly USD 57.81 million to strengthen its air space.

- In 2023, Raytheon announced an accomplishment and launch of winning a USD 36.3 million contract and Data Link Technology respectively. The contract majorly focuses on developing cameras, and surveillance for the US Army’s Rapid Aerostat Initial Deployment System surveillance programs whereas, technology improves security in making two-way communication.

- In 2022, Safran Electronics & Defense and Leonardo agreed on a contract for developing and supplying the Euroflir 610 high-performance airborne electro-optical system for the program of Eurodrone.

- In 2021 – TerraSense Analytics entered into a contract worth USD 977,439 offered by the Department of National Defence’s Innovation for Defence Excellence and Security (IDEaS) program with an intent to develop Multimodal Input Surveillance & Tracking (MIST) advanced airborne surveillance system.

- In 2021 – HENSOLDT, a leading sensor manufacturing company, was approved in the Factory Acceptance Test of its new airborne multi-mission surveillance radar PrecISR.

January 2021 – Saab Ab was awarded a five-year follow on a contract worth USD 1.018 billion to deliver two GlobalEye systems to the United Arab Emirates

Segments covered in the Report:

The Global Airborne Surveillance Market has been segmented on the basis of Type, Product Type and End User. Based on the Type, the market is segmented into RADAR, LIDAR, Imaging System. Based on the Product Type, the market is segmented into Manned System, Unmanned System. Based on the End User, the market is segmented into Military, Defense, and Security, Commercial.

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Device, By Product Type, By End User, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | BAE Systems, Israel Aerospace Industries Ltd., Leonardo, Boeing¸ Leica Geosystems AG, Thales Group, Lockheed Martin Corporation¸ Saab, FLIR Systems Inc., Raytheon Company, Northrop Grumman, L-3 Corporate, UTC Aerospace Systems, Safran, Start-Up Ecosystem and Teledyne Technologies, among others. a total of 16 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Airborne Surveillance Market by Type

-

- RADAR

- LIDAR

- Imaging System

Global Airborne Surveillance Market by Product Type

-

- Manned System

- Unmanned System

Global Airborne Surveillance Market by End User

-

- Military, Defense, and Security

- Commercial

Global Airborne Surveillance Market by Region

-

-

North America Airborne Surveillance Market (Option 1: As a part of the free 25% customization)

- By Type

- By Product Type

- By End User

- US Market All-Up

- Canada Market All-Up

-

Europe Airborne Surveillance Market (Option 2: As a part of the free 25% customization)

- By Type

- By Product Type

- By End User

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Airborne Surveillance Market (Option 3: As a part of the free 25% customization)

- By Type

- By Product Type

- By End User

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Airborne Surveillance Market (Option 4: As a part of the free 25% customization)

- By Type

- By Product Type

- By End User

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Airborne Surveillance (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- BAE Systems

- Israel Aerospace Industries Ltd.

- Leonardo

- Boeing

- Leica Geosystems AG

- Thales Group

- Lockheed Martin Corporation

- Saab

- FLIR Systems Inc.

- Raytheon Company

- Northrop Grumman

- L-3 Corporate

- UTC Aerospace Systems

- Safran

- Start-Up Ecosystem

- Teledyne Technologies

Related Reports

- Published Date: Aug-2023

- Report Format: Excel/PPT

- Report Code: ICT02A-00-0719

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Airborne Surveillance Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research