Food Additives Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

Food Additives Market Size, Share, Trends, Growth Report, By Product (Flavours & Enhances, Enzymes, Sweeteners, Emulsifiers, Fat Replacers, Prebiotics, Others), By Source (Natural, Synthetic), By Application (Bakery & Confectionary, Beverages, Convenience Foods, Dairy & Frozen Desserts, Spices, Condiments, Sauces, & Dressings, Others) and By Region

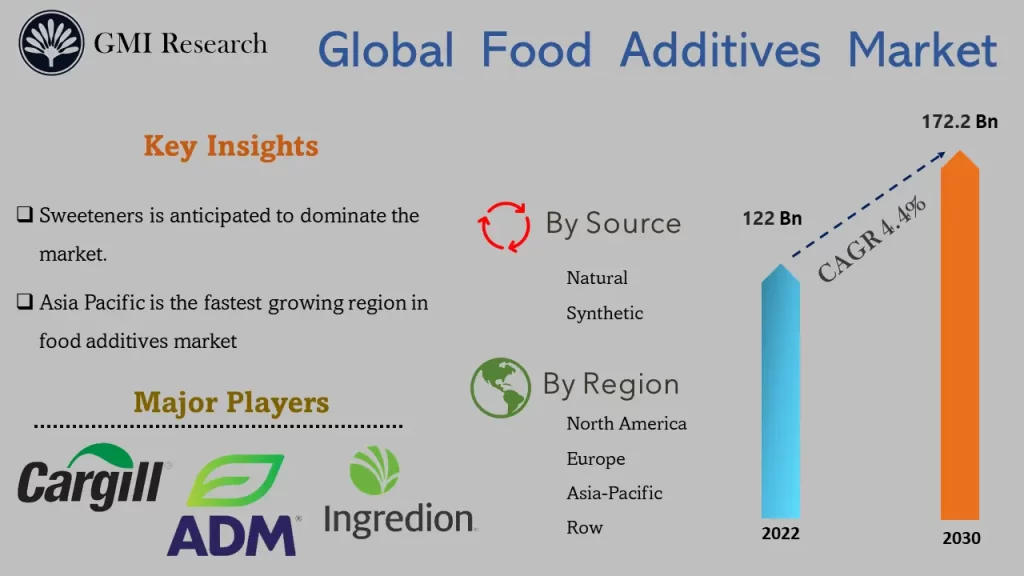

Food Additives Market size reached USD 122.0 billion in 2022 and is estimated to reach USD 172.2 billion in 2030 and the market is estimated to grow at a CAGR of 4.4% from 2023-2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Food Additives Market” request for Sample Report here

Major Food Additives Market Drivers

The food additives market is driven by the rising need to enhance the flavour, texture, and overall appearance of foods and beverages. The key factor boosting the market growth is the expansion of food and beverage industry across the globe. Due to the change in the dietary habits of consumer, the demand for packaged food and beverage products increases. This is expected to increase demand for food additives which are used to enhance the nutritional value and quality of processed foods. Food and beverage players are putting more effort to lower the amount of sugar, fat, and calories in their food products. This opportunity to develop low-sugar and low-fat food and beverage items is anticipated to arise from regulatory approvals for such low-calorie sweeteners and fat replacers. To enhance their production techniques and provide premium ingredients, manufacturers are implementing new technology. For instance, Firmenich SA introduced Firgood Ingredients in 2021, which are pure and manufactured entirely of natural extracts. As consumers are consuming more efficiently high-quality foods and beverages with enhanced aesthetic and gustatory appeal, which is furthermore predicted to stimulate the global additives market. Moreover, various organizations introduced general standard for food additives such as Food Administrative Organization, US Department of Agriculture and the Joint FAO/WHO Expert Committee on Food Additives, in an effort to boost international trade. For instance, the Malaysia Ministry of Health formally approved Rebaudioside D, E, and M, three zero-calorie Bestevia sweeteners from SweeGen, for use as ingredients in food and beverage products in 2021. These factors will propel the global food additives industry.

Clean-label additives are used in a variety of food products, such as ready meals, white cooking sauces, low- and high-fat vegan dressings, and egg replacements. As a result, producers of food and beverages are progressively reformulating their goods to fulfil the growing consumer demand for natural components. In 2021, Corbion NV, a global producer of lactic acid planned to invest to enhance its capacity for generating lactic acid in North America (by about 40%) to fulfil the rising demand for natural ingredients across industries.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on product, sweeteners segment is anticipated to dominate the market.

Sweeteners is driven by the growing concerns about obesity and cardiovascular illness, the consumer had reduced the demand for fatty foods and has replaced it with high intensity sweeteners like stevia, aspartame. Whereas people who are concern about fatty food may opt to whey protein and starch instead of foods containing high fructose corn syrup (HFCS) and sucrose. High intensity sweeteners, and fat substitutes will get benefited and expected to contribute in the growth.

For instance, PepsiCo had declared its intention to lower the typical amount of added sugars in its products by 25% by 2025 and by 50% by 2030 in July 2021 to fulfil the demand of consumers. These efforts by food and beverage producers to meet the growing demand for high-intensity sweeteners, Flavors, and enhancers, as well as fat substitutes to enhance flavour without the use of salt or sugar are further fuelling the market growth.

Based on source, the natural segment is expected to boost the market.

The natural additive has a strong demand in the market as additives produced through natural procedure are less dangerous for human health as compared to additives that processed with chemicals. Moreover, chemical-based additives such as sweeteners, emulsifiers, and other flavouring compound often cause allergies and effect directly or indirectly to human health, sometime causes to diseases like cancer, and psoriasis.

In 2021, Modern Plant-Based Foods Inc. teamed up with Real Vision Foods, LLC, a producer of natural foods to produce plant-based meals and bars for high-performance cognitive athletes due to the growing demand from consumers. As a result, the growth of the natural source is anticipated to be supported by rising demand for natural additives among food and beverage makers.

Based on Application, the bakery and confectionary segment is projected to grow at the fastest rate.

Bread and confectionery manufacturers are moving ahead and preparing edible items with enzymes, sweeteners, emulsifiers, and dietary fibres to boost the quality of edible item, while keeping the same taste. For instance, DuPont’s Nutrition & Biosciences division has introduced the POWERBake 6000 and 7000 enzymes to prepare bakery items like white breads and buns.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

Based on Region, the Asia Pacific region is predicted to increase at fastest CAGR during the forecast period.

Due to the rising demand for processed foods, Asia-Pacific is the largest and fastest-growing region in the food additives industry. Moreover, India and Australia are two of the biggest milk producers in the world and demand for flavoured milk, ice cream, and other dairy products is rising across the region. Value-added dairy products must be made with food additives, such as colours, emulsifiers, food flavours, sweeteners, and others. For example, emulsifiers are widely utilized in the ice cream industry, particularly E4701, which aids in viscosity, stability, and fat reduction and is employed by dairy producers like Amul. Additionally, the need for food colouring has dramatically increased throughout Asia. Additionally, ingredient producers are aggressively entering and growing their market share in India. For instance, True Elements, a clean-label health food brand owned by HW Wellness Solutions Pvt. Ltd., raised USD 1.36 billion in finance in 2021 to increase its presence in India. It is further projected that growing food and beverage industries in populous nations like China, India, and Indonesia will have a favourable effect on APAC food additives market.

Food Additives Market Leaders

Some of the major players operating in the global Biofuel Market includes BASF SE, Cargill, ADM Company, Chr. Hansen Holding, Kerry Group, International Flavors & Fragrances, Inc, Ajinomoto, Ingredion, DuPont de Nemours Inc. Givaudan SA, Tate & Lyle Plc, Royal DSM NV, among others.

Key Development:

-

- In 2022, BASF Aroma Ingredients launched Virtual Aroma Assistants to simplify the navigation of BASF’s Aroma Ingredients Portfolio. The launch ceremony of BASF’s Virtual Assistant was held at the World Perfumery Congress 2022 in Miami, Florida. The Virtual Aroma Assistant has an expanded portfolio of their products for the Flavor & Fragrance Industry, which can be accessed through BASF’s official website.

- In 2022, Cargill Salt planned to expand their salt plant named ST. Clair Plant. The expansion will increase the area of salt processing unit up to 50,000 sq.fts, which will be cost about USD 68 million.

- In 2022, Brenntag SE partnered with BASF to smooth their distribution process of Baxxodur. Baxxodur is amine based curing agents, Brenntag is a well-established and renowned firm in food additive segment, based in North America. Brenntag SE and BASF collaboration will extract some major key benefits for the firm such as expansion in revenue, brand image by expanding its business distribution channel.

Segments covered in the Report:

The global Food Additives market has been segmented on the basis of source, product, application and region. Based on source, the market has been segmented into Flavours & Enhances, Enzymes, Emulsifiers, Sweeteners, Fat Replacers, Prebiotics and Others. Based on the product, the market has been segmented into Natural and Synthetic. Based on the application, the market has been segmented into Bakery &Confectionary, Beverages, Convenience Foods, Spices, Sauces, Condiments, Dairy & Frozen Desserts & Dressings and Others.

For detailed scope of the “Food Additives Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 122.0 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Source, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | BASF SE, Cargill, ADM Company, Chr. Hansen Holding, Kerry Group, International Flavors & Fragrances, Inc, Ajinomoto, Ingredion, DuPont de Nemours Inc. Givaudan SA, Tate & Lyle Plc, Royal DSM NV, among others; a total of 12 Companies Covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Food Additives Market by Product

-

- Flavours & Enhances

- Enzymes

- Sweeteners

- Emulsifiers

- Fat Replacers

- Prebiotics

- Others

Global Food Additives Market by Source

-

- Natural

- Synthetic

Global Food Additives Market by Application

-

- Bakery &Confectionary

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces, & Dressings

- Others

Global Food Additives Market by Region

-

- North America Food Additives Market (Option 1: As a part of the free 25% customization)

- By Source

- By Product

- By Application

- US Market All-Up

- Canada Market All-Up

- Europe Food Additives Market (Option 2: As a part of the free 25% customization)

- By Source

- By Product

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Food Additives Market (Option 3: As a part of the free 25% customization)

- By Source

- By Product

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Food Additives Market (Option 4: As a part of the free 25% customization)

- By Source

- By Product

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Food Additives Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Global Food Additives (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- BASF SE

- Cargill

- ADM Company

- Hansen Holding

- Kerry Group

- International Flavors & Fragrances Inc

- Ajinomoto

- Ingredion

- DuPont de Nemours Inc.

- Givaudan SA

- Tate & Lyle Plc

- Royal DSM NV

Frequently Asked Question About This Report

Food Additives Market [UP3515-001001]

Analysis from GMI Research finds that the Food Additives Market earned revenues of USD 122.0 billion in 2022 and estimated to touch USD 172.2 billion in 2030.

Food Additives Market will grow at a CAGR of 4.4% from 2023-2030.

Natural source is expected hold the largest market share in the global food additive market.

Major players include Cargill, ADM Company, Ingredion, Kerry, among others.

Asia Pacific is the fastest growing region in Food Additives Market.

- Published Date: Aug-2023

- Report Format: Excel/PPT

- Report Code: UP3515-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Food Additives Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research