Insurance Fraud Detection Market by Component, By Deployment Type, By Organization Size, and By Application, and by Geography – Opportunities and Forecast, 2022-2029

Insurance Fraud Detection Market by Component (Solutions and Services), By Deployment Type (On-Premises and Cloud), By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) and By Application (Claims Fraud, Identity Theft, Payment Fraud and Billing Fraud and Payment Fraud and Billing Fraud) and by Geography

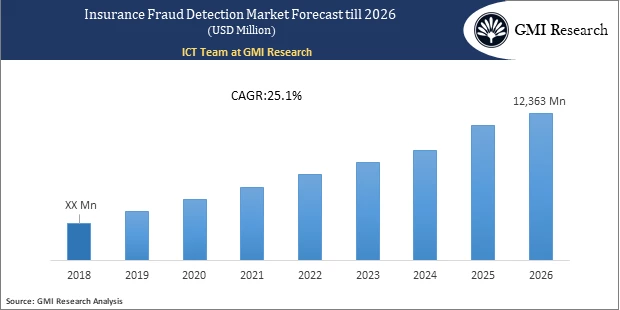

Analysts at GMI Research estimates that the Insurance Fraud Detection Market was worth USD 4.2 billion in 2021, and forecast to touch USD 22.1 billion in 2029, growing at a significant higher CAGR of 23.1% from 2022-2029.

To have an edge over the competition by knowing the market dynamics and current trends of “Insurance Fraud Detection Market”, request for Sample Report here

Key Drivers

Increasing cyber-attack, substantial financial losses due to attacks on the insurance sector, and growing need to manage the enormous volume of identities by enterprises are driving the market growth. For instance, according to the Federal Bureau of Investigation, Insurance fraud is a second mostly white-collar crime in the United States, and it accounts for around $300 million losses every year. In addition, increasing the adoption of advanced technology like Artificial Intelligence (AI), Big Data and data analytics to enhance customer experience is also propelling the market growth. Moreover, growing trends of advance technology such as the Internet of Things (IoT), cloud computing and increasing penetration smartphones, tablets, laptops etc increases the volume of data and transactions which increases the chance of being targeted by fraudsters which further increases the need of fraud detection solution. However, lack of awareness among organisation about fraud detection and lack of integration coupled with improper implementation of fraud detection solutions are restraining the market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Regional – Segment Analysis

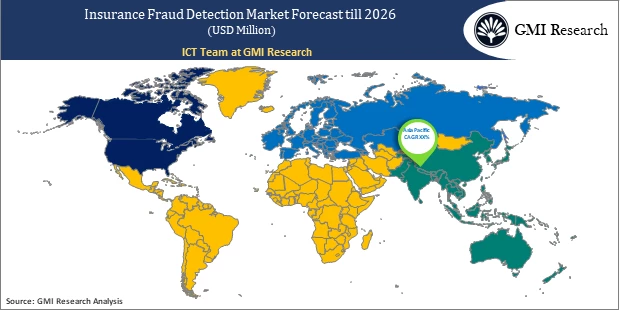

In terms of region, North America is expected to hold the largest market size in insurance fraud detection and expected to hold the maximum market during the forecast period owing to the rapid adoption of insurance fraud detection technology among organizations in this region. The rise in threats and vulnerabilities and government compliances and presence of a large number of insurance fraud detection solution and services providers in the in this region is also expected to drive the market growth during the forecast period. While Asia-Pacific region is expected to grow at the fastest CAGR during the forecast period due to increasing awareness about benefits of insurance fraud detection solution among small and medium enterprises and also in large enterprises to prevent various fraud such as payment frauds, identity theft, claim fraud, etc. which drive the market growth.

Top Market Players

Various notable players in the Insurance Fraud Detection market include SAS Institute, FICO, BAE Systems plc, Experian plc, Iovation Inc., IBM Corporation, Lexisnexis, SAP SE, FRISS, Fiserv, Inc., and among others. Major players are focussing on product launch, acquisition, collaboration to expand their global reach and become a market competitive.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Segments covered in the Report:

The Insurance Fraud Detection Market has been segmented on the basis of Component, Deployment Type, Organization Size, application and Geography. Based on the component market is categorized into Solutions and Services. On the basis of deployment type market is segmented into On-premises and Cloud. Based on the organization size market is segmented into Small and Medium-sized Enterprises and Large Enterprises. Based on the application market is categorized into Claims Fraud, Identity Theft, Payment Fraud and Billing Fraud and Payment Fraud and Billing Fraud and by geography.

For detailed scope of the “Insurance Fraud Detection Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is the global insurance fraud detection market growing? What will be a growth trend in the future?

- What are the key drivers and restraints in the current market? What will be the impact of drivers and restraints in the future?

- What are the regional revenue and forecast breakdowns? Which are the major regional revenue pockets for growth in the global insurance fraud detection market?

- What are the various application areas and how they are poised to grow?

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 4.2 billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Component, By Deployment Type, By Organization Size, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | SAS Institute, FICO, BAE Systems plc, Experian plc, Iovation Inc., IBM Corporation, Lexisnexis, SAP SE, FRISS, Fiserv, Inc., and among others. a total of 10companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Insurance Fraud Detection Market By Component

-

- Solutions

- Services

Global Insurance Fraud Detection Market By Deployment Type

-

- On-Premises

- Cloud

Global Insurance Fraud Detection Market By Organization Size

-

- Small and Medium-sized Enterprises

- Large Enterprises

Global Insurance Fraud Detection Market By Application

-

- Claims Fraud

- Identity Theft

- Payment Fraud and Billing Fraud

- Payment Fraud and Billing Fraud

Global Insurance Fraud Detection Market by Region

-

- North America HR Analytics Market (Option 1: As a part of the free 25% customization)

- By Component

- By Deployment Type

- By Organization Size

- By Application

- US Market All-Up

- Canada Market All-Up

- Europe Global Insurance Fraud Detection Market (Option 2: As a part of the free 25% customization)

- By Component

- By Deployment Type

- By Organization Size

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Global Insurance Fraud Detection Market (Option 3: As a part of the free 25% customization)

- By Component

- By Deployment Type

- By Organization Size

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Global Insurance Fraud Detection Market (Option 4: As a part of the free 25% customization)

- By Component

- By Deployment Type

- By Organization Size

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America HR Analytics Market (Option 1: As a part of the free 25% customization)

Leading Market Players

• SAS Institute

• FICO, BAE Systems plc

• Experian plc

• Lovation Inc.

• IBM Corporation

• Lexisnexis

• SAP SE

• FRISS

• Fiserv, Inc.

Frequently Asked Question About This Report

Insurance Fraud Detection Market [UP125A-00-1128]

Increasing cyber-attack, substantial financial losses due to attacks on the insurance sector, and growing need to manage the enormous volume of identities by enterprises are the key factors driving the market growth.

The growth rate of Insurance Fraud Detection Market during forecast period is 23.1%.

The top players over the market include SAS Institute, FICO, BAE Systems plc, Experian plc, Iovation Inc., IBM Corporation, Lexisnexis, SAP SE, FRISS, Fiserv, Inc., and among others.

The Asia-Pacific region is expected to grow at the highest CAGR during the forecast period due to increasing awareness about benefits of insurance fraud detection solution among small and medium enterprises and also in large enterprises to prevent various fraud such as payment frauds, identity theft, claim fraud, etc. which drive the market growth.

- Published Date: Oct-2021

- Report Format: Excel/PPT

- Report Code: UP125A-00-1128

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Insurance Fraud Detection Market by Component, By Deployment Type, By Organization Size, and By Application, and by Geography – Opportunities and Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research