Lithium-Ion Battery Market Share, Size, Statistics, Growth Opportunities & Industry Forecast Report, 2025-2032

Lithium-Ion Battery Market Size

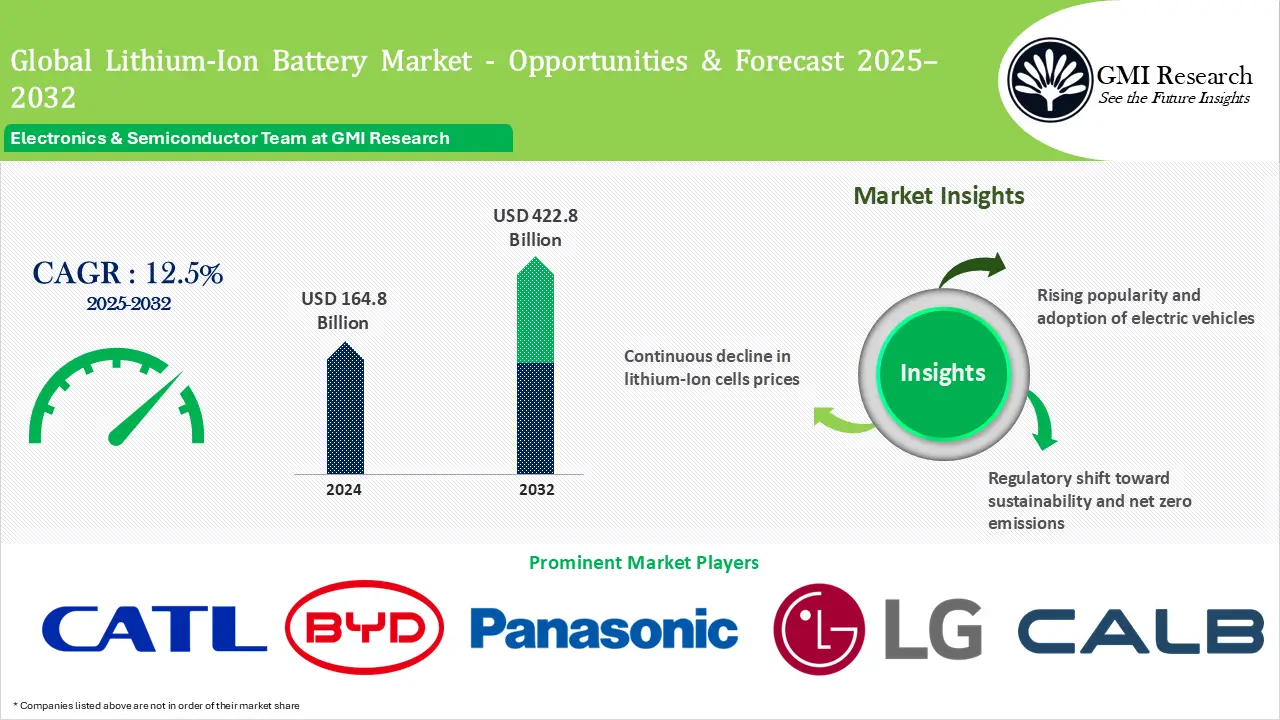

Lithium-Ion Battery Market size reached USD 164.8 billion in 2024 and is estimated to reach USD 422.8 billion in 2032, and the market is estimated to grow at a robust CAGR of 12.5% from 2025-2032, however by kilowatt the market is projected to grow at CAGR of 27% in the forecast years, primarily fueled by the rising popularity of electric vehicles and the increasing global focus on renewable energy initiatives driving demand for battery energy storage systems (BESS). However, the Lithium-Ion Battery volume is forecast to grow at a CAGR of around 28% between 2025 and 2032 and reach around 5.5 TWh by 2032.

Key Market Insights

Market Size:

-

- 2024 – USD 164.8 Billion

- 2032 – USD 422.8 Billion

- Market Forecast – CAGR of 12.5% from 2025-2032

Segment Insights

-

- Product Insights: The LCO segment holds the largest revenue share

- Capacity Insights: The 3,001 – 10,000 mAh segment generates the largest revenue

- Application Insights: Automotive segment captures the largest market share

- Regional Insights: Asia Pacific hold the largest revenue share

Lithium-Ion Battery Industry Overview

Lithium ion batteries are rechargeable energy storage devices found in mobile phones and hybrid or electric cars among others. Its adoption is increasing in various fields driven by their light weight and impressive energy density for longer battery life along with rechargeable capabilities. The global demand for the batteries is projected to surge in the coming decade with the required GWh set to reach approximately 5.5 TWh by 2032.

Lithium-Ion Battery Market Drivers

Rising Popularity and Adoption of Electric Vehicles

The global lithium ion battery market size growth is primarily fueled by the rising electric vehicles adoption worldwide. EVs have a smaller climate footprint in comparison to internal combustion engine vehicles. Governments worldwide are embracing greener and emission-free mobility with electric vehicles reshaping future transportation trends thereby fostering the lithium ion battery market share growth. Companies like Tesla are utilizing these batteries in their electric vehicles while Europe’s strict emissions laws and ambitious public electric transportation initiatives are further driving market growth.

The automotive industry has seen a significant increase in EV adoption fueled by government efforts to transition away from vehicles using fuel. The global push towards zero carbon goals has significantly fostered the demand for EVs which accelerated the need for the batteries in EV power systems. The growing reliance on consumer electronics has further resulted in an increased need for rechargeable batteries with high performance. These batteries are used in numerous devices including smartphones and smart wearables.

Regulatory Shift toward Sustainability and Net Zero Emissions

The lithium ion battery market size growth is further driven by the rising renewable energy efforts across many countries. The push for cleaner energy has accelerated the development of solar and wind energy projects which in turn has increased the need for the batteries. The batteries are increasingly preferred for clean energy storage as these offer a reliable solution to balance the intermittent availability of wind and solar energy. These batteries not only store power generated from renewable sources but are also crucial in stabilizing the grid and supporting the renewable energy integration into current infrastructure. The increasing focus on sustainability has thereby provided ample market prospects.

The transition to renewable energy is gaining traction driven by concerns over climate change along with innovations in technology. Many countries are increasingly implementing strong policies and establishing targets to enhance their reliance on renewable power. As an example, India has greatly increased its renewable energy goals, targeting a 500 GW increase in installed capacity. Solar and wind energy generation in India saw tremendous growth driven by supportive government policies and attractive incentives.

Continuous Decline in Lithium-Ion Cells Prices

The drop in prices has also contributed to the lithium ion battery market growth. The cell is the main component in the batteries which makes up to 50% of the total battery cost. Recent advancements by LIB manufacturers have contributed to a decline in battery prices with further reductions expected in the coming years. Declining component prices and the implementation of innovative technologies to improve battery capacity are significant contributors to the widespread use of LIB.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Challenges Faced by Lithium-Ion Battery Market Players

Despite their popularity, manufacturing LIB presents significant challenges. A major challenge is the environmental impact related to lithium extraction and disposal along with the manufacturing process itself. Billions of discarded batteries from smartphones and electric vehicles are piling up driven by the unavailability of affordable recycling solutions. The residual charge in spent batteries also poses a danger of unintended discharge that could potentially damage property and harm individuals. Batteries must be stored securely especially if they are not properly labeled as they may still hold a charge. Small batteries particularly should be kept safely to prevent accidental ingestion.

Manufacturers are working to improve battery manufacturing methods by making them more sustainable to address these concerns. Recycling presents an alternative to mining for battery materials. While the recycling segment is currently small, it is estimated to expand more than three times in the next decade as more batteries come to their disposal stage. Additionally, security concerns surrounding LIB including thermal runaway and fire hazards demand continuous research and improvements in battery design to establish stronger safety protocols. The industry aims to improve battery performance and increase energy density, all while maintaining safety and reliability.

Lithium-Ion Battery Market Segment Analysis

Product Insights: The LCO segment holds the largest revenue share

The increasing need for LCO batteries within devices like mobile phones and cameras owing to their significant energy density along with safety is estimated to boost segment growth in the years ahead. The LFP battery segment is also growing rapidly driven by its long lifespan and exceptional safety performance. The increasing need for NCA owing to its superior specific energy and long lifespan is estimated to drive segment growth in the coming years. NCA is utilized in EVs and industrial applications.

NMC batteries can be utilized as energy or power cells with the flexibility to offer substantial specific energy content or power just like other battery types. NMC battery performance relies on the optimal combination of manganese and nickel. When used separately manganese and nickel are not highly effective. Nickel offers excellent energy density but lacks stability. Meanwhile, manganese adopts a spinel configuration with minimal internal resistance yet results in low energy density. Merging the two components boosts their strengths while overcoming their individual limitations. The battery is selected for EVs because of its extremely minimal self-heating speed. This is also commonly utilized in power tools and various electric powertrains.

Capacity Insights: The 3,001 – 10,000 mAh segment captured the largest revenue share

The segment is particularly ideal for EVs and industrial applications because of their substantial capacities. The growing consumer electronics markets have also fueled the demand for batteries with high capacity which ensures devices can run for longer hours while maintaining performance for large screen devices and offering reliable power backup. There is also a rapid increase in the usage of mobile electronic devices including laptops and smartphones. With limited battery life, these devices need regular charging. LIB in power banks provides enhanced safety and reliability. This has led to an increased need for power banks to charge various portable devices.

Application Insights: Automotive segment dominated the market share

The automotive lithium ion battery market is witnessing substantial growth. With petrol prices continuing to rise more consumers are being attracted to hybrid or electric vehicles because of their environmental benefits. The growing emphasis on sustainable transportation by industries and governments has driven the need for EVs. The rise in EV adoption is thereby propelling growth in the global LIB industry. Favored for their exceptional efficiency and energy density, LIBs have become the foundation of automotive transformation. These batteries fuel electric vehicles which offer the performance and range needed to rival standard combustion engine cars. The LIB industry is seeing remarkable growth as these batteries are key to addressing environmental concerns and ensuring dependable energy storage options in the automotive sector. LIB is positioned to lead this transformation as it reshapes the energy sector while enabling a greener and more sustainable transportation future.

Consumer electronics along with mobile devices rely on integrated portable batteries. Portable batteries find use in various devices including mobile phones and digital cameras. These also see applications in hearing aids along with other wearable electronics. Continuous innovations in digital devices along with the growing demand for longer battery performance and quicker charging further fuel the need for LIB.

Regional Insights: Asia Pacific dominated the market with the largest revenue share

Asia Pacific leads the market share in the forecast years with Japan and China being the largest electric vehicle markets globally where the automotive sector is increasingly using lithium ion batteries. The growing need for smartphones and various electronic devices in countries including China and India is also expected to contribute to market growth in the region. Countries in Asia Pacific are shifting towards green energy with a focus on creating an ecosystem for manufacturing LIB within their borders. This region has emerged as an appealing automobile market as it recently became a key automotive manufacturing hub. The ongoing infrastructure advancements and industrialization in developing countries are paving the way for OEMs to explore new opportunities. The growing consumer purchasing power has also fueled the need for electronics and vehicles thereby driving market growth.

North America is also poised for robust growth with the United States leading the charge as increasing consumer electronics along with electric vehicles sales boost the market size. Africa and the Middle East are set to witness robust growth fueled by extensive construction efforts and accelerated urban development across cities. This increasing development consequently drives the need for construction and industrial power tools powered by lithium ion batteries.

Lithium-Ion Battery Market Major Players & Competitive Landscape

Several leading companies operating in the market are CATL, BYD, Panasonic, LG, Samsung SDI, CALB, EVE Energy, SK On Co., Ltd, Rept Battero, Tesla.

The market sees intense competition with numerous key players involved across diverse regions. Leading companies including to CATL, BYD, Panasonic, LG, Samsung SDI, among others have robust supply chain and extensive distribution systems which allows them to maintain a dominant market position. Governments worldwide are focusing on developing renewable energy which require highly efficient energy storage units. This prompts major manufacturers to enhance their production capabilities and innovation to meet the increasing demand for energy. To stay ahead in the market, companies are also embracing growth strategies including product development along with mergers and expanding their business operations.

Lithium-Ion Battery Market News

-

- In 2024, leading company Amprius Technologies reached a deal with a firm Fortune 500 firm to design a tailored SiMaxx battery pouch with high energy capacity incorporating its proprietary silicon anode innovation. The company intends to reduce the size and weight of batteries by about half and aims to produce more than a million cells per year for EVs soon.

- In 2024, Panasonic Energy announced a long-term partnership with H&T recharge which is a leading battery component manufacturing company to supply LIB cans within North America that boosts the production of secure EV batteries.

- In 2024, Asahi Kasei disclosed plans to establish a comprehensive facility in Canada for producing base films and coating for its Hipore LIB separator. The company has reached a preliminary agreement with Honda regarding the plant with the two organizations considering a joint investment.

- In 2024 Panasonic Energy finished constructing an EV battery manufacturing plant in Japan which is estimated to become the batteries biggest research center in the country employing approximately 1,100 people.

- In 2023 Samsung SDI revealed that it is the first company in lithium battery production to obtain environmental footprint certification from the Carbon Trust. The carbon footprint tracks greenhouse gas emissions throughout the entire product journey from its production and raw materials sourcing to distribution along with final disposal.

- In February 2023, Honda Motor Company, a major automobile company based out of Japan announced that it has signed an agreement with Ascend Elements to collaborate for procuring recycled lithium-ion batteries in North America.

- In February 2022, Panasonic Corporation, unveiled its plans to set up production facility for new lithium-ion batteries, which are specifically designed for electric vehicles, at Wakayama facility in Japan.

- In January 2022, Nexeon Limited, a major battery materials and manufacturing company based out of United Kingdom, announced that it has licensed NSP-1 technology to SKC Company, a leading advanced materials company in South Korea. By licensing NSP-1 technology, its customers will have reliable access to these strategic materials.

- In October 2021, LG Energy Solution Ltd., a battery manufacturing company based in South Korea signed a memorandum of understanding (MoU) agreement with Stellantis, to form a joint venture for manufacturing battery cells and modules in North American region.

- In March 2020, BYD Company Ltd., announced the launch of its Blade Battery, which is primarily developed to increase fire safety in electric vehicles. This battery slowly releases heat, uses battery thermal management systems and it does not release oxygen breakdown.

Lithium-Ion Battery Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 164.8 billion |

| Market Revenue Forecast in 2032 |

USD 422.8 billion |

| CAGR |

12.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Capacity, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | CATL, BYD, Panasonic, LG, Samsung SDI, CALB, EVE Energy, SK On Co., Ltd, Rept Battero, Tesla, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Lithium-Ion Battery Market Research Report Segmentation

The Lithium-Ion Battery Market has been segmented on the basis of product, capacity, application and region. Based on the product, the market is segmented into lithium cobalt oxide battery (lco), lithium iron phosphate (lfp), lithium nickel cobalt aluminum oxide, lithium manganese battery, lithium titanate, and lithium nickel manganese cobalt. Based on the capacity, the market is segmented into below 3,000 mah, 3,001 mah–10,000 mah, 10,001 mah–60,000 mah, and above 60,000 mah. Based on the application, the market is segmented into automotive, consumer electronics, industrial, energy storage systems, medical devices, and others.

Global Lithium-Ion Battery Market by Product

-

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide

- Lithium Manganese Oxide

- Lithium Titanate

- Lithium Nickel Manganese Cobalt

Global Lithium-Ion Battery Market by Capacity

-

- Below 3,000 mAh

- 3,001 mAh–10,000 mAh

- 10,001 mAh–60,000 mAh

- Above 60,000 mAh)

Global Lithium-Ion Battery Market by Application

-

- Automotive

- Consumer Electronics

- Industrial

- Energy Storage Systems

- Medical Devices

- Others

Global Lithium-Ion Battery Market by Region

-

-

North America Lithium-Ion Battery Market(Option 1: As a part of the free 25% customization)

- By Product

- By Capacity

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Lithium-Ion Battery Market(Option 2: As a part of the free 25% customization)

- By Product

- By Capacity

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Lithium-Ion Battery Market(Option 3: As a part of the free 25% customization)

- By Product

- By Capacity

- By Application

- China Market All-Up

- Global Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Lithium-Ion Battery Market(Option 4: As a part of the free 25% customization)

- By Product

- By Capacity

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating the Lithium-Ion Battery(Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- CATL

- BYD

- Panasonic

- LG

- Samsung SDI

- CALB

- EVE Energy

- SK On Co., Ltd

- Rept Battero

- Tesla

Frequently Asked Question About This Report

Lithium-Ion Battery Market [CFES01A-00-0719]

Lithium-Ion Battery Marke size was estimated at USD 164.8 billion in 2024.

The market demand is primarily fueled by the rising popularity of electric vehicles and the increasing global focus on renewable energy initiatives driving demand for battery energy storage systems (BESS).

Lithium-Ion Battery Market size forecast to grow at a robust CAGR of 12.5% between 2025-2032

Major players are CATL, BYD, Panasonic, LG, Samsung SDI, CALB, EVE Energy.

Asia Pacific dominated the market with the largest revenue share.

Automotive lithium batteries dominated the market share in 2024 and is projected to dominate the global demand till 2032.

China dominates the global lithium-Ion battery market and is forecast to account for 45% of the total Lithium-ion demand in 2025.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: CFES01A-00-0719

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Lithium-Ion Battery Market Share, Size, Statistics, Growth Opportunities & Industry Forecast Report, 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research