Specialty Coatings Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

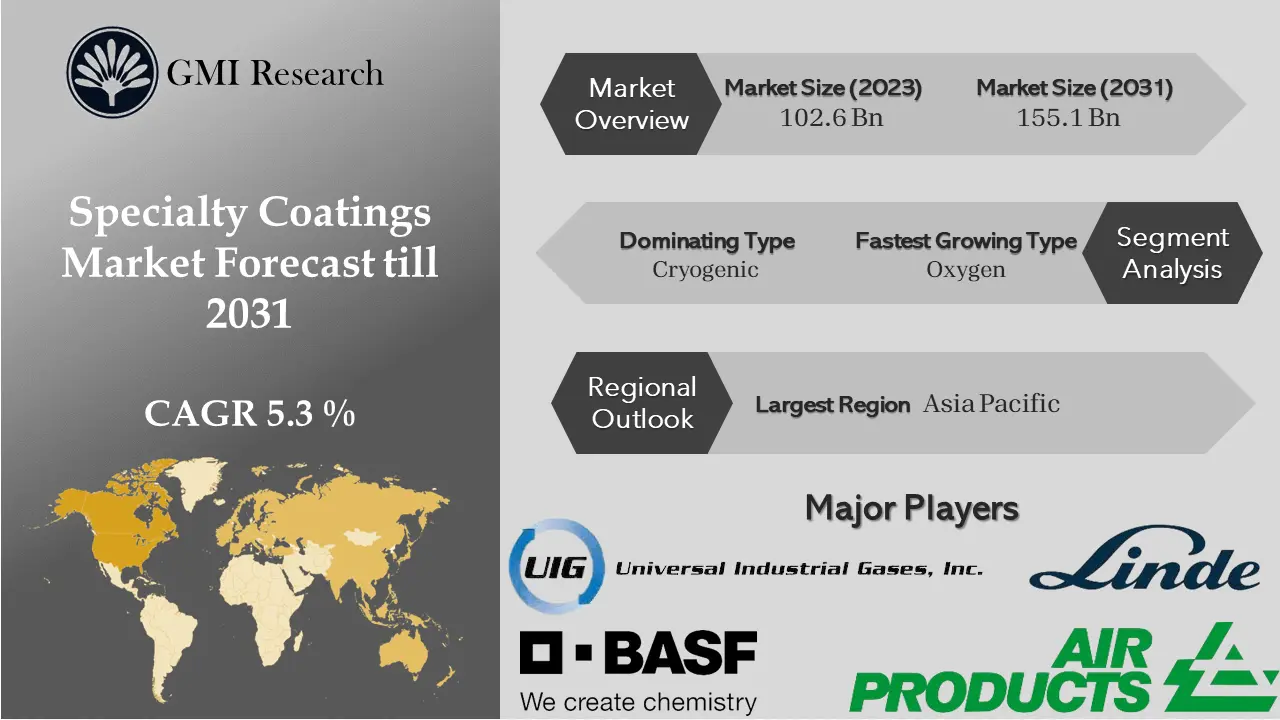

Analysis from GMI Research finds that the Specialty Coatings Market earned revenues of USD 3.4 billion in 2023 and estimated to touch USD 4.7 billion in 2031 will grow at a CAGR of 4.0% from 2024-2031.

To have an edge over the competition by knowing the market dynamics and current trends of “Specialty Coatings Market” request for Sample Report here

Major Specialty Coatings Market Drivers

The primary factors that drive the specialty coatings market are a rise in demand for automotive, increased investment in research and development activities, and favorable governmental policies. A rise in the global paints and coatings market and a rising demand for coating materials tailored to precise uses are anticipated to foster the growth of the specialty coating market. The growing customer demands, such as improved performance, increased durability, and durable service, are estimated to increase the need for specialty coatings in the forecast period. These coatings are anticipated to become more prevalent in commercial and residential segments because they resist chemicals, abrasion, and heat. They are also likely to witness strong demand from market players making original equipment, especially in the chemical and automotive industries. The market is estimated to grow because industries in developed countries are upgrading along their capacity expansions in emerging nations such as India, Malaysia, Brazil, China, and others.

Specialty coatings are used in different industries, including consumer electronics, automotive, lifestyle products, and construction. Presently, most consumption is aimed at construction and architectural applications. The specialty coatings market is estimated to rise due to increase in investment in construction and developed infrastructure, especially in developed nations such as Western Europe, Japan, and the U.S. However, growth is restricted due to rising environmental concerns related to VOC emissions. In addition, sustainability is another key driver, and there is a rising aim for eco-friendly coatings like water-based and low-VOC formulations, presenting the industry’s dedication to environmental responsibility. Nanotechnology is gaining prevalence by introducing improved nano coatings with remarkable features such as superhydrophobicity and self-cleaning. In addition, the demand for anti-corrosion coatings and fire-resistant coatings is rising due to rapid infrastructure development. Online sales and digital platforms are becoming necessary for disrupting products and sharing information, with shifting consumer preferences. The specialty coatings industry is set for continued growth, driven by innovation, eco-friendliness, and varied applications in different industries.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Anti-corrosion coatings segment registered the largest market size by coating type in the global specialty coatings market

Anti-corrosion coatings are worthy of protecting infrastructure and equipment. These coatings are essential in different industries including automotive, manufacturing, and construction. Waterproof coatings also hold a significant market share because it has an application of moisture protection across different applications, including electronic devices and buildings. In contrast, heat-resistant coatings, while catering to specialized sectors, contribute to a smaller yet significant market share within the coating industry. Anti-graffiti coatings and UV-resistant coatings have carved out niche markets, gaining momentum as urban population seek solutions for vandalism and UV protection. Abrasion-resistant coatings, crucial for heavy-duty applications, hold a smaller share compared to corrosion and fire-resistant coatings. The rest category includes a variety of specialized coatings personalized to unique requirements, collectively contributing to the overall market share by fulfilling specific niche demands.

Solvent-based coatings accounted for the largest market size by technology in the global specialty coatings market

Solvent-based coatings registered a significant market share due to their strong performance, particularly in demanding applications. The market is observing a growing interest in water-based coatings, coupled with the industry’s move towards sustainable solutions and supervisory compliance. Powder coatings, valued for their durability and aesthetic appeal, maintain a substantial presence in markets like automotive and appliances. High-solid coating, valued for its outstanding coverage, addresses specific requirements and contributes to the market share. The emergence of Nano Coatings, featuring advanced properties such as self-cleaning and superhydrophobicity, marks a technologically progressive segment. The ‘others’ category encompasses innovative, niche technologies. With growing environmental concerns, there is an expected increase in the adoption of water-based coatings and high-solid changes, reflecting a market shift towards sustainability.

Automotive registered the largest revenue share by end-use industries in the global specialty coatings market

The automotive segment growth is attributed to the demand for coatings that not only enhance aesthetics but also offer protection. The industrial sector projects to be propelled by the necessity for corrosion-resistant and durable coatings in machinery and structures. While more niche, the marine industry depends on specialty coatings to address its unique demands and lead the market. Construction uses coatings, highlighting fire-resistant, anti-corrosion, and waterproof properties to mark its existence. The electronics sector, although smaller, is witnessing growth due to the important role coatings play in preventing sensitive components. The rest category spans different industries like healthcare and aerospace, each with unique requirements, collectively contributing to the market share. As sustainability and improved technology shape the industry, market may evolve with an increasing emphasis on eco-friendly solutions and developed applications.

Direct sales distribution channel dominated the largest share in the global specialty coatings market

The direct sales distribution channel segment growth is influenced because it is simplified by manufacturers and this channel enables companies to offer technical support and establish direct relationships with clients, precisely large-scale, and customized projects. Retail sales constitute a significant segment, delivering customers easy accessibility to specialty coatings for DIY projects and small-scale applications through brick-and-mortar stores. Online sales are experiencing steady growth, driven by the convenience, extensive product choices, and customer reviews offered by e-commerce platforms. The prevalence of online channels for purchasing specialty coatings is on the rise. The market share is anticipated to evolve further as e-commerce platforms expand, emphasizing the importance of a different distribution strategy in the industry to align with changing consumer purchasing behaviors.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

By region, North America region dominated the market share in the global specialty coatings market

North America is dominant for its well-established industries and a robust emphasis on innovation and technology, holds a substantial share of the global specialty coatings market. The U.S. is a key contributor in the region due to its numerous industrial landscape, encompassing sectors such as construction, automotive, and electronics, all of which are significant customers of specialty coatings. In addition, around the region the increased awareness of sustainability and stringent environmental regulations are driving the demand for eco-friendly coatings, in line with global industry trends. As the industry consistently adapts to evolving requirements and regulations, it is expected that North America, especially the U.S., will sustain its significant market share.

Top Market Players

Various notable players operating in the market include PPG Industries, AkzoNobel, Sherwin-Williams, Axalta Coating Systems, RPM International Inc., BASF SE, The Valspar Corporation (a Sherwin-Williams Company), Hempel A/S, Jotun A/S, Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., Asian Paints, Berger Paints India Ltd., Masco Corporation, Diamond Vogel among others.

Key Developments

-

- In 2023, BASF joined hands with Oriental Yuhong to address rising need for rooftop solar panels in China.

- In 2017, Sherwin-Williams acquired Valspar to be competent in the market.

- In 2017, AkzoNobel planned to separate its business of specialty chemical from paints and coatings to sell it to an partner of the AkzoNobel Group for amount of nearly INR 320 crore.

Segments covered in the Report:

The Global Specialty Coatings Market has been segmented on the basis of Coating type, Technology, End user and Distribution Channel. Based on the Technology, the market is segmented into Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, High-Solid Coatings, Nano Coatings, Others. Based on the Coating type, the market is segmented into Fire-resistant Coatings, Anti-Corrosion Coatings, Waterproof Coatings, Anti-Graffiti Coatings, heat resistant Coatings, UV-Resistant Coatings, Abrasion-Resistant Coatings, Others. Based on the end-user, the market is segmented into Industrial, Automotive, Marine, Construction, Electronics, Others. Based on the Distribution Channel, the market is segmented into Direct Sales, Retail Sales, Online Sales.

For detailed scope of the “Specialty Coatings Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 3.4 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Coating type, By Technology, By End user, By Distribution Channel, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | PPG Industries, AkzoNobel, Sherwin-Williams, Axalta Coating Systems, RPM International Inc., BASF SE, The Valspar Corporation (a Sherwin-Williams Company), Hempel A/S, Jotun A/S, Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., Asian Paints, Berger Paints India Ltd., Masco Corporation, Diamond Vogel among others; a total of 15 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Specialty Coatings Market by Coating type

-

- Anti-Corrosion Coatings

- Fire-resistant Coatings

- Waterproof Coatings

- Heat resistant Coatings

- Anti-Graffiti Coatings

- UV-Resistant Coatings

- Abrasion-Resistant Coatings

- Others

Global Specialty Coatings Market by Technology

-

- Solvent-Based Coatings

- Water-Based Coatings

- Powder Coatings

- High-Solid Coatings

- Nano Coatings

- Others

Global Specialty Coatings Market by End user

-

- Automotive

- Industrial

- Marine

- Construction

- Electronics

- Others

Global Specialty Coatings Market by Distribution Channel

-

- Direct Sales

- Retail Sales

- Online Sales

Gobal Specialty Coatings Market by Region

-

-

North America Specialty Coatings Market (Option 1: As a part of the free 25% customization)

-

- By Coating type

- By Technology

- By End user

- By Distribution Channel

- US Market All-Up

- Canada Market All-Up

-

-

Europe Specialty Coatings Market (Option 2: As a part of the free 25% customization)

-

- By Coating type

- By Technology

- By End user

- By Distribution Channel

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

-

Asia-Pacific Specialty Coatings Market (Option 3: As a part of the free 25% customization)

-

- By Coating type

- By Technology

- By End user

- By Distribution Channel

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

-

RoW Specialty Coatings Market (Option 4: As a part of the free 25% customization)

-

- By Coating type

- By Technology

- By End user

- By Distribution Channel

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

-

Global Specialty Coatings Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- PPG Industries

- AkzoNobel

- Sherwin-Williams

- Axalta Coating Systems

- RPM International Inc.

- BASF SE

- The Valspar Corporation (a Sherwin-Williams Company)

- Hempel A/S

- Jotun A/S

- Nippon Paint Holdings Co. Ltd.

- Kansai Paint Co. Ltd.

- Asian Paints

- Berger Paints India Ltd.

- Masco Corporation

- Diamond Vogel

Related Reports

- Published Date: Jan-2024

- Report Format: Excel/PPT

- Report Code: GR24AB-01-003

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Specialty Coatings Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research