Specialty Polymers Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

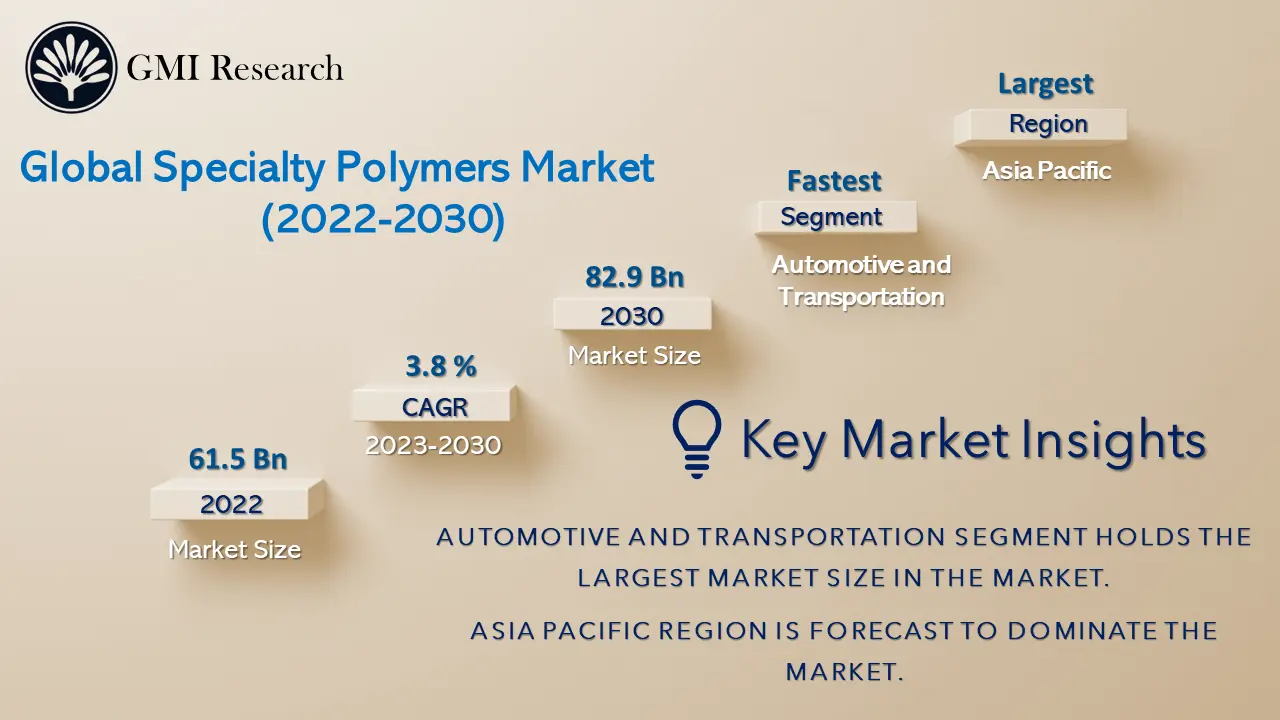

GMI Research analysis indicates that the Specialty Polymers Market size was estimated at USD 61.5 billion in 2022 and is slated to register a single digit CAGR of 3.8% over the forecast period, and is projected to reach USD 82.9 billion in 2030.

To have an edge over the competition by knowing the market dynamics and current trends of “Specialty Polymers Market” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Specialty Polymers Market” request for Sample Report here

Major Specialty Polymers Market Drivers

The global specialty polymers market has been observing considerable growth due to significant growth in demand from different end-use industries including electrical and electronics, healthcare, automotive, construction, and consumer products. The high growth in demand in these industries for high-performance presentation of specialty polymers in particular settings is also predicted to increase in demand for specialty polymers in the forecast duration due to their electrical insulation, resistance to wear, developed endurance limit, corrosion resistance, and thermal stability. Moreover, the high growth in technological innovations, extending industrial segments, product development, and the rise in demand for developing materials that offer high performance and working are anticipated to be the foremost growth drivers propelling the global specialty polymers market size. Other than this, with a significant rise in the demand for renewable energy sources, alike solar power, and wind, specialty polymers are broadly utilized in the introduction of lightweight and robust components for solar panels and wind turbines.

The growing emphasis on lightweight and fuel-efficient solutions in the industries of automotive and aerospace is a key driver propelling the demand for specialty polymers globally. In 2021, global vehicle production reached 80,145,988 units, marking a 3% growth from the previous year, as reported by OICA. Among the continents, Europe produced 16,330,509 motor vehicles, while America produced 16,151,639 units, and Africa contributed 931,056 units to the complete production. Specialty polymers deliver lightweight replacements to conventional materials such as metals in automotive applications. Substituting metal components with specialty polymers can decrease vehicle weight, developing fuel effectiveness and lowering emissions. Lightweight specialty polymers develop the performance of automobiles, handling, and complete energy effectiveness. Additionally, the aerospace industry is profoundly committed to cutting weight to develop fuel effectiveness and raise payload capacity. The specialty polymers propose lightweight solutions for special aerospace applications, including structural machineries, aerospace applications, interiors, engine parts, structural components, and fuel systems. Through the usage of specialty polymers, aircraft companies accomplish weight reduction while meeting the required criteria for safety, strength, and performance. Moreover, strict regulations concerning emissions and fuel-efficiency standards in both automotive and aerospace segments foster the demand for lightweight solutions. Specialty polymers assist industrialists meet these governing demands by enabling weight deduction without negotiating security and performance. Governments and industry administrations encourage the implementation of lightweight and fuel-efficient raw materials, propelling a favorable environment for their usage.

Furthermore, the high growth in demand for electronic devices such as tablets, smartphones, and laptops istec predicted to foster specialty polymers market forecast. Specialty polymers, valued for their excellent electrical insulation and thermal stability, find applications in introducing different electronic components, alike connections, displays, and housings, which further present a positive impact on the global specialty polymers market share.

Specialty polymers, with properties like flame resistance and heat stability, are commonly utilized in monomers, resins, and intermediates owing to their advantageous characteristics. Specialty polymers are costly to produce, demanding improved technology. Their production procedure is complex, leading to a higher price tag. In addition, costs fluctuate depending on market conditions and different influencing aspects. Also, the complexity of fabrication challenges and specialty polymers can be more vulnerable to damage compared to their alternatives. Even if the exterior appears intact, the internal structure may suffer. This can result in high repair costs, all of which may hinder the global specialty polymer market growth in the forecast period.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

By End-User, Automotive and Transportation segment registered the market growth

Due to different properties including wear resistance, tremendous thermal resistance, ease of processing and designing, and fatigue strength, the usage of specialty polymers is extensive in the automotive and transportation industries. The increasing demand for lightweight and fuel-efficient vehicles has led to augmented polymer usage in automotive components, replacing heavy metals to decrease complete weight. It is anticipated that a 10% decrease in vehicle weight can lead to a 5-7% decrease in fuel consumption, emphasizing the significance of specialty polymer materials in developing fuel efficiency.

In automobile manufacturing also, specialty polymers play an important role due to which demand for these materials are growing with the significant growth in sales of vehicles around the globe. The automotive polymer composite industry accelerating economic activity around the vehicle supply chain, impacting payrolls for both the industry and customers. Specialty polymers are essential for the light vehicle market, facing substantial competition, specifically from aluminum and steel, in the constant drive for innovation and effectiveness.

In 2021, according to the Japan Automobile Manufacturers Association reports, Japan introduced 7,846,955 units of passenger and lightweight automobiles. Hence, through the growth in the number of polymer usage throughout automobile manufacturing and the high rise in demand for lightweight automobiles, specialty polymer use is predicted to rise across the automotive and transportation segments.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

By Region, Asia Pacific led the market growth

Emerging nations, significant developments in industrial sectors, and high growth in demand for high-performance components are the foremost factors for Asia Pacific Specialty Polymers Market. The growing need for specialty polymers in different industries such as packaging, automotive, electronics, and construction is estimated to be the other important factors propelling the APAC specialty polymers market. Therefore, the considerable growth in several expansions in automotive and electrical industries in emerging nations such as India, and China, along with industrial advancement are projected to present a positive impact on regional market growth.

China and India stand as two of the largest automotive markets globally, presenting consistent growth in both vehicle production and sales. The initiative of the Chinese government is to boost electric vehicle production to 2 million units in a year by 2020 and further to 7 million units by 2025 is focused on significantly growing the share of EVs in China’s total new care production. If successful, this target could elevate EVs to represent 20% of the total production of new car across China by 2025. The rising demand for electric and hybrid vehicles in India and China opens new market growth opportunities for specialty polymers. These polymers are essential components in battery systems, connectors, wiring, and thermal management solutions, addressing the precise requirements of electric vehicles and attributing to their increasing popularity in market. In the electrical and electronics segments, both developed and developing nations are observing speedy growth which is driven by growing disposable income, high rise in urbanization, and technological advancements. For instance, the Japan Electronics and IT Industries Association reported an 8% year-on-year growth in global production by Japanese electronics and IT businesses during 2021, reaching nearly USD 285.39 billion. This rise in the electronics segment is predicted to propel the need for the ethylbenzene market during the forecast period.

By Region, North America is predicted to be the fastest-growing region in the market

A steady rise in demand for specialty polymers in a variety of industries such as healthcare, automotive, and aerospace, is contributing to the North American specialty polymer market growth. The demand in North America for specialty polymers is estimated to grow due to effective growth in demand for high-performance elements in the aerospace and automotive segments. Different market players are in the global specialty polymers market highly competitive and to be competitive they are increasingly raising their spending in research and development activities which is further expected to propel the growth of specialty polymers in the North America region.

Top Market Players

Various notable players operating in the market include Arkema Group, 3M, Ashland Inc., Associated industries Inc., BASF SE, Braskem, Chemtura Corporation, Covestro, Croda International PLC, Elantas GmbH, Endurance Technologies Limited, Evonik Industries AG among others

Key Developments

-

- In 2023, Arkema expanded in China to start production of its Sartomer specialty UV/LED curing resins to develop its leading portfolio of sustainable and high-performance materials.

- In 2023, BASF expanded its polymer distribution business in Merak, Indonesia to bring additional supply dependability to meet the rising demand for styrene-butadiene and acrylics dispersions around the Southeast Asia, Australia, and NZ markets.

- In 2023, Arkema announced an expansion, growing its organic peroxide production facilities at its Changshu location across China by two-and-a-half times. This investment of €50 million, focuses on strengthening the company’s help for its Asian customers in speedy increasing markets, especially in the field of renewable energy.

- In 2023, Braskem announced an expansion of biopolymer production by 30% and an investment of USD 87 million respectively to fulfill the rising universal demand for sustainable products.

- In 2023, Evonik expanded its global facility for VESTAMID to increase the production of PEBA in Shanghai.

- In 2023, Covestro expanded its production capacity for polycarbonate films across Thailand to meet the rising need across the Asia Pacific region and globally.

- In 2022, Arkema was developing its previously announced PVDF facility expansion in Changshu to meet the growing demand for lithium-ion batteries from its partner clients.

- In 2022, Ashland announced an expansion of its Viatel in Mullingar, Ireland to make Ashland a pleasant employer in Ireland and respond to rising customer requirements with higher speed.

Segments covered in the Report:

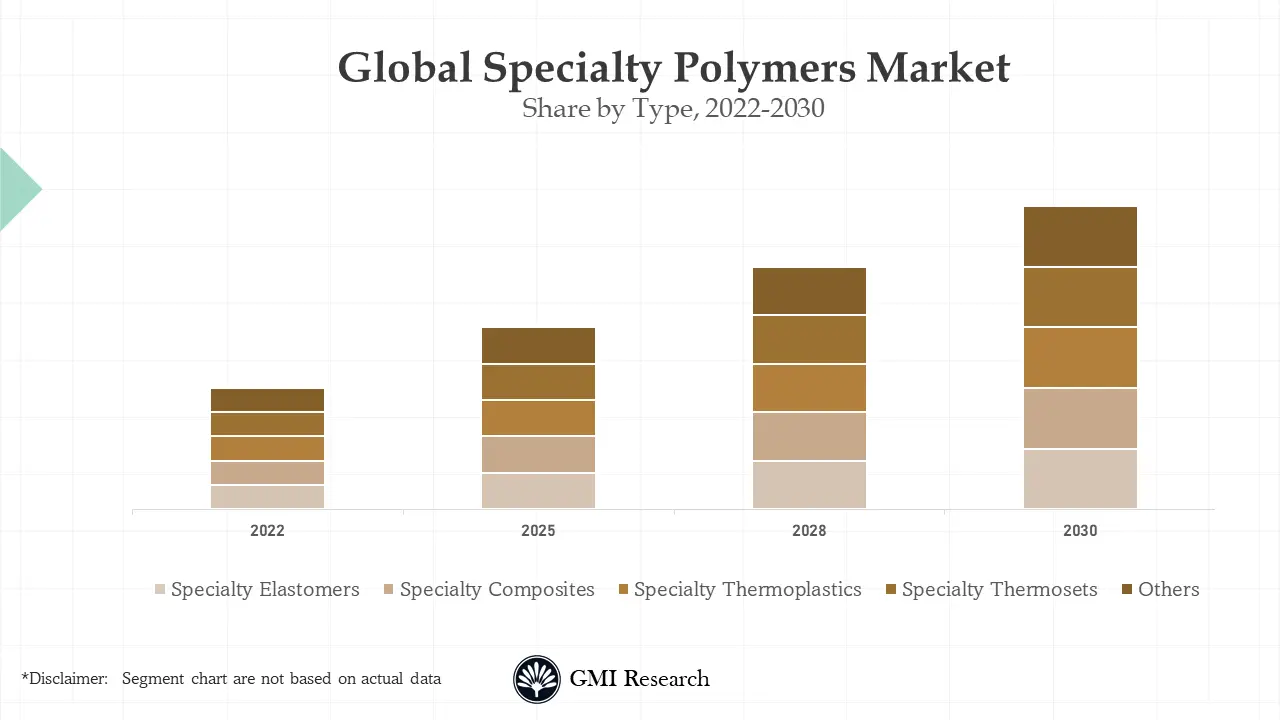

The Specialty Polymers Market has been segmented on the basis of Type and End-user Industry. Based on the Type, the market is segmented into Specialty Elastomers, Specialty Composites, Specialty Thermoplastics, Specialty Thermosets and Other Types. Based on the End-user Industry, the market is segmented into Automotive and Transportation, Consumer Goods, Building and Construction, Coatings, Adhesives, and Sealants, Electrical and Electronics, Healthcare and Other End-user Industries.

For detailed scope of the “Specialty Polymers Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 61.5 Billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By End-user Industry, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | 3M, Arkema Group, Ashland Inc., Associated industries Inc., BASF SE, Braskem, Chemtura Corporation, Covestro, Croda International PLC, Elantas GmbH, Endurance Technologies Limited, Evonik Industries AG among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation:

Global Specialty Polymers Market by Type

-

- Specialty Elastomers

- Specialty Composites

- Specialty Thermoplastics

- Specialty Thermosets

- Other Types

Global Specialty Polymers Market by End-user Industry

-

- Automotive and Transportation

- Consumer Goods

- Building and Construction

- Coatings, Adhesives, and Sealants

- Electrical and Electronics

- Healthcare

- Other End-user Industries

Global Specialty Polymers Market by Region

-

North America Global Specialty Polymers Market (Option 1: As a part of the free 25% customization)

-

- By Type

- By End-user Industry

- US Market All-Up

- Canada Market All-Up

-

-

Europe Global Specialty Polymers Market (Option 2: As a part of the free 25% customization)

-

- By Type

- By End-user Industry

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

-

Asia-Pacific Global Specialty Polymers Market (Option 3: As a part of the free 25% customization)

-

- By Type

- By End-user Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

-

RoW Global Specialty Polymers Market (Option 4: As a part of the free 25% customization)

-

- By Type

- By End-user Industry

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Specialty Polymers Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- 3M

- Arkema Group

- Ashland Inc.

- Associated industries Inc.

- BASF SE

- Braskem

- Chemtura Corporation

- Covestro

- Croda International PLC

- Elantas GmbH

- Endurance Technologies Limited

- Evonik Industries AG

- Published Date: Oct - 2023

- Report Format: Excel/PPT

- Report Code: UP3551-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Specialty Polymers Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research