India Automotive Aftermarket Market Size & Insights

India Automotive Aftermarket Market size was estimated at USD 11.3 billion in 2024 and it is projected to reach USD 21.1 billion in 2032, growing at a CAGR of 8.1% during the forecast period from 2025-2032. India Automotive Aftermarket market is growing at a robust growth rate in the years ahead owing to growth in the sales of new vehicles, rise in the number of vehicles on the road and robust used car market sales.

Key Market Insights

Market Size:

-

- 2024 – USD 11.3 Billion

- 2032 – USD 21.1 Billion

- Market Forecast – CAGR of 8.1% from 2025-2032

Segment Insights

-

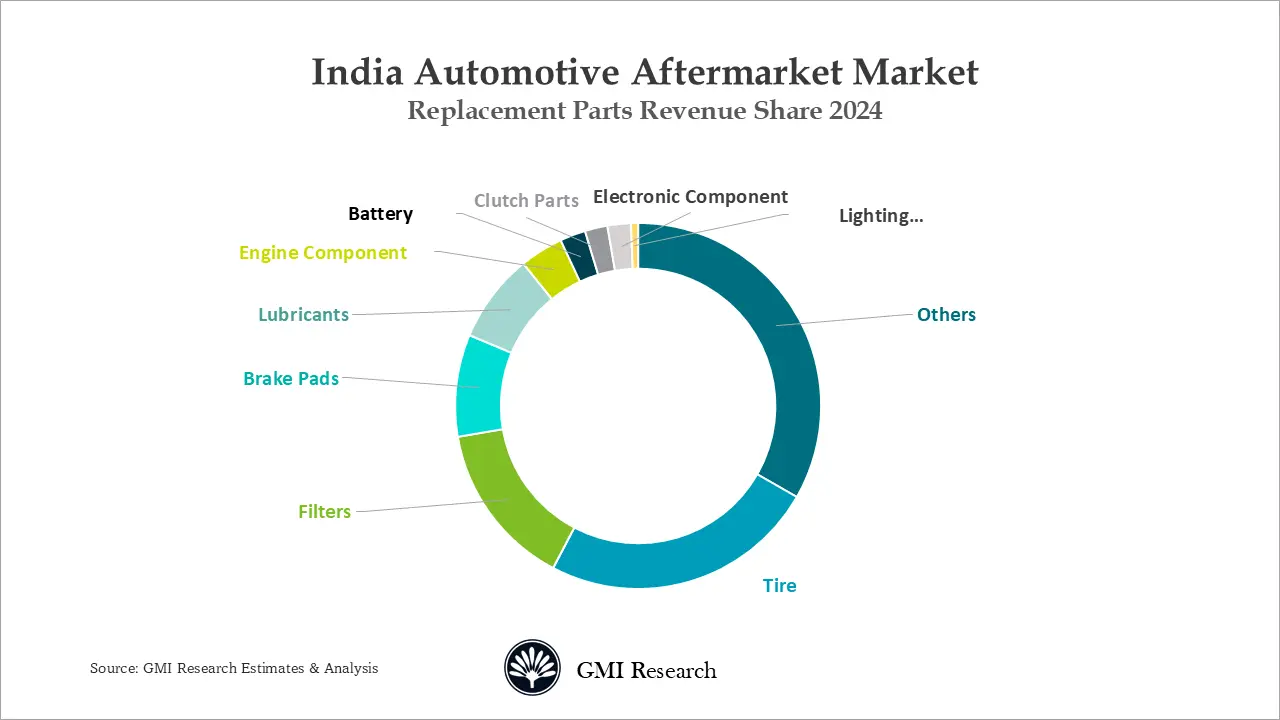

- Replacement Parts Type Insights: Tire captures the largest revenues share of India automotive aftermarket.

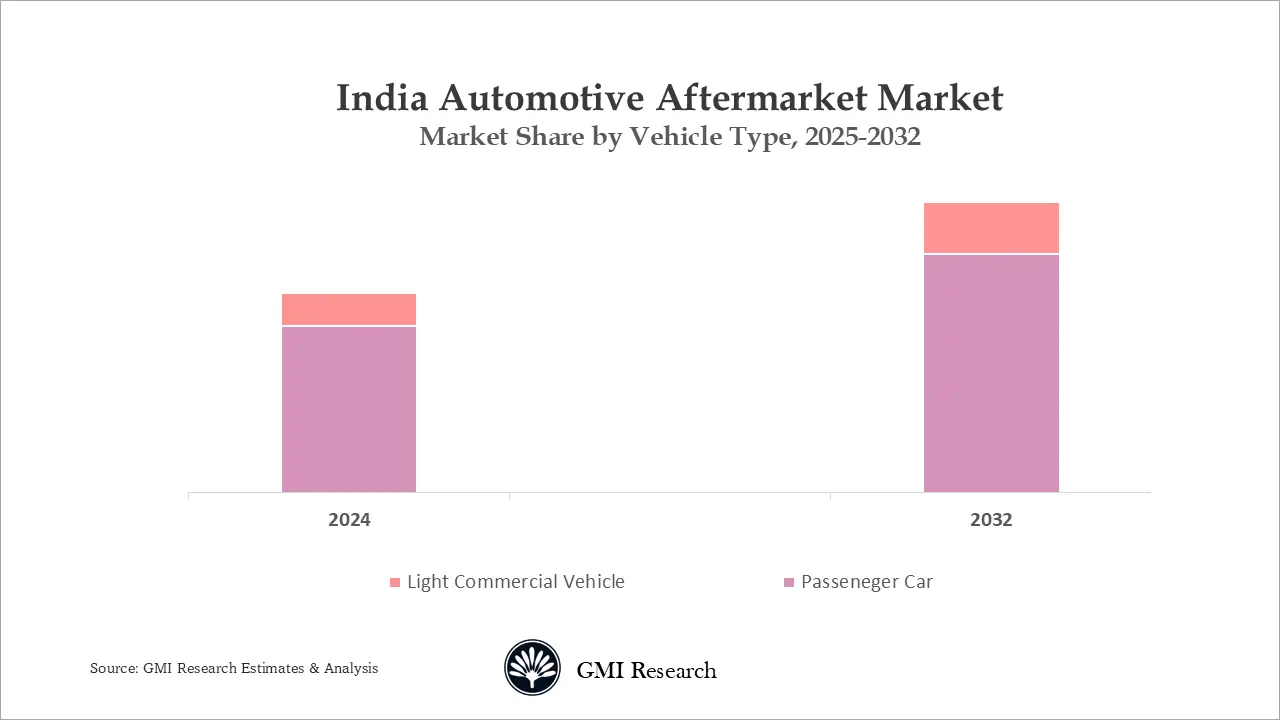

- Vehicle Type Insights: Passenger vehicle type generates the largest revenue share.

- Parts Certification Type Insights: Genuine parts type dominates the market in 2024 and is forecast to grow at a robust rate due to robust new vehicle sales.

India Automotive Aftermarket Market Overview

The market is currently moving towards a favourable growth trajectory, considering the existing opportunities and challenges. Government policies foster market growth through the introduction of updated safety requirements which stimulates innovation in safety component manufacturing and ensuring their reliability. Additionally, changes in the automotive landscape are propelling market expansion with the rise of online e-commerce and multi-brand outlets altering how consumers make purchasing decisions. Online markets have evolved to provide a complete selection of automotive components, including both OEM parts and economical alternatives. With a making significant contribution to the manufacturing GDP, India automotive aftermarket parts serve as a pivotal force driving macroeconomic development and technological progress in the country.

The automobile components sector makes a substantial contribution of 3.8% to the national GDP and supports indirect employment for 1.5 million individuals. The industry has the accessibility and capability to export auto components to major international automotive markets such as Europe, Japan, and Korea, achieving total exports of USD 13.5 billion in 2018. India’s comparative advantages in exporting auto components including its strategic geographic proximity to major markets, enhanced product quality achieved through advanced manufacturing practices, and robust investment coupled with supportive government initiatives, underscore its leadership in the global automotive supply chain.

Major India Automotive Aftermarket Industry Drivers

Growing Vehicle Parc

The India automotive aftermarket growth is driven by surge in vehicle parc owing to growth in new vehicle sales. India has one the largest car parc in the world with millions of vehicle currently plying on Indian road and it is as per GMI Research estimates that the vehicle parc is forecast to grow at a robust rate till 2032.

Indian Aftermarket sector is growing due to a continuous expansion of the vehicles on the road. Passenger vehicles are anticipated to experience strong growth and will grow from about 47 million to more than 72 million by 2028. In the same year, the number of commercial vehicles in operation is estimated to increase from 13 million to 19 million. Domestic aftermarket is projected to grow by approximately 150% times in the coming five years, fueled by increasing demand for vehicles and the competitive strengths of Indian aftermarket providers.

Increase in New Vehicle Sales

The Indian passenger car sales show resilience despite a slowdown in economy, according to OICA, the new passenger vehicle unit sales stood at 4.3 million units in 2024 an increase of 4.2% over 2023. However, if compared the passenger car unit sales Vs. 2019 the sales grew by 44.3% in 2024. The passenger car sales continue to post a positive growth since 2021 however the growth rate declining continuing in 2024, the passenger car sales growth decline to 4.2% in 2024 compared to 8.2% in 2023.

Robust Growth in Used Car Market

In 2024 used car sales in India reached over 5.4 million units which surpassed the 4.1 million units of new cars sold. This increase is supported by greater consumer trust in reputable sellers along with a widening price difference between used and new cars coupled with more accessible financing options. The increasing used cars popularity in India is fueling the need for repair and maintenance services for aging vehicles driving demand for aftermarket automotive part in India.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Government Support

The other factor supporting the growth of India automotive aftermarket industry is supportive government initiatives for market expansion. For instance, the Production-Linked Incentive scheme in the auto components and automobile industry was announced by the Union Cabinet led by Prime Minister Narendra Modi. Through the USD 3.5 billion PLI scheme, the automobile sector will receive incentives up to 18% aimed at promoting the local manufacture of advanced automotive technological innovations and fostering investment across the manufacturing ecosystem.

The incentives apply to eligible product sales made in India starting April 1, 2022, and lasting for five years consecutively. The Ministry of Heavy Industries has extended the period of PLI scheme for auto components and automobile by an additional year with some revisions. The revised program extends the incentive over five continuous fiscal years beginning from 2023 to 2024. The scheme stipulates that eligible participants can avail benefits for up to five consecutive fiscal years which concludes by March 31, 2028. A total of 115 companies submitted applications for this PLI scheme, resulting in 85 approvals, with 18 under the Champion OEM Incentive and 67 under the Component Champion Incentive.

The scheme has successfully attracted proposed investments totalling INR 67,690 Cr which surpasses the target estimate of INR 42,500 Cr in a five-year period. Approved applicants under the Champion OEM scheme span international business groups including those from countries such as the USA, Japan, South Korea, to Italy.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

Challenges

Despite the rapid development, India automotive aftermarket industry also faces a key challenge including adequate mechanics training which is often overlooked in the industry. The gap in mechanics’ training has become more pronounced with the introduction of technologies like BS IV and VI norms, yet training initiatives for mechanics are often sidelined due to various reasons. In the past, frequent gatherings of mechanics and dealers promoted information exchange and facilitated learning through networking. Now, traditional face-to-face interactions are rapidly giving way to digital learning methods primarily through training videos which are receiving varied responses and levels of acceptance.

India Automotive Aftermarket Market Segment Analysis

Vehicle Type Insights: Passenger vehicle drives the aftermarket market revenues

Passenger vehicle type generates the largest revenue share as passenger vehicle dominate the VIO and is projected to drive the India aftermarket revenues.

Replacement Parts Market Insights: Tire generates the largest revenues

Tire segment generates the largest market revenues and forecast maintain its dominant position during the forecast period.

India Automotive Aftermarket Market Major Players & Competitive Landscape

Major players operating in the market are Suzuki, Hyundai, Robert Bosch, Delphi, Champion, Bharat Forge, Toyota, Valeo, Bridgestone, Hella, Continental, CEAT, MRF, Amara Raja Batteries, Exide etc.

The suppliers of Indian components must prioritize forming alliances with international purchasing groups to expand market reach, invest in enhancing their branding and marketing efforts, boost their online presence, and foster collaboration among industry peers to collectively leverage global market prospects. Key players in the country’s automotive industry includes Suzuki, Honda, Tata Motors, among others.

India Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 11.3 Billion |

| Market Revenue Forecast in 2032 |

USD 21.1 Billion |

| CAGR |

8.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | India |

| Companies Profiled | Suzuki, Hyundai, Robert Bosch, Delphi, Champion, Bharat Forge, Toyota, Valeo, Bridgestone, Hella, Continental, CEAT, MRF, Amara Raja Batteries, Exide among others; a total of 15 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

India Automotive Aftermarket Market Report Segmentation

The India Automotive Aftermarket Market has been segmented on the basis of vehicle type, replacement part, certification. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters (air filter, oil filter, others), lighting components, electronic components, lubricants, clutch parts, engine components, (timing belt, spark plugs, others) & others. Based on certification, the market has been segmented into genuine parts, certified parts, counterfeit parts, others.

India Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

India Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

-

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

-

-

- Timing Belt

- Spark Plugs

- Others

-

-

- Others

India Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

India Automotive Aftermarket Market Leading players

-

- Suzuki

- Hyundai

- Robert Bosch

- Delphi

- Champion

- Bharat Forge

- Toyota

- Valeo

- Bridgestone

- Hella

- Continental

- CEAT

- MRF

- Amara Raja Batteries

- Exide

Frequently Asked Question About This Report

India Automotive Aftermarket Market [GR24AB-01-00288]

India automotive aftermarket size was USD 11.3 billion in 2024.

Indian Automotive Aftermarket market growth is driven by growth in the sales of new vehicles, rise in the number of vehicles on the road and robust used car market sales.

Tire dominates the Indian automotive aftermarket revenue.

The Indian automotive aftermarket is projected to grow at a steady CAGR of 8.1% between 2025 and 2032, the market is forecast to reach USD 21.1 billion in 2032.

India automotive aftermarket is dominated by Suzuki, Hyundai, Robert Bosch, Delphi, Champion, Bharat Forge, Toyota, Valeo, Bridgestone, Hella, Continental, Amara Raja Batteries, Exide etc.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00288

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

India Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research