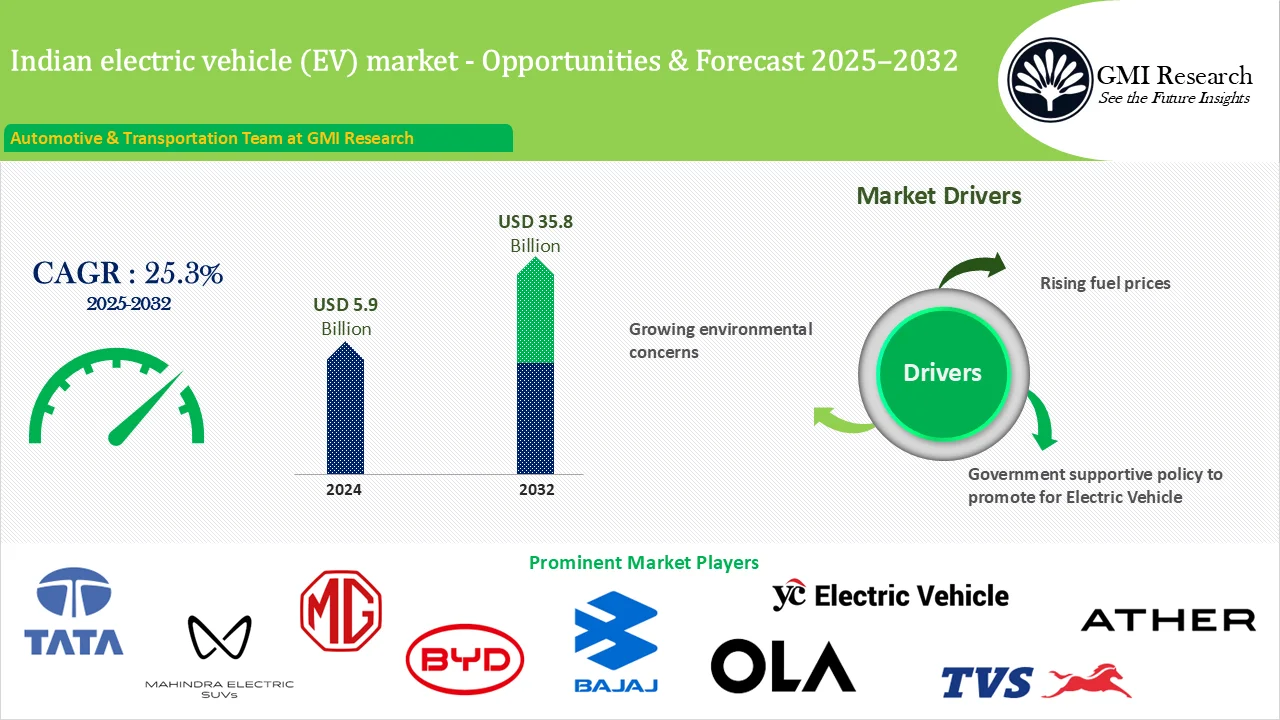

Analysts at GMI Research estimates that the Indian electric vehicle (EV) market size was worth USD 5.9 billion in 2024, and forecast to touch USD 35.8 billion in 2032 growing at a significant higher CAGR of 25.3% from 2025-2032 primarily driven by the rising fuel prices and environmental concerns along with the government support for the industry.

The electric vehicle (EV) sales in India touched 1.95 million mark in 2024 growing 27% over 2023. Currently electric Two Wheller and Three Wheller dominated the total EV sales in India.

Major Market Drivers and Emerging Trends

The India electric vehicle market is still in its early stages but it is estimated to experience significant growth in the years ahead fueled by increasing fuel prices and supportive government policies. Market growth is primarily fueled by rising fuel prices with India depending on imports for around 80% of its crude oil which leads to higher fuel costs. This creates a ripple effect on end users which prompts them to seek more affordable alternatives. Even with considerable government efforts in the energy sector fuel prices in India have surged almost five times more rapidly than general consumer prices. Petrol prices in India are primarily influenced by the global oil market prices. Given its heavy reliance on crude oil imports, changes in the global market have a direct effect on domestic prices.

Furthermore, the Indian government applies a considerable excise duty along with various taxes on diesel and petrol. Even though these taxes contribute significantly to government revenue they also have a considerable impact on the final price paid by consumers. With fuel prices climbing electric vehicles will become an increasingly attractive and affordable alternative for consumers.

Environmental concerns are another major factor driving the electric vehicle market growth in India. Road transport is responsible for carbon emissions from energy use and is also a crucial factor in air pollution levels. The growing less fuel efficient vehicles sales significantly contribute to higher oil consumption and greenhouse gases. India should focus on decarbonizing road transport to meet its net zero 2070 target and combat air pollution with electrification being an important factor. Electric vehicles are becoming a sustainable substitute for traditional cars that run on fossil fuels. Battery technology advancements have also enhanced energy density while lowering manufacturing costs which leads to better performance.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

A decreasing lithium ion battery costs is also important in boosting the market that is highly price sensitive. Lowering battery costs is crucial for accelerating EV adoption because it reduces the TCO and makes electric vehicles more affordable. Over the past ten years battery costs have reduced by about 85 percent which further drives wider EV adoption in all vehicle segments.

The other factor supporting electric vehicle market in India is the strong government support. The FAME and NEMMP schemes are a crucial step to enhance EV adoption while transforming its transportation system toward a more innovative future. India has set a goal to increase EV sales to 70% within commercial vehicles and 30% within private cars along with 80% in two wheelers. Achieving this goal means by 2030 India will have 80 million electric vehicles on the roads. Furthermore India is working towards achieving full domestic electric vehicle manufacturing under the Make in India program. At least 25,202 public EV charging stations have been set up with Karnataka leading followed by Maharashtra and Uttar Pradesh.

The ongoing innovation particularly in battery design and charging infrastructure is among the major trends driving the EV revolution. Developments in li-ion battery technology have improved energy density and quicker charging times for electric vehicles. Companies in India are dedicating considerable resources to R&D which focuses on developing advanced battery technologies for the market. Smart technologies like regenerative braking and connected vehicle features are integrated into new EVs which provides consumers with an improved experience.

Are you Looking for a Partner for your India Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Indian market is the right choice for you.

India is also on track to become a global production base which exports electric two wheelers along with vital electric vehicle components. The partnership between the government and industry in fields like smart charging or battery recycling will foster innovation. By maintaining its efforts India can take the lead in the EV revolution aimed at lowering carbon emissions and strengthening energy security.

In response to range anxiety and the need for more variety, automakers in India are set to introduce around twelve new electric vehicle models launching this year with many targeting the premium market featuring longer ranges and quicker charging speeds to appeal to buyers amid slowing global EV demand. Most of the new releases are specifically designed as electric vehicles with a range of at least 400 kilometers. Mahindra and other automakers are introducing models with over 600 kilometers of range and the ability to charge from 20% to 80% in less than twenty minutes.

One primary challenge facing the market for the electric vehicles in India is the higher initial cost in comparison to traditional vehicles. Even though electric vehicles have lower operational costs but their initial price makes them less affordable for many consumers. Despite government subsidies the high initial investment continues to be a barrier particularly in markets that are sensitive to price.

Based on vehicle type segment, the two wheeler leads the EV market in India accounting for roughly 60% of the market share. Increasing consumer interest in electric motorcycles and scooters is behind this dominance. Its leadership is also driven by factors like affordability and convenience in crowded urban areas. It also has lower operational expenses than traditional vehicles. With traffic congestion in metro cities intensifying electric scooters are rapidly gaining popularity because these are ideal for daily commutes within the city. Electric two wheelers offer cost efficiency with battery powered scooters providing higher mileage in comparison to traditional ICE vehicles.

Based on propulsion type segment BEVs are leading the electric vehicle market share in India owing to their superior efficiency and zero emission capabilities. The segment growth is fueled by the introduction of additional BEV models and advancements in battery technology. This allows manufacturers to fit larger battery packs in smaller spaces. The advancement allows manufacturers to create electric vehicles with longer ranges.

The HEV segment is also experiencing growth driven by factors like strong production capabilities and familiarity with hybrid vehicle technology among consumers. With lower ownership costs and dual energy sources HEVs are becoming a popular choice for consumers seeking cleaner mobility alternatives.

With rising awareness about air pollution and climate change more consumers are also turning to PHEVs that offer the advantages of gasoline and electric power. The dual capability helps drivers to cut emissions and address range anxiety which provides the flexibility to switch to gasoline if required.

Based on two wheelers battery type the lithium ion segment holds the dominant position. This dominance is owing to it offering higher capacity and shorter charging times in comparison to lead acid batteries.

Based on two wheelers price range vehicles priced below USD 1,000 are expected to hold the largest share of the market volume. Their dominance is attributed to their affordability which makes them accessible to a larger consumer base.

Based on two wheelers driving range segment vehicles that have driving range under 70 km are expected to dominate in terms of volume in the market. It is owing to their mass production and high adoption driven by their affordability.

Based on four wheels driving range segment vehicles exceeding 200 km are projected to lead the market in volume and value. The dominance is driven by consumer preference for vehicles with longer ranges that offer more travel flexibility. There is also a rising need from ride hailing firms for vehicles with extended ranges. In India the maximum range provided by electric vehicles is roughly 492 km. The lowest range is offered by the MG Comet at 230 km whereas the Mercedes EQS Limousine boasts the longest range at 857 km.

Top Market Players

Major key players in India electric vehicle market includes Tata Motors Limited, Mahindra Electric Mobility, Hyundai Motor India Ltd., MG Motor India Pvt. Ltd., Okinawa Autotech Pvt. Ltd., Lohia Global, Hero Electric, Kinetic Green Energy & Power Solutions Ltd., Ather Energy, Electrotherm (India) Limited and Avon Cycles among others. Companies are establishing strategic collaborations to leverage strengths. Automakers are also forming partnerships with battery manufacturers and tech providers to establish their own ecosystem which aligns with their long term electrification targets.

Key Market Developments:

-

- In 2024, JSW MG Motor India has introduced some programs to strengthen the EV ecosystem. That includes the eHUB app that enables users to locate and reserve charging stations from various networks through a single platform.

- In 2023 Hyundai Motor India has entered into an asset purchase agreement in Gurugram to acquire specific assets associated with GMI Talegaon facility in Maharashtra.

- In 2023 Mahindra & Mahindra unveiled its EV brands BE and XUV in the United Kingdom.

- In 2019, MG Motor India Ltd. announced the launch of all-electric MG EZS having a maximum range of 340kms, battery capacity of 44.5kWh and maximum power of 142.7PS.

- In 2019, Tata Motors announced the launch of Nexon EV in January 2020 and will be available in XZ+ LUX, XZ+ and XM variants. Nexon EV is equipped with power of 129PS and a battery capacity of 30.2 kWh lithium-ion battery along with a range of more than 300kms.

- In 2019, Hyundai Motor India Ltd. launched fully-electric Hyundai Kona having a range of 452 kms with a battery capacity of 39.2kWh and maximum power of 136PS.

- Tata Motors introduced an extended range of Tigor EV Electric Sedan that is certified by ARAI and has the availability in 3 variants, which are XM+, XE+, and XT+ along with two driving modes – sport and drive. The price of this car starts from Rs. 9.44 Lakh onwards and it is available in about 30 cities.

- In 2019, Hyundai Motor India Ltd., along with Kia Motors, planned to invest $ 300 million in the initiative of electric vehicles of a cab-hailing company of India, Ola. Through this investment, the company is aiming to increase its sales for electric vehicles and will also speed up into smart mobility plans. Hyundai and Kia Motors also planned to work with Ola for the development of electric vehicles specifically for India market and also establish the required infrastructure for electric vehicles along with using e-cars for the development of new mobility solutions.

Segments covered in the Report:

The India electric vehicle market has been segmented on the basis of vehicle type, volume, propulsion type, two-wheelers battery type, two-wheelers price range, four-wheelers price range, two-wheelers distance range and four-wheelers distance range. Based on vehicle type, the market is segmented into two-wheelers, three-wheelers, and four-wheelers. On the basis of volume, the market is segmented into two-wheelers, three-wheelers, and four-wheelers. Based on propulsion type, the market is segmented into battery electric vehicle, plug-in hybrid electric vehicle, and hybrid electric vehicle. On the basis of two-wheelers battery type, the market is segmented into lithium-ion battery and lead acid battery. Based on the two-wheelers price range, the market is segmented into Less than 800 USD, 800-1,200 USD, and more than 1,200 USD. On the basis of the four-wheelers price range, the market is segmented into Less than 16,000 USD, 16,000-36,000 USD, and more than 36,000 USD. Based on the two-wheelers driving range, the market is segmented into less than 70 Km, 70-100 Km, and more than 100 Km. On the basis of the four-wheelers driving range, the market is segmented into less than 150 Km, 150-200 Km, and more than 200 km.

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD 5.9 billion |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Value (USD Billion) |

| Market Segment | By Vehicle Type, By Volume, By Propulsion Type, By Two-Wheelers Battery Type, By Two-Wheelers Price Range, By Four-Wheelers Price Range, By Two-Wheelers Driving Range, and By Four-Wheelers Driving Range |

| Regional Coverage | India |

| Companies Profiled | Tata Motors Limited, Mahindra Electric Mobility, Hyundai Motor India Ltd., MG Motor India Pvt. Ltd., Okinawa Autotech Pvt. Ltd., Lohia Global, Hero Electric, Kinetic Green Energy & Power Solutions Ltd., Ather Energy, Electrotherm (India) Limited and Avon Cycles among others; a total of 11 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

India Electric Vehicle Market by Vehicle Type Revenues USD

-

- Two-Wheelers

- Three-Wheelers

- Four-Wheelers

India Electric Vehicle Market by Volume (Units)

-

- Two-Wheelers

- Three-Wheelers

- Four-Wheelers

India Electric Vehicle Market by Propulsion Type

-

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

India Electric Vehicle Market by Two-Wheelers Battery Type

-

- Lithium-ion Battery

- Lead Acid Battery

India Electric Vehicle Market by Two-Wheelers Price Range

-

- Less than 800 USD

- 800-1,200 USD

- More than 1,200 USD

India Electric Vehicle Market by Four-Wheelers Price Range

-

- Less than 16,000 USD

- 16,000 – 36,000 USD

- More than 36,000 USD

India Electric Vehicle Market by Two-Wheelers Driving Range

-

- Less than 70 Km

- 70-100 Km

- More than 100 Km

India Electric Vehicle Market by Four-Wheelers Driving Range

-

- Less than 150 Km

- 150-200 Km

- More than 200 Km

India electric vehicle market Leading players

-

- Tata Motors Limited

- Mahindra Electric Mobility

- Hyundai Motor India Ltd.

- MG Motor India Pvt. Ltd

- Okinawa Autotech Pvt. Ltd.

- Lohia Global

- Hero Electric

- Kinetic Green Energy & Power Solutions Ltd.

- Ather Energy

- Electrotherm (India) Limited

- Avon Cycles

Frequently Asked Question About This Report

India Electric Vehicle Market [UP261A-00-1219]

India electric vehicle market reached USD 5.9 billion in 2024 and is estimated to reach USD 35.8 billion in 2032 and expanding at a significant CAGR of 25.3% till 2032.

Market growth is primarily driven by escalating fuel costs, environmental concerns, and robust government support.

Two wheelers dominate the market attributed to the rising consumer interest in electric motorcycles and scooters.

Key players in the industry include Mah Tata Motors Limited, Mahindra Electric Mobility, Hyundai Motor India Ltd., MG Motor India Pvt. Ltd., Okinawa Autotech Pvt. Ltd., Lohia Global, Hero Electric, Kinetic Green Energy & Power Solutions Ltd., Ather Energy, Electrotherm (India) Limited, Avon Cycles, and several others.

Related Reports

- Published Date: Oct-2023

- Report Format: Excel/PPT

- Report Code: UP261A-00-1219

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

India Electric Vehicle Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research