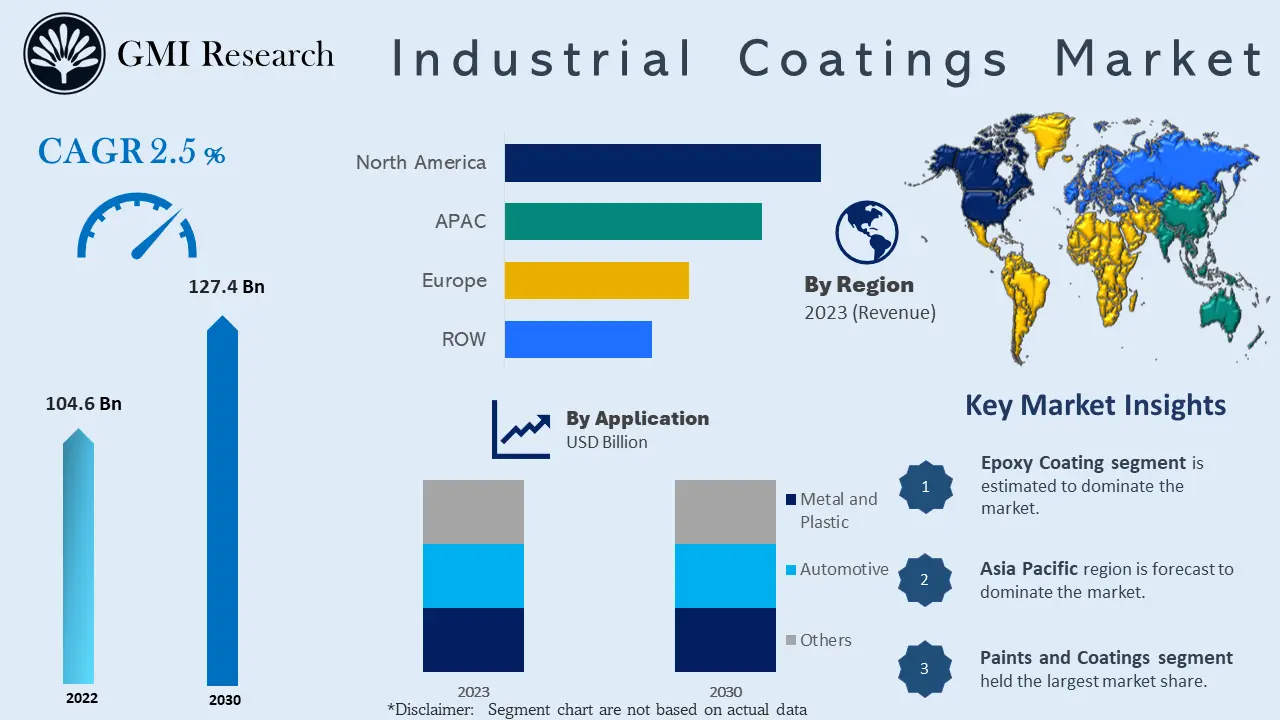

Industrial Coatings Market registered a revenue of USD 104.6 billion in 2022 and is projected to reach USD 127.4 billion in 2030, growing at a CAGR of 2.5% during the forecast period from 2023-2030.

Industrial Coatings Market Overview

An industrial coating is a paint or coating that is specially engineered for functional and protective properties. Although protection is their major goal, but it can be aesthetic at the same time. Polymers are mostly used in industrial coating that includes epoxy, fluoropolymer, polyurethane etc. It is mostly used in in controlling the corrosion of steel or concrete. Industrial coatings extend the overall lifespan of the materials, which reduces the replacement cost, which in turn is propelling the growth of the market.

To have an edge over the competition by knowing the market dynamics and current trends of “Industrial coatings Market”, request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Industrial coatings Market”, request for Sample Report here

Major Industrial Coatings Market Drivers

The key factors driving the demand for the global industrial coatings market are growing urbanization, industrialization, and a rapid rise in commercial activities. In the automotive sector, the effective applications of the product have developed due to the growing demand for aesthetics and offer caution to vehicles. These industrial goods are becoming increasingly prevalent in the fields of oil & and gas, aerospace, marine industries, and energy and power. Technological innovations, speedy increase in investment in research and development practices, and developing applications in different industries are propelling the global industrial coatings market growth. Moreover, market players in the market are continuously developing new coatings that have sustainable applications. At present, the technology used in manufacturing coating has advanced increasingly, different from traditional approaches. For example, the Gujarat Government and Asian Paints have entered into a MoU to initiate the expansion of paint production capacity to 250,000 KL, and resins and emulsions to 85,000 MT as compared to 32,000 MT. The company planned to spend USD 11.58 billion for this expansion, which will be carried out on their existing land in the state over 2-3 years.

In the coatings industry, there is a growing emphasis on sustainability. Pigments, additives, resins, and producers of final coating formulations are aiming to introduce sustainable procedures that lessen the eco-friendly methods that decrease power consumption, reduce waste, and reduce pollutant emissions. Some market players have taken formal initiatives to increase awareness, propel transformation, and facilitate the continuous development and development of sustainable practices. Whereas, Solvay has regularly aimed at the introduction of environmentally friendly coatings. Their coating solutions are designed for different products, including industrial direct-to-metal coating, waterborne architectural paints, printing inks, and adhesives. To develop the performance of the binder, the Group’s Sipomer series of specialty monomers, when mixed with surfactants, offers new and innovative functionalities, enhanced durability, sustainability, and developed adhesion and corrosion resistance. For instance, the European Chemical Industry Council reported a rise in chemical production with a 3.1% rise in 2018, which has accelerated the demand for industrial coatings. In addition, trade and strategic government initiatives have facilitated housing activities. For example, the relaxation provided by ASEAN countries’ governments, as noted by the Asia Development Bank, has led to an increase in both soft and hard infrastructure development practices.

Passenger and commercial automobiles require industrial finishes which is estimated to increase the demand for industrial coating across the automotive market. An increase in sales of vehicles and production of heavy passenger vehicles are predicted to drive the industrial coating market globally. For instance, the demographic trends include the younger generation and fewer older people concerned with the environmental influence of auto emissions affect demand. The growing automobile industry is one of the key factors increasing the demand for industrial coating market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Acrylic segment estimated to hold the largest market share.

The acrylic segment registered the market growth as it is widely used in the industrial coatings market. In the automobile industry, acrylic resin type used widely due to stiff environmental limitations which is predicted to drive demand for acrylic. Acrylic resin is a great rust resistance of the industrial coating is another key driver for driving the market growth.

Alkyd segment is predicted to witness the fastest growth rate in near future.

The alkyd industrial coatings segment is anticipated to witness substantial growth in the forecast period due to its prolonged applications in the oil & gas, automotive, and general industries. On the other hand, epoxy industrial coatings find extensive usage in wastewater treatment plants, construction, and shipbuilding, due to their effective properties, such as crack resistance, stain resistance, tolerance to extreme temperatures, and blistering prevention.

General industrial segment leads the global industrial coating market.

The growth is accredited to the significant rise in the usage of industrial coatings in construction, packaging, wooden, agricultural, and coil applications. A growing trend in activities of infrastructure advancement, as well as an increasing middle-class population, are attributing fastest growth prospects. Additionally, this segment is fostered by growing industrialization and urbanization and rising application in the manufacturing sector would offer growth opportunities in the forecast period. In the automotive sector also, these coatings are used increasingly. The significant rise in demand for passenger automobiles, increasing modernization of vehicles, and the developing need for fuel-efficient vehicles offer the growth of this segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Asia Pacific region dominated the global industrial coatings market and is predicted to exhibit a high CAGR in the forecast period.

Growing good demand from different industries such as automobiles and immediate industrialization in emerging nations like Japan, India, and others. Being a powerful nation, the government of India took the initiative of ‘Make in India’ which has increased FDI in the manufacturing sector of the nation and increased the need for industrial coating. Emerging nations of APAC has low labor cost which has attracted diverse foreign investors to establish their manufacturing facilities around the region. Thus, increasing number of manufacturing facilities is presenting positive growth. Also, a significant rise in environmental concerns is anticipated to drive market growth in the Asia Pacific region.

North America industrial coating market is predicted to hold a significant share during the forecast period

Increase in consumer spending, continuous spending by giant market players, and an early rise in GDP. The market players in the North American industrial coating market are investing continuously through strategic acquisitions and organic expansions.

Top Market Players

Top Market Players

Various notable players operating in the market, include, Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Axalta Coatings System LLC., Jotun , TIKKURILA OYJ Kansai Paint Co.,Ltd., RPM International Inc., Hempel A/S, among others.

Key Developments:

-

- In 2023, PPG Industries, Inc. planned to invest US$ 44.0 Billion investment plan to develop and modernize five powder coating manufacturing facilities situated in the U.S. and Latin America.

- In 2023, BASF Shanghai Coatings opened its new technical center building at the BSC Minhang location, making a foremost achievement in the Minhang extension project. This cutting-edge facility is predicted to strengthen BSC’s assistance to automotive original equipment producers in China by offering developed technology, services, and products shortly.

- In 2022, PPG completed its acquisition of Arsonsisi, an industrial coatings company situated in Milan, Italy, along with its powder coating business. As a part of this transaction, PPG attained a highly automated manufacturing plant in Verbania, Italy, capable of handling both small and large batches.

- In 2022, Sherwin-Williams has introduced a new line of coatings for the aerospace sector i.e., SkyTech. This innovative range is specifically crafted to offer quality protection against harsh weather conditions, abrasion, and corrosion, catering to the unique requirements of the aerospace industry.

- In 2022, Axalta acquired United Paints Group to broaden Axalta’s footprints in the European market and develop its series of industrial coating products, strengthening a significant development for the company.

- In 2022, BASF introduced a new series of low-VOC coatings i.e., EcoEfficiency for the industrial sector. This innovative series helps individuals in decreasing their environmental impact while upholding high performance and quality standards.

- In 2018, Nippon Paint Industrial Coatings Co., Ltd. Invested in the powder coating plant in China and Japan. This investment helped the company in expanding the coating business and may lead to technological advancements soon.

- In 2018, Axalta officially announced its expansion in production capacity in Jacksonville, the US, located in North America by approximately one million gallons annually. This expansion helped in generating more revenue from the coatings form the region.

Segments Covered in the Report:

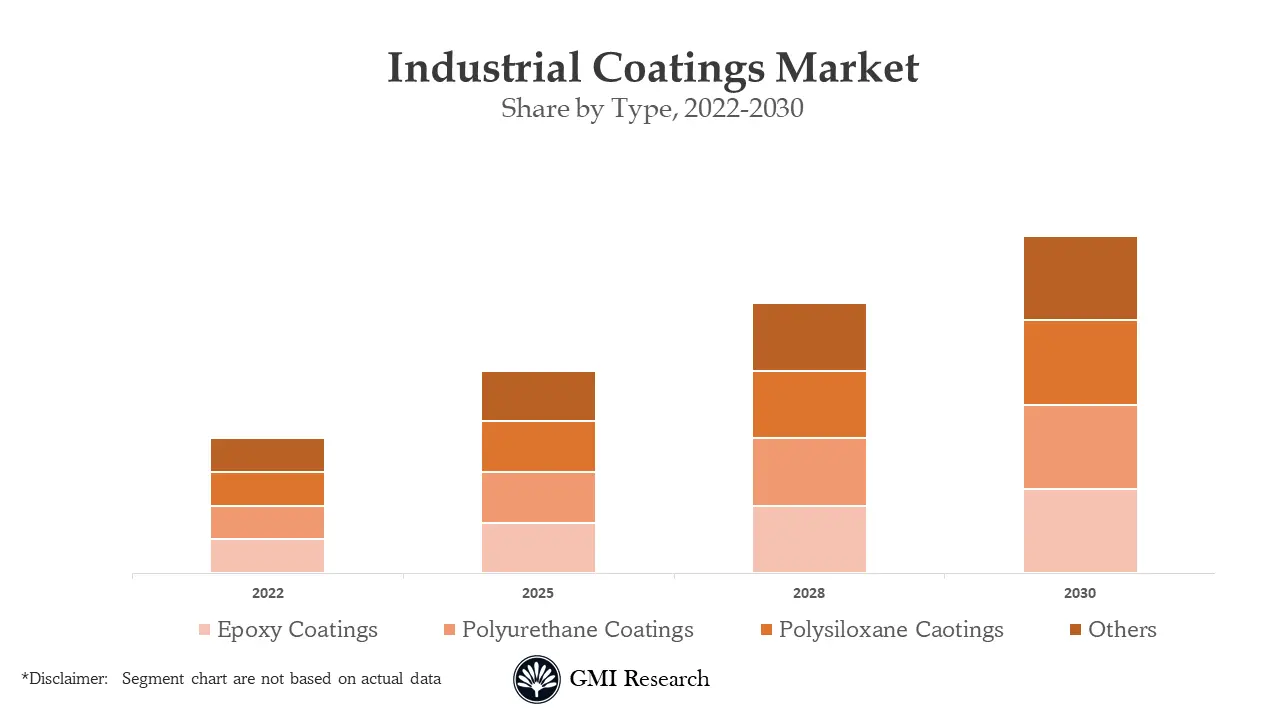

The Global Industrial Coatings Market has been segmented on the basis of Resin, Technology and End-user Industry. Based on the Resin, the market is segmented into Epoxy, Polyurethane, Acrylic, Alkyd, Polyester, Other Resins. Based on the Technology, the market is segmented into Solvent Borne Water Borne, Powder Based, Others. Based on the End-user Industry, the market is segmented into General Industrial, Protective Coatings. The Protective Coatings segment is further segmented into Oil and Gas, Mining, Power, Infrastructure, Other Protective Coatings.

For detailed scope of the “Industrial coatings Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 104.6 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Axalta Coatings System LLC., Jotun , TIKKURILA OYJ, Kansai Paint Co.,Ltd., RPM International Inc., Hempel A/S,among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Industrial coatings Market by Resin

-

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Other Resins

Global Industrial coatings Market by Technology

-

- Solvent Borne

- Water Borne

- Powder Based

- Others

Global Industrial coatings Market by End-user Industry

-

- General Industrial

- Protective Coatings

- Oil and Gas

- Mining

- Power

- Infrastructure

- Other Protective Coatings

Global Industrial coatings Market by Region

-

-

North America Industrial coatings Market (Option 1: As a part of the free 25% customization)

- By Resin

- By Technology

- By End-user Industry

- US Market All-Up

- Canada Market All-Up

-

Europe Industrial coatings Market (Option 2: As a part of the free 25% customization)

- By Resin

- By Technology

- By End-user Industry

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Industrial coatings Market (Option 3: As a part of the free 25% customization)

- By Resin

- By Technology

- By End-user Industry

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Industrial coatings Market (Option 4: As a part of the free 25% customization)

- By Resin

- By Technology

- By End-user Industry

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Industrial coatings (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Akzo Nobel N.V.,

- PPG Industries, Inc.,

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Axalta Coatings System LLC.

- Jotun

- TIKKURILA OYJ Kansai Paint Co., Ltd.

- RPM International Inc.

- Hempel A/S

- TIKKURILA OYJ

Frequently Asked Question About This Report

Industrial Coatings Market

- Published Date: Feb- 2023

- Report Format: Excel/PPT

- Report Code: UP1745-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Industrial Coatings Market Size, Share, Growth & Industry Trends Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research