Insurance Analytics Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2023-2030

Insurance Analytics Market witnessed USD 12,043 million in 2022, and is expected to touch USD 38,406 Million in 2030 and growing at a robust CAGR of 15.6% during forecast period.

Insurance Analytics Market Overview

Insurance analytics refers to the process of collecting, analyzing, and extracting relevant insights from different data sources to effectively manage risks and provide the best possible insurance contracts in fields including healthcare, life, and property, among others. The insurance analytics tools and solutions help brokers and companies to efficiently track expenses, ensures stable financial operations and liquidity, and helps in monitoring various operational expenses such as sales, marketing, operations, among others.

To have an edge over the competition by knowing the market dynamics and current trends of “Insurance Analytics Market”, request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Insurance Analytics Market”, request for Sample Report here

Major Insurance Analytics Drivers

One of the major factors that is the growth of the global insurance analytics market includes the increasing requirement for big data and predictive modelling capabilities during the emergence of the COVID-19 pandemic. Data is considered as one of the most valuable assets, and predictive analytics solutions are helping businesses to make most of the data. The capability of predictive modelling in insurance software helps in defining and delivering rat changes and new products more efficiently. Additionally, the increasing adoption of advanced analytics techniques and data-driven decision making-techniques in insurance is further boosting the market growth. Insurance analytics provide services and tools are used to process and analyze data to generate insights, which helps in decision making.

With the increasing adoption of insurance analytic solutions, the enterprises are emphasizing on enhancing customer experience and providing solutions based on a deep understanding of customer behavior and requirements. Through the customer’s behavioral data, the insurer can revise and redevelop new strategies and products, which has more sales success in the market. It enables insurers to empower distributors or agents with tools to identify several business opportunities and service existing customers.

Restraint in the Insurance Analytics Market

The increasing cyberattacks and their threats is a major factor that is hindering the market growth over the coming years.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

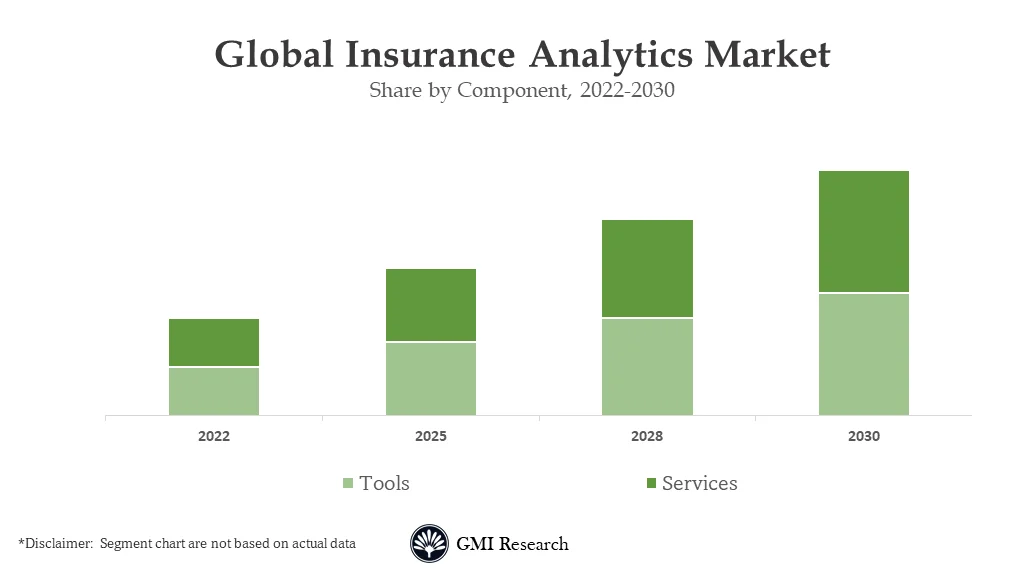

Component – Segment Analysis

Based on the component, the tools segment is expected to grow at a higher CAGR during the forecast period. This is mainly due to the increasing focus on compliance and government regulations in the insurance industry. Moreover, the emerging regulations including GDPR have further increased the demand for insurance analytics solutions over the coming years.

Application – Segment Analysis

Based on the application, the risk management segment is projected to grow at a higher CAGR during the forecast period. Risk management includes the identification, assessment, and management of potential risks, incorporation of analytics to support decision-making by stating the business goals and objectives. It offers the insures with the risk capacity to maintain specific credit ratings, manage capital, and decrease earnings volatility in insurance companies.

Deployment Mode – Segment Analysis

Based on the deployment mode, the cloud segment is projected to increase at a higher CAGR during the forecast period. Various advantages, including cost control, resource pooling, and less implementation time are attracting various end-users to opt for this deployment mode. Moreover, cloud deployment provides flexibility, scalability, and high cost-effectiveness, thus allowing businesses to have more control over the server, infrastructure, and systems.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

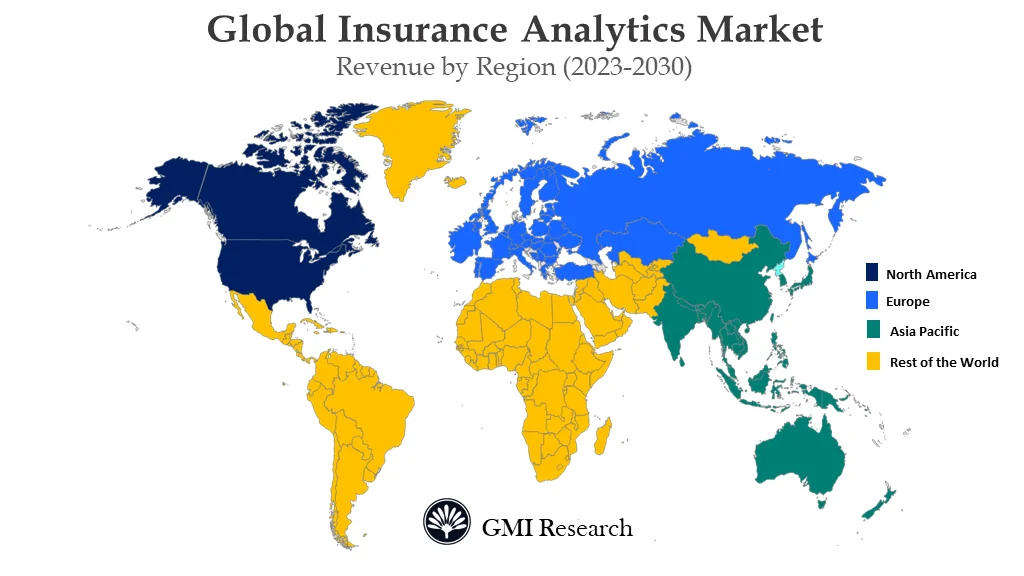

Regional – Segment Analysis:

Based on the region, North America region is expected to dominate the market during the forecast period. This is due to the increasing adoption of insurance analytics tools in this region. In addition to this, the various end-user industries, such as government agencies, insurance companies, and other third-party administrations, are focusing on opting for insurance analytics to offer customer-centric products.

Top Market Players

Various notable players operating in the market include IBM, Salesforce.com, Oracle, Microsoft Corporation, Opentext, SAP SE, Verisk Analytics, SAS Institute, WNS, and Vertafore, among others.

Key Developments:

-

- In 2020, IBM introduced a new risk-analytics based service known as IBM Risk Analytics. This service is helping the business to apply the same analytics that is used for traditional business decisions.

- In 2020, WNS introduced EXPIRIUS, AI, and analytics-driven customer experience solution.

Segments covered in the Report:

The global Insurance Analytics market has been segmented on the basis of Component, Application, Deployment Mode, Organization Size, End-User, and regions. Based on Component, the market is segmented into Tools and Services. Based on Application, the market is segmented into Claims Management, Risk Management, Customer Management and Personalization, Process Optimization, and Others. Based on Deployment Mode, the market is segmented into On-premises and Cloud. Based on Organization Size the market is segmented into Small and Medium-Sized Enterprises and Large Enterprises. Based on the End User, the market is segmented into Insurance Companies, Government Agencies, and Third-Party Administrator, Brokers, and Consultancies.

For detailed scope of the “Insurance Analytics Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 12,043 Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Component, By Application, By Deployment Mode, By Organization Size, By End User, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | IBM, Salesforce.com, Oracle, Microsoft Corporation, Opentext, SAP SE, Verisk Analytics, SAS Institute, WNS, and Vertafore, among others; a total of 10 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Insurance Analytics Market by Component

-

- Tools

- Services

Global Insurance Analytics Market by Application

-

- Claims Management

- Risk Management

- Customer Management and Personalization

- Process Optimization

- Others

Global Insurance Analytics Market by Deployment Mode

-

- On-premises

- Cloud

Global Insurance Analytics Market by Organization Size

-

- Small and Medium-Sized Enterprises

- Large Enterprises

Global Insurance Analytics Market by End User

-

- Insurance Companies

- Government Agencies

- Third-Party Administrator, Brokers, and Consultancies.

Global Insurance Analytics Market by Region

-

-

North America Insurance Analytics Market (Option 1: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Mode

- By Organization Size

- By End User

- US Market All-Up

- Canada Market All-Up

-

Europe Insurance Analytics Market (Option 2: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Mode

- By Organization Size

- By End User

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Insurance Analytics Market (Option 3: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Mode

- By Organization Size

- By End User

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Insurance Analytics Market (Option 4: As a part of the free 25% customization)

- By Component

- By Application

- By Deployment Mode

- By Organization Size

- By End User

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Insurance Analytics (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- IBM

- com

- Oracle

- Microsoft Corporation

- Opentext

- SAP SE

- Verisk Analytics

- SAS Institute

- WNS

- Vertafore

Frequently Asked Question About This Report

insurance analytics market [UP2119-001001]

The leading players over the market are IBM, Salesforce.com, Oracle, Microsoft Corporation, Opentext, SAP SE, Verisk Analytics, SAS Institute, WNS, and Vertafore, among others.

The growth rate of Insurance Analytics Market during 2023-2030 is 15.6%.

The tools segment is expected to grow at a higher CAGR during the forecast period. This is mainly due to the increasing focus on compliance and government regulations in the insurance industry.

The risk management segment is projected to grow at a higher CAGR during the forecast period. Risk management includes the identification, assessment, and management of potential risks, incorporation of analytics to support decision-making by stating the business goals and objectives.

- Published Date: Apr- 2023

- Report Format: Excel/PPT

- Report Code: UP2119-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Insurance Analytics Market Size, Growth Opportunities, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research