Insurtech Market by Type, By Service, By End-Use, By Technology and By Region – Global Opportunities & Forecast, 2020-2027

Insurtech Market by Type (Auto, Business, Health, Home, Speciality, Travel, and Others), By Service (Consulting, Support & Maintenance, andManaged Services), By End-Use (Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation, and Others), By Technology, and By Region – Global Opportunities & Forecast, 2020-2027

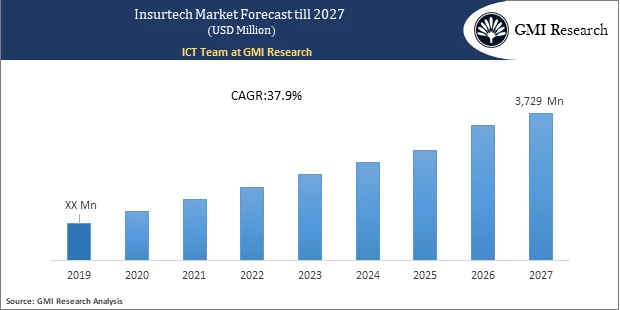

Insurtech Market is projected to reach USD 3729 Million by 2027, exhibiting a CAGR of 37.9% during forecast period.

Insurtech comes from the addition of two words, ‘insurance’ and ‘technology’. It refers to the advanced technologies used to analyze and tackle the data available to understand whether the policies are lucrative for the company or not. Insurance is one of the oldest businesses, which requires a group of people to categorize the different policies for lucrative results. In simple words, insurtech is the technology used by several insurance companies to become more efficient and accurate in their operations. Insurtech enhances a company’s backend processes and customer experiences to avoid loss in their business.

To have an edge over the competition by knowing the market dynamics and current trends of “Insurtech Market”, request for Sample Report here

The growing adoption of advanced technologies by insurance companies to enhance their operations, increasing automation, and improving communication with clients are the major factors surging the growth of the global insurtech market. Insurtech provides faster services and allows companies to analyze market risks. This factor is increasing the demand for insurtech solutions among insurance companies. Insurance companies deal with a large volume of data, which becomes difficult to manage and monitor. Insurtech improves the efficiency of management of large volume of data. The use of payment processed technologies has also increased to provide smooth transaction processes.

Insurtech helps in customization of policies by using new streams of data, which sets the dynamic price of the premiums on the basis of customer behavior. This technology enhances the security of business by simplifying the unstructured that is present through data analytics. In insurance companies, the identification of customers is essential, thus it becomes difficult to carry out this process manually. Insurtech makes it easy and fast to identify customers, reduce costs, and increase profitability. These factors drive the growth of the global insurtech market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on the type, the market is segmented into auto, business, health, home, speciality, travel, and others. The health segment is expected to grow at a higher CAGR over the forecast period. The growing adoption of technologies, such as machine learning, internet of things (IoT), and artificial intelligence (AI) to connect brokers, carriers, exchanges, and providers in health insurance is driving the growth of this segment. The increasing adoption of digital platforms such as digital payments, digital enrolment, underwriting, and collaborative and connected care delivery help in enhancing the operations of insurance companies, which further propels the growth of the health segment in the insurtech market.

Based on the service, the market is segmented into consulting, support & maintenance, and managed services. Managed services provide a different platform, where allows insurance companies to test new technologies on their products with no harm to downstream results. They provide industry expertise to conquer the challenges faced in business. Managed services enable insurance companies to induce emerging technologies for simpler access to their products and information, growing personalization, and enhancing service opportunities by providing differentiation, agility, transformation, and automation (DATA) model. These factors drive the growth of the managed services segment.

Based on the technology, the market is segmented into blockchain, cloud computing, IoT, machine learning, robot advisory, and others. The cloud computing segment is likely to grow at a higher CAGR during the forecast period. Cloud computing highlights the key risk indicators, risk assessment and control, within a single organization. Cloud computing detects any scam or unusual activity that happens in a transaction process. These factors align the growth of the cloud computing segment.

Based on the end-use, the market is segmented into automotive, BFSI, government, healthcare, manufacturing, retail, transportation, and others. The BFSI segment is anticipated to grow at a faster CAGR over the forecast period. In order to increase financial security, several initiatives have been taken by the government to implement digital platforms in the BFSI sector. The implementation of advanced technologies improves the client experience and provides continuous access to the customer database and secures transactions. These advantages are surging the growth of this segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

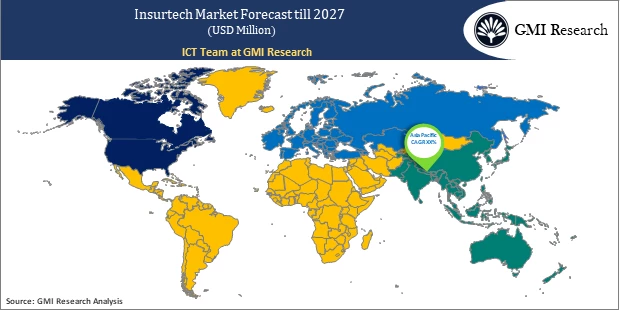

Based on the region, the Asia-Pacific region is projected to dominate the insurtech market over the forecast period owing to the growing government initiatives to implement digital tools and platforms to improve the banking operations. The entry of new insurance companies with cost-competitive policies to match with the affordability of the customers is increasing the induction of digital services, thus growing the insurtech market in Asia-Pacific region.

Various notable players operating in the market include DXC Technology Company, Damco Group, Insurance Technology Services, Oscar Insurance, Majesco, Quantemplate, Wipro Limited, Shift Technology, Zhongan Insurance, and Trōv, Inc., among others.

Key Developments:

-

- In 2020, Oscar Insurance, the first technology driven health insurance company, partnered with MercyOne, a connected system of health care facilities and services to provide an improved experience with more savings.

- In 2020, Majesco launched the version 11 R2 of its product, P&C Core Suite to shift the insurance sector to a next-generation digital era of insurance. This product has the capability to enhance the speed to value, ecosystem connectivity, customer experience, and cloud activity.

The global insurtech market has been segmented on the basis of type, service, technology, end-use and regions. Based on type, the market is segmented into auto, business, health, home, speciality, travel, and others. Based on service, the market is segmented into consulting, support & maintenance, managed services. Based on technology, the market is segmented into blockchain, cloud computing, IoT, machine learning, robo advisory, and others. Based on End-Use the market is segmented into automotive, BFSI, government, healthcare, manufacturing, retail, transportation, and others. Based on the regions, the global insurtech market has been segmented into Asia-Pacific, Europe, North America, and RoW

For detailed scope of the “Insurtech Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global insurtech market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in insurtech market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global insurtech market?

- Which type generated maximum revenues in 2019 and identify the most promising type during the forecast period?

- What are the various end-use areas of global insurtech market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2019 |

| Market Forecast Period |

2020-2027 |

| Market Revenues (2027) |

USD 3729 Million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Service, By Technology, By End-Use, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | DXC Technology Company, Damco Group, Insurance Technology Services, Oscar Insurance, Majesco, Quantemplate, Wipro Limited, Shift Technology, Zhongan Insurance, Trōv, Inc., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Insurtech Market by Type

-

- Auto

- Business

- Health

- Home

- Speciality

- Travel

- Others

Global Insurtech Market by Service

-

- Consulting

- Support & Maintenance

- Managed Services

Global Insurtech Market by Technology

-

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Global Insurtech Market by End-Use

-

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Global Insurtech Market by Region

-

- North America Insurtech Market (Option 1: As a part of the free 25% customization)

- North America Insurtech Market by Type

- North America Insurtech Market by Service

- North America Insurtech Market by Technology

- North America Insurtech Market by End-Use

- US Insurtech Market All-Up

- Canada Insurtech Market All-Up

- Europe Insurtech Market (Option 2: As a part of the free 25% customization)

- Europe Insurtech Market by Type

- Europe Insurtech Market by Service

- Europe Insurtech Market by Technology

- Europe Insurtech Market by End-Use

- UK Insurtech Market All-Up

- Germany Insurtech Market All-Up

- France Insurtech Market All-Up

- Spain Insurtech Market All-Up

- Rest of Europe Insurtech Market All-Up

- Asia-Pacific Insurtech Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Insurtech Market by Type

- Asia-Pacific Insurtech Market by Service

- Asia-Pacific Insurtech Market by Technology

- Asia-Pacific Insurtech Market by End-Use

- China Insurtech Market All-Up

- India Insurtech Market All-Up

- Japan Insurtech Market All-Up

- Rest of APAC Insurtech Market All-Up

- RoW Insurtech Market (Option 4: As a part of the free 25% customization)

- RoW Insurtech Market by Type

- RoW Insurtech Market by Service

- RoW Insurtech Market by Technology

- RoW Insurtech Market by End-Use

- Brazil Insurtech Market All-Up

- South Africa Insurtech Market All-Up

- Saudi Arabia Insurtech Market All-Up

- UAE Insurtech Market All-Up

- Rest of world (remaining countries of the LAMEA region) Insurtech Market All-Up

- North America Insurtech Market (Option 1: As a part of the free 25% customization)

Major Players Operating the Insurtech (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- DXC Technology Company

- Damco Group

- Insurance Technology Services

- Oscar Insurance

- Majesco

- Quantemplate

- Wipro Limited

- Shift Technology

- Zhongan Insurance

- Trōv, Inc.

Frequently Asked Question About This Report

Insurtech Market [UP480A-00-0620]

The growth rate of Insurtech Market is 37.9% during 2020-2027.

The Asia-Pacific region is projected to dominate the insurtech market over the forecast period owing to the growing government initiatives to implement digital tools and platforms to improve the banking operations.

The cloud computing segment is projected to grow at a higher CAGR during the forecast period. Cloud computing highlights the key risk indicators, risk assessment and control, within a single organization.

End use of the Insurtech Market are automotive, BFSI, government, healthcare, manufacturing, retail, transportation, and others.

- Published Date: Jan - 2021

- Report Format: Excel/PPT

- Report Code: UP480A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Insurtech Market by Type, By Service, By End-Use, By Technology and By Region – Global Opportunities & Forecast, 2020-2027

$ 4,499.00 – $ 6,649.00

Why GMI Research