Lithium-ion Battery Recycling Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

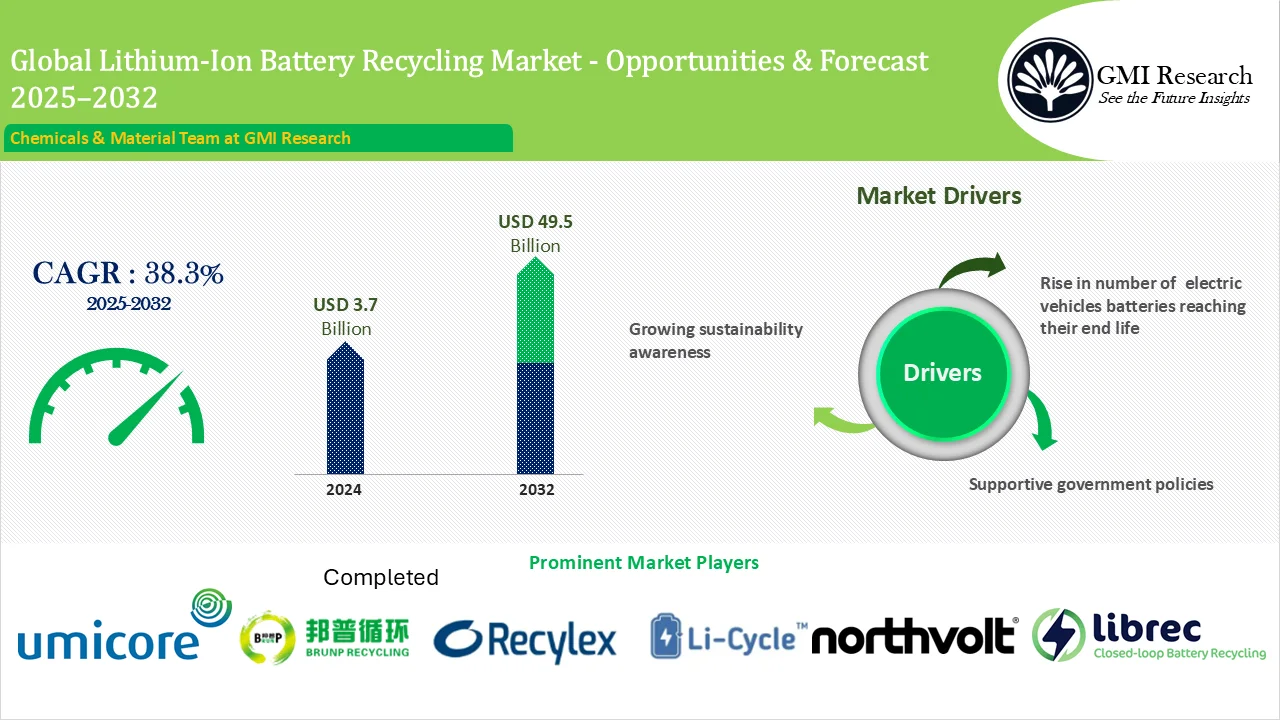

GMI Research analysis indicates that the Lithium-ion Battery Recycling Market size was estimated at USD 3.7 billion in 2024 and is slated to register a double digit CAGR of 38.3% over the period 2025-2032 and is projected to reach USD 49.5 billion in 2032, primarily fueled by as first batch of electric vehicles batteries reaching their end life, couple with the growing sustainability awareness and supportive government policies to address this demand.

Major Market Drivers and Emerging Trends

Lithium ion batteries are less harmful to the environment with a higher potential for reuse and recycling. Its widespread use in consumer goods has increased battery waste generation and growing environmental concerns which makes recycling an unavoidable solution. These batteries can be recycled through several technological methods like mechanical recycling approaches.

The lithium ion battery recycling market size is forecast to grow driven by the increasing electric vehicles adoption along with stringent government regulations. In 2023 electric vehicle sales reached nearly fourteen million with 95 percent among these sales concentrated in China along with the United States and Europe. BILITI Electric projects that around three million electric vehicles are on US roads which represents about 1% of all cars in the United States. In 2022 companies manufactured about 442,000 EVs which reflects a rising electric car production. The zero emissions have made EVs a practical substitute for conventional combustion engine vehicles. Continuous innovation in EV design and battery technology has further contributed to improved driving ranges and better performance across electric vehicles. Their enhanced practicality and appeal have led to a surging demand which in turn eventually supports the lithium ion battery recycling market growth.

There is a growing consumer trend where people are considering the environmental and social implications from their purchases. Many consumers are opting for products featuring recycled materials thus supporting environmentally responsible businesses. This trend extends to the battery market with consumers increasingly seeking EVs and electronics featuring recycled battery materials. This shifting consumer preferences drives manufacturers to commit to and support responsible battery recycling initiatives. Consumers today are more knowledgeable and discerning since they are placing greater importance on the entire product lifecycle and ethical material sourcing. This involves providing clear details about the battery sourcing process and production methods along with proper disposal practices. Battery recycling resolves these challenges by strengthening a commitment to efficient resource use.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Companies that focus on their commitment to recycling are more appealing to buyers where rising environmental consciousness among consumers shows a significant transformation rather than just a trend. The growing demand for sustainability is accelerating the market because it motivates corporations and governments to work towards a responsible future.

Governments worldwide are introducing regulations to encourage sustainable battery recycling and effective waste management which motivates businesses to join the recycling efforts. Several countries have further set recycling targets for lithium ion batteries to promote sustainable practices. To meet these targets manufacturers are obligated to reach specific recycling rates or may face potential penalties. It motivates the industry to improve recycling processes while encouraging increased involvement in the efforts. To promote battery recycling governments may provide financial support like subsidies for running recycling plants. Government support works to be the catalyst and makes it more financially feasible for businesses to make investments in battery recycling technologies.

However the risks associated with storing and transporting used batteries could limit the global lithium ion battery recycling market growth. The residual charge in used batteries can cause unplanned discharges which potentially results in harm to people or property. Batteries that are not clearly labeled must be treated as if they still hold a charge and stored safely. If manufacturers label large lithium batteries incorrectly, they could be mistaken for lead acid batteries which creates potential safety risks. Failure to sort these batteries properly could lead to dangers so these batteries must be separated during storage. To address these concerns many governments have put regulations in place on how spent batteries should be stored and transported.

Industry Insights: Automotive segment is anticipated to hold the largest market share

Lithium ion batteries offer several key advantages including high discharge tolerance and longer cycle life. They also have faster recharge times which makes them a top choice for transportation applications. The automotive companies are exploring the use of recycled batteries for energy storage infrastructure as it offers a long term strategy for grid stability and the integration of renewable energy. The automotive industry is increasingly focusing on clean fuels driven by the transportation system’s significant dependence on oil with vehicles consuming about 70% of it. The growing dependence on oil is generating concerns from environmentalists and economists alike which prompts a rise in electric vehicle adoption fueled by the rising environmental awareness. The rise in EV usage is contributing to a growing demand for lithium-ion batteries that are necessary for a steady power supply which in turn is expected to boost market growth. The growing availability of various electric vehicle types including cars and buses is further anticipated to drive a substantial rise in battery recovery. Rising EV sales are also expected to lead to increasing batteries reaching the end of their usable life which highlights the importance of recycling the entire EV battery stock. EV battery recyclers are further projected to expand capacity as battery volumes grow driven by increased EV adoption and second life recovery.

The non automotive segment including consumer electronics is also experiencing significant growth. The global demand for consumer electronics including smartphones which rely on lithium-ion batteries is growing. As consumer electronics usage increases, many lithium-ion batteries will soon finish their operational life which leads to increasing waste generation. The rising waste from used batteries coupled with growing concern about the environmental harm caused by improper disposal presents an opportunity for increased recycling efforts. With essential metals like lithium and cobalt these batteries present significant investment opportunities which further establishes the consumer electronics sector to be the major contributor in supplying lithium ion batteries for recycling.

Recycling Process Insights: Hydrometallurgical segment is expected to maintain a strong position in the market

The hydrometallurgical segment is projected to hold a major share in the global market driven by its environmentally conscious processes and straightforward procedure along with minimal gas and water emissions. The pyrometallurgical segment is also expected to experience substantial growth owing to its affordable extraction methods and capacity to handle various battery chemistries.

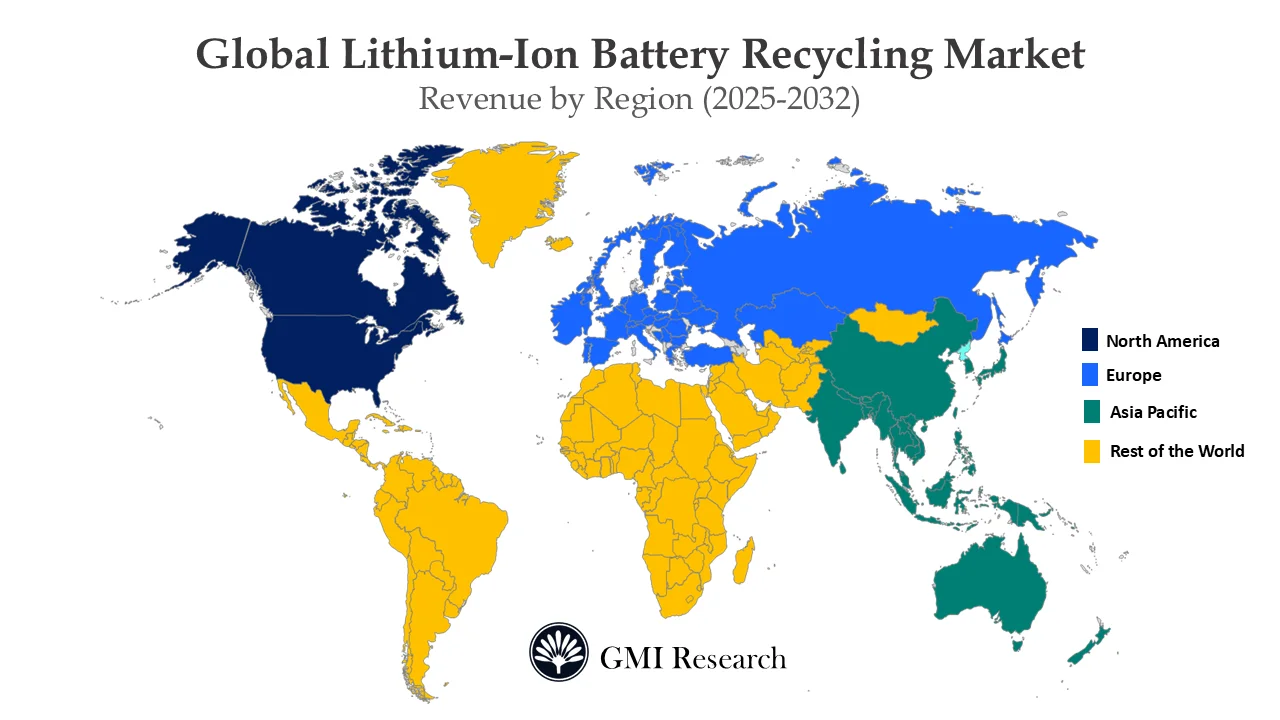

Regional Insights: Asia Pacific is set to hold a dominant position in the market

Asia Pacific is positioned to dominate the market driven by the rapid EV adoption rise along with the growing demand for consumer electronics. With increasing populations in countries like China and India, the demand for li ion battery recycling is experiencing rapid growth. The growing emphasis on environmental issues coupled with technological innovations and government support are major trends driving the li ion battery recycling market forward in China. There is also a growing focus on developing innovative techniques to get valuable materials from discarded batteries and improve recycling efficiency.

North America is projected to experience growth driven by increased EV adoption and innovations in recycling technologies. The rising consumer electronics proliferation has raised concerns about the batteries disposal especially in large volumes which leads to waste generated by households and other sources. The emphasis on circular economy has further led to a surging investments in recycling plants and technologies in the region.

Top Market Players

Several major players in the market include Umicore, Lithion Recycling, Glencore, Cirba Solutions, CATL, RecycLiCo Battery Materials Inc., Northvolt, Altilium Metals, Librec among others. Various companies are actively participating in different phases within the lithium ion battery production cycle. These businesses are working on expanding their recycling capabilities to strengthen their market standing.

Key Developments:

-

- In 2024 the MoU between EcoPro and Cirba Solutions marked a major collaboration aimed at improving lithium ion battery recycling which responds to the growing need for battery materials and the push for clean energy in the United States.

- In 2023 Toyota Kirloskar Motor invested around USD 8 billion in a battery plant in North Carolina which reinforces its dedication to environmental responsibility and its position as a major contributor to the electric vehicle supply chain.

- In 2021, Li-Cycle Holdings established a commercial lithium-ion battery recycling facility in Tuscaloosa, Alabama, which will process approximately 5,000 tons of battery production scrap and end-of-life batteries per year. This expansion will strengthen the company’s position in the market to cater to the rising demand and improve its presence in southeastern US.

- In 2021, Glencore collaborated with Britishvolt, a pioneer in electric vehicle battery technology. This partnership is intended to strengthen the position of Glencore in the lithium-ion battery recycling market and expand its product portfolio.

- In 2021, Accurec reconstructed the Krefeld plant. The reconstructed plant has double security storage and building capacity for lithium batteries. This development increases the production capacity of the company and ensures growth in the lithium-ion battery recycling market.

- In 2021, Glencore signed a MoU for the potential supply of ethically sourced and traceable raw materials for inclusion in FREYR’s lithium-ion battery (LIB) cells, which will be manufactured at planned facilities in Norway.

- In 2020, Umicore N.V. announced a collaboration with Northvolt for a new pilot plant that will produce lithium-ion battery (LIB) cells for BMW. Umicore N.V. will contribute to the production of a sustainable battery cell in Europe.

- In 2020, Snam signed an agreement with funds managed by Blackstone Tactical Opportunities for acquiring a strategic stake of about 33% in Industrie De Nora S.p.A., a global technology supplier of clean energy and water treatment based on a 100% enterprise value of approximately €1.2 billion.

Segments covered in the Report:

The Lithium-ion Battery Recycling Market has been segmented on the basis of Industry, Recycling Process and Regions. Based on Industry, the market is segmented into Automotive and Non-Automotive. The Non-Automotive segment is further segmented into Industrial, Power, Marine, Consumer Electronics, and Other Sources. Based on Recycling Process, the market is segmented into Hydrometallurgical, Pyrometallurgy, and Physical/Mechanical.

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD 3.7 billion |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD billion) |

| Market Segment | By Industry, By Recycling Process, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Umicore, Lithion Recycling, Glencore, Cirba Solutions, CATL, RecycLiCo Battery Materials Inc., Northvolt, Altilium Metals, Librec, among others; a total of 9 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Lithium-ion Battery Recycling Market by Industry

-

- Automotive

- Non-Automotive

- INDUSTRIAL

- POWER

- MARINE

- CONSUMER ELECTRONICS

- OTHER SOURCES

Global Lithium-ion Battery Recycling Market by Recycling Process

-

- Hydrometallurgical

- Pyrometallurgy

- Physical/ Mechanical

Global Lithium-ion Battery Recycling Market by Region

-

-

North America Lithium-ion Battery Recycling Market (Option 1: As a part of the free 25% customization)

- By Industry

- By Recycling Process

- US Market All-Up

- Canada Market All-Up

-

Europe Lithium-ion Battery Recycling Market (Option 2: As a part of the free 25% customization)

- By Industry

- By Recycling Process

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Lithium-ion Battery Recycling Market (Option 3: As a part of the free 25% customization)

- By Industry

- By Recycling Process

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Lithium-ion Battery Recycling Market (Option 4: As a part of the free 25% customization)

- By Industry

- By Recycling Process

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Lithium-ion Battery Recycling (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Umicore

- Lithion Recycling

- Glencore

- Cirba Solutions

- CATL

- RecycLiCo Battery Materials Inc.

- Northvolt

- Altilium Metals

- Librec

Frequently Asked Question About This Report

Lithium-ion Battery Recycling Market [UP1871-001001]

GMI Research reports that the lithium-ion battery recycling market was valued at USD 3.7 billion in 2024 and is expected to grow at a CAGR of 38.3% between 2025 and 2032, reaching USD 49.5 billion by the end of the forecast period.

A key driver of market growth is the surge in end-of-life EV batteries, paired with growing environmental consciousness and policy incentives supporting battery recycling.

The automotive segment is projected to dominate the market in terms of share.

Asia Pacific is projected to maintain a leading position in the market.

Related Reports

- Published Date: Apr-2025

- Report Format: Excel/PPT

- Report Code: UP1871-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Lithium-ion Battery Recycling Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research